Are Natural Resources Good or Bad for Development?

Natural resources development undoubtedly plays an important role in the economies of many countries. Whether their contribution to development is positive or negative is, however, a contested and difficult question. Arguably, countries like Australia, Botswana, and Norway have gained enormously over long periods from sustained natural resources development. Others, such as Azerbaijan, Kazakhstan, and Russia, have achieved significant economic growth through natural resources development but perhaps at the expense of institutional progress. In contrast, in some countries—such as Angola and Sierra Leone—natural resources development has been at the heart of violent conflicts, with devastating consequences for society. With many developing countries being highly resource-dependent, a deeper understanding of the sources of success and the risks associated with natural resources development is highly relevant. This brief reviews the main issues and points to key policy challenges for transforming resource rents from natural resources development into a driver rather than a detriment to overall development.

Is it good for a country to be rich in natural resources? Superficially, the answer to this question would obviously seem to be “yes”. How could it ever be negative to have something in addition to labor and produced capital? How could it be negative to have something valuable “for free”? Yet, the answer is far from that simple and one can relatively quickly come up with counterarguments: “Having natural resources takes away incentives to develop other areas of the economy which are potentially more important for long-run growth”; “Natural resource-income can cause corruption or be a source of conflict”, etc.

Looking at some of the starkest cases, the “benefits” of resources can indeed be questioned. Take the Democratic Republic of Congo for example. It is the world’s largest producer of cobalt (49% of the world’s production in 2009) and of industrial diamonds (30%). It is also a large producer of gemstone diamonds (6%), it has around 2/3 of the world’s deposits of coltan and significant deposits of copper and tin. At the same time, it has the world’s worst growth rate and the 8th lowest GDP per capita over the last 40 years.[1] The picture for Sierra Leone and Liberia is very similar – they possess immense natural wealth, yet they are found among the worst performers both in terms of economic growth and GDP per capita. While the experiences of countries such as Bolivia and Venezuela are not as extreme their resource wealth in terms of natural gas and oil, respectively, seems to have brought serious problems in terms of low growth, increased inequality and corruption. When one, on top of this, adds that some of the world’s fastest-growing economies over the past decades – such as Hong Kong, South Korea and Singapore – have no natural wealth the picture that emerges is that resources seem to be negative for development.

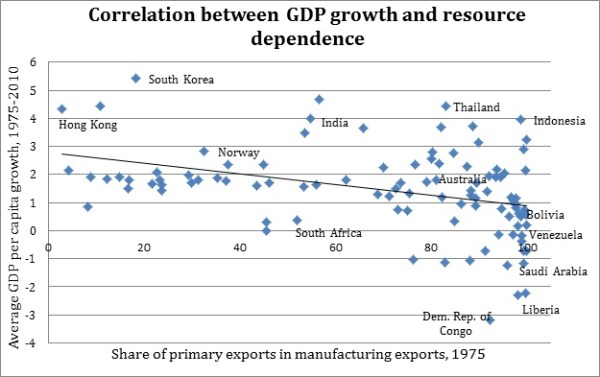

These are not isolated examples. By now, it is a well-established fact that there is a robust negative relationship between a country’s share of primary exports in GDP and its subsequent economic growth. This relationship, first established in the seminal paper by Sachs & Warner (1995) is the basis for what is often referred to as the resource curse, that is, the idea that resource dependence undermines long-run economic performance.[2]

Based on the World Development Indicators database (World Bank). Primary exports consist of agricultural raw materials exports, fuel exports, ores and metals, and food exports.

At the same time, there are numerous countries that provide counterexamples to this idea. Being the second largest exporter of natural gas and the fifth largest of oil, Norway is one of the richest world economies. Botswana produces 29% of the world’s gemstone diamonds and has been one of the fastest-growing countries over the last 40 years. Australia, Chile, and Malaysia are other examples of countries that have performed well, not just despite their resource wealth, but, to a large extent, due to it.

Given these examples the relevant question becomes not “Are resources good or bad for development?” but rather “Under what circumstances are resources good and when are they bad for development?. As Rick van der Ploeg (2011) puts it in a recent overview: “the interesting question is why some resource-rich economies [.] are successful while others [.] perform badly despite their immense natural wealth”. To begin to answer this question it is useful to first review some of the many theoretical explanations that have been suggested and to see what empirical support they have received. Clearly, our overview is far from complete but we think it gives a fair picture of how we have arrived at our current stage of knowledge.[3]

Theories and Evidence

The most well-known economic explanation of the resources curse suggests that a resource windfall generates additional wealth, which raises the prices of non-tradable goods, such as services. This, in turn, leads to real exchange rate appreciation and higher wages in the service sector. The resulting reallocation of capital and labor to the non-tradable sector and to the resource sector causes the manufacturing sector to contract (so-called “de-industrialization”). This mechanism is usually referred to as “Dutch disease” due to the real exchange rate appreciation and decrease in manufacturing exports observed in the Netherlands following the discovery of North Sea gas in the late 1950s. Of course, the contraction of the manufacturing sector is not necessarily harmful per se, but if manufacturing has a higher impact on human capital development, product quality improvements and on the development of new products, this development lowers long-run growth.[4] Other theories have focused on the problems related to the increased volatility that comes with high resource dependence. In particular, it has been suggested that irreversible and long-term investments such as education decrease as volatility goes up. If human capital accumulation is important for long-run growth this is yet another potential problem of resource wealth.

The empirical support for the Dutch disease and related mechanisms is mixed. Some authors find that a resource boom causes a decline in manufacturing exports and an expansion of the service sector (e.g. Harding and Venables (2010)), others do not (e.g. Sala-i-Martin and Subramanian (2003)). But even the studies that do find evidence of the Dutch disease mechanism, usually do not analyze its effect on the growth rates. In principle, Dutch disease could be at work without this hurting growth. Another problem is that the Dutch disease theory suggests that natural resources are equally bad for development across countries. This means that the theories cannot account for the great heterogeneity of observed outcomes, that is, they cannot explain why some countries fail and others succeed at a given level of resource dependence. The same goes for the possibility that natural resources create disincentives for education. Gylfason 2001, Stijns (2006) and Suslova and Volchkova (2007) find evidence of lower human capital investment in resource-rich countries but the theory cannot explain differences across (equally) resource-rich countries.

As a result, greater attention has been devoted to the political-economic explanations of the resource curse. The main idea in recent work is that the impact of resources on development is heavily dependent on the institutional environment. If the institutions provide good protection of property rights and are favourable to productive and entrepreneurial activities, natural resources are likely to benefit the economy by being a source of income, new investment opportunities, and of potential positive spillovers to the rest of the economy. However, if property rights are insecure and institutions are “grabber-friendly”, the resource windfall instead gives rise to rent-seeking, corruption and conflict, which have a negative effect on the country’s development and growth. In short, resources have different effects depending on the institutional environment. If institutions are good enough resources have a positive effect on economic outcomes, if institutions are bad, so are resources for development.

Mehlum, Moene and Torvik (2006) develop a theoretical model for this effect and also find empirical support for the idea. In resource-rich countries with bad institutions incentives become geared towards “grabbing resource rents” while in countries where institutions render such activities difficult resources contribute positively to growth. Boschini, Pettersson and Roine (2007) provide a similar explanation but also stress the importance of the type of resources that dominate. They show that if a country’s institutions are bad, “appropriable” resources (i.e., resources that are more valuable, more concentrated geographically, easier to transport etc. – such as gold or diamonds) are more “dangerous” for economic growth. The effect is reversed for good institutions – gold and diamonds do more good than less appropriable resources. In turn, better institutions are more important in avoiding the resource curse with precious metals and diamonds than with mineral production. The following graph illustrates their result by showing the marginal effects of different resources on growth for varying institutional quality. Distinguishing the growth contribution of mineral production in countries with good institutions with the effect in countries with bad institutions, the left panel shows a positive effect in the former and a negative one in the latter case. The right-hand panel illustrates the corresponding, steeper effects when isolating only precious metals and diamond production.

Even if these papers provide important insights and allow for the possibility of similar resource endowments having variable effects depending on the institutional setting, two major problems still remain. First, the measures of “institutional quality” are broad averages of institutional outcomes (rather than rules).[5] Even if Boschini et al. (2007), and in particular Boschini, Pettersson and Roine (2011) test the robustness of the interaction result using alternative institutional measures (including the Polity IV measure of the degree of democracy) it remains an important issue to understand more precisely which aspects of institutions that matter. An attempt at studying a particular aspect of this question is the paper by Andersen and Aslaksen (2008), which shows that presidential democracies are subject to the resource curse, while it is not present in parliamentary democracies. They argue that this result is due to higher accountability and better representation of the parliamentary regimes.

A second remaining issue is that even if one concludes that the impact of natural resources differs across institutional environments it is an obvious possibility that natural resources have an impact on the chosen policies and institutional arrangements. For example, access to resource rents may provide additional incentives for the current ruler to stay in power and to block institutional reforms that threaten his power, such as democratization. In a well-known paper with the catchy title “Does oil hinder democracy?” Ross (2001) uses pooled cross-country data to establish a negative correlation between resource dependence and democracy.

However, one needs to be careful in distinguishing such a correlation from a causal effect. There are at least two issues that can affect the interpretation: First, there could be an omitted variable bias, that is, the natural resource dependence and institutional environment can be influenced by an unobserved country-specific variable, such as historically given institutions (which in turn could be the result of unobserved effects of resources in previous periods), culture, etc. For the same reason, cross-country comparisons may also be misleading. One way of dealing with this problem is to use fixed-effect panel regressions to eliminate the effect of the country-specific unobserved characteristics. This approach produces mixed empirical results: in the analysis of Haber and Menaldo (2011) the effect of resources on democracy disappears, while Aslaksen (2010) and Andersen and Ross (2011) find support for a political resource curse.

Second, the measures of natural resource wealth may be endogenous to institutions and, in particular, its level of democracy. For example, the level of oil production and even the efforts put into oil discovery can be affected by the decisions of (and constraints on) those in power. Thereby one would need to find instrumental variables that influence the level of democracy only through the resource measures.[6] Tsui (2011) investigates the causal relationship between democracy and resources by looking at the impact of oil discovery event(s) on a cross-country sample. His identification strategy is based on using the exogenous variation in oil endowments (an estimate of the total amount of oil initially in place) to instrument for the amount of total discovered oil to date. The idea is that, while the amount of oil discovered could well be influenced by the institutional environment, the size of the oil endowment is determined only by nature. Tsui’s findings also support the political resource curse story.

There are also numerous studies about the effect of resources on particular institutional aspects and policies. For example, Beck and Laeven (2006) find that resource wealth delayed reform in Eastern Europe and the CIS, Desai, Olofsgård and Yousef (2009) point to natural resource income as central for the possibilities of autocratic governments to remain in power through buying support, Egorov et. al. (2009) show that there is fewer media freedom in oil-rich economies, with the effect being the strongest for the autocratic regimes. Andersen and Aslaksen (2011) find that natural resource wealth only affects leadership duration in non-democratic regimes. Moreover, in these countries, less appropriable resources extend the term in power (in line with the ruler incentive argument above), while more appropriable resources, such as diamonds, shorten political survival (perhaps, due to increased competition for power). Several papers show that in a bad institutional environment natural resources increase corruption (e.g., Bhattacharyya and Hodler (2010) or Vincente (2010)), and reduce corporate transparency (Durnev and Guriev (2011)).

Implications for Policy

Overall the literature points to potential economic as well as political problems connected to natural resources. Even if some issues remain contested it seems clear that many of the economic problems are solvable with appropriate policy measures and in general that natural resources can have positive effects on economic development given the right institutional setting. However, it seems equally clear that natural resource wealth, especially in initially weak institutional settings, tends to delay diversification and reforms, and also increases incentives to engage in various types of rent-seeking. In autocratic settings, resource incomes can also be used by the elite to strengthen their hold on power.

Successful examples of managing resource wealth, such as the establishment of sovereign wealth funds that can both reduce the volatility and create transparency and also smooth the use of resource incomes over time, are not always optimal or easily implementable. Using the money for large investments could be perfectly legitimate and consumption should be skewed toward the present in a capital-scarce developing setting (as shown by van der Ploeg and Venables, 2011). But no matter what we think we know about the optimal policy it still has to be implemented and if the institutional setting is weak the problems are very real. This is just because of potentially corrupt governments but also due to the difficulty to make credible commitments even for perfectly benevolent politicians (see e.g. Desai, Olofgård and Yousef, 2009).

Many political leaders in resource-rich countries have pointed to the hopelessness of their situation and have expressed a wish to rather be without their natural wealth. Such conclusions are unnecessarily pessimistic. Even if it is true that the policy implications from the literature more or less boil down to a catch-22 combination of 1) “Resources are bad (only) if you have poor institutions, so make sure you develop good institutions if you have resource wealth” and 2) “Natural resources have a tendency to impede good institutional development”, there are possibilities. Some countries have succeeded in using their resource wealth to develop and arguably strengthen their institutions. Even if it is often noted that Botswana had relatively good institutions already at the time of independence, it was still a poor country with no democratic history facing the challenge of developing a country more or less from scratch. And at the time of independence, they also discovered and started mining diamonds which have since been an important source both of growth and government revenue. This development has to a large part been due to good, prudent policy.

There is nothing inevitable about the adverse effects of natural resources but resource-rich developing countries must face the challenges that come with having such wealth and use it wisely. The first step is surely to understand the potential problems and to be explicit and transparent about how one intends to deal with them.

References

- Andersen, J. J. and Aslaksen, S., 2008. “Constitutions and the resource curse.” Journal of Development Economics, Volume 87, Issue 2.

- Andersen, J. J. and Aslaksen, S., 2011. “Oil and political survival.” mimeo.

- Andersen, J. J. and Ross, M., 2011, “Making the Resource Curse Disappear: A re-examination of Haber and Menaldo’s: “Do Natural Resources Fuel Authoritarianism?”.” mimeo.

- Aslaksen, S., 2010. “Oil and Democracy – More than a Cross-Country Correlation?,” Journal of Peace Research, vol. 47(4).

- Beck, T., and Laeven, L., 2006. “Institution Building and Growth in Transition Economies.” CEPR Discussion Paper 5718, Centre for Economic Policy Research:London.

- Bhattacharyya, S., and Hodler, R., 2010. “Natural resources, democracy and corruption” European Economic Review, Elsevier, vol. 54(4).

- Boschini, A.D., Pettersson, J. and Roine, J., 2007. “Resource curse or not: a question of appropriability” Scandinavian Journal of Economics, 109.

- Boschini, A.D., Pettersson, J. and Roine, J., 2011. “Unbundling the resource curse” mimeo.

- David, P. A., and Wright, G.. 1997. “The Genesis of American Resource Abundance” Industrial and Corporate Change 6.

- Desai, R. M., Olofsgård, A. and Yousef, T., 2009. “The Logic of Authoritarian Bargains” Economics & Politics, Vol. 21, Issue 1.

- Durnev, A. and Guriev, S. M., 2011. ”Expropriation Risk and Firm Growth: A Corporate Transparency Channel.”, mimeo

- Egorov, G., Guriev, S. M. and Sonin, K., 2009. “Why Resource-Poor Dictators Allow Freer Media: A Theory and Evidence from Panel Data.” American Political Science Review, Vol. 103, No. 4.

- Gylfason, T., 2001. “Nature, Power, and Growth” Scottish Journal of Political Economy, Scottish Economic Society, vol. 48(5).

- Gylfason, T., Herbertsson, T. T., and Zoega, G., 1999. “A mixed blessing” Macroeconomic Dynamics, 3.

- Findlay, R. and Lundahl M., 1999. “Resource-Led Growth: A Long-Term Perspective.” Helsinki: World Institute for Development Economics Research.

- Frankel, J. A., 2010 “The Natural Resource Curse: A Survey.” HKS Working Paper No. RWP10-005.

- Haber, S. H. and Menaldo, V. A., 2011. “Do Natural Resources Fuel Authoritarianism? A Reappraisal of the Resource Curse.” American Political Science Review, Vol. 105, No. 1.

- Harding, T. and Venables, A.J., 2011. “Exports, imports and foreign exchange windfalls.” mimeo.

- Hausmann R., Hwang J. and Rodrik, D., 2007. “What you export matters.” Journal of Economic Growth, Springer, vol. 12(1).

- Leite, C. A. and Weidmann, J., 1999. “Does Mother Nature Corrupt? Natural Resources, Corruption, and Economic Growth.” IMF Working Paper No. 99/85.

- Mehlum, H., Moene, K. and Torvik, R., 2006. ”Institutions and the resource curse.” Economic Journal, 116.

- Montague, D., 2002. “Stolen Goods: Coltan and Conflict in the Democratic Republic of Congo.” SAISReview – Volume 22, Number 1, Winter-Spring, pp. 103-118

- van der Ploeg, F., 2011. “Natural Resources: Curse or Blessing?.” Journal of Economic Literature, American Economic Association, vol. 49(2).

- van der Ploeg, F. and Venables, A. J., 2011. “Harnessing Windfall Revenues: Optimal Policies for Resource-Rich Developing Economies.” Economic Journal, Royal Economic Society, vol. 121(551).

- Ross, M.L., 2001. “Does Oil Hinder Democracy?” World Politics, 53(3).

- Sachs, J. D. and Warner, A. M., 1995. “Natural Resource Abundance and Economic Growth.” NBER Working Papers 5398, National Bureau of Economic Research, Inc.

- Sala-I-Martin, X., Doppelhofer, G. and Miller, R. I., 2004. “Determinants of Long-Term Growth: A Bayesian Averaging of Classical Estimates (BACE) Approach.” American Economic Review, American Economic Association, vol. 94(4).

- Sala-I-Martin, X., and Subramanian, A., 2003. “Addressing the Natural Resource Curse: An Illustration from Nigeria.” NBER Working Paper 9804.

- Stijns, J.-P., 2006. “Natural resource abundance and human capital accumulation.” World Development, Elsevier, vol. 34(6).

- Suslova, E. and Volchkova, N., 2007. “Human Capital, Industrial Growth and Resource Curse.” Working Papers WP13_2007_11, Laboratory for Macroeconomic Analysis, HSE.

- Torvik, R., 2009. “Why do some resource-abundant countries succeed while others do not?”, Oxford Review of Economic Policy, vol. 25(2).

- Tsui, K. K., 2011. “More Oil, Less Democracy: Evidence from Worldwide Crude Oil Discoveries.” The Economic Journal, 121.

- Vincente, P., 2010. “Does Oil Corrupt? Evidence from a Natural Experiment in West Africa,” Journal of Development Economics, 92(1).

- Wright, G., 1990. “The Origins of American Industrial Success, 1879-1940.” American Economic Review 80.

Footnotes

[1] Based on World Development Indicators database (World Bank).

[2] Its robustness has been confirmed in, for example, Gylfason, Herbertsson and Zoega (1999), Leite and Weidmann (1999), Sachs and Warner (2001) and Sala-i-Martin and Subramanian (2003). Doppelhoefer, Miller and Sala-i-Martin (2004) find that the negative relation between the fraction of primary exports in total exports and growth is one of 11 variables which is robust when estimates are constructed as weighted averages of basically every possible combination of included variables.

[3] The interested reader should consult more extensive overviews such as Torvik (2009), Frankel (2010) or van der Ploeg (2011).

[4] This assumption has been criticized by, for example, Wright (1990), David and Wright (1997), and Findlay and Lundahl (1999) who all point to historical examples where resource extraction has been a driver for the development of new technology. On the other hand others, e.g. Hausmann, Hwang and Rodrik (2007), provide evidence that export product sophistication predicts higher growth.

[5] The distinction between using institutional outcomes rather than institutional rules has been much debated in the literature on the importance of institutions in general. It is, for example, possible for a dictator to choose to enforce good property rights protection even if this is something typically associated with democracy.

[6] The studies by Boschini, Pettersson and Roine (2007) and (2011) also use instrumental variables to try to account for the potential endogeneity problems. The results are in line with the OLS results but instruments are weak in this setting.

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.