Tag: Poland

Gender Gap in Life Expectancy and Its Socio-Economic Implications

Today women live longer than men virtually in every country of the world. Although scientists still struggle to fully explain this disparity, the most prominent sources of this gender inequality are biological and behavioral. From an evolutionary point of view, female longevity was more advantageous for offspring survival. This resulted in a higher frequency of non-fatal diseases among women and in a later onset of fatal conditions. The observed high variation in the longevity gap across countries, however, points towards an important role of social and behavioral arguments. These include higher consumption of alcohol, tobacco, and fats among men as well as a generally riskier behavior. The gender gap in life expectancy often reaches 6-12 percent of the average human lifespan and has remained stubbornly stable in many countries. Lower life expectancy among men is an important social concern on its own and has significant consequences for the well-being of their surviving partners and the economy as a whole. It is an important, yet under-discussed type of gender inequality.

Country Reports

| Belarus Country Report | FROGEE POLICY BRIEF |

| Georgia Country Report | FROGEE POLICY BRIEF |

| Latvia Country Report | FROGEE POLICY BRIEF |

| Poland Country Report | FROGEE POLICY BRIEF |

Gender Gap in Life Expectancy and Its Socio-Economic Implications

Today, women on average live longer than men across the globe. Despite the universality of this basic qualitative fact, the gender gap in life expectancy (GGLE) varies a lot across countries (as well as over time) and scientists have only a limited understanding of the causes of this variation (Rochelle et al., 2015). Regardless of the reasons for this discrepancy, it has sizable economic and financial implications. Abnormal male mortality makes a dent in the labour force in nations where GGLE happens to be the highest, while at the same time, large GGLE might contribute to a divergence in male and female discount factors with implications for employment and pension savings. Large discrepancies in life expectancy translate into a higher incidence of widowhood and a longer time in which women live as widows. The gender gap in life expectancy is one of the less frequently discussed dimensions of gender inequality, and while it clearly has negative implications for men, lower male longevity has also substantial negative consequences for women and society as a whole.

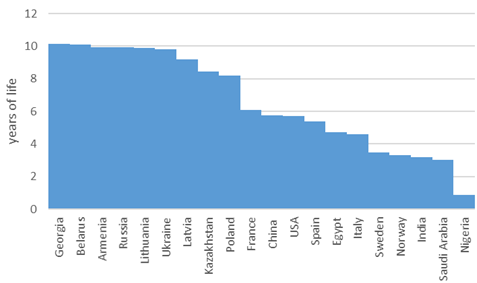

Figure A. Gender gap in life expectancy across selected countries

Source: World Bank.

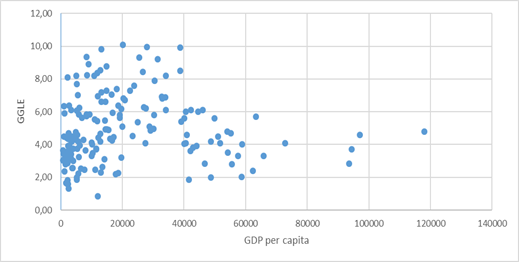

The earliest available reliable data on the relative longevity of men and women shows that the gender gap in life expectancy is not a new phenomenon. In the middle of the 19th century, women in Scandinavian countries outlived men by 3-5 years (Rochelle et al., 2015), and Bavarian nuns enjoyed an additional 1.1 years of life, relative to the monks (Luy, 2003). At the beginning of the 20th century, relative higher female longevity became universal as women started to live longer than men in almost every country (Barford et al., 2006). GGLE appears to be a complex phenomenon with no single factor able to fully explain it. Scientists from various fields such as anthropology, evolutionary biology, genetics, medical science, and economics have made numerous attempts to study the mechanisms behind this gender disparity. Their discoveries typically fall into one of two groups: biological and behavioural. Noteworthy, GGLE seems to be fairly unrelated to the basic economic fundamentals such as GDP per capita which in turn has a strong association with the level of healthcare, overall life expectancy, and human development index (Rochelle et al., 2015). Figure B presents the (lack of) association between GDP per capita and GGLE in a cross-section of countries. The data shows large heterogeneity, especially at low-income levels, and virtually no association from middle-level GDP per capita onwards.

Figure B. Association between gender gap in life expectancy and GDP per capita

Source: World Bank.

Biological Factors

The main intuition behind female superior longevity provided by evolutionary biologists is based on the idea that the offspring’s survival rates disproportionally benefited from the presence of their mothers and grandmothers. The female hormone estrogen is known to lower the risks of cardiovascular disease. Women also have a better immune system which helps them avoid a number of life-threatening diseases, while also making them more likely to suffer from (non-fatal) autoimmune diseases (Schünemann et al., 2017). The basic genetic advantage of females comes from the mere fact of them having two X chromosomes and thus avoiding a number of diseases stemming from Y chromosome defects (Holden, 1987; Austad, 2006; Oksuzyan et al., 2008).

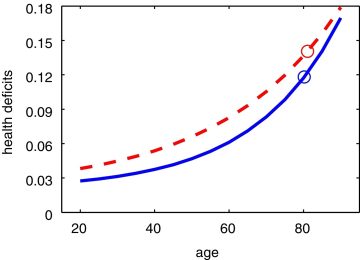

Despite a number of biological factors contributing to female longevity, it is well known that, on average, women have poorer health than men at the same age. This counterintuitive phenomenon is called the morbidity-mortality paradox (Kulminski et al., 2008). Figure C shows the estimated cumulative health deficits for both genders and their average life expectancies in the Canadian population, based on a study by Schünemann et al. (2017). It shows that at any age, women tend to have poorer health yet lower mortality rates than men. This paradox can be explained by two factors: women tend to suffer more from non-fatal diseases, and the onset of fatal diseases occurs later in life for women compared to men.

Figure C. Health deficits and life expectancy for Canadian men and women

Source: Schünemann et al. (2017). Note: Men: solid line; Women: dashed line; Circles: life expectancy at age 20.

Behavioural Factors

Given the large variation in GGLE, biological factors clearly cannot be the only driving force. Worldwide, men are three times more likely to die from road traffic injuries and two times more likely to drown than women (WHO, 2002). According to the World Health Organization (WHO), the average ratio of male-to-female completed suicides among the 183 surveyed countries is 3.78 (WHO, 2024). Schünemann et al. (2017) find that differences in behaviour can explain 3.2 out of 4.6 years of GGLE observed on average in developed countries. Statistics clearly show that men engage in unhealthy behaviours such as smoking and alcohol consumption much more often than women (Rochelle et al., 2015). Men are also more likely to be obese. Alcohol consumption plays a special role among behavioural contributors to the GGLE. A study based on data from 30 European countries found that alcohol consumption accounted for 10 to 20 percent of GGLE in Western Europe and for 20 to 30 percent in Eastern Europe (McCartney et al., 2011). Another group of authors has focused their research on Central and Eastern European countries between 1965 and 2012. They have estimated that throughout that time period between 15 and 19 percent of the GGLE can be attributed to alcohol (Trias-Llimós & Janssen, 2018). On the other hand, tobacco is estimated to be responsible for up to 30 percent and 20 percent of the gender gap in mortality in Eastern Europe and the rest of Europe, respectively (McCartney et al., 2011).

Another factor potentially decreasing male longevity is participation in risk-taking activities stemming from extreme events such as wars and military activities, high-risk jobs, and seemingly unnecessary health-hazardous actions. However, to the best of our knowledge, there is no rigorous research quantifying the contribution of these factors to the reduced male longevity. It is also plausible that the relative importance of these factors varies substantially by country and historical period.

Gender inequality and social gender norms also negatively affect men. Although women suffer from depression more frequently than men (Albert, 2015; Kuehner, 2017), it is men who commit most suicides. One study finds that men with lower masculinity (measured with a range of questions on social norms and gender role orientation) are less likely to suffer from coronary heart disease (Hunt et al., 2007). Finally, evidence shows that men are less likely to utilize medical care when facing the same health conditions as women and that they are also less likely to conduct regular medical check-ups (Trias-Llimós & Janssen, 2018).

It is possible to hypothesize that behavioural factors of premature male deaths may also be seen as biological ones with, for example, risky behaviour being somehow coded in male DNA. But this hypothesis may have only very limited truth to it as we observe how male longevity and GGLE vary between countries and even within countries over relatively short periods of time.

Economic Implications

Premature male mortality decreases the total labour force of one of the world leaders in GGLE, Belarus, by at least 4 percent (author’s own calculation, based on WHO data). Similar numbers for other developed nations range from 1 to 3 percent. Premature mortality, on average, costs European countries 1.2 percent of GDP, with 70 percent of these losses attributable to male excess mortality. If male premature mortality could be avoided, Sweden would gain 0.3 percent of GDP, Poland would gain 1.7 percent of GDP, while Latvia and Lithuania – countries with the highest GGLE in the EU – would each gain around 2.3 percent of GDP (Łyszczarz, 2019). Large disparities in the expected longevity also mean that women should anticipate longer post-retirement lives. Combined with the gender employment and pay gap, this implies that either women need to devote a larger percentage of their earnings to retirement savings or retirement systems need to include provisions to secure material support for surviving spouses. Since in most of the retirement systems the value of pensions is calculated using average, not gender-specific, life expectancy, the ensuing differences may result in a perception that men are not getting their fair share from accumulated contributions.

Policy Recommendations

To successfully limit the extent of the GGLE and to effectively address its consequences, more research is needed in the area of differential gender mortality. In the medical research dimension, it is noteworthy that, historically, women have been under-represented in recruitment into clinical trials, reporting of gender-disaggregated data in research has been low, and a larger amount of research funding has been allocated to “male diseases” (Holdcroft, 2007; Mirin, 2021). At the same time, the missing link research-wise is the peculiar discrepancy between a likely better understanding of male body and health and the poorer utilization of this knowledge.

The existing literature suggests several possible interventions that may substantially reduce premature male mortality. Among the top preventable behavioural factors are smoking and excessive alcohol consumption. Many studies point out substantial country differences in the contribution of these two factors to GGLE (McCartney, 2011), which might indicate that gender differences in alcohol and nicotine abuse may be amplified by the prevailing gender roles in a given society (Wilsnack et al., 2000). Since the other key factors impairing male longevity are stress and risky behaviour, it seems that a broader societal change away from the traditional gender norms is needed. As country differences in GGLE suggest, higher male mortality is mainly driven by behaviours often influenced by societies and policies. This gives hope that higher male mortality could be reduced as we move towards greater gender equality, and give more support to risk-reducing policies.

While the fundamental biological differences contributing to the GGLE cannot be changed, special attention should be devoted to improving healthcare utilization among men and to increasingly including the effects of sex and gender in medical research on health and disease (Holdcoft, 2007; Mirin, 2021; McGregor et al., 2016, Regitz-Zagrosek & Seeland, 2012).

References

- Albert, P. R. (2015). “Why is depression more prevalent in women?“. Journal of Psychiatry & Neuroscience, 40(4), 219.

- Austad, S. N. (2006). “Why women live longer than men: sex differences in longevity“. Gender Medicine, 3(2), 79-92.

- Barford, A., Dorling, D., Smith, G. D., & Shaw, M. (2006). “Life expectancy: women now on top everywhere“. BMJ, 332, 808. doi:10.1136/bmj.332.7545.808

- Holden, C. (1987). “Why do women live longer than men?“. Science, 238(4824), 158-160.

- Hunt, K., Lewars, H., Emslie, C., & Batty, G. D. (2007). “Decreased risk of death from coronary heart disease amongst men with higher ‘femininity’ scores: A general population cohort study“. International Journal of Epidemiology, 36, 612-620.

- Kulminski, A. M., Culminskaya, I. V., Ukraintseva, S. V., Arbeev, K. G., Land, K. C., & Yashin, A. I. (2008). “Sex-specific health deterioration and mortality: The morbidity-mortality paradox over age and time“. Experimental Gerontology, 43(12), 1052-1057.

- Luy, M. (2003). “Causes of Male Excess Mortality: Insights from Cloistered Populations“. Population and Development Review, 29(4), 647-676.

- McCartney, G., Mahmood, L., Leyland, A. H., Batty, G. D., & Hunt, K. (2011). “Contribution of smoking-related and alcohol-related deaths to the gender gap in mortality: Evidence from 30 European countries“. Tobacco Control, 20, 166-168.

- McGregor, A. J., Hasnain, M., Sandberg, K., Morrison, M. F., Berlin, M., & Trott, J. (2016). “How to study the impact of sex and gender in medical research: A review of resources“. Biology of Sex Differences, 7, 61-72.

- Mirin, A. A. (2021). “Gender disparity in the funding of diseases by the US National Institutes of Health“. Journal of Women’s Health, 30(7), 956-963.

- Oksuzyan, A., Juel, K., Vaupel, J. W., & Christensen, K. (2008). “Men: good health and high mortality. Sex differences in health and aging“. Aging Clinical and Experimental Research, 20(2), 91-102.

- Regitz-Zagrosek, V., & Seeland, U. (2012). “Sex and gender differences in clinical medicine“. Sex and Gender Differences in Pharmacology, 3-22.

- Rochelle, T. R., Yeung, D. K. Y., Harris Bond, M., & Li, L. M. W. (2015). “Predictors of the gender gap in life expectancy across 54 nations“. Psychology, Health & Medicine, 20(2), 129-138. doi:10.1080/13548506.2014.936884

- Schünemann, J., Strulik, H., & Trimborn, T. (2017). “The gender gap in mortality: How much is explained by behavior?“. Journal of Health Economics, 54, 79-90.

- Trias-Llimós, S., & Janssen, F. (2018). “Alcohol and gender gaps in life expectancy in eight Central and Eastern European countries“. European Journal of Public Health, 28(4), 687-692.

- WHO. (2002). “Gender and road traffic injuries“. World Health Organization.

- WHO. (2024). “Global health estimates: Leading causes of death“. World Health Organization.

- Łyszczarz, B. (2019). “Production losses associated with premature mortality in 28 European Union countries“. Journal of Global Health.

About FROGEE Policy Briefs

FROGEE Policy Briefs is a special series aimed at providing overviews and the popularization of economic research related to gender equality issues. Debates around policies related to gender equality are often highly politicized. We believe that using arguments derived from the most up to date research-based knowledge would help us build a more fruitful discussion of policy proposals and in the end achieve better outcomes.

The aim of the briefs is to improve the understanding of research-based arguments and their implications, by covering the key theories and the most important findings in areas of special interest to the current debate. The briefs start with short general overviews of a given theme, which are followed by a presentation of country-specific contexts, specific policy challenges, implemented reforms and a discussion of other policy options.

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Active Labor Market Policy in the Baltic-Black Sea Region

This brief outlines the characteristics of active labor market policy (ALMP) in four countries in the Baltic-Black Sea region: Belarus, Lithuania, Poland, and Ukraine. An analysis of the financing expenditure structure within this framework reveals significant differences between the countries, even for Poland and Lithuania, where the policies are to be set within a common EU framework. Countries also differed in terms of their ALMP reaction to the economic challenges brought about by the Covid-19 pandemic, as Poland and Lithuania increased their ALMP spending, while Ukraine, and, especially, Belarus, lagged behind. Despite these differences, all four countries are likely to benefit from a range of common recommendations regarding the improvement of ALMP. These include implementing evidence-informed policymaking and conducting counterfactual impact evaluations, facilitated by social partnership. Establishing quantitative benchmarks for active labor market policy expenditures and labor force coverage by active labor market measures is also advised.

Introduction

This policy brief builds on a study aimed at conducting a comparative analysis of labor market regulation policies in Belarus, Ukraine, Lithuania, and Poland. In comparing the structure of labor market policy expenditures, the aim was to identify common features between Poland and Lithuania, both of which are part of the EU and employ advanced labor market regulation approaches. We also assessed Ukraine’s policies, currently being reformed to align with EU standards, contrasting them with Belarus, where economic reforms are hindered by the post-Soviet authoritarian regime.

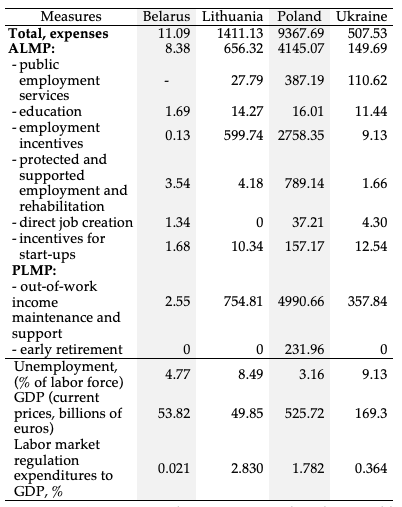

The analysis of the labor market policies for the considered countries is based on an evaluation of the structure of pertinent measures between 2017 and 2020 (Mazol, 2022). We used the 2015 OECD systematization of measures of active labor market policy, as presented in the first column of Table 1.

Our study reveals substantial differences in active labor market policies within the four considered countries. Still, motivated by OECD’s approach to ALMP, we provide a range of common policy recommendations that are relevant for each country included in the study. Arguably, aligning with the OECD approach would have more value for current EU and OECD members, Poland and Lithuania, and the aspiring member, Ukraine. However, these recommendations also hold value when considering a reformation of the Belarusian labor market policy.

ALMP Expenditures in Belarus, Lithuania, Poland and Ukraine

Labor market policy comprises of active and passive components. Active labor market policy involves funding employment services and providing various forms of assistance to both unemployed individuals and employers. Its primary objective is to enhance qualifications and intensify job search efforts to improve the employment prospects of the unemployed (Bredgaard, 2015). Passive labor market policy (PLMP) encompasses measures to support the incomes of involuntarily unemployed individuals, and financing for early retirement.

Poland and Lithuania are both EU and OECD members, so one would expect their labor market policies to be driven by the EU framework, and, thus, mostly aligned. However, our analysis showed that the structure of their expenditures on active labor market policies in 2017-2019 differed (Mazol, 2022). In Lithuania, the majority of the funding was allocated to employment incentives for recruitment, job maintenance, and job sharing. From 2017 to 2019, the share for these measures was between 18 and 28 percent of all expenditures for state labor market regulation. In Poland, the majority of funding was allocated to measures supporting protected employment and rehabilitation. The spending on these measures fluctuated between 23 and 34 percent of all expenditures for state labor market regulation between 2017 and 2019.

The response to the labor market challenges during the Covid-19 pandemic in Poland and Lithuania resulted in a notable surge in state labor market policy spendings in 2020, amounting to 1.78 percent of GDP and 2.83 percent of GDP, respectively. Both countries sharply increased the total spending on employment incentives (see Table 1 which summarizes the expenditure allocation for 2020). Poland experienced a nine-fold increase in costs for financing these measures (29.4 percent of total expenditures on state labor market regulation). Meanwhile, in Lithuania, financing for employment incentives increased more than tenfold, amounting to 42.5 percent of all expenditures for state labor market regulation. In both countries it became the largest active labor market policy spending area.

Table 1. Financing of state labor market measures in Baltic-Black Sea region countries in 2020 (in millions of Euro).

Source: DGESAI, 2023. Author’s estimations based on World Bank data (World Bank, 2023), National Bank of Belarus data, National Bank of Ukraine data.

In Ukraine, the primary focus for active labor market policy expenditures was, from 2017 to 2020, directed towards public employment services, comprising 18 to 24 percent of total labor market policy expenditures. Notably, despite the Covid-19 pandemic, there were no significant changes in either the structure or the volume of active labor market policy expenditures in Ukraine in 2020. Despite Ukraine’s active efforts to align its economic and social policies with EU standards, the government has underinvested in labor market policy, with expenditures accounting for only 0.33-0.37 percent of GDP between 2017 and 2020. This is significantly below the levels observed in Lithuania and Poland.

In Belarus, labor market policy financing is one of the last priorities for the government. In 2020, financing accounted for about 0.02 percent of GDP, amounts clearly insufficient for having a significant impact on the labor market. Moreover, Belarus stood out as the sole country in the reviewed group to have reduced its funding for labor market policies, including both active and income support measures, during the Covid-19 pandemic. The majority of the financing for labor market policy has been directed towards protected and supported employment and rehabilitation, including job creation initiatives for former prisoners, the youth and individuals with disabilities.

ALMP Improvement Recommendations

As illustrated above, the countries under review do not have a common approach to active labor market policy spendings. Further, countries like Poland and Lithuania took a more flexible stance on addressing labor market challenges caused by the Covid-19 pandemic, by implementing additional financial support for active labor market policies. However, Ukraine and Belarus did not adjust their expenditure structures accordingly. Part of these cross-country differences can be attributed to differing legal framework: Poland and Lithuania are OECD and EU member states, and, thus, subject to corresponding regulations. Ukraine is in turn motivated by the prospects of EU accession, while Belarus currently has no such prosperities to take into account.

Another important source of deviation arises from the differences in current labor market and economic conditions in the respective countries, and the governments’ need to accommodate these. While such a market-specific approach is well-justified, aligning expenditure structures with current labor market conditions necessitates obtaining updated and reliable information about the labor market situation and the effectiveness of specific labor market measures or programs. An effective labor market policy thus requires establishing a reliable system for assessing the efficiency of government measures, i.e., deploying evidence-informed policy making (OECD, 2022).

To achieve this, it is crucial to establish a robust system for monitoring and evaluating the implementation of specific measures. This involves leveraging data from various centralized sources, enhancing IT infrastructure to support data management, and utilizing modern methodologies such as counterfactual impact evaluations (OECD, 2022).

Moreover, an effective labor market regulation policy necessitates the ability to swiftly adapt existing active measures and service delivery methods in response to changes in the labor market. This might entail rapid adjustments in the legal framework, underscoring the importance of close cooperation and coordination among key stakeholders, and a well-functioning administrative structure (Lauringson and Lüske, 2021).

To accomplish this objective, it is vital to foster close collaboration between the government and institutions closely intertwined with the labor market, capable of providing essential information to labor market regulators. One of the most useful tools in this regard appears to be so-called social partnerships – a form of a dialogue between employers, employees, trade unions and public authorities, involving active information exchange and interaction (OECD, 2022).

A reliable system to assess labor market policy and in particular to facilitate their targeting, is an essential component of this approach.

Ukraine and Belarus are underfunding their labor market policies, both in comparison to the levels observed in Poland and Lithuania, and in absolute terms. It is therefore advisable to establish quantitative benchmark indicators to act as guidance for these countries, in order to ensure that any labor market policy implemented is adequately funded. Here, a reasonable approach is to align the costs of implementing labor market measures with the average annual levels for OECD countries (which are 0.5 percent of GDP for active measures and 1.63 percent for total labor market policy expenditures (OECD, 2024). Furthermore, it’s essential to ensure a high level of labor force participation in active labor market regulation measures. A target standard could be set, based on the average annual coverage from active labor market measures, at 5.8 percent of the national economy labor force, as observed in OECD countries (OECD, 2024).

Conclusion

The countries under review demonstrate varying structures of active labor market expenditures. Prior to the Covid-19 pandemic, employment incentives received the most financing in Lithuania. In Poland the largest share of expenditures was instead directed to measures to support protected employment and rehabilitation. In Ukraine, the main expenditures were directed towards financing employment services and unemployment benefits while Belarus primarily allocated funds to protected and supported employment and rehabilitation. Notably, Lithuania and Poland responded to the economic challenges following Covid-19 by significantly increasing spending on employment incentives, while Ukraine and Belarus did not undertake such measures.

Part of the diverging patterns may be attributable to the countries varying legal framework and differences in the countries respective labor market and economic conditions.

While some of the differences in labor market policies are thus justified, ensuring funding at the OECD level for labor market measures, alongside adequate tools for monitoring and evaluating labor market policies, are likely to benefit all four Baltic-Black Sea countries.

References

- Bredgaard, T. (2015). Evaluating What Works for Whom in Active Labour Market Policies. European Journal of Social Security, 17 (4), 436-452.

- DGESAI. (Directorate-General for Employment, Social Affairs and Inclusion). (2023. Expenditure by LMP intervention – country https://webgate.ec.europa.eu/empl/redisstat/databrowser/explore/all/lmp?lang=en&subtheme=lmp_expend.lmp_expend_me&display=card&sort=category&extractionId=LMP_EXPME

- Lauringson, A. and Lüske M. (2021). Institutional Set-up of Active Labour Market Policy Provision in OECD and EU Countries: Organisational Set-up, Regulation and Capacity. OECD Social, Employment and Migration Working Papers no. 262.

- Mazol, A. (2022). Active Labor Market Policy in the Countries of the Baltic-Black Sea Region. BEROC Policy Paper Series, PP no. 115.

- OECD. (2015). OECD Employment database – Labour market policies and institutions https://www.oecd.org/employment/Coverage-and-classification-of-OECD-data-2015.pdf

- OECD. (2022). Impact Evaluation of Vocational Training and Employment Subsidies for the Unemployed in Lithuania. Connecting people with jobs. Paris: OECD Publishing.

- OECD. (2024). OECDstats: Labor market programs https://stats.oecd.org

- World Bank. (2023). World Development Indicators. https://databank.worldbank.org/source/world-development-indicators

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Widowhood in Poland: Reforming the Financial Support System

Drawing on a recent Policy Paper, we analyse the degree to which the current system of support in widowhood in Poland limits the extent of poverty among this large and growing group of the population. The analysis is set in the context of a proposed reform discussed lately in the Polish Parliament. We present the budgetary and distributional consequences of this proposal and offer an alternative scenario which limits the overall cost of the policy and directs additional resources to low-income households.

Introduction

Losing a partner usually comes with consequences, both for mental health and psychological well-being (Adena et al., 2023; Blanner Kristiansen et al., 2019; Lee et al., 2001; Steptoe et al., 2013), and for material welfare. Economic deprivation may be particularly pronounced in cases of high-income differentials between spouses and in situations when the primary earner – often the man – dies first. Many countries have instituted survivors’ pensions, whereby the surviving spouse continues to receive some of the income of her/his deceased partner alongside other incomes. The systems of support differ substantially between countries and they often combine social security benefits and welfare support for those with lowest incomes.

In this Policy Brief we summarise the results from a recent paper (Myck et al., 2024) and discuss the material situation of widows versus married couples in Poland. We show the degree to which the ‘survivors’ pension’, i.e. the current system of support in widowhood, limits the extent of poverty among widows and compare it to a proposed reform discussed lately in the Polish Parliament, the so called ‘widows’ pension’. In light of the examined consequences from this proposal we relate it to an alternative scenario, which – as we demonstrate – brings very similar benefits to low-income widows, but, at the same time, substantially reduces the cost of the policy.

Reforming the System of Support in Widowhood

Our analysis draws on a sample of married couples aged 65 and older from the Polish Household Budget Survey – a group representing a large part of the Polish population (almost 1,7 million couples). Each of these couples is assigned to an income decile, depending on the level of their disposable income. Incomes of 9.5 percent of the sample locate them in the bottom decile, i.e. the poorest 10 percent of the population, while 4.4 percent of these older couples have incomes high enough to place them in the top income group – the richest 10 percent of the population.

Next, in order to examine the effectiveness of the different systems of support, we conduct the following exercise: incomes of these households are re-calculated assuming the husbands have passed away. This simulates the incomes of the sampled women in hypothetical scenarios of widowhood. The incomes are calculated under four different systems of support as summarized in Table 1.

Table 1. Modelled support scenarios.

Using these re-calculated household incomes, we can identify the relative position in the income distribution in the widowhood scenario as well as the poverty risk among widows under different support systems.

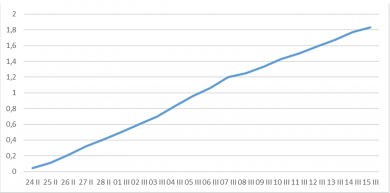

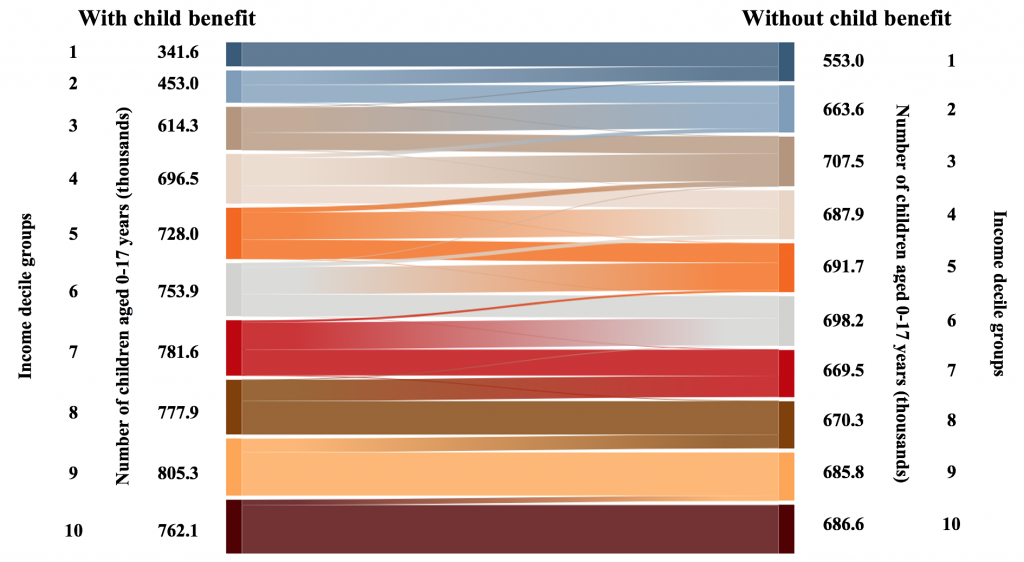

The change in the relative position in the income distribution following widowhood under the four support systems is presented in Figure 1. The starting point (the left-hand side of each chart) are the income groups of households with married couples aged 65+, i.e. before the simulated widowhood. The transition to the income deciles on the right-hand side of each chart is the result of a change in equivalised (i.e. adjusted for household composition) disposable income in the widowhood simulation, under different support scenarios (I – IV).

Figure 1. Change in income decile among women aged 65+, following a hypothetical death of their husbands.

Source: Own calculations based on HBS 2021 using SIMPL model; graphs were created using: https://flourish.studio/

Figure 1a shows that, without any additional support, the financial situation of older women would significantly deteriorate in the event of the death of their spouses (Figure 1a). The share of women with incomes in the lowest two deciles would be as high as 54.7 percent (compared to 17.5 percent of married couples). The current survivor’s pension seems to protect a large proportion of women from experiencing large reductions in their income (Figure 1b), although the proportion of those who find themselves in the lowest two income decile groups more than doubles relative to married couples (to 38.3 percent). The widow’s pension (Figure 1c) offers much greater support and a very large share of new widows remain in the same decile or even move to a higher income group following the hypothetical death of their spouses. For example, with the widows’ pension, 8.0 percent of the widows would be in the 9th income decile group and 5.3 percent in the 10th group, while in comparison 7.0 and 4.4 percent of married couples found themselves in these groups, respectively. The proposed alternative system (Figure 1d) raises widows’ incomes compared to the current survivor’s pension system, but it is less generous than the system with the widow’s pension. At the same time 4.6 percent and 3.4 percent of widows would be found in the 9th and 10th deciles, respectively.

Importantly, the alternative support system is almost as effective in reducing the poverty risk among widows as the widow’s pension. In the latter case the share of at-risk-of poverty drops from 35.3 percent (with no support) and 20.7 percent (under the current system) to 11,0 percent, while under the alternative system, it drops to 11.8 percent. Because the alternative system limits additional support to households with higher incomes, this reduction in at-risk-of poverty would be achieved at a much lower cost to the public budget. We estimate that while the current reform proposal would result in annual cost of 24.1 bn PLN (5.6 bn EUR), the alternative design would cost only 10.5 bn PLN (2.5 bn EUR).

The distributional implications of the two reforms are presented in Figure 2 which shows the average gains in the incomes of ‘widowed’ households between the reformed versions of support and the current system with the survivor’s pension. The gains are presented by income decile of the married households. We see that the alternative system significantly limits the gains among households in the upper half of the income distribution.

Figure 2. Average gains from an implementation of the widow’s pension and the alternative system, by income decile groups.

Source: Own calculations based on HBS 2021 using the SIMPL model. Notes: Change in the disposable income with respect to the current system with survivor’s pension. 1PLN~0.23EUR.

Conclusions

While subjective evaluations of the material conditions of older persons living alone in Poland have shown significant improvements, income poverty within this groups has increased since 2015. This suggests that the incomes of older individuals have not sufficiently kept up with the dynamics of earnings of and social transfers to other social groups in Poland. As shown in our simulations, the current widowhood support system substantially limits the risk of poverty following the death of one’s partner. However, while the current survivor’s pension decreases the poverty risk from 35.3 percent in a system without any support to 20.7 percent, the risk of poverty among widows is still significantly higher compared to the risk faced by married couples.

The simulations presented in this Policy Brief examine the implications of a support system reform; the widow’s pension which is currently being discussed in the Polish Parliament, as well as an alternative proposal putting more emphasis on poorer households. The impactof these two reforms on the at-risk-of poverty levels among widowed individuals would be very similar, but the design of the alternative system would come at a significantly lower cost to the public budget. The total annual cost to the public sector of the widow’s pensions would amount to 24.1 bn PLN (5.6 bn EUR) while our proposed alternative would cost only 10.5 bn PLN (2.5 bn EUR) per year.

An effective policy design allowing the government to achieve its objectives at the lowest possible costs should always be among the government main priorities. This is especially important in times of high budget pressure – due to demographic changes or other risks – as is currently the case in Poland.

References

- Adena, M., Hamermesh, D., Myck, M., & Oczkowska, M. (2023). Home Alone: Widows’ Well-Being and Time. Journal of Happiness Studies.

- Blanner Kristiansen, C., Kjær, J. N., Hjorth, P., Andersen, K., & Prina, A. M. (2019). Prevalence of common mental disorders in widowhood: A systematic review and meta-analysis. Journal of Affective Disorders, 245, 1016–1023.

- Lee, G. R., DeMaris, A., Bavin, S., & Sullivan, R. (2001). Gender Differences in the Depressive Effect of Widowhood in Later Life. The Journals of Gerontology: Series B, 56(1), S56–S61.

- Myck, M., Król, A. & Oczkowska, M. (2024). Reforming financial support in widowhood: the current system in Poland and its potential reforms. FREE Network Policy Paper Series.

- Steptoe, A., Shankar, A., Demakakos, P., & Wardle, J. (2013). Social isolation, loneliness, and all-cause mortality in older men and women. Proceedings of the National Academy of Sciences, 110(15), 5797–5801.

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Polish Parliamentary Elections 2023: Social Transfers and the Voters the Government is Counting On

The heated election campaign preceding the October 15th election in Poland has focused on fundamental issues related to the rule of law, migration, media freedom, women’s and minority rights, climate policy as well as Poland’s role on the international arena. The election outcome will determine Poland’s role in the EU and as well as the country’s future relations with Ukraine. It will also be decisive for the direction of Polish politics and the foundations of socio-economic development for many years to come. Despite these issues, the primary worries for a substantial portion of Polish households concern the domestic challenges of increasing prices and material uncertainty. With this in mind, this Policy Brief summarizes the results of CenEA’s recent analysis, which demonstrates a clear pattern in the United Right government’s policy, that in the last four years has strongly favored older groups of the Polish population. In the 2019 elections financial support directed to families with children was a key factor in securing a second term in office for the governing coalition. It remains to be seen if the focus on older voters pays off in the same way on October 15th.

Introduction

The upcoming parliamentary elections on October 15th will close a very special term of the Polish Parliament, marked by the Covid-19 pandemic, a surge in prices of goods and services, as well as the full-scale, ongoing Russian invasion of Ukraine and the tragic consequences associated with it. An evaluation of the second term of the United Right’s (Zjednoczona Prawica) government should, on the one hand, cover the most important decisions made in response to these crises. On the other hand, the last four years have also been a time of significant decisions with important medium- and long-term consequences, both directly for Polish households’ financial situation and more broadly for the economy at large and the country’s socio-economic development.

The heated election campaign has focused on the fundamental issues related to the rule of law, migration, media freedom, women’s and minority rights, climate policy as well as Poland’s role on the international arena. The upcoming vote is likely to be decisive in regard to Poland’s relations with partners in the EU, the role it will play in the EU and – as recent government declarations have demonstrated – the development of future relations with Ukraine. The result of the October elections will be pivotal also for the direction of Polish politics and the foundations of socio-economic development for many years to come. At the same time however, recent surveys have shown that the main concern for a significant part of the Polish society lies closer to home, driven by the challenges of rising prices of goods and services and related material uncertainty.

In light of this, this policy brief summarizes the tax and benefit policies directly affecting household finances, which were implemented in the first and second term of the United Right’s rule (i.e., 2015-2019 and 2019-2023). The brief draws upon a detailed analysis published recently in the CenEA Preelection Commentaries (Myck et al. 2023 a,b,c). The results show a notable shift in the government’s focus – while families with children were the main beneficiaries of the reforms implemented in the first term, the policies over the last four years have concentrated transfers and tax advantages to older generations. As we approach election day, it seems likely that the government will further try to mobilize support from this group of voters

The United Right’s Second Term: Tax and Benefit Reforms During High Inflation

In recent years, Polish households has, apart from two major crises (the Covid-19 pandemic and the complex consequences from the Russian invasion of Ukraine), faced one of the greatest price increases in the EU. During the closing term of Parliament, from January 2020 to July 2023, prices increased by 35.6 percent and have continued to grow at a rate significantly exceeding the inflation target set by the National Bank of Poland (2.5 percent +/- 1 percentage point per year). By the end of 2023 the combined inflation rate will reach 38.7 percent. Although average wages have also been rising (nominally by 41.7 percent from January 2023 to July 2023), wage growth has not kept up with the inflation for many workers. One needs to also bear in mind that a significant proportion of Polish households rely on income from transfers and state support. At the same time households’ material conditions have deteriorated as a result of a significant reduction in the real value of their savings.

In 2022 and 2023 the government introduced a number of temporary policies designed specifically to assist households facing higher energy and food prices. Throughout the final term in office, it also adopted several reforms which – as we show below – affected some groups more than others, reflecting a clear policy preference:

a) in January 2020 and May 2022 respectively, the government legislated an additional level of support addressed to retirees and disability pensioners. These so-called 13th and 14th pensions have raised the minimum level of pension benefits.

b) in January 2022 the government implemented a major overhaul of the income tax system (the so-called Polish Deal) which significantly influenced the tax burden on most taxpayers, strongly benefitting pension recipients.

c) throughout the term of Parliament, the government has kept the values of most social benefits frozen at their nominal level. This includes its flagship program – the universal 500+ parental benefit (500 PLN, roughly 110 EUR per child per month), introduced in 2016 – as well as means tested family benefits directed to poorer families with children. As a result, both the values as well as eligibility thresholds has fallen by nearly 40 percent.

The implications of these three policy areas are reported in Table 1 for the 2019-2023 term of Parliament and contrasted with benefits and costs from government policies implemented in the first term of Parliament (2015-2019). The results have been calculated using the SIMPL microsimulation model and are based on a representative sample of over 30 000 Polish households from the 2021 Household Budget Survey (for methodological details see Myck et al., 2015; 2023c). The applied method allows for singling out policy effects from other factors affecting household incomes.

Table 1 shows a clear difference in focus; from substantial benefits directed at families with children in 2015-2019 to policies targeted at pensioners, partly at the cost of families with children, in the second term. It is also worth noting that while government policy continued to increase household incomes, the resulting gains in disposable incomes in the second term have been much more modest.

Table 1. The impact of modelled policies in the tax and benefit system on household income in the two terms of the United Right’s government.

Source: CenEA – own calculations using the SIMPL model based on 2021 Household Budget Survey data (reweighted for simulation purposes and indexed to July 2023).

Notes: Simulations with respect to the system and price level from July 2023. Changes are presented in relation to the indexed system from 2015 for the first term of office of the United Right government and the indexed system from 2019 for the second term of office. *Including family allowance with supplements, care benefits, parental leave benefit, and one-off allowance for the birth of a child. The applied exchange rate is 4.6PLN=1EUR.

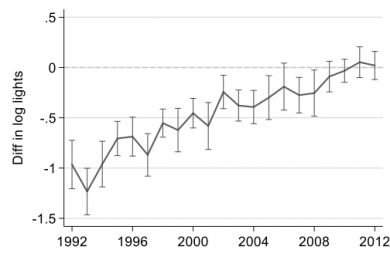

The contrast is also visible when the totals from Table 1 are divided and allocated to specific family types, as presented in Figure 1. On average lone parent families gained about 800 PLN (170 EUR) per month as a result of policies implemented in the 2015-2019 term, while they lost 160 PLN (35 EUR) in the second term. Married couples with children gained 950 PLN (205 EUR) and lost 259 PLN (55 EUR) in each term, respectively. In contrast to this, gains of pensioner families were modest during the first term, while the policies implemented in the second term imply gains of about 310 PLN (70 EUR) per month for single pensioners and 630 PLN (140 EUR) per month to pensioner couples. Gains and losses by family type resulting from policies implemented between 2019-2023 are shown in more detail in Figure 2. Over 85 percent of single pensioners have seen gains of more than 200 PLN (45 EUR) per month, and a similar proportion of pensioner couples gained over 400 PLN (90 EUR) per month. At the same time the majority of families with children, both among lone parent families and married couples, principally as a result of benefit freezes, saw their incomes fall in real terms. The values of the universal 500+ parental benefit will be indexed in January 2024, and the government has made this indexation an important element of the campaign. However, the indexation will not compensate the losses that families experienced in the last four years, a period with high inflation. It remains to be seen if a promise of higher transfers in the future will translate into political support, as seen in the 2019 elections (Gromadzki et al. 2022).

Figure 1. The impact of modelled policies in the tax and benefit system on household income in the two terms of the United Right’s government, by family types.

Source: CenEA – own calculations using the SIMPL microsimulation model based on 2021 Household Budget Survey data (reweighted for simulation purposes and indexed to July 2023).

Figure 2. Ranges of monthly benefits and losses resulting from the modelled policies introduced in the United Right government’s second term of office (2019-2023), by family type.

Source: CenEA – own calculations using the SIMPL microsimulation model based on 2021 Household Budget Survey data (reweighted for simulation purposes and indexed to July 2023).

Timing and Other Tricks: Securing the Votes of Older Generations

The so-called 13th and 14th pensions are paid once per year, in May and September respectively, to recipients of public pensions, at a value equivalent to a monthly minimum pension (approximately 360 EUR). While the first is a universal benefit, the latter has a withdrawal threshold and is thus targeted at lower income pensioners. In 2023 the government decided to increase the value of the 14th pension to about 580 EUR, with the benefits paid out to pensioners in September, the month before the election. This additional bonus came at the cost of about 7 billion PLN (1.6 billion EUR) – a budget which could have paid for two years of indexation of benefits targeted at low-income families with children or financed the payment of the indexed value of the universal 500+ parental benefit for nearly four months. The decision completes the picture of a clear preference for the older generation in regard to social policy in recent years and suggests a clear focus on this group of voters prior to the upcoming election.

The government has also taken a number of steps to facilitate electoral participation among voters in smaller communities by increasing the number of polling stations and making it obligatory for local administrations to finance transportation for older individuals with mobility limitations. The government is also mobilizing voters in smaller communities with turn-out competition initiatives. Additionally, some commentators have pointed out that the choice of election day – one day ahead of the so-called ‘Papal day’, devoted to the memory of John Paul II – is also non-accidental.

Conclusion

The analysis presented in the recent CenEA Preelection Commentaries and summarized in this brief indicates that in the area of reforms directly affecting household incomes, pensioners are the social group that benefited most from the United Right’s government policies in the 2019-2023 term of office. This is evident both from policies that have become a permanent feature of the Polish tax and benefit system, as well as from various one-off decisions. Taking into account other policies surrounding the approaching parliamentary election, it seems clear that the government is strongly counting on the support of older generations of voters on October 15th. As election day is approaching it becomes more and more evident though, that securing their vote may not suffice to win a third term in office. Numerous policy and corruption scandals, a significant departure from judicial independence and an extreme degree of governing party dominance in public media have come to the fore of public debate ahead of the vote. According to recent polls the final outcome is still uncertain and even small shifts in support might swing the future parliamentary majority. According to Gromadzki et al. (2022), financial support directed to families with children was a key factor for securing a second term in office for the United Right coalition four years ago. It remains to be seen if the policy focus on older voters pays off in the same way on October 15th.

Acknowledgement

The authors wish to acknowledge the support of the Swedish International Development Cooperation Agency (Sida) under the FROGEE and FROMDEE projects. FREE Policy Briefs contribute to the discussion on socio-economic development in the Central and Eastern Europe. For more information, please visit www.freepolicybriefs.com.

References

- Gromadzki, J., Sałach, K., Brzezinski, M. (2022). When Populists Deliver on their Promises: the Electoral Effects of a Large Cash Transfer Program in Poland. http://dx.doi.org/10.2139/ssrn.4013558

- Myck, M., Król, A, Oczkowska, M., Trzciński, K. (2023a). Druga kadencja rządów Zjednoczonej Prawicy: wsparcie rodzin z dziećmi w czasach wysokiej inflacji [The second term of the United Right’s rule: support to families with children in times of high inflation]. CenEA Preelection Commentary 13.09.2023. https://cenea.org.pl/2023/09/13/wybory-parlamentarne-2023-w-polsce-komentarze-przedwyborcze-cenea/

- Myck, M., Król, A, Oczkowska, M., Trzciński, K. (2023b). Druga kadencja rządów Zjednoczonej Prawicy: kto zyskał, a kto stracił? [The second term of the United Right’s rule: who gained and who lost?] CenEA Preelection Commentary, 14.09.2023. https://cenea.org.pl/2023/09/13/wybory-parlamentarne-2023-w-polsce-komentarze-przedwyborcze-cenea/

- Myck, M., Król, A, Oczkowska, M., Trzciński, K. (2023c). Materiały metodyczne [Methodology volume]. https://cenea.org.pl/2023/09/13/wybory-parlamentarne-2023-w-polsce-komentarze-przedwyborcze-cenea/

- Myck, M., Kundera, M., Najsztub, M., Oczkowska, M. (2015). Dwie kadencje w polityce podatkowo-świadczeniowej: programy wyborcze i ich realizacja w latach 2007-2015. IV Raport Przedwyborczy CenEA. (Two terms of the tax-benefit policies: electoral promises and their realization in years 2007-2015. IV CenEA Preelection Report.) https://cenea.org.pl/pl/2015/09/03/dwie-kadencje-w-polityce-podatkowoswiadczeniowej-programy-wyborcze-i-ich-realizacja-w-latach-2007-2015/

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

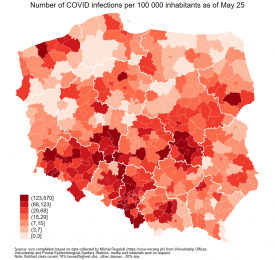

What Can We Learn from Regional Patterns of Mortality During the Covid-19 Pandemic?

Given the nature of the spread of the virus, strong regional patterns in fatal consequences of the Covid-19 pandemic are to be expected. This brief summarizes a detailed examination of the spatial correlation of deaths in the first year of the pandemic in two neighboring countries – Germany and Poland. Among high income European countries, these two seem particularly different in terms of the death toll associated with the pandemic, with many more excess deaths recorded in Poland as compared to Germany. Detailed spatial analysis of deaths at the regional level shows a consistent spatial pattern in deaths officially registered as related to Covid-19 in both countries. For excess deaths, however, we find a strong spatial correlation in Germany but little such evidence in Poland. These findings point towards important failures or neglect in the areas of healthcare and public health in Poland, which resulted in a massive loss of life.

Introduction

While almost all European countries currently refrain from imposing any Covid-19 related restrictions, the pandemic still takes a huge economic, health and social toll across societies worldwide. The regional variation of incidence and different consequences of the pandemic, observed over time, should be examined to draw lessons for ongoing challenges and future pandemics. This brief outlines a recently published paper by Myck et al. (2023) in which we take a closer look at two neighboring countries, Germany and Poland. Within the pool of high-income countries, these are particularly different in terms of the death toll associated with the Covid-19 pandemic. In 2020 in Poland, the excess deaths rate (with reference to the 2016-2019 average) was as high as 194 per 100,000 inhabitants, over 3 times higher than the 62 deaths per 100,000 inhabitants in Germany (EUROSTAT, 2022a, 2022b). While, in relative terms, the death toll officially registered as resulting from Covid-19 infections in 2020 was also higher in Poland than in Germany, the difference was considerably lower (about 75 vs 61 deaths per 100,000 inhabitants, respectively) (Ministry of Health, 2022; RKI, 2021). Population-wise Germany is 2.2 times larger than Poland and, before the pandemic struck, the countries differed also in other relevant dimensions related to the socio-demographic structure of the population, healthcare and public health. The nature of Covid-19 and the high degree of regional variation between and within the two countries along some crucial dimensions thus make Germany and Poland an interesting international case for comparison of the pandemic’s consequences. We show that the differences in the spatial pattern of deaths between Germany and Poland may provide valuable insight to the reasons behind the dramatic differences in the aggregate numbers of fatalities (Myck et al., 2023).

Regional Variation in Pandemic-Related Mortality and Pre-Pandemic Characteristics

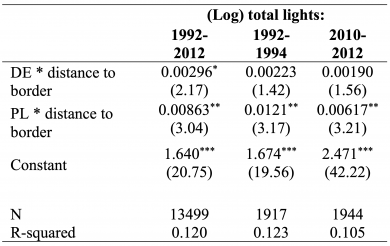

We examine three measures of mortality in the first year of the Covid-19 pandemic in 401 German and 380 Polish counties (Kreise and powiats, respectively): the officially recorded Covid-19 deaths, the total numbers of excessive deaths (measured as the difference in the number of total deaths in year 2020 and the 2015-2019 average) and the difference between the two measures. Figure 1 shows the regional distribution of these three measures calculated per 1000 county inhabitants. All examined indicators were generally much higher in Poland as compared to Germany. In Poland, deaths officially registered as caused by Covid-19 were concentrated in the central and south-eastern regions (łódzkie and lubelskie voivodeships), while in Germany they were concentrated in the east and the south (Sachsen and Bayern). Excess mortality was predominantly high in German regions with high numbers of Covid-19 deaths, but also in nearby regions. As a result, these same regions also show greater differences between excessive deaths and Covid-19 deaths. On the contrary, high excessive deaths can be noted throughout Poland, including the regions where the number of Covid-19 deaths were lower. In the case of Poland, spatial clusters are much less obvious for both excess deaths and the difference between excess and Covid-19 deaths. To further explore the degree of regional variation between and within countries with respect to the mortality outcomes, we link them to regional characteristics such as population, healthcare and economic conditions, which might be relevant for both the spread of the virus and the risk of death from Covid-19. In Figure 2 we illustrate the scope of regional disparities with examples of (a) age structure of the population, (b) the pattern of economic activity and (c) distribution of healthcare facilities in years prior to the pandemic.

Figure 1. Regional variation of death incidence in 2020: Germany and Poland.

Note: The panels share a common legend based on the quintile distribution of Covid-19 deaths, with two additional categories added at the top and bottom of the scale. County borders in white, regional borders in yellow and country border in grey. Source: Myck et al. (2023).

Figure 2. Pre-pandemic regional variation of socio-economic indicators: Germany and Poland.

Note: Two top and bottom categories in the legend cover 10% of observations each, the rest of categories cover 20% of observations each. County borders in white, regional borders in yellow and country border in grey. Source: Myck et al. (2023).

Shares of older population groups (aged 85+ years) are clearly substantially higher in Germany compared to Poland, and within both countries these shares are higher in the eastern regions. On the other hand, the proportion of labor force employed in agriculture is significantly higher in Poland and heavily concentrated in the eastern parts of the country. In Germany, this share is much lower and more evenly spread. This indicator illustrates that socio-economic conditions in 2020 were still substantially different between the two countries. The share of employed in agriculture is also important from the point of view of pandemic risks – it reflects lower levels of education, and specific working conditions that make it challenging to work remotely yet entail less personal contact and more outdoor labor. The distribution of hospital beds reflects the urban/rural divide in both countries. It is also a good proxy for detailing the differences in the overall quality of healthcare between the two countries, i.e. displaying significantly better healthcare infrastructure in German counties.

Uncovering the Spatial Nature of Excess Deaths in Germany and Poland

While spatial similarities among regions are present along many dimensions, they are particularly important when discussing such phenomena as pandemics, when infection spread affects nearby regions more than distant ones. With regard to the spatial nature of excess deaths in the first year of the pandemic, a natural hypothesis is thus that the pattern of these deaths should reflect the nature of contagion. This applies primarily to excess deaths directly caused by the pandemic (deaths resulting from infection with the virus). At the same time, some indirect consequences of Covid-19 such as limitations on the availability of hospital places and medical procedures, or lack of medical personnel to treat patients not affected by Covid-19, are also expected to be greater in regions with a higher incidence of Covid-19. On the other hand, spatial patterns are much less obvious in cases where excess deaths would result, for example, from externally or self-imposed restrictions such as access to primary health care, reduced contact with other people, diminished family support, or mental health problems due to isolation. While these should also be regarded as indirect consequences of the pandemic, as they would arguably not have realized in its absence, these consequences do not necessarily relate to the actual spread of the virus. Our in-depth analysis of the spatial distribution of the three examined mortality-related measures, therefore, allows us to make a crucial distinction in possible explanations for the dramatic differences in the observed death toll in the first year of the pandemic in Germany and Poland. We explore the degree of spatial correlation in the three mortality outcomes using multivariate spatial autoregressive models, controlling for a number of local characteristics (for more details see Myck et al., 2023).

We find that in Germany, all mortality measures show very strong spatial correlation. In Poland, we also confirm statistically significant spatial correlation of Covid-19 deaths. However, we find no evidence for such spatial pattern either in the total excess deaths or in the difference between excess deaths and Covid-19 deaths. In other words, in Poland, the deaths over and above the official Covid-19 deaths do not reflect the features to be expected during a pandemic. As the results of the spatial analysis show, these findings cannot be explained by the regional pre-pandemic characteristics but require alternative explanations. This suggests that a high proportion of deaths results from a combination of policy deficits and individual reactions to the pandemic in Poland. Firstly, during the pandemic, individuals in Poland may have principally withdrawn from various healthcare interventions as a result of fear of infection. Secondly, those with serious health conditions unrelated to the pandemic may have received insufficient care during the Covid-19 crisis in Poland, and, as a consequence, died prematurely. This may have been a result of lower effectiveness of online medical consultations, excessive limitations to hospital admissions – unjustified from the point of view of the spread of the virus, and/or worsened access to healthcare services as a result of country-wide lockdowns and mobility limitations. The deaths could also have resulted from reduced direct contact with other people (including family and friends as well as care personnel) and mental health deterioration as a consequence of (self)isolation. Our analysis does not allow us to differentiate between these hypotheses, but the aggregate excess deaths data suggests that a combination of the above reasons came at a massive cost in terms of loss of lives. The consequences reflect a very particular type of healthcare policy failure or policy neglect in the first year of the pandemic in Poland.

Our study also shows that a detailed analysis of country differences concerning the consequences of the ongoing pandemic can serve as a platform to set and test hypotheses about the effectiveness of policy responses to better tackle future global health crises.

Acknowledgement

The authors wish to acknowledge the support of the German Research Foundation (DFG, project no: BR 38.6816-1) and the Polish National Science Centre (NCN, project no: 2018/31/G/HS4/01511) in the joint international Beethoven Classic 3 funding scheme – project AGE-WELL. For the full list of acknowledgements see Myck et al. (2023).

References

- EUROSTAT. (2022a). Excess mortality—Statistics.

- EUROSTAT. (2022b). Mortality and life expectancy statistics.

- Ministry of Health. (2022). Death statistics due to COVID-19 in 2020.

- Myck, M., Oczkowska, M., Garten, C., Król, A., & Brandt, M. (2023). Deaths during the first year of the COVID-19 pandemic: Insights from regional patterns in Germany and Poland. BMC Public Health, 23(1), 177.

- RKI. (2021). SARS-CoV-2 Infektionen in Deutschland. 2.6.2021 (Version 2022-02-07) [Data set]. Zenodo.

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Social Norms, Conspiracy Theories and Vaccine Scepticism: A Snapshot from the First Year of the Covid-19 Pandemic in Poland

In January 2022, Poland experienced the highest rate of SARS-CoV-2 transmission since the beginning of the COVID-19 pandemic. Considering the widespread consensus among experts about the efficacy of vaccines in preventing hospitalisation and death resulting from the virus, low vaccination rates and widespread anti-vaccine sentiments in Poland are of great concern. We use data from the DIAGNOZA+ Survey to demonstrate the relationship between various demographic characteristics, opinions around certain gender norms, the propensity for conspiratorial thinking, concern about the pandemic, and vaccine scepticism. While controlling for exogenous demographic characteristics, we measure the strength of the relationship between various beliefs that people hold and how they feel about the COVID-19 vaccine. Our analysis indicates that while respondents who hold more traditional views on gender roles are 6 percentage points less likely to get vaccinated, those who agree with a variety of conspiratorial statements are 43 percentage points less likely to vaccinate against COVID-19.

Introduction

As of January 2022, Europe finds itself well into the 4th wave of the COVID-19 pandemic, with some countries, including Poland, experiencing the highest rates of transmission since the virus was first detected. There are a few tools available to policymakers and healthcare professionals for combating the spread of the virus, ranging from preventative measures to strict social lockdowns aimed at reducing interpersonal interaction. A comprehensive literature review of 72 academic studies conducted by the BMJ found that the implementation of preventative measures such as hand washing, mask wearing, and social distancing decreased the risk of transmission by 53% (Talic et al., 2021). But even though such measures reduce transmission, the shortcomings in adherence and enforcement make high vaccination rates much more effective in diminishing the risk of hospitalization and death (Moline et al., 2021). With a consensus among experts reaffirming the effectiveness of vaccines in minimising the more severe cases of COVID-19 illness, the widespread availability of the vaccine has become the most effective and cost-efficient tool in limiting morbidity while avoiding future instances of economically unsustainable lockdowns. The drawbacks of the alternative scenario have already been made evident in 2020, before the development and distribution of COVID-19 vaccines. Over the course of the year, hospital capacities were overwhelmed in many countries around the world, leading to significant spikes in excess deaths. Poland saw an increase of over 18% in all-cause mortality in 2020 (OECD, 2021), the fourth-highest in the OECD and second-highest in the European Union (Eurostat, 2021).

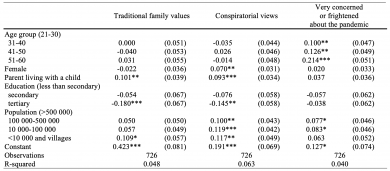

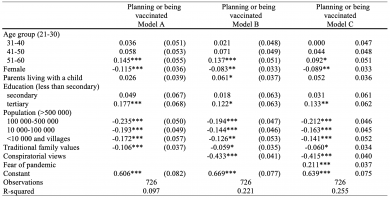

Considering the central role that prevalent vaccination plays in combating the impact of COVID-19, it is important to understand the underlying factors and demographic characteristics of individuals who are driving the low vaccination rates in countries such as Poland. With this in mind, we use an online survey: DIAGNOZA+ (DIAGNOZA Plus, 2020-2021), conducted on a representative sample of adults in Poland throughout the pandemic, allowing for the identification of characteristics that are most strongly correlated with vaccine scepticism. This kind of analysis can provide useful indicators for the targeting of certain policies and information campaigns that encourage vaccinations, and thereby suppress future outbreaks of SARS-CoV-2, as well as any other future pandemics. Below, we first outline the key features of the DIAGNOZA+ data, describe the methodology adopted in this study, and present results on the relationship between key demographic characteristics, social norms, views of respondents, and attitudes towards COVID-19 vaccination. We show a strong correlation between traditional family values, conspiratorial views, and reservations relating to the vaccination programme. Having traditional family values (expressed by about 40% of the sample) is associated with an over 10 percentage point (p.p.) lower probability to declare a willingness to get vaccinated. This drops to about 6 p.p. when we extend the model to account for conspiratorial thinking, which strongly dominates the relationship. Individuals who express strong conspiratorial and anti-establishment views (about a quarter of the sample), conditional on other demographic characteristics, were more than 40 p.p. less likely to declare a willingness to get vaccinated.

Methodology

The following analysis is based on data from DIAGNOZA+, an online survey collected in seven waves over the course of the COVID-19 pandemic (DIAGNOZA Plus, 2020-2021). The panel survey was conducted with the purpose of assessing changes in the labour market situation of adults in Poland between April 2020 and July 2021. The survey consistently included standard questions on individual and household characteristics such as age, gender and education, as well as questions on as well as questions about the respondent’s labor market status, hours worked, and financial situation. Waves 3 and 4 included additional modules where respondents were asked to express their opinions on a variety of statements surrounding gender norms such as “In general, fathers are as well suited to look after their children as mothers”, “A pre-school child is likely to suffer if his or her mother works” and “When jobs are scarce, men should have more right to a job than women”. The questions were answered on a scale of 1 (strongly agree) to 4 (strongly disagree). For the analysis, these categorical variables are dichotomised, with a value of 1 assigned to responses 1 and 2 (strongly agree or agree) and a value of 0 assigned to responses 3 and 4 (disagree or strongly disagree). Thus, for each question, we develop a binary variable that categorises respondents as either having a progressive or traditional reaction to each particular gender norms statement.

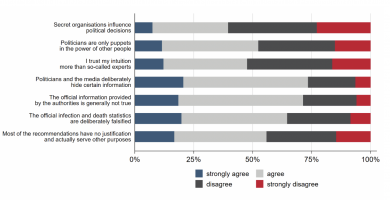

In consecutive waves, the same respondents were asked questions surrounding their willingness to vaccinate against the virus (in wave 5) and their trust in experts and the government response to the COVID-19 pandemic (in wave 6). For this analysis, we select questions that may influence an individual’s likelihood to vaccinate, starting with their level of concern about the pandemic or their fear of the virus itself. Furthermore, we identify individuals with a high predisposition for conspiratorial beliefs based on information from wave 6. Each variable included in this module is converted into a binary measure of agreement or disagreement, as outlined above for the social norms questions. We consider seven statements from the survey related to conspiratorial views, including “Secret organisations influence political decisions” or “I trust my intuition more than the so-called experts” (see the full list of statements in Figure 2). For each of them, the variable is converted into a binary measure of agreement or disagreement, similarly to the social norms questions above. Those who agreed or strongly agreed with all seven statements are classified as having conspiratorial views.

Due to sample attrition and after dropping respondents who did not answer one (or more) of the questions needed for our analysis, the sample reduces to 726 individuals (see table A1 in the Annex). Although each wave of the DIAGNOZA+ survey is carefully weighted to ensure population representativeness of the survey, these cross-sectional weights are only relevant to each independent wave of the survey. Therefore, for our sample, we develop frequency weights by sex and age using population data from Statistics Poland (Statistics Poland, 2021), which are utilised throughout the analysis. Given the low number of participants in the oldest age groups (those above 60 years old), we limit the sample to individuals aged between 21 and 60. Unfortunately, calibrating the weights according to additional characteristics such as education and municipal population is not feasible with a sample of this size. Clearly, the requirement of consistent consecutive participation in at least three waves of the survey has implications for its representativeness. For example, after the sample of respondents that participated in wave 6 is cut to include only those who also participated in waves 3, 4 and 5, we observe a bias in favour of conspiratorial views among the remaining observations, indicating that individuals who hold these views were more likely to continue their participation in the survey. For example, while 18.1% of the total cross-sectional sample of individuals in wave 6 hold conspiratorial views, the proportion is 23.4% in the sample we analyse (falling slightly to 23.2% when weights are applied). From this perspective, while indicative of existing correlations, the results ought to be treated with some caution.

Limiting the sample to respondents who answered all sets of questions across several rounds of the survey allows us to study vaccine scepticism and respondents’ susceptibility to conspiracy theories in relation to a number of personal characteristics. Furthermore, we consider the relationship between a respondent’s attitudes towards certain social norms (asked in waves 3 and 4), their individual response to COVID-19 (asked in wave 5), and their trust in the government’s response to the pandemic (asked in wave 6). We begin the analysis by assessing the relationship between respondents’ demographic characteristics and their opinions on gender roles, their propensity to hold conspiratorial beliefs, and their concern about the pandemic. This is followed by two models measuring respondents’ willingness to vaccinate. In the first of these models, demographic characteristics and traditional family values are used as explanatory variables, while in the second model conspiratorial views are included as well. Finally, we conclude with a summary of results and policy considerations.

Survey Results

Traditional Family Values in Poland

The respondents of the DIAGNOZA+ survey vary, on average, in the ‘traditionality’ of their attitudes towards gender and family depending on the selected indicator. The shares of answers to the three questions about gender norms are presented in Figure 1. The results demonstrate that progressive views on gender norms in Poland were more common in relation to the workplace than the home and family. For example, the statement to which most respondents were opposed was “When jobs are scarce, men have more right to a job than women”, with 37.2% of respondents disagreeing and 50.3% of respondents strongly disagreeing. On the other hand, slightly fewer respondents disagreed (50.5%) or strongly disagreed (34.8%) with “In general, fathers are not as well suited to look after their children as mothers”. Finally, respondents were most ‘traditional’ in their views in reaction to the statement “A pre-school child is likely to suffer if his or her mother works”, with 28% agreeing and 10% strongly agreeing. There is a natural correlation between these different views, and in our analysis, we examine the significance of different combinations of the three indicators. Given the relatively small sample, only the last indicator proved to be significantly related to our main outcome of interest and we use this one to represent the view on the ‘progressive-traditional’ spectrum

Figure 1. Gender norms in the survey sample

Source: DIAGNOZA+ survey, waves 3 and 4. Note: Data weighted using weights generated from Statistics Poland’s data on population by sex and age. Sample limited to individuals aged 21-60. The statement “In general, fathers are as well suited to look after their children as mothers” from the questionnaire was adjusted in the graph for better readability.

Conspiratorial Views