Tag: low-income families

Financial Support for Families with Children and Its Trade-Offs: Balancing Redistribution and Parental Work Incentives

Authors: Michal Myck, Anna Kurowska and Michal Kundera, CenEA.

Reforms of tax-benefit system of financial support for families with children have a broad range of consequences. In particular, they often imply trade-offs between effects on income redistribution and work incentives for first and second earners in the family. Understanding the complexity of the consequences involved in reforming family policy is crucial if the aim is to “kill two birds with one stone” namely to reduce poverty and improve incentives to work. In this brief, we illustrate these complex trade-offs by analyzing several scenarios of reforming financial support for families with children in Poland. We show that it is possible to create incentives for second earners in the family to join the labor force without destroying the work incentives of the first earners. Moreover, the same reform would allocate resources to families with lower incomes, which could result in a direct reduction of child poverty.

Financial support for families with children is an important and integral part of the broad family policy package, the goals of which fall into two basic categories of reducing child poverty and increasing labour market activity of parents (Whiteford and Adema, 2007; Björklund, 2006; Immervoll, et al., 2001). However, the particular policy aimed at one of these objectives may be detrimental to the achievement of other goals. For example, family/child benefits may directly increase family income and thus reduce child poverty. These same benefits could have a negative effect on parental incentives to work, particularly for so-called second earners, usually mothers (see e.g. Kornstad and Thoresen, 2007). However, employment of both parents often turns out to be crucial for a long-term poverty reduction (Whiteford and Adema, 2007).

The trade-offs implied by the different family policy instruments are often poorly understood or treated superficially in the policy debate. The effect of this lack of understanding may result in badly designed policy reactions to identified problems, which in turn may imply that one of the objectives is achieved at the cost of the other, or even that policies work against all of them in a longer perspective.

Using the Polish microsimulation model SIMPL, we simulate modifications of several elements of the Polish tax and benefit system to demonstrate the complex nature of trade-offs between income and employment policy, and within employment policy itself. The underlying assumption of the analysis is that any effective policy that aims at lowering child poverty in the long run ought to realize and address issues of parental labour market activities. Governments should therefore aim at a design of financial support for families to provide assistance to poor households and at the same time strong work incentives for parents.

The Polish system of support for low-income families, Family Benefits, consists primarily of Family Allowance (FA) with supplements. These are means-tested and are available to families with net incomes below 504 PLN (€121) per month and per person. The value of the FA depends on the age of the child and ranges from 68 PLN to 98 PLN (€16.40 to €23.60) per month. For eligible parents this is supplemented by additional means-tested payments to such groups as lone parents, families with more than two children, and those with school-aged children. Eligibility for Family Benefits is assessed with reference to a threshold, which once exceeded makes the family ineligible to claim the benefits. This point withdrawal of benefits implies very high effective marginal tax rates and has significant implications for average effective rates of taxes (see Myck et al., 2013). In addition to Family Benefits, financial support for families is also channelled through the tax system. Tax-splitting (joint taxation) is available to married couples and lone parents, and since 2007 parents can set their tax liabilities against the Child Tax Credit, which is a non-refundable tax credit, the maximum value of which is 1,112.04 PLN (€268) per year for every dependent child.

The starting point for our analysis, and a reference in terms of potential costs of the reform, is the move to tapered withdrawal of Family Benefits (System 1). For this purpose we use the rate of withdrawal at 55%, which is the rate used in a broadly studied in-work support programme in the UK, the Working Families’ Tax Credit (WFTC) in the late 1990s and early 2000s (see, e.g.: Blundell et al., 2000; Brewer et al., 2006; Clark et al., 2002). Application of the taper implies that with an increase of net income of 1 PLN beyond the withdrawal threshold, the total value of benefits is reduced by 0.55 PLN. Such a change would imply greater certainty and predictability of benefit receipt, compared to the current point withdrawal system. However, as it extends the availability of benefits to families who currently no longer qualify for them, it would carry additional costs. We estimate this cost to be in the range of about 1.04 billion PLN (€250mln) per year, an increase in the total value of family benefits by about 14%.

Changes in Family Benefits under System 2 involve simple increases in the values of Family Allowance, which is raised by 20% given the above cost benchmark of 1.04 billion PLN. The final reform to Family Benefits (System 3) combines introduction of the withdrawal taper (at 55%) with a bonus system for two-earner families with the specific aim of providing stronger work incentives for second earners. The bonus consists of an increase in the level of the withdrawal threshold by 50% for families where both parents work compared to the baseline threshold value.

The first reform of Child Tax Credit (System 4) assumes an increase in the value of the CTC by 19.8% (calibrated to cost same 1.04 billion PLN), while the second uses this tax credit instrument to reward two-earner status. In the latter case, double-earner couples are granted an additional value of the credit (92.70 PLN per month). The cost of this reform is again calibrated to the level of other reforms by adjusting the earnings requirement set for both parents to qualify as double-earner couples. This calibrated requirement is 2,324.50 PLN per month and per person, which is equivalent to 176.5% of the minimum wage.

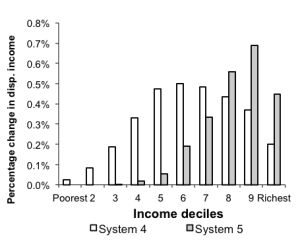

The assumptions underlying the modelled scenarios are very clearly reflected in the (static) distributional effects of the simulated changes. The proportional changes in incomes among families with children by population decile groups resulting from the simulated reforms are demonstrated in Figure 1A for Systems 1-3 and Figure1B for Systems 4-5.

Figure 1. Distributional consequences of modelled reforms: Proportional changes in incomes of families with children by income deciles.

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Figures 2 and 3 show how the modelled reforms would affect incentives to work for first and second earners measured as average changes in replacement rates[1] (RRs) by centiles of the baseline distribution of replacement rates for modelled families. The RR for the first earner is the ratio of the family income when neither partners work and the family income when the first earners works full time. The RR for the second earner is the ratio of the family income when only first earners work and the family income when both partners work full time. Lowest values of RRs imply the strongest incentives and highest values reflect the weakest incentives to work. When the difference in RR between the Baseline and a particular System is greater than zero it implies that this System increases incentives to work for a particular earner compared to the Baseline. This approach provides evidence on the trade-off between improving work incentives for those facing strong and weak incentives in the baseline system. The pattern that emerges from Figures 2 and 3 reflects to some extent the distributional effects of the chosen reforms (Figure 1). This is because richer families are usually those with high labour market incomes and thus low RRs (high labour market incentives), while poorer families face weaker incentives given their low actual (or potential) earnings, and thus face higher replacement ratios.

Figure 2. Changes in RRs by baseline work incentives – first earners Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Notes: Based on a sample of couples with children. System 5 does not change first earner incentives.

Figure 3. Changes in RRs by baseline work incentives – second earners

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Notes: Based on a sample of couples with children. System 5 does not change first earner incentives.

Figure 3. Changes in RRs by baseline work incentives – second earners

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Notes: Based on a sample of couples with children.

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Notes: Based on a sample of couples with children.

Apart from the well-established trade-off between equity and labour market concerns, our paper draws attention to the need to balance out first and second earner work incentives as well as incentives by the degree of existing financial motivation to work.

Reforms at the two extremes of the distributional spectrum, namely an increase in the level of Family Benefits (System 2) and a Child Tax Credit bonus for two-earner couples (System 5), result in very different incentive effects. The former significantly weakens incentives of both first and second earners in couples, while the second, which specifically directs resources at second earners, produces important improvements in incentives to work for second earners. However, these gains focus on the part of the spectrum of the baseline distribution of work incentives where these are already strong. This contrasts with a reform in which a two-earner “bonus” is created as part of Family Benefits (System 3). This system increases the generosity of in-work support for first earners in couples in a similar way to the benchmark reform. At the same time, however, it improves the attractiveness of work for second earners by raising the level of income from which benefits are withdrawn for couples in which both partners are working.

This arrangement balances out the negative influence on second earner incentives of the income effect of making work more financially attractive for first earners, which does not happen under our benchmark scenario (System 1). Moreover, we demonstrate that trying to increase work incentives through higher levels of Child Tax Credit available to families would have a positive effect on the work incentives of a large number of families, in particular on first earners in couples. The flip side of this effect would be some negative incentive effects on second earners, but generally both types of effect would be very low given the assumed cost restriction of the modelled reforms.

Naturally, there is an endless number of ways in which a billion PLN can be spent on families with children. As we argued above, each type of reform will have a complex set of consequences on household incomes and incentives to work for parents. The breakdown of employment pattern in Poland suggests that to increase labour market activity, the family support policy should focus on trying to make work pay for second earners in couples, most of whom are women. As we demonstrated this can be done in such a way as to balance out incentives for first earners and provide strong incentives to those second earners who currently face the weakest incentives to work. At the same time, resources would be directed to families in the lower half of income distribution that could result in direct reduction of child poverty.

▪

References

- Blundell R., A. Duncan, J. McCrae and C. Meghir (2000) The Labour Market Impact of the Working Families’ Tax Credit, Fiscal Studies, vol. 21(1), pp. 75-104.

- Brewer M., A. Duncan, A. Shephard and M.-J. Suarez (2006) “Did Working Families’ Tax Credit Work? The Impact of In-Work Support on Labour Supply in Great Britain”, Labour Economics, vol. 13, pp. 699-720.

- Björklund A. (2006) Does family policy affect fertility? Journal of Population Economics, vol. 19 (1), pp. 3-24.

- Clark T., A. Dilnot, A. Goodman, and M. Myck (2002) Taxes and Transfers, Oxford Review of Economic Policy, vol.18 (2), pp. 187-201.

- Immervoll H., H. Sutherland, K. de Vos (2001) Reducing child poverty in the European Union: the role of child benefits, in: Vleminckx K. and Smeeding T.M. (eds) Child well-being, Child poverty and Child Policy in Modern Nations. What do we know? Revised Edition; The Policy Press: Bristol.

- Kornstad T. and T. O. Thoresen (2007) A Discrete Choice Model for Labor Supply and Child Care, Journal of Population Economics, vol. 20 (4), pp. 781-803.

- Myck, M., A. Kurowska, and M. Kundera (2013) “Financial Support for Families with Children and its Trade-offs: Balancing Redistribution and Parental Work Incentives”, Baltic Journal of Economics, 13(2), 59-84.

- Whiteford P. and W. Adema (2007) What Works Best in Reducing Child Poverty: A Benefit of Work strategy? OECD Social, Employment and Migration Woking Papers, nr 51, OECD, Paris.

[1]For the couples in the subsample we compute three sets of family-level incomes, conditional on employment either of the first earner (who is the person with higher expected earnings in a couple) or of both partners; Y(1,1) for the scenario where both partners are employed (full-time); Y(1,0) for the scenario where the first earner is employed (full-time); Y(0,0) for the scenario where both partners are not employed. This allows us to compute replacement ratios for the first earner (RR1) and the second earner (RR2) for each of the analysed tax and benefit systems (S): RR1(s,j)=Y(s,j)(0,0)/Y(s,j)(1,0) and RR2(s,j)=Y(s,j)(1,0)/Y(s,j)(1,1).