Tag: robustness

Trade Induced Technological Change: Did Chinese Competition Increase Innovation in Europe?

The last 30 years has witnessed a shift of the world’s manufacturing core from Europe and North America to China. A key question is what impact this has had on manufacturing workers in other developed economies, and also on innovation, patenting, IT adoption, and productivity growth. While a rigorous data analysis on these variables for developing economies, particularly in Eastern Europe, is not yet available, this brief examines the impact of the rise of China on innovation in Western Europe, and also reviews the evidence on the impact of the rise of China generally. Recent research by Bloom, Draca, and Van Reenen (2016) found that Chinese competition induced a rise in patenting, IT adoption, and TFP by 30% of the total increase in Europe in the early 2000s. Yet, we find numerous problems with the Bloom et al. analysis, and, overall, we do not find convincing evidence that Chinese competition increased innovation in Europe.

Few events have inspired the ire of economists as much as Brexit and the rise of Donald Trump, two events seen as related as both were a seeming reaction to both globalization and slowing economic growth, particularly as some (such as Trump himself) saw the former as a key cause of the latter. Both Brexit and the trade war spawned by Trump do seem to have had negative economic effects – US equities have suffered every time the trade war has escalated, while anecdotal reports and more sophisticated economic analyses seem to suggest that Brexit has cost the UK jobs.

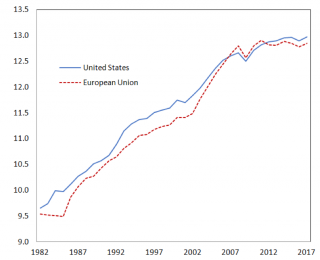

And yet, there is a need for policy makers and economists to hold two ideas in our heads simultaneously: Trump’s trade war and Brexit may be policy disasters, and yet globalization can create both winners and losers, even if it is clear that, generally speaking, the overall gains are likely positive and large. This is likely also true of the rise of China – one of the most dramatic events in international economics in the past 50 years. Figure 1 shows the increase in trade with China from the early 1980s to 2017, a period in which US imports from China grew from 7 to 476 billion dollars.

Figure 1. Chinese Imports (in logs, deflated)

Source: World Bank WITS

The academic literature tends to show that this impact, the rise of China, may have cost the US as much as 2.2 million jobs directly (Autor et al.), and as much as 3 million jobs once all input-output and local labor market effects are included. While approximate, these numbers are large enough for the China shock to have played a role in the initial onset of “secular stagnation” – the growth slowdown which began around 2000 for many advanced nations, including the US and Europe. In addition, Autor et al. (forthcoming) found that Chinese competition also resulted in a decline in patent growth. In the European context, however, other authors have found that although China did do some damage to certain sectors, overall, it does not appear to have been quite as damaging, particularly in Germany, which also benefitted from exporting increased machine tools to the Chinese manufacturing sector. And, in a seminal paper, Bloom, Draca, and Van Reenen (2016) find that Chinese competition actually led to an increase in patents, IT adoption, and productivity in Europe from 1996 to 2005, along accounting for nearly 30% of the increase. This is important, as it implies that without the rise of competition with China, the slowdown in European growth would have been even more pronounced than it was. It also implies that, far from being a source of stagnation, Chinese competition has been a source of strength. It also makes it more likely that the slowdown in growth since 2000 was caused by supply-side factors, such as new inventions becoming more difficult over time, as is perhaps the leading explanation among economists, notably Northwestern University business professor, Robert Gordon (2017), and also supported by others (see this VoxEU Ebook featuring a “who’s who?” among economists). It would also be evidence that contradicts the “Bernanke Hypothesis” that the former US Fed Chair first laid out in a 2005 speech at Jackson Hole, in which he suggested that international factors – particularly the savings glut and US trade deficit – were behind falling interest rates in the US. Since then, Ben Bernanke has followed up with a series of blog posts suggesting that these international factors were the cause of the initial onset of secular stagnation.

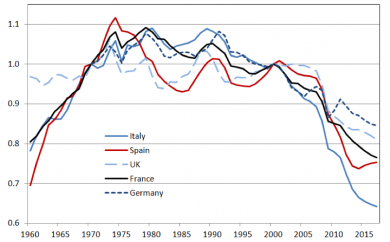

Figure 2. European Growth Relative to Trend

Source: World Bank WDI

In this brief, I present new research in which my coauthor and I test the robustness of the research finding that China had a positive impact on innovation in Europe (Campbell and Mau, 2019). We find that these findings are very sensitive to controls for time trends and other slight changes in specification. We also find that the number of patents matched to firms in the sample shrinks over the sample period (from 1996 to 2005). Overall, we conclude that, unfortunately, it is unlikely that the rise led to a significant increase in innovation in Europe, although more research is needed. Our research also sheds light on the so-called “replication crisis” currently gripping the social sciences, as researchers begin to realize that many published findings are not robust.

Trade-Induced Technical Change?

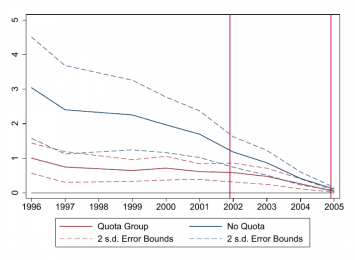

Bloom, Draca, and Van Reenen (2016) – hereafter BDV – tried to isolate the impact of the rise of China on Europe using several methods, using firm-level data for Europe. They placed each firm in a 4-digit sector, where they measured imports from China over time. First, they just looked at changes in patents, IT, and total factor productivity (TFP) at the firm level for sectors in which Chinese imports increased a lot vs. other sectors. But, because economists are always weary of the difficulty of isolating a causal relationship from non-experimental data, the authors, worrying that the sectors which saw increases in Chinese imports might differ systematically from the others, the authors also used what is called an instrumental variable. That is, they used the fact that when China joined the WTO in 2001, they also negotiated a reduction in textile quotas. Thus, BDV reason that textile sectors which had tightly binding quotas prior to removal were likely to have had fast growth in Chinese imports after China’s accession to the WTO. Thus, they end up comparing textile sectors in which the quotas were binding to sectors in which they were not binding. We went back and compared the evolution of patents in these same groups (sectors with binding textile quotas vs. not binding) below in Figure 3.

Figure 3. Patent Growth in China-Competing Sectors (Quota Group) vs. Other Sectors

Notes: The vertical red lines are dates when textile quotas were removed. The blue line shows the evolution of patents in the sectors without binding quotas (non-competing sectors), and the red line is the evolution of patents in the China-competing sectors. The dotted lines are 2 standard deviation error bounds.

What is immediately obvious in Figure 3 is that patents are declining rapidly over the whole period in both groups. The overall level of patents was falling in both groups for the full period. There is a 95.8% decline in patenting for the China-competing group, vs. a 96.2% decline for firms in the non-competing (“No quota”) group. By 2005, average patents per firm are close to zero in both groups (.04 in the China-competing sectors vs. .11 in the others). However, in the “No quota” group, the initial level of patents – close to three per firm per year – was much larger than in the quota group. Since patents are falling rapidly in both groups but bounded by zero, the level of the fall in patents in the non-quota group is larger, but one can easily see that much of this decline happens before quotas are removed. If we control for simple time trends, the effect goes away. Also, given the tendency of patents to decline, we can also remove the correlation between Chinese competition and patent growth in some specifications by simply controlling for the lagged level of patents. The overall declining share of patents in the BDV data also raises questions about data selection issues, as patents granted in the BDV data in the later years were a smaller share of the total patents actually granted in reality.

BDV also look at the impact of the rise of China on IT adoption. However, here they proxied IT adoption by computers per worker, but they did not collect enough data to control for pre-trends properly in the data, so we cannot be sure whether this correlation is causal or not. (For what it is worth, on the data we do have, from 2000 to 2007, including trends in the data renders the apparent correlation between Chinese import growth and computers-per-worker insignificant.)

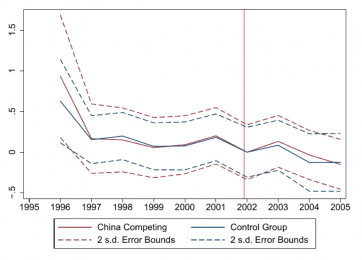

Lastly, BDV look at the impact of the rise of China on TFP growth. Here, unlike before, we find that their measure is robust across various estimation methodologies. However, when we look at changes in a commonly used alternative measure of productivity, value-added per worker, instead of TFP (as TFP needs to be calculated using strong assumptions about the functional form of technology), we find no impact (see Figure 4 below).

Figure 4. Value-Added per worker Growth: China-competing sectors vs. others

Figure 4 above compares the evolution of value-added per worker in the most China-competing sectors vs. the others. Trends look similar for firms in either group of sectors (China-competing or otherwise), and we do not find a correlation. We also do not find that Chinese competition led to an increase in profits, nor an increase in sales per worker (in fact, we found a significant decrease in most specifications).

Conclusion

All in all, we find that the BDV findings suggesting that the rise of China had a large impact on innovation in Europe is not robust. However, in most specifications, we also don’t find a negative impact as did Autor et al. (forthcoming) for the US. This might have to do with data quality, although it does seem to be closer to other work, such as Dauth et al. (2014), which suggests that the rise of China had a smaller impact in Germany than in the US.

We also felt it was a bit alarming that a simple plot of the trends in patents for China-competing and not-competing sectors was enough to seriously question the conclusions of BDV, as their paper was published in the Review of Economic Studies, a top 5 journal in academic economics. If influential articles published in the most fancy journals can exhibit such mistakes, this underscores the extent which the profession of economics may suffer from many published “false-positive” results. The reasons why this could be the case are obvious: researchers are under pressure to find significant results, as top journals don’t often publish null results, and replication is exceedingly rare in a field in which one needs to make friends to publish. However, there are signs that replication is becoming more mainstream, and as it does, we can certainly hope that voters around the world will turn back to science.

References

- Autor, D., D. Dorn, G. H. Hanson, G. Pisano, and P. Shu. Forthcoming. Foreign Competition and Domestic Innovation: Evidence from US Patents. Forthcoming: AEJ:Insights.

- Bloom, N., M. Draca, and J. Van Reenen. 2016. “Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, IT and Productivity.” The Review of Economic Studies 83 (1): 87–117.

- Campbell, Douglas and Mau, Karsten. 2019.. Trade Induced Technological Change: Did Chinese Competition Increase Innovation in Europe?”, mimeo

- Dauth, W., S. Findeisen, and J. Suedekum. 2014. “The Rise of the East and the Far East: German Labor Markets and Trade Integration.” Journal of the European Economic Association 12 (6): 1643–1675.

- Gordon, R.J., 2017. The rise and fall of American growth: The US standard of living since the civil war (Vol. 70). Princeton University Press.

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.