Tag: Poland

Unemployment in Transition and Its Long-Term Consequences

We examine the relationship between the experience of unemployment in the early years of the socio-economic transition in Poland and a number of wellbeing measures about two decades later. The analysis takes advantage of the rich content of data from the Survey of Health, Ageing and Retirement in Europe (SHARE) by matching retrospective information on labour market experiences with outcomes observed in the survey after year 2006. While there is a strong correlation between unemployment and general wellbeing measures such as life satisfaction, depression and subjective assessment of material conditions, the relationship cannot be interpreted as causal. On the other hand, we find that unemployment in the early years of the transition has strong, negative, long-term consequences for income and house ownership. The analysis sheds light on the implications of unemployment and on the nature of job losses in the follow-up of the Polish ‘shock-therapy’.

Introduction

Next year, the countries of Central and Eastern Europe will celebrate the 30th anniversary of the political breakthrough and the beginning of a major socio-economic transformation which followed. In the Polish case, the ‘shock therapy’ approach to the reform process implemented by the Mazowiecki government, though not without faults, has generally been viewed as the origin of the country’s economic success story. Afterwards, Poland experienced nearly three decades of uninterrupted economic growth and the Polish GDP returned to its pre-reform level already in 1995.

However, discussions of negative implications of the reform package still fuel the academic discourse as well as the political debate. While the majority of the population managed to avoid significant economic difficulties, many families experienced the painful hardship of the transition period in the form of job losses, poverty and exclusion. Given the scale of the socio-economic change, surprisingly little is known about the long-term consequences of individual experiences at that time. In particular, it is unclear if the negative outcomes observed many years after the reforms started can be causally linked to individual experiences in the early 1990s.

This lack of evidence is not unique for Poland and is largely due to unavailability of good individual-level data spanning the time before and after the collapse of communism. Since the transition cannot be lived through again, we shall never know how socio-economic conditions would have looked like under numerous alternative reform scenarios. However, as we show in a recent paper (Myck & Oczkowska, 2018), much can be learnt from the combination of contemporary and retrospective information on the nature of labour market histories during the transition and their relationship to outcomes recorded many years later.

The analysis presented in Myck and Oczkowska (2018) relies on the treatment of the systemic changes in the early 1990s as a major exogenous shock and on differentiating between reasons behind individual experiences of unemployment. We demonstrate that the observed strong correlation between unemployment in the initial years of the transition and a number of subjective wellbeing measures in later life is endogenous, and may reflect unobservable individual characteristics. It seems plausible to argue that these characteristics were the reasons behind the recorded job losses once the economy was liberalised and firms could fire their least productive employees.

Work histories in the SHARE dataset

The analysis is based on individual-level data from the Polish part of the Survey of Health, Ageing and Retirement in Europe (SHARE). SHARE is a multidisciplinary biennial panel survey focusing on individuals aged 50 years and over. Since the start of the project in year 2004 seven waves of data have been collected, and the survey was conducted in Poland in waves 2, 3, 4, 6 and 7. While the standard waves of the survey focus on contemporary conditions of respondents such as health, economic conditions, labour market activity and social networks, in wave 3 (the so-called SHARE-Life), participants were asked about their life histories including their family history, mobility and labour market experiences. The detailed labour market histories recorded in SHARE-Life allow us to identify transition-related job losses, which can be matched with current information on several measures of material conditions and wellbeing for the same individuals.

In Figure 1 we present labour market profiles since 1988 of those in the sample who were working prior to the start of the reform process.

Figure 1. Labour market status 1988 – 2008 conditional on working in 1988 in Poland

Source: Myck and Oczkowska, 2018.

The figure shows that along with rapidly increasing unemployment rates, the degree of inactivity of the Polish population grew substantially in the two decades following the transition. This data confirms that in the follow-up of the ‘shock-therapy’ reforms many individuals faced unemployment, while others, especially among older groups of employees, used several other labour market exit options, such as retirement or disability.

Analysing long-term consequences of economic shocks

To examine the role of unemployment experiences in the initial years of the transition for outcomes observed a few decades later, we use data from waves 2, 3 and 4 of the SHARE study. The analysis focuses on two groups of later-life outcomes – objective measures of material conditions such as household income, real assets and house ownership, and subjective indicators of wellbeing such as life satisfaction, depression or reporting difficulties in making ends meet.

We are able to control for an extensive set of individual characteristics which are usually unobservable to the researcher, through a complex set of background variables available in SHARE. These include respondents’ childhood conditions, parental background as well as health and labour market experience prior to 1988. With regard to the experience of unemployment we differentiate the instances of unemployment between the initial (1989-1991) and later (1992-1995) period of the transition to examine the potential differential implications of the rapid pace of the reforms in the early 1990s. Most importantly though, the data allows us to distinguish between different reasons behind job losses and we can separately examine the relationship with plant/office closures and other reasons for unemployment. Following other examples in the literature (Farber, 2011; Jacobson et al., 1993), we argue that plant closures can be treated as reasons for exogenous job separations. This in turn allows us on the one hand, to give a causal interpretation to the estimated coefficients, and on the other, to interpret those on other reasons for unemployment in the light of the causal relations.

Effects of unemployment experience on later-life outcomes

We find that experiencing unemployment due to plant/office closure between 1989 and 1991 is associated with almost a 30 percent lower level of household income and a lower probability of house ownership of about 10 percentage points (pp) some two decades afterwards. There is also a strong relationship between unemployment in the early years of the transition and wellbeing measures two decades later – individuals who experienced unemployment in the first three years of the transition have a 14 pp. higher likelihood of reporting great difficulties in making ends meet, a 10 pp. lower probability of high life satisfaction and a 11 pp. higher likelihood of depression. However, since these relations do not hold for unemployment due to plant closures, they cannot be treated as causal. The results are therefore most likely driven by unobserved factors which simultaneously determine the lower level of outcomes two decades after the ‘shock-therapy’ reforms, and the likelihood of experiencing unemployment in the early 1990s.

Conclusion

In this policy brief we outline recent results on long-term implications of labour market developments in the early years of the economic transition in Poland. The analysis is based on a combination of contemporary and retrospective data from the SHARE survey, and focuses on the associations between the experience of unemployment in the initial years of the transition in Poland and a number of outcomes measured about two decades later. Using plant/office closures as exogenous sources of job separations during the early 1990s, we find a strong and statistically significant, negative, long-term effect on income and home ownership, which can be treated as causal.

We also find strong negative associations between unemployment for other reasons than plant / office closures and a number of subjective measures of wellbeing. This relationship however, does not hold for the exogenous reasons for job losses, which suggests an important role of unobservable factors that lead to unemployment and at the same time are responsible for the lower level of outcomes in later life. This is consistent with the labour market reality of central planning characterised by labour hoarding and maintaining employment regardless of workers’ productivity. When the economic reality changed in 1989, the least productive individuals were the first to be fired, and as our analysis shows, these are also the individuals with lower subjective levels of wellbeing two decades later. We confirm thus that those who lost their jobs in the early 1990s have lower measures of the subjective wellbeing outcomes, although the latter cannot be identified as specific consequences of unemployment in the first years of transition.

References

- Farber, H. (2011). “Job loss in the great recession: historical perspective from the Displaced Workers Survey, 1984-2010”, NBER Working Paper No. 17040, National Bureau of Economic Research.

- Jacobson, L., LaLonde, R. and Sullivan, D. (1993). “Earnings losses of displaced workers”, American Economic Review, 83, pp. 685–709.

- Myck, M. and Oczkowska, M. (2018). “Shocked by therapy? Unemployment in the first years of the socio-economic transition in Poland and its long-term consequences”, Economics of Transition, 26(4), pp. 695-724.

Acknowledgement

The authors gratefully acknowledge the support of the Polish National Science Centre through project no. 2015/17/B/HS4/01018. For the full list of acknowledgements see Myck and Oczkowska (2018).

Poland’s Road to “High Income Country” Status: Lessons Learnt – Not Only for Other Countries

In this brief we summarize and discuss results presented in a recent World Bank Report focused on Poland’s path from middle to high-income country status. In the period until 2015, Poland’s economic development distinguished itself by its stability and consistency of the implemented reform package, and its inclusive nature. Poland became classified as a high-income country after only 15 years from gaining a middle-income status. At the same time, income inequality remained stable and absolute poverty levels fell significantly. The World Bank Report offers lessons from and insights for Poland, which are discussed from the perspective of the policies implemented by the governments in the last two years.

Poland’s status in the World Bank nomenclature has recently been “upgraded” from being middle to high-income country. While this categorization is only a nominal change, it reflects the country’s economic development over the recent decades and is an important recognition of the success of a wide range of reforms implemented across a broad number of areas. Notably, Poland moved from the middle to high-income status in a period of less than 15 years.

In a book recently published by the World Bank, it is argued that the Polish experiences from the reform process can serve as valuable lessons for countries that are in the process of, or have just embarked upon major socio-economic reforms, as well as for those, who have fallen into the so-called middle-income trap and are looking for solutions to their stagnant economies. At the same time, in comparison to other established high-income countries, there are a number of insights that Poland’s policy makers ought to bear in mind in order to stay on course of the reform process and continued stable growth.

Looking at policies of the recent governments, however, one gets a strong impression that some important insights have been ignored. As rapid population aging looms over the horizon, the lack of necessary adjustments combined with the risks to stability of the political and economic environment might in the medium run have significant implications for Poland’s further development.

The big picture

The key feature of the Polish socio-economic policy approach, over the period covered by the World Bank analysis (i.e. up to 2015), was a unique consistency of a broad direction taken by subsequent administrations. This allowed the reform process to develop without major breaks or U-turns, which ensured the overall stability of the socio-economic environment and provided stable investment prospects. The World Bank highlights the key role of institutions, including rule of law, property rights, and democratic accountability of different levels of government. Basic market institutions, including the respect for rules on price and product regulations, corporate governance and market regulations, as well as foreign trade and investment, have played a crucial role. This framework allowed for continued improvement in the efficiency of resource allocation – including the allocation between sectors of the economy, as well as between and within enterprises.

Crucially, Poland prepared well and took full advantage of the integration with the European Union. The EU accession was first used as a common anchor for stability of the reform process, and after 2004, the European funds became an additional engine of growth. At the macro level, stability of the fiscal framework with limited deficits and public debt were combined with appropriate regulation and supervision of the financial sector, an independent central bank, and close links to global markets.

Shared prosperity

While the above points provided the basis for Poland’s economic development, the Report highlights another unique feature of Poland’s success, namely the degree to which the fruits of the process have been equally shared among different groups of society. The overall income inequality has remained relatively stable, with the Gini coefficient actually falling slightly between 2005 and 2014, from 0.351 to 0.343. Relative income poverty levels remained stable over this period (at about 20%), and the levels of absolute poverty fell significantly. For example, the proportion of the population living on less than $10 per day fell from 51.3% in 2005, to 29.6% in 2014. Growing incomes were primarily driven by increases in labor earnings, but employment growth – in particular among older age groups –also made a contribution. The government’s labor market policy also played a role with a rapid increase in the level of the national minimum wage (NMW), which grew by 65% in real terms between 2005 and 2015, i.e. almost twice as fast as the average wage. While there is evidence that the rapid growth in the NMW had negative effects on employment – in particular among temporary, young, and female workers, these have been relatively modest. Additionally, the tax and benefit policy has contributed to reduced inequality. It has been estimated that nearly half of the reduction in the Gini coefficient, over the period 2005–2014, resulted from reforms of the tax and benefit system (Myck and Najsztub, 2017).

It is clear that human capital was one of the cornerstones of Poland’s success in recent years. Developments on the labor market, such as a rapid productivity growth, were facilitated by a well-educated labor force, which could respond and adjust to the changing conditions and requirements. In this regard, Poland’s advantage in comparison to many other low and middle-income countries has been the relatively high level of spending on public education and healthcare, not only since the start of the economic transformation in the 1990s, but also before that. Indicators, such as the infant mortality rate, were low in Poland already in the 1980s, and have since further improved (see Figure 1). For a long time, public spending on education has been at levels comparable to those in established high-income countries (see Figure 2). Additionally, a series of reforms to the education system since 1990, have resulted in improvements in the quality and coverage of education. This, in turn, has lead to a rapid improvement of scores in language, mathematics, and science in the PISA study (Programme for International Student Assessment), in which Polish students recently outperformed those from many other OECD countries (OECD 2014). Importantly, the improvements in the education results have been found across the socio-economic spectrum, which further stresses the inclusive character of the changes that have taken place.

Figure 1. Infant mortality rate (per 1,000 live births), 1980 and 2014

Notes: Countries grouped in the following manner: red – middle-income countries; blue – new high-income countries; green – established high-income countries. Horizontal lines represent group averages. Source: World Bank (2017), Figure 5.16, based on World Development Indicators.

Figure 2. Government expenditure on education, percent of GDP, 1990

Source: World Bank (2017), Figure 5.11, see notes to Figure 1.

Insights for Poland

“As economies enter the high-income group, weakness in economic institutions such as the rule of law, property rights, and the quality of governance become increasingly important to sustain convergence.”

World Bank (2017)

While the Polish reform experience, over the period examined in the World Bank Report, offers important lessons for other countries aspiring to the high-income status, the authors point out that Poland’s continued development needs to rely on further improvements in a number of key areas. The following policy areas have been highlighted in the Report:

- Working on more inclusive political and economic institutions and enhancing the rule of law with the focus on the judiciary;

- Adjustments to fiscal policy in particular to deal with the consequences of population aging;

- Increasing the domestic level of savings to facilitate large investment needs;

- Supporting innovation through more intense competition and high quality research education;

- Improving social assistance programs and access to high quality health and education for low income groups;

- Increasing the progressivity of the tax system to support inclusive growth;

- Adjusting migration policies to bring in skills and innovative ideas and compensate for the country’s aging workforce.

“Sustaining Poland’s record of high, stable growth will require adjustments to fiscal policy (…). Government will need to create the fiscal space to deal with the increasing pressures coming from aging, the inevitable decline of EC structural funds for investment, and a more uncertain global context.”

World Bank (2017)

Lessons, insights and recent policies

While several of the Law and Justice majority governments’ policies since 2015 have been well in line with the World Bank recommendations, there have also been a number of questionable policy areas. One major concern seems to relate to the broad background of reforms of the judiciary, which have drawn significant criticism of the European Commission and other international institutions. Implications of such major changes for economic growth are uncertain but potentially very damaging.

Another long-term concern arises from the new pension age reform. From the socio-economic perspective, rapid ageing of the population is one of the main challenges facing the country. Between 2015 and 2030, the number of people aged 65+ will grow from 6.1 million to 8.6 million, i.e. by over 40%. This will put significant strains on the country’s public finances due to increasing public-pension expenditures and growing costs of health and long-term care. These pressures will only be exacerbated by the current government’s decision to lower the statutory retirement age to 60 for women and 65 for men, from the target uniform age of 67 legislated in the reform of 2012. Given the contributions-defined nature of the Polish pension system, this will result in significantly lower levels of pensions, especially among women, and a substantial drain on public finances resulting from lower levels of contributions and taxes.

The generous family benefits of the Family 500+ Program – implemented in 2016 and which cost about 1.3% of the GDP – have also been criticized on a number of grounds. They have undoubtedly changed the financial conditions of numerous families and limited the extent of child poverty. At the same time, they contribute to maintaining low levels of female labor-force participation and there is so far little indication that they have significantly changed Poland’s very low fertility rate. It seems that while the program may have positive long-term consequences resulting from reduced poverty, it is unlikely to shift the demographic dynamics.

Uncertainty also surrounds the consequences of a haphazard major education reform, which is another trademark policy of the Law and Justice party. The reform re-introduced the 8+4 system in place of the post-1999 three-level educational arrangement (6+3+3). The new system takes the number of years of general education back from 9 to 8 years, and instead extends by one year the length of secondary schooling. While the potential effects of such a change are difficult to foresee, the 8+4 system may be in particular disadvantageous to children from rural areas, who are most likely to continue their education in their rural primary schools for the two extra years.

A number of steps taken by the government since late 2015, and in particular those related to the redistributive policies implemented in the last two years, seem to be consistent with the World Bank insights. On the other hand, the approach towards the reforms of the judiciary, the general approach to the rule of law, and the reforms of education and pension regulations, quite clearly appear to ignore not only the insights, but also the lessons resulting from Poland’s own experience of the recent decades. Given the challenge of rapid aging in the Polish population, there seems to be much gained from taking them seriously if the current and future administrations want to ensure Poland’s continued inclusive growth and to secure its status as an established high-income country.

********

This policy brief draws heavily on the World Bank (2017) Report: “Lessons from Poland, Insights for Poland: A sustainable and inclusive transition to high-income status” (co-authored by Michal Myck) and the accompanying Working Paper by Myck and Najsztub (2016). Views and opinions expressed in this brief are the sole responsibility of the author and are not endorsed by the World Bank or CenEA.

References

- Myck, M., and M. Najsztub (2016) “Distributional Consequences of Tax and Benefit Policies in Poland: 2005–2014.” CenEA Microsimulation Report 02/16, Centre for Economic Analysis, Szczecin.

- OECD (Organisation for Economic Co-operation and Development) (2014) PISA 2012 Results: What Students Know and Can Do—Student Performance in Mathematics, Reading and Science (Volume I: Revised edition, February 2014). Paris: OECD Publishing.

- World Bank (2017) “Lessons from Poland, Insights for Poland: A sustainable and inclusive transition to high-income status”, The World Bank, Washington.

Paid Work after Retirement – Does Quality of Your Main Job in the Past Matter?

In this brief, we summarize the results of a recent analysis focused on identifying the key determinants of engagement in paid work after retirement based on life histories data from the Survey of Health, Ageing and Retirement in Europe (SHARE). We find a strong link between the probability of work after retirement and indicators of quality of work prior to labor market exit, such as high physical and psychosocial demands, lack of control or receiving adequate social support. These results suggest a potentially important role of job-quality regulations. We find no significant association with past experience of adequate rewards with respect to efforts in the main job, which suggests that involvement in paid work after retirement may to a lesser extent be driven by financial concerns. This might mean that policy initiatives targeted at higher level of labor market activity among retirees should stress non-material aspects of employment in later life.

The collection of data in the 7th wave of the Survey of Health, Ageing and Retirement in Europe (SHARE) proceeded in 2017, and the Centre for Economic Analysis (CenEA) has recently published a report based on information collected in previous waves of the survey. The report entitled “The Polish 50+ generation in the European context: activity, health and wellbeing” examined among other issues the determinants of labor market activity of people aged 50+ with a special focus on Poland (Myck and Oczkowska, 2017).

SHARE is a panel survey conducted every two years and focuses on health conditions, material situation and social relations of the population aged 50 years and older. In 2017, in the 7th Wave, interviews were conducted with over 80,000 participants in 26 European countries and Israel. While the survey usually focuses on contemporary conditions of respondents, the interviews in Wave 3 (the SHARE-Life conducted in 2008-2009) is concerned with respondents’ life histories and topics such as family history, mobility and work histories.

In this brief, we draw on one of the chapters from the report and present results of a analysis that combines information on the quality of the main job of the respondents’ working careers, with information on engagement in paid work among retired individuals to examine key determinants of undertaking paid work after labor market exit.

Work histories in SHARE

The life-history interview includes a series of 12 questions evaluating effort-reward imbalance in the main job of individuals’ working careers (Siegrist and Wahrendorf, 2011; Siegrist et al., 2004; 2014). Based on these questions, five dimensions of the quality of the workplace were identified: physical and psychosocial demands, control, social support and reward (see Table 1). Figure 1 presents an example of the distribution of answers to one of the questions used to define these dimensions, which asked about the extent to which the respondents’ main jobs was physically demanding. Generally, men’s past main job is more often described as physically demanding than women’s. While less than half of respondents in France and Sweden claimed physically strenuous main job, the respective measure in Poland and Greece was as high as 75%.

Table 1. Dimensions of job quality

| Dimension | SHARE Questionnaire Items |

| Physical demands |

– „My job was physically demanding.” – „My immediate work environment was uncomfortable (for example, because of noise, heat, crowding).” |

| Psychosocial demands | – „My work was emotionally demanding.”

– „I was exposed to recurrent conflicts and disturbances.” |

| Control | – „I was under constant time pressure due to a heavy workload.”

– „I had very little freedom to decide how to do my work.” |

| Social support at work | – „I received adequate support in difficult situations.”

– „There was a good atmosphere between me and my colleagues.” – „In general, employees were treated fairly.” |

| Reward |

– „I had an opportunity to develop new skills.” – „I received the recognition I deserved for my work.” – „Considering all my efforts and achievements, my salary was adequate.” |

Notes: answer categories: “strongly agree, agree, disagree, strongly disagree”. Source: adapted from Siegrist and Wahrendorf (2011).

Figure 1. “My job was physically demanding”

Notes: includes wave 3 respondents with at least 10 years of seniority who retired by the time of wave 6; weighted. Source: own calculation based on SHARE data waves 3 (2008-2009) and 6 (2015).

Following Wahrendorf and Siegrist (2011), for the purpose of further analysis, we construct five measures of workplace quality based on the questions listed in Table 1. For each dimension of job quality, we calculate a sum-score of answers (from 1 “strongly agree” through 2 “agree”, 3 “disagree” to 4 “strongly disagree”) to selected questions, and identify the upper (lower) tertile of observations. We create five binary indicators (with 1 meaning “yes”) describing the quality of work in the sense of high physical or psychosocial demands, lack of control, and adequate social support or adequate reward. The results are presented in Figure 2 in association with the frequency of paid work after retirement.

Figure 2. Associations between quality of work in the past and frequency of paid work after retirement

Notes: includes wave 3 respondents with at least 10 years of seniority who retired by the time of wave 6 from selected countries (CZ, FR, DE, GR, PL, ES, SE); weighted. Source: own calculation based on SHARE data waves 3 (2008-2009) and 6 (2015).

In most cases the percentage of retirees engaged in paid work was significantly higher among those positively evaluating the quality of their past workplace. The only dimension where no significant difference was found in the level of involvement in paid work was between the retirees who estimated rewards at work as adequate to their efforts and those who assessed them otherwise.

What determines paid work after retirement?

The role of the five measures of job quality was further examined using models of probability of paid work after retirement. Apart from quality indicators regarding the main job, controls included total labor market experience, unemployment incidence, as well as detailed demographics and information concerning current health status and material conditions. Odds ratios were estimated separately for men and women from a group of selected countries: Czech Republic, France, Germany, Greece, Poland, Spain and Sweden.

Higher education is positively associated with the odds of employment after retirement, but have the opposite effect for age, poor health and living in rural areas. Each additional year of labor market experience increases the odds of working after retirement, but we find no significant effect of unemployment episodes.

Both men and women without experience of high physical demands and lack of control in their main job have higher odds of working after retirement than those who declared such experiences. For example, men who did not experience highly, physically demanding main jobs have 1.4 times higher odds of work after retirement compared to those who did. The respective odds for those who did not experience lack of control are 1.9. On the other hand, high psychosocial demands and adequate social support have significant influence only among retired women. Women who did not report high psychosocial demands had 1.25 times higher odds of work after retirement, while those who received adequate support in their past job had 1.5 times higher odds. We find no significant effect of the experience of adequate rewards with respect to efforts in the main job, and similarly no significant association between material conditions and employment of retirees. Both of these may imply that involvement in paid work after retirement is to a lesser extent driven by financial concerns.

Further discussion and policy implications

Differences in the degree of engagement in paid work after retirement with respect to the assessment of past job quality suggest a potentially important role of job quality regulations. At the same time, lack of significant association between the material situation and paid work after retirement implies that policy initiatives targeted at higher levels of labor market activity among retirees may benefit from stressing the non-material aspects of employment in later life.

Results point to a strong link between quality of work in the past and probability of work after retirement, which is in line with what other studies have showed: e.g. that low quality of work in the past strongly correlates with the desire to retire as soon as possible (e.g. Dal Bianco et al., 2014). Given the demographic pressure on public finances observed or expected in many developed countries, and foreseen reductions in the generosity of pension benefits, increasing the level of engagement in paid work after labor market exit may become an important policy challenge. The results summarized in this brief suggest that governments should, on the one hand, pay attention to the labor market conditions faced by those currently employed, and on the other hand focus on a broad set of incentives to encourage employment among older generations, going beyond financial remuneration.

References

- Dal Bianco, C., Trevisan, E., Weber, G., 2014. „I want to break free. The role of working conditions on retirement expectations and decisions”, European Journal of Ageing, 12(1), 17-28.

- Myck, M., Oczkowska, M. (eds.), 2017. „The Polish 50+ generation in the European context: activity, health and well-being. Results from the SHARE survey” („Pokolenie 50+ w Polsce na tle Europy: aktywność, zdrowie i jakość życia. Wyniki na podstawie badania SHARE”), CenEA (in Polish).

- Siegrist, J., Li, J., Montano, D., 2014. “Psychometric properties of the effort-reward imbalance questionnaire”. Düsseldorf University.

- Siegrist, J., Starke, D., Chandolab, T., Godinc, I., Marmot, M., Niedhammer, I., Peter, R., 2004. “The measurement of effort-reward imbalance at work: European comparisons”, Social Science & Medicine, 58, 1483-99.

- Siegrist, J., Wahrendorf, M., 2011. “Quality of Work, Health and Early Retirement: European Comparisons”, in: Börsch-Supan, A., Brandt, M., Hank, K., Schröder, M. (eds.). “The Individual and the Welfare State: Life Histories in Europe”. Springer Berlin Heidelberg.

- Wahrendorf, M., Siegrist, J., 2011. “Working conditions in midlife and participation in voluntary work after labour market exit”, in: Börsch-Supan, A., Brandt, M., Hank, K., Schröder, M. (eds.). “The Individual and the Welfare State: Life Histories in Europe”. Springer Berlin Heidelberg.

Socio-Economic Policy in Poland: A Year of Major Changes in Benefits, Taxes, and Pensions

2016 was the first full calendar year of the new Polish government elected to power in October 2015. The year marked a number of major changes legislated in the area of socio-economic policy some of which have already been implemented and others that will take effect in 2017. In this policy brief, we analyse the distributional consequences of changes in the direct tax and benefit system, and discuss the long-term implications of these policies in combination with the policy to reduce the statutory retirement age.

The Law and Justice party (Prawo i Sprawiedliwość, PiS) won an absolute majority of seats in both houses of the Polish Parliament in the parliamentary elections of October 2015. Earlier that year, Andrzej Duda of PiS was elected President of the Polish Republic. In both cases, the electoral victories came on the wave of pledges of significant financial support to families with children and to low-income households, especially pensioners. The new president pledged to cut back the pension age to the levels prior to the 2012 reform, which introduced a gradual increase from 60 and 65 to 67 for both women and men, and to nearly triple the income tax allowance. Following Duda’s victory in May 2015, PiS reiterated these pledges in the parliamentary election campaign and added the promise to increase the total level of financial support for families with children by over 140% through a nearly universal benefit called “Family 500+” and to hike the minimum wage by over 8%.

Despite a rather tight budget situation, the government went ahead with the “Family 500+” and successfully rolled it out in April 2016 (Myck et al., 2016a). The new instrument directs support of 500 PLN per child per month (110 EUR) to all second and subsequent children in the family in the age group between 0 and 17. Benefits for the first child in the family in this age group are granted conditional on overcoming an income threshold of 800 PLN (180 EUR) per person per month. Since April 2016, over 2.7 million families have received the benefit and 60% of them received the means tested support (if they have more than one child this is paid out in combination with the universal benefit).

The second key electoral pledge – to increase the tax allowance from 700 to 1,850 EUR at an estimated cost of 4.8 billion EUR – has so far been postponed (CenEA, 2015a). Increases in the allowance became a major policy issue in October 2015 when the Constitutional Tribunal ruled that maintaining its level below minimum subsistence, as it was at the time, was unconstitutional. To satisfy the Tribunal’s ruling, the allowance would have to increase to ca. 1,500 EUR at a cost of nearly 15 billion PLN (3.4 billion EUR, and about 0.8% of GDP, CenEA 2015b). Instead of a simple increase in the allowance, the government decided to implement a digressive tax allowance for 2017. This raised the value to the required minimum subsistence level for the lowest income tax payers, but since it is rapidly withdrawn as taxable income rises, the allowance will be unchanged to a large majority of taxpayers and will cost the public purse only 0.2 billion EUR (CenEA, 2016). This policy will be more than paid for by the fiscal drag given the decision to freeze all other parameters of the tax system, which will cost the taxpayers 0.5 billion EUR (Myck et al., 2016b).

The policies that directly affect household budgets will in total amount to about 5.5 billion EUR in 2017 (1.3% of GDP and 6.2% of the planned central budget expenditures) and will include also an increase in the minimum pension to benefit about 1.5 million pensioners. The cost of the “Family 500+” reform makes up the large majority of this value (5.4 billion EUR). Households from the lower income decile groups will benefit the most from this reform package, with their monthly disposable income increasing on average by 15.1% (ca. 60 EUR). High-income households from the top income decile will see their income grow on average by only 0.5% (see Figure 1). Overall, nearly all of the gains will go to families with children, with single parents gaining on average about 95 EUR and married couples with children about 84 EUR per month. Other types of families will, on average, see negligible changes in their household disposable incomes (see Figure 2). Thus, the implemented package clearly has a very progressive nature and redistributes significant resources to families with children.

Figure 1. Distributional consequences of changes in direct tax and benefit measures implemented between 2016-2017

Source: calculations using CenEA’s microsimulation model SIMPL based on PHBS 2014 data.

Source: calculations using CenEA’s microsimulation model SIMPL based on PHBS 2014 data.

The pension age and public finances in the years to come

The most recent major reform, legislated at the end of 2016 and which will come into effect in October 2017, represents an implementation of yet another costly electoral pledge. This policy has overturned gradual increases in the statutory retirement age, initiated by the previous government in 2012. Despite the very rapid ageing of the Polish population, the new government decided to return to the pre-2012 retirement ages of 60 and 65 for women and men, respectively. This comes at a time when, according to EUROSTAT (Eurostat, 2014), the old-age dependency ratio in Poland, i.e. the proportion of the 65+ population to the working-age population, will grow from the current 24% to 27% in 2020 and to 40% in 2040. With the defined contribution pension system, the shorter working lives resulting from this change will be reflected in significantly reduced benefits (Figure 2). For example, pension benefits of men retiring in 2020 will on average be 13.5% lower than the pre-reform value. For women that retire in 2040, the pension benefits will on average fall by 15.2%, which corresponds to a 43% lower benefit than the pre-reform value, and with consequences of the reform becoming more severe over time. The reform will also be very costly to the government budget. In 2017, it is expected to cost 1.3 billion EUR and its full effect will kick in after 2021, when the cost of the reform will exceed 3.9 billion EUR per year (Figure 2).

Figure 2. Reducing the statutory retirement age and its implications on pension benefits and public finances

Source: Based on data from Council of Ministers (2016).

Source: Based on data from Council of Ministers (2016).

Conclusion

Since coming to power in October 2015, the PiS government has implemented a majority of its costly electoral pledges. Direct changes in taxes and benefits will cost 5.5 billion EUR in 2017 and benefit primarily those in the lower end of the income distribution and in particular families with children. The reduced statutory retirement age will add an extra 1.3 billion EUR in 2017 and as much as 3.9 billion EUR four years later. The very generous “Family 500+” programme has significantly reduced child poverty and may have important positive long-term effects in terms of health and education for today’s beneficiaries. However, its fertility implications are still uncertain and the programme is expected to reduce the employment rate among mothers. While the government maintains that its financing is secured, it is becoming clear that maintaining the policy will not be possible without higher taxes.

The government came to power claiming that the implementation of this programme will be based on reducing tax fraud and that only a small fraction will be financed from tax increases. While it seemed likely at the time when these declarations were made, the expected major shift in the reduction of tax fraud has yet not materialised. The government have withdrawn from the pledge of reducing the VAT and from assisting those with mortgages denominated in Swiss Francs, while its income tax allowance reform was nearly thirty times less expensive compared to that announced in its electoral programme.

With a very tight budget for 2017 based on relatively optimistic assumptions, the key factors determining further realisations of the generous programme will be the rate of economic growth and related dynamics on the labour market. Developments of the labour market will also be essential for the longer-term economic success of the implemented reform package. This relates both to the future level of participation of women and to the success of extend working lives of people who will soon reach the new reduced retirement age.

References

- CenEA (2015a) Konsekwencje prezydenckiej propozycji podwyższenia kwoty wolnej od podatku (Consequences of the presidential proposal to raise the incoem tax allowance), CenEA press release, 3 December 2015.

- CenEA (2015b) Co z kwotą wolną od podatku po wyroku Trybunału Konstytucyjnego? (what will happen to the income tax allowance after the decision of the Constitutional Tribunal?), CenEA press release, 13 November 2015.

- CenEA (2016) Zmiany w kwocie wolnej od podatku za 800 mln rocznie (Changes in the income tax allowance at the cost of 800m per year), CenEA press release, 29 November 2016.

- EUROSTAT (2014) Eurostat – Population projections EUROPOP2013, access 21 December 2016.

- Myck, M., Kundera, M., Najsztub, M., Oczkowska, M. (2016a) 25 miliardów złotych dla rodzin z dziećmi: projekt Rodzina 500+ i możliwości modyfikacji systemu wsparcia. (25bn for families with children: plans for the Family 500+ reform and other options to modify the system of support.), CenEA Commentaries, 18 January 2016.

- Myck, M., Kundera, M., Najsztub, M., Oczkowska, M., 2016b, Zamrożony PIT i utrzymane wyższe stawki VAT – jak brak zmian w podatkach wpłynie na budżety gospodarstw domowych? (Frozen PIT and higher VAT – how lack of changes in taxees will affect househod budgets?), CenEA Commentaries, 05 October 2016.

- Council of Ministers (2016) Position of the Council of Ministers on the presidential bill proposal, Warsaw, 25 July 2016.

Traces of Transition: Unfinished Business 25 Years Down the Road?

This year marks the 25-year anniversary of the breakup of the Soviet Union and the beginning of a transition period, which for some countries remains far from completed. While several Central and Eastern European countries (CEEC) made substantial progress early on and have managed to maintain that momentum until today, the countries in the Commonwealth of Independent States (CIS) remain far from the ideal of a market economy, and also lag behind on most indicators of political, judicial and social progress. This policy brief reports on a discussion on the unfinished business of transition held during a full day conference at the Stockholm School of Economics on May 27, 2016. The event was organized jointly by the Stockholm Institute of Transition Economics (SITE) and the Swedish Ministry for Foreign Affairs, and was the sixth installment of SITE Development Day – a yearly development policy conference.

A region at a crossroads?

25 years have passed since the countries of the former Soviet Union embarked on a historic transition from communism to market economy and democracy. While all transition countries went through a turbulent initial period of high inflation and large output declines, the depth and length of these recessions varied widely across the region and have resulted in income differences that remain until today. Some explanations behind these varied results include initial conditions, external factors and geographic location, but also the speed and extent to which reforms were implemented early on were critical to outcomes. Countries that took on a rapid and bold reform process were rewarded with a faster recovery and income convergence, whereas countries that postponed reforms ended up with a much longer and deeper initial recession and have seen very little income convergence with Western Europe.

The prospect of EU membership is another factor that proved to be a powerful catalyst for reform and upgrading of institutional frameworks. The 10 countries that joined the EU are today, on average, performing better than the non-EU transition countries in basically any indicator of development including GDP per capita, life expectancy, political rights and civil liberties. Even if some of the non-EU countries initially had the political will to reform and started off on an ambitious transition path, the momentum was eventually lost. In Russia, the increasing oil prices of the 2000s brought enormous government revenues that enabled the country to grow without implementing further market reforms, and have effectively led to a situation of no political competition. Ukraine, on the other hand, has changed government 17 times in the past 25 years, and even if the parliament appears to be functioning, very few of the passed laws and suggested reforms have actually been implemented.

Evidently, economic transition takes time and was harder than many initially expected. In some areas of reform, such as liberalization of prices, trade and the exchange rate, progress could be achieved relatively fast. However, in other crucial areas of reform and institution building progress has been slower and more diverse. Private sector development is perhaps the area where the transition countries differ the most. Large-scale privatization remains to be completed in many countries in the CIS. In Belarus, even small-scale privatization has been slow. For the transition countries that were early with large-scale privatization, the current challenges of private sector development are different: As production moves closer to the world technology frontier, competition intensifies and innovation and human capital development become key to survival. These transformational pressures require strong institutions, and a business environment that rewards education and risk taking. It becomes even more important that financial sectors are functioning, that the education system delivers, property rights are protected, regulations are predictable and moderated, and that corruption and crime are under control. While the scale of these challenges differ widely across the region, the need for institutional reforms that reduce inefficiencies and increase returns on private investments and savings, are shared by many.

To increase economic growth and to converge towards Western Europe, the key challenges are to both increase productivity and factor input into production. This involves raising the employment rate, achieving higher labor productivity, and increasing the capital stock per capita. The region’s changing demography, due to lower fertility rates and rebounding life expectancy rates, will increase already high pressures on pension systems, healthcare spending and social assistance. Moreover, the capital stock per capita in a typical transition country is only about a third of that in Western Europe, with particularly wide gaps in terms of investment in infrastructure.

Unlocking human potential: gender in the region

Regardless of how well a country does on average, it also matters how these achievements are distributed among the population. A relatively underexplored aspect of transition is to which extent it has affected men and women differentially. Given the socialist system’s provision of universal access to education and healthcare, and great emphasis on labor market participation for both women and men, these countries rank fairly well in gender inequality indices compared to countries at similar levels of GDP outside the region when the transition process started. Nonetheless, these societies were and have remained predominantly patriarchal. During the last 25 years, most of these countries have only seen a small reduction in the gender wage gap, some even an increase. Several countries have seen increased gender segregation on the labor market, and have implemented “protective” laws that in reality are discriminatory as they for example prohibit women from working in certain occupations, or indirectly lock out mothers from the labor market.

Furthermore, many of the obstacles experienced by small and medium-sized enterprises (SMEs) are more severe for women than for men. Female entrepreneurs in the Eastern Partnership (EaP) countries have less access to external financing, business training and affordable and qualified business support than their male counterparts. While the free trade agreements, DCFTAs, between the EU and Ukraine, Georgia, and Moldova, respectively, have the potential to bring long-term benefits especially for women, these will only be realized if the DCFTAs are fully implemented and gender inequalities are simultaneously addressed. Women constitute a large percentage of the employees in the areas that are the most likely to benefit from the DCFTAs, but stand the risk of being held back by societal attitudes and gender stereotypes. In order to better evaluate and study how these issues develop, gendered-segregated data need to be made available to academics, professionals and the general public.

Conclusion

Looking back 25 years, given the stakes involved, things could have gotten much worse. Even so, for the CIS countries progress has been uneven and disappointing and many of the countries are still struggling with the same challenges they faced in the 1990’s: weak institutions, slow productivity growth, corruption and state capture. Meanwhile, the current migration situation in Europe has revealed that even the institutional development towards democracy, free press and judicial independence in several of the CEEC countries cannot be taken for granted. The transition process is thus far from complete, and the lessons from the economics of transition literature are still highly relevant.

Participants at the conference

- Irina Alkhovka, Gender Perspectives.

- Bas Bakker, IMF.

- Torbjörn Becker, SITE.

- Erik Berglöf, Institute of Global Affairs, LSE.

- Kateryna Bornukova, Belarusian Research and Outreach Center.

- Anne Boschini, Stockholm University.

- Irina Denisova, New Economic School.

- Stefan Gullgren, Ministry for Foreign Affairs.

- Elsa Håstad, Sida.

- Eric Livny, International School of Economics.

- Michal Myck, Centre for Economic Analysis.

- Tymofiy Mylovanov, Kyiv School of Economics.

- Olena Nizalova, University of Kent.

- Heinz Sjögren, Swedish Chamber of Commerce for Russia and CIS.

- Andrea Spear, Independent consultant.

- Oscar Stenström, Ministry for Foreign Affairs.

- Natalya Volchkova, Centre for Economic and Financial Research.

Taxes and Benefits in the Polish Parliamentary Election Campaigns

Authors: Michal Myck and Monika Oczkowska, CenEA.

The upcoming parliamentary elections in Poland, scheduled for the 25th of October 2015, have on the one hand stimulated debate on the record of the current coalition government, and on the other opened the debate on the nature of socio-economic policy to be conducted in the coming years. In this brief, we draw on two recent pre-election reports published by the Centre for Economic Analysis, CenEA. We discuss developments in tax and benefit policies under the coalition of the Civic Platform and the Polish People’s Party over the last eight years, as well as the pre-election pledges regarding tax and benefit policies to be implemented after the elections. We show a significant shift in policy priorities with respect to the distributional effect of the tax-benefit policies between the first (2007-2011) and the second (2011-2015) term in office, towards more support for low-income families. We also argue that, judging by the presented electoral pledges, Polish voters face a difficult choice between the promises of the opposition parties, which seem too costly to be realistic, and an enigmatic tax overhaul reform proposed by the governing Civic Platform, which is supposed to substantially benefit nearly all working households at a low cost for the state budget, with details of the reform design, however, kept away from public scrutiny.

Distribution of the VAT Burden in Poland by Income Group and Demographic Characteristics

Authors: Michal Myck and Monika Oczkowska, CenEA.

The Value Added Tax (VAT) is the main source of revenue for the public budget in Poland. Though issues regarding VAT rates or tax settlement mechanisms are brought into the public debate in Poland on a regular basis, little is still known on the distribution of the VAT burden among Polish households. In this brief, we analyze the VAT relation to household income, consumption and demographic structure in Poland. We find that the VAT burden is inversely related to income, with the bottom ten percent of the population paying on average 16.3% of their income in VAT and the top income group paying only 6.8%. Larger households, such as those with children, pay about 11%-15% more VAT due to higher spending. However, as a result of different spending structures, the additional VAT burden of families with children is independent of the number of children and only marginally dependent on their age. These differences in the tax burden should be taken into consideration in the current debate on the possibility of unifying the VAT rates in Poland.

Financial Support for Families with Children and Its Trade-Offs: Balancing Redistribution and Parental Work Incentives

Authors: Michal Myck, Anna Kurowska and Michal Kundera, CenEA.

Reforms of tax-benefit system of financial support for families with children have a broad range of consequences. In particular, they often imply trade-offs between effects on income redistribution and work incentives for first and second earners in the family. Understanding the complexity of the consequences involved in reforming family policy is crucial if the aim is to “kill two birds with one stone” namely to reduce poverty and improve incentives to work. In this brief, we illustrate these complex trade-offs by analyzing several scenarios of reforming financial support for families with children in Poland. We show that it is possible to create incentives for second earners in the family to join the labor force without destroying the work incentives of the first earners. Moreover, the same reform would allocate resources to families with lower incomes, which could result in a direct reduction of child poverty.

Financial support for families with children is an important and integral part of the broad family policy package, the goals of which fall into two basic categories of reducing child poverty and increasing labour market activity of parents (Whiteford and Adema, 2007; Björklund, 2006; Immervoll, et al., 2001). However, the particular policy aimed at one of these objectives may be detrimental to the achievement of other goals. For example, family/child benefits may directly increase family income and thus reduce child poverty. These same benefits could have a negative effect on parental incentives to work, particularly for so-called second earners, usually mothers (see e.g. Kornstad and Thoresen, 2007). However, employment of both parents often turns out to be crucial for a long-term poverty reduction (Whiteford and Adema, 2007).

The trade-offs implied by the different family policy instruments are often poorly understood or treated superficially in the policy debate. The effect of this lack of understanding may result in badly designed policy reactions to identified problems, which in turn may imply that one of the objectives is achieved at the cost of the other, or even that policies work against all of them in a longer perspective.

Using the Polish microsimulation model SIMPL, we simulate modifications of several elements of the Polish tax and benefit system to demonstrate the complex nature of trade-offs between income and employment policy, and within employment policy itself. The underlying assumption of the analysis is that any effective policy that aims at lowering child poverty in the long run ought to realize and address issues of parental labour market activities. Governments should therefore aim at a design of financial support for families to provide assistance to poor households and at the same time strong work incentives for parents.

The Polish system of support for low-income families, Family Benefits, consists primarily of Family Allowance (FA) with supplements. These are means-tested and are available to families with net incomes below 504 PLN (€121) per month and per person. The value of the FA depends on the age of the child and ranges from 68 PLN to 98 PLN (€16.40 to €23.60) per month. For eligible parents this is supplemented by additional means-tested payments to such groups as lone parents, families with more than two children, and those with school-aged children. Eligibility for Family Benefits is assessed with reference to a threshold, which once exceeded makes the family ineligible to claim the benefits. This point withdrawal of benefits implies very high effective marginal tax rates and has significant implications for average effective rates of taxes (see Myck et al., 2013). In addition to Family Benefits, financial support for families is also channelled through the tax system. Tax-splitting (joint taxation) is available to married couples and lone parents, and since 2007 parents can set their tax liabilities against the Child Tax Credit, which is a non-refundable tax credit, the maximum value of which is 1,112.04 PLN (€268) per year for every dependent child.

The starting point for our analysis, and a reference in terms of potential costs of the reform, is the move to tapered withdrawal of Family Benefits (System 1). For this purpose we use the rate of withdrawal at 55%, which is the rate used in a broadly studied in-work support programme in the UK, the Working Families’ Tax Credit (WFTC) in the late 1990s and early 2000s (see, e.g.: Blundell et al., 2000; Brewer et al., 2006; Clark et al., 2002). Application of the taper implies that with an increase of net income of 1 PLN beyond the withdrawal threshold, the total value of benefits is reduced by 0.55 PLN. Such a change would imply greater certainty and predictability of benefit receipt, compared to the current point withdrawal system. However, as it extends the availability of benefits to families who currently no longer qualify for them, it would carry additional costs. We estimate this cost to be in the range of about 1.04 billion PLN (€250mln) per year, an increase in the total value of family benefits by about 14%.

Changes in Family Benefits under System 2 involve simple increases in the values of Family Allowance, which is raised by 20% given the above cost benchmark of 1.04 billion PLN. The final reform to Family Benefits (System 3) combines introduction of the withdrawal taper (at 55%) with a bonus system for two-earner families with the specific aim of providing stronger work incentives for second earners. The bonus consists of an increase in the level of the withdrawal threshold by 50% for families where both parents work compared to the baseline threshold value.

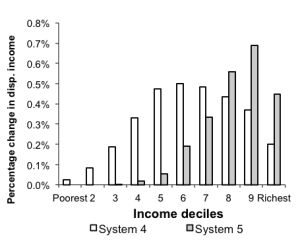

The first reform of Child Tax Credit (System 4) assumes an increase in the value of the CTC by 19.8% (calibrated to cost same 1.04 billion PLN), while the second uses this tax credit instrument to reward two-earner status. In the latter case, double-earner couples are granted an additional value of the credit (92.70 PLN per month). The cost of this reform is again calibrated to the level of other reforms by adjusting the earnings requirement set for both parents to qualify as double-earner couples. This calibrated requirement is 2,324.50 PLN per month and per person, which is equivalent to 176.5% of the minimum wage.

The assumptions underlying the modelled scenarios are very clearly reflected in the (static) distributional effects of the simulated changes. The proportional changes in incomes among families with children by population decile groups resulting from the simulated reforms are demonstrated in Figure 1A for Systems 1-3 and Figure1B for Systems 4-5.

Figure 1. Distributional consequences of modelled reforms: Proportional changes in incomes of families with children by income deciles.

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Figures 2 and 3 show how the modelled reforms would affect incentives to work for first and second earners measured as average changes in replacement rates[1] (RRs) by centiles of the baseline distribution of replacement rates for modelled families. The RR for the first earner is the ratio of the family income when neither partners work and the family income when the first earners works full time. The RR for the second earner is the ratio of the family income when only first earners work and the family income when both partners work full time. Lowest values of RRs imply the strongest incentives and highest values reflect the weakest incentives to work. When the difference in RR between the Baseline and a particular System is greater than zero it implies that this System increases incentives to work for a particular earner compared to the Baseline. This approach provides evidence on the trade-off between improving work incentives for those facing strong and weak incentives in the baseline system. The pattern that emerges from Figures 2 and 3 reflects to some extent the distributional effects of the chosen reforms (Figure 1). This is because richer families are usually those with high labour market incomes and thus low RRs (high labour market incentives), while poorer families face weaker incentives given their low actual (or potential) earnings, and thus face higher replacement ratios.

Figure 2. Changes in RRs by baseline work incentives – first earners Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Notes: Based on a sample of couples with children. System 5 does not change first earner incentives.

Figure 3. Changes in RRs by baseline work incentives – second earners

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Notes: Based on a sample of couples with children. System 5 does not change first earner incentives.

Figure 3. Changes in RRs by baseline work incentives – second earners

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Notes: Based on a sample of couples with children.

Source: Authors’ calculations using the SIMPL microsimulation model on PHBS 2010 data.

Notes: Based on a sample of couples with children.

Apart from the well-established trade-off between equity and labour market concerns, our paper draws attention to the need to balance out first and second earner work incentives as well as incentives by the degree of existing financial motivation to work.

Reforms at the two extremes of the distributional spectrum, namely an increase in the level of Family Benefits (System 2) and a Child Tax Credit bonus for two-earner couples (System 5), result in very different incentive effects. The former significantly weakens incentives of both first and second earners in couples, while the second, which specifically directs resources at second earners, produces important improvements in incentives to work for second earners. However, these gains focus on the part of the spectrum of the baseline distribution of work incentives where these are already strong. This contrasts with a reform in which a two-earner “bonus” is created as part of Family Benefits (System 3). This system increases the generosity of in-work support for first earners in couples in a similar way to the benchmark reform. At the same time, however, it improves the attractiveness of work for second earners by raising the level of income from which benefits are withdrawn for couples in which both partners are working.

This arrangement balances out the negative influence on second earner incentives of the income effect of making work more financially attractive for first earners, which does not happen under our benchmark scenario (System 1). Moreover, we demonstrate that trying to increase work incentives through higher levels of Child Tax Credit available to families would have a positive effect on the work incentives of a large number of families, in particular on first earners in couples. The flip side of this effect would be some negative incentive effects on second earners, but generally both types of effect would be very low given the assumed cost restriction of the modelled reforms.

Naturally, there is an endless number of ways in which a billion PLN can be spent on families with children. As we argued above, each type of reform will have a complex set of consequences on household incomes and incentives to work for parents. The breakdown of employment pattern in Poland suggests that to increase labour market activity, the family support policy should focus on trying to make work pay for second earners in couples, most of whom are women. As we demonstrated this can be done in such a way as to balance out incentives for first earners and provide strong incentives to those second earners who currently face the weakest incentives to work. At the same time, resources would be directed to families in the lower half of income distribution that could result in direct reduction of child poverty.

▪

References

- Blundell R., A. Duncan, J. McCrae and C. Meghir (2000) The Labour Market Impact of the Working Families’ Tax Credit, Fiscal Studies, vol. 21(1), pp. 75-104.

- Brewer M., A. Duncan, A. Shephard and M.-J. Suarez (2006) “Did Working Families’ Tax Credit Work? The Impact of In-Work Support on Labour Supply in Great Britain”, Labour Economics, vol. 13, pp. 699-720.

- Björklund A. (2006) Does family policy affect fertility? Journal of Population Economics, vol. 19 (1), pp. 3-24.

- Clark T., A. Dilnot, A. Goodman, and M. Myck (2002) Taxes and Transfers, Oxford Review of Economic Policy, vol.18 (2), pp. 187-201.

- Immervoll H., H. Sutherland, K. de Vos (2001) Reducing child poverty in the European Union: the role of child benefits, in: Vleminckx K. and Smeeding T.M. (eds) Child well-being, Child poverty and Child Policy in Modern Nations. What do we know? Revised Edition; The Policy Press: Bristol.

- Kornstad T. and T. O. Thoresen (2007) A Discrete Choice Model for Labor Supply and Child Care, Journal of Population Economics, vol. 20 (4), pp. 781-803.

- Myck, M., A. Kurowska, and M. Kundera (2013) “Financial Support for Families with Children and its Trade-offs: Balancing Redistribution and Parental Work Incentives”, Baltic Journal of Economics, 13(2), 59-84.

- Whiteford P. and W. Adema (2007) What Works Best in Reducing Child Poverty: A Benefit of Work strategy? OECD Social, Employment and Migration Woking Papers, nr 51, OECD, Paris.

[1]For the couples in the subsample we compute three sets of family-level incomes, conditional on employment either of the first earner (who is the person with higher expected earnings in a couple) or of both partners; Y(1,1) for the scenario where both partners are employed (full-time); Y(1,0) for the scenario where the first earner is employed (full-time); Y(0,0) for the scenario where both partners are not employed. This allows us to compute replacement ratios for the first earner (RR1) and the second earner (RR2) for each of the analysed tax and benefit systems (S): RR1(s,j)=Y(s,j)(0,0)/Y(s,j)(1,0) and RR2(s,j)=Y(s,j)(1,0)/Y(s,j)(1,1).

Increasing Resources for Families with Children Through the Tax System: Recent Reform Proposals from Poland

This brief discusses the consequences of a recent reform proposal that aims to redistribute resources to low-income families with children through the income tax system in Poland. The proposed reform replaces the current child tax credit with additional amounts of the universal tax credit, and by changing the sequence in which tax deductions are accounted for, it increases resources of low-income families with children by about 1.7 billion PLN per year (0.4 billion EUR). The brief examines four possible ways of additional tax system modifications that would make the reform package neutral for the public finances, and presents distributional implications of the reforms.

The level and structure of financial support for families with children has become an important policy focus in Poland; a country that faces high levels of child poverty and one of the lowest fertility rates in Europe (Immervoll et al., 2001; Haan and Wrohlich, 2011; Eurostat, 2013). In this brief, we outline recent tax reform proposals that aim to increase financial support for low-income families with children through the tax system. A range of such potential reforms has been examined in Myck et al. (2013b); a report prepared for the Chancellery of the President of the Republic of Poland. One of the options became the key element of the President’s family support program Better climate for families proposed in May 2013. Below we discuss its main features and various options for financing the proposals.

The proposed modification of financial support for families would replace the current child tax credit with additional amounts of the universal tax credit conditional on the number of children, and increase tax advantages for families by changing the sequence in which tax credits are accounted for in a way that is favorable for families with children (Chancellery of the President of Poland, 2013). The main beneficiaries of this reform would be low-income families with children whose income is too low to take full advantage of the current child-related advantages. The overall cost of the reform would amount to about 1.7 billion PLN (0.4 billion EUR). In the final section of the brief we discuss potential ways of making the reform budget neutral.

The analysis has been conducted using CenEA’s micro-simulation model SIMPL on reweighted and indexed data from the 2010 Household Budget Survey (HBS) collected annually by the Polish Central Statistical Office (see Morawski and Myck, 2010, 2011; Myck, 2009; Domitrz et al., 2013; Creedy, 2004).

Financial Support for Polish Families in 2013

In Poland, financial support for families with children depends on the level of family income and the demographic structure of the household. The system consists of two main elements – family benefits on the one hand, and tax preferences for families with children on the other. Following Myck et al. (2013a), we define financial support for a family j (FSFj) as the sum of family benefits received by the family (FBj), and tax preferences that families with children collect in the PIT system is defined as the difference in the level of tax liabilities and health insurance contributions paid by the family (PITHIjD0 – PITHIjDn) supposing they have no children (D0) and on condition them having n number of dependent children (Dn):

FSFj = FBj + (PITHIjD0 – PITHIjDn) [1]

Figure 1a presents the current level of the financial support for single-earner married couples and Figure 1b presents the same for single parents with one and three children in relation to the level of gross earnings.

Family benefits

Family benefits, which include family allowance with supplements, childbirth allowance and nursing benefits, are means-tested and related to the number and age of dependent children in the family and specific family circumstances. Family benefits are granted only to low-income families and are subject to point withdrawal once the family crosses the income eligibility threshold (539 PLN of net income per person). For example, the stylized married couples in Figure 1 lose family benefits when their monthly gross income exceeds 2,060 PLN if they have one child and 3,435 PLN if they have three children (for single parents these thresholds equal 785 PLN and 1,825 PLN respectively).

Figure 1. Monthly level of financial support received by families with one and three children dependent on their age and family gross income in 2013 (PLN/month) (a) Married couple with one spouse working b) Single parent working Note: FB – family benefits; CTC – child tax credit; joint taxation preferences: UTC – additional amount of universal tax credit; IB – shift of tax income bracket. In case of the single parent alimonies from the absent parent are assumed at the median value from 2010 data, which is 410.50 PLN for 1 child and 724.67 PLN for 3 children. Gross income of the single parent includes income from work only. Alimonies are taken into account for FB income means testing. Source: Myck et al. (2013a).

Note: FB – family benefits; CTC – child tax credit; joint taxation preferences: UTC – additional amount of universal tax credit; IB – shift of tax income bracket. In case of the single parent alimonies from the absent parent are assumed at the median value from 2010 data, which is 410.50 PLN for 1 child and 724.67 PLN for 3 children. Gross income of the single parent includes income from work only. Alimonies are taken into account for FB income means testing. Source: Myck et al. (2013a).

Tax preferences

Taxpayers with children can deduct a non-refundable child tax credit (CTC) from the accrued tax, with the maximum values of the CTC related to the level of universal tax credit available to all tax payers (UTC is 46.37 PLN per month). For each of the first two children in the family, taxpayers can deduct up to two values of the UTC (92.67 PLN per month), for the third child up to three values (139.00 PLN per month) and for the fourth and following children up to four values of the UTC (185.34 PLN per month). The CTC is not available for high-income parents with one child (whose annual taxable income exceeds 112,000 PLN per year).

Further tax advantages are available for single parents through joint taxation, which translates into substantial gains in particular for high-income parents. As Figure 1 shows, single parents whose gross income exceeds the second tax income bracket (15,745 PLN per month) gain up to 1,044.19 PLN per month if they have one child and 1,368.54 PLN if they have three children. With the same income levels, the system grants nothing to married couples if they have one child and 324.34 PLN if they have three.

In the current system, the CTC can be deducted from the accrued tax only after the full amount of UTC and the tax-deductible part of health insurance (HI) contributions have been exhausted. As a consequence, there is a large group of low-income families whose income is too low to take full advantage of the CTC. As Figure 2 illustrates, the higher the number of children is in a family, the lower is the proportion of families who take full advantage of the credit. Although the percentage of those using the full CTC is 76.1% for families with one child, it decreases to 67.6% for those with two children and is as little as 30.8% for families with three or more kids. Over 40% of the latter use only half of the CTC they are entitled to.

Figure 2. Use of maximum amount of CTC by number of children Note: Proportions of families with taxable income satisfying other conditions for CTC. Source: Myck et al. (2013a).Recent Reform Proposals