Location: Global

Gender and Development: the Role of Female Leadership

This policy brief reports on a discussion of the role of female leadership in development held during a full day conference at the Stockholm School of Economics on June 16, 2014. The event was organized jointly by the Stockholm Institute of Transition Economics (SITE) and the Swedish Ministry for Foreign Affairs, and was the fourth installment of Development Day – a yearly development policy conference. It is well known that women fall behind men on many markers of welfare and life opportunities, both in developed and developing countries. For most indicators, though, such as education and labor force participation, both the absolute and relative position of women tend to improve with economic development. However, in some areas the beneficiary effect of raising incomes is less clear. Access to leadership positions and decision-making roles are examples of such areas. To discuss this question, the conference brought together a distinguished and experienced group of policy oriented scholars and practitioners from government agencies, international organizations, civil society and the business community.

Hedge Funds Non-Transparency: Skill of Risk-Taking?

This policy brief raises the issue of whether the secretive nature of hedge funds allows funds to misbehave and take excess risks that may in turn be contagious for the whole economy. We use a novel dataset and a new methodology to argue that at least part of the excess performance of more secretive funds during the pre-crisis period was indeed due to higher risks taken.

Hedge Funds – the Secretive Investment Vehicles

In the modern era of delegated portfolio management, hedge funds constitute some of the most interesting and complicated investment vehicles, with a global industry size of over US$2.5 trillion and an overall number of funds of about 10,000 (according to Hedge Fund Research, Inc). The industry grew dramatically during the early 2000s, often providing investors with returns superior to those available in other financial sectors.

The natural question arising is then what exactly made hedge funds enjoy these superior returns. Historically, hedge funds have operated in a relatively secretive way that did not require them to disclose the details about their operations to regulators. Some have argued that it is this secretive nature of hedge funds that has allowed fund managers to employ superior trading strategies and effectively preserve the managerial know-how (in terms of stock-picking skill, market timing or faster trading technology) from being potentially replicated by others.

At the same time the secretive nature of hedge funds might simply allow the fund managers to hide the excessive risks their strategies are exposed too, thereby earning superior returns during relatively good periods (when risky strategies earn the risk premium), but having drastic collapses during relatively bad periods (when these risks realize).

Distinguishing between these two major explanations of superior performance is critically important for potential policy implications regarding hedge funds transparency and disclosure. If the secretive nature of hedge funds attracts more skillful managers that employ proprietary know-how strategies and invests into acquiring more information about the instruments they trade (i.e. generate so called “alpha”), more disclosure would not be necessarily good. This, since it would allow other funds or investors to free-ride on these more skillful managers, reducing their competitive advantage and incentives for providing superior performance. If on the other hand, secrecy allows hedge funds to misbehave and take more systematic risk than they claim they take (i.e. they have a higher “beta”), then there may be a rationale for increasing disclosure requirements, so that investors understand what they are being compensated for in the form of superior returns.

Is There More Risk in Secretive Hedge Funds?

The traditional approach to distinguishing between high-alpha and high-beta funds involves adopting a certain model of risk, i.e. selecting a set of observable risk factors that hedge funds may load on, and then adjusting their raw performance using the estimated exposures to these different factors. This would yield alpha – the risk-adjusted return – that can in turn be used as a measure of managerial skill.

In Gorovyy et al. (2014), we argue that the above methodological approach may sometimes be misleading in evaluating managerial performance. Indeed, in the absence of the true model (e.g. not knowing all factors or not being able to observe them) such alpha would be overestimated as long as these omitted or unobserved factors are earning positive returns during the estimation period (and underestimated, respectively, if the returns are negative). For practical purposes this means that if hedge funds load on unobservable factors, which during the estimation period happen to crash rarely, but deliver a positive return most of the time, we would erroneously attribute funds’ superior returns to managerial skill and not risk.

To tackle this issue, we offer a different approach and suggest that during relatively good times high-alpha and high-beta explanations may be observationally equivalent, but during relatively bad times, they are not. In particular, if during bad times the risks that funds have been loading on realize, we would observe relatively worse performance of funds that loaded more on such factors, ceteris paribus. Thus, in order to distinguish between high-alpha and high-beta funds, we need to look precisely at periods when we would be comfortable assuming that such unobserved factors are likely to crash.

In order to implement this idea, we use a novel proprietary dataset obtained from a fund-of-funds – that is, a hedge fund that invests in other hedge funds, and, hence, has a lot of information about these other hedge funds – and spans April 2006 to March 2009, to directly measure the secrecy level of a fund that is missing in public hedge-fund databases. This qualitative measure describes the willingness of the hedge-fund manager to disclose information about its positions, trades and immediate returns to fund investors. It is based on formal and informal interactions of the fund-of-funds with hedge funds it invests in, such as internal reports, meetings with managers and phone calls.

Figure 1. Performance of Secretive vs. Transparent Funds Source: Author’s own calculations.

Source: Author’s own calculations.

First of all, we document that secretive funds significantly outperform transparent funds during the relatively good times, as suggested, for example, by the period between April 2006 and March 2007 – a growth period according to NBER, and a period of rapid rise of the U.S. stock market indices. In particular, we find that the most secretive funds earned on average about 5% in annualized terms more than the most transparent funds during this period, even when we control for differential risk exposure of different strategies over time and various hedge-fund control variables.

In order to understand whether this superior performance of more secretive funds is due to managerial skill, or some other factors that may not be observable or not known in the model, we need to see what happened to these funds during the relatively bad period of time, i.e. during the period when we would feel comfortable assuming that risk factors on which hedge funds may have loaded did indeed realize. Although we may have in mind some of the omitted factors being potentially related to rare events and tail risk (as also supported by loadings on strategies associated with option-based returns as in Agarwal and Naik, 2004), they may well represent other risks that were likely to realize during the crisis period. We therefore label April 2008 to March 2009 as the “bad” period – a recession period according to NBER, highlighted by the bankruptcy filing by Lehman Brothers in September 2008 and some of the largest drops of stock market indices in history.

As we see from the graph in figure 1, the performance comparison between secretive and transparent funds largely reversed during this bad period. In particular, also supported by our more saturated regression results, transparent funds outperformed the secretive ones during the crisis by the magnitude of about 10-15% in annualized terms, depending on the exact specification. This explicit consideration of the bad period allows us to conclude that at least a part of the performance differential between secretive and transparent funds during good times can be attributed to a higher risk-taking by secretive funds, which earned a premium during good times but faced these realized risks during bad times.

Potential Policy Implications

As a response to the recent financial crisis, many developed economies have passed regulatory reforms considerably increasing the required disclosure levels, suggesting that the secretive nature of alternative investment vehicles has been considered to be something undesirable (e.g. for contagious effects on the economy, or the ex-post bailouts of the “too-big-to-fail” financial institutions). The examples of such policies include the U.S. Dodd-Frank Wall Street Reform Act passed in July 2010, the European Union Alternative Investment Fund Managers Directive 2011/61/EU that entered into force in July 2013, and the Regulation Guide 240 issued by the Australian Securities and Investments Commission in September 2012.

However, given that hedge funds receive money from relatively sophisticated and wealthy investors (i.e. generally having at least $1 million in net worth), whether more risk in hedge funds strategies is good or bad for them in particular, and the society in general becomes a somewhat debatable question. More importantly, the essence of many of the hedge-fund strategies lies in the so-called dynamic trading – with asset positions and risk exposures being adjusted daily or even more frequently. In such an environment, reporting these positions to the regulatory authorities even on a monthly basis may not adequately describe the exact risks taken by the hedge funds.

More relevant questions, on the other hand, may be about whether investors correctly perceive the exact risks faced by the fund, how large the degree of asymmetric information is within the hedge fund industry, and whether any action may be needed to correct it. These remain open questions and we hope that future research will address them.

▪

References

- Agarwal, V., and Naik N.Y., 2004, “Risks and portfolio decisions involving hedge funds,” Review of Financial Studies, 17(1), 63-98.

- Gorovyy Sergiy, Patrick Kelly, and Olga Kuzmina, “Hedge Funds Non-Transparency: Skill of Risk-Taking?”, CEFIR Working paper.

Trust and Economic Reforms

This brief discusses the importance of trust in economic development. In the aftermath of the 2008 financial crisis, many countries experienced a decline in the level of both general trust and trust and confidence in the government and market institutions. Trust is important for economic growth as it facilitates economic transactions by reducing uncertainty and risk. A lack of trust in the government hinders implementation of structural reforms needed for economic development. Hence, policies aimed at rebuilding trust in the government and institutions become especially important for countries like Ukraine.

Recent events in Ukraine have highlighted an acute crisis of trust in the Ukrainian society (such as trust in the government, politicians, institutions, etc.). Over the past two decades, in the absence of a fair and transparent legal and court system, Ukrainians have become accustomed to relying on informal and often corrupt ways of living and doing business. According to a poll conducted in December 2013, less than 20 percent of the Ukrainian population said that they trust the government, police and courts.

A low level of trust in society is not, however, limited to Ukraine; this problem is also pronounced in many other parts of the world. According to the 2012 Edelman Trust Barometer survey, the general level of trust in most countries surveyed decreased compared to 2011. The most notable decline was in Brazil (36.3%), Japan (33.3%) and Spain (27.5%). These countries also experienced large drops in the level of confidence in the government: Brazil went down by 62.4%, Japan by 51% and Spain by 53.5%. According to the OECD report, generally, less than half (40%) of the citizens trust their government (OECD, 2013).

General trust is important for economic life as it reduces uncertainty and costs associated with economic transactions. Trust affects the functioning of businesses, financial markets, and government intuitions. The level of general trust varies significantly across countries (see Figure 1). While only 3.8 percent of people in Trinidad and Tobago fully trust most people, the Scandinavian countries’ share of trusting people exceeds 60 percent (Algan and Cahuc, 2013).

Economists have in their studies repeatedly appealed to the problem of trust because there are several channels through which trust may influence economic development. First, trust creates favorable conditions for long-term investment and financial market development (Algan and Cahuc, 2013). Second, a higher level of trust in various regulatory authorities increases the level of compliance with the rules and regulations if citizens believe in the fairness of such rules and regulations (Murthy, 2004). In Tabellini (2010), the level of economic development (measured by GDP per capita) of different regions of the EU member countries is compared to their level of trust (defined as in the Figure 1) and respect (defined as the proportion of people who mentioned the quality “tolerance and respect for other people” as being important). Using data from the World Value Survey rounds conducted in the 1990s, he shows that regions with a high level of trust and respect are also the regions that are the most economically developed.

In his Master thesis, the graduate of the Kyiv School of Economics Oleksii Khodenko (Khodenko 2013) analyzed the relationship between the level of trust in the government and the attitude towards market economy (in particular, the attitude towards competition and private property). For this purpose, he used data from the World Values Survey and the European Values Survey. His results have different implications for developed and less developed countries. While a lack of trust in the government in developed countries is transformed into a desire to see more market mechanisms in the economy, this mistrust of the government in developing countries (including Ukraine) undermines the faith in the entire market economy.

Khodenko’s results highlight important policy implications for transition countries: people who grew up in a centrally planned economy tend to underestimate the benefits of the free market and, therefore, only puts confidence in the government and the state as a whole to achieve the development of market mechanisms. Thus a lack of trust hinders, or even prevents implementation of structural economic reforms, which are often “painful” for some groups or for society as a whole. In countries with a low level of trust, the long-term promise of the implemented reforms to improve the lives of people is not perceived as credible. Instead of being viewed by the general public as a today’s sacrifice in the name of future prosperity, they are rather viewed as a deadweight loss (Györffy, 2013).

Figure 1. The Level of Trust in the World Source: Yann and Cahuc (2013), Figure 1.

Note: Trust is computed as the country average from responses to the trust question in the five waves of the World Values Survey (1981-2008), the four waves of the European Values Survey (1981-2008) and the third wave of the Afrobarometer (2005). The question regarding trust asks: “Generally speaking, would you say that most people can be trusted or that you need to be very careful in dealing with people?” Trust is equal to 1 if the respondent answers ”Most people can be trusted” and 0 otherwise.

Source: Yann and Cahuc (2013), Figure 1.

Note: Trust is computed as the country average from responses to the trust question in the five waves of the World Values Survey (1981-2008), the four waves of the European Values Survey (1981-2008) and the third wave of the Afrobarometer (2005). The question regarding trust asks: “Generally speaking, would you say that most people can be trusted or that you need to be very careful in dealing with people?” Trust is equal to 1 if the respondent answers ”Most people can be trusted” and 0 otherwise.

Moreover, low levels of trust affect all types of structural reforms. Elgin and Garcia (2012) show that the effect of the tax reform on the economy can significantly differ depending on the level of trust in the government; under low levels of trust the announced tax cuts do not lead to exit from the informal sector.

The question is then how to revive or rebuild trust? Knack and Zak (2003) argue that the most efficient policies for building general trust are policies that (1) reduce income inequality since people in countries with more equal income distribution tend to have higher levels of interpersonal trust, and (2) strengthen civil society to increase government accountability. Income inequality often resulting from unequal opportunities can be reduced via increases in educational attainment and income redistribution programs. The presence of a strong civil society with free press ensures that the government is accountable and responsive to its citizens. A government needs to be reliable, open and transparent to effectively address citizens’ demands (OECD, 2013). All these policies cannot be implemented without a fair legal system that guarantees equal treatment of all citizens.

▪

References

- Algan, Y. and P. Cahuc (2013) “Trust, Growth and Well-being: New Evidence and Policy Implications”, IZA Discussion Paper No. 7464

- Elgin, C. and M. Solis-Garcia (2012), “Public Trust, Taxes and the Informal Sector”, Journal Review of Social, Economic and Administrative Studies, 26(1), pp. 27-44

- Györffy, D. (2013), Institutional Trust and Economic Policy: Lessons from the History of the Euro, Central European University Press

- Knack, S. and P.J. Zak (2003), “Building Trust: Public Policy, Interpersonal Trust, and Economic Development”, Supreme Court Economic Review, 10, pp.91-107

- Khodenko, Oleksii (2013). How Does Confidence in the State Authorities Shape Pro-market Attitudes?

- Murthy, K. (2004), “The Role of Trust in Nurturing Compliance: A Study of Accused Tax Avoiders”, Centre for Tax System Integrity, Working paper No49

- OECD (2013), Government at a Glance 2013, OECD Publishing.

- Tabellini, G. (2010), “Culture and Institutions: Economic Development in the Regions of

- Europe”, Journal of the European Economic Association, 8(4), pp. 677–71

The Charity of the Extremely Wealthy

Analyzing data from the Giving Pledge (a public pledge to give away at least half of one’s fortune during one’s lifetime, launched by Bill Gates and Warren Buffett in 2010) and the Forbes billionaires’ list, I find that self-made billionaires are substantially more likely to give away large amounts of money, than do billionaires who inherited their money. Policy makers in many emerging markets with ‘new’ billionaires thus better quickly modernize their charity laws.

In 2010, two billionaires Bill Gates and Warren Buffett launched the Giving Pledge, a public pledge to give away at least half of one’s fortune during one’s lifetime (http://givingpledge.org/), which by now has been signed by 114 people. 114 are not much, you might think, and you might want to add your own name to the list. But, unfortunately, not everybody is invited to make this pledge. Gates and Buffet focus only on the extremely wealthy people: 85 of the signatories of the pledge are among the 1426 billionaires identified by Forbes in 2013, and most of the others were on Forbes’ billionaire list in earlier years. Of these 1426, 135 billionaires come from Central and Eastern Europe or the Former Soviet Union (see table I)

Worldwide, about 6% of billionaires (85/1426) have made this pledge. Among the signatories is one Russian billionaire, Vladimir Putanin, and one Ukrainian billionaire, Victor Pinchuk, which makes Ukraine score above average, with one out of ten, or 10% of Ukrainian billionaires signing.

Table 1. Number of 2013 Forbes Billionaires from the Former Soviet Union|

# 2013 Forbes Billionaires |

# of Selfmade |

Giving Pledge |

Name of Signatory |

|

|

Russia |

110 |

110 |

1 |

Vladimir Potanin |

|

Ukraine |

10 |

10 |

1 |

Victor Pinchuk |

|

Kazakhstan |

5 |

4 |

0 |

|

|

Czech Republic |

4 |

4 |

0 |

|

|

Poland |

4 |

4 |

0 |

|

|

Romania |

1 |

1 |

0 |

|

|

Georgia |

1 |

1 |

0 |

In my most recent working paper, Claire Monteiro of Georgetown University and myself investigate whether it is possible to explain why these 6 % have signed, and the other 94% have not (yet) signed the Pledge. Or to put it in a more interesting way, why Putanin and Pinchuk signed but the other CEE/FSU oligarchs have not.

We investigate this question by analyzing whether generous billionaires have specific characteristics in common, characteristics that not so generous billionaires do not have. Doing this is possible because Forbes publishes not only a ranking of billionaires, it also provides background information about each billionaire like the billionaire’s education, age, how many children (s)he has and so on.

My analysis shows that three factors have a significant effect on the chance that a billionaire will be generous. First, a billionaire who is self-made is about three to four times more likely to sign than a billionaire who inherited his/her billion(s). This finding that how one earned one’s money affect how one spends this money is consistent with University of Chicago professor Richard Thaler’s ‘mental accounting’ theory and with earlier research showing that the propensity to consume is bigger if income received is framed as a bonus rather than if it is framed as a rebate, and the research showing that windfall gains (money won in a lottery) is more readily consumed than non-windfall gains (money for which one had to work). Note that all but one billionaire from the CEE/FSU are categorized by Forbes as self-made.

Second, billionaires with more money are more likely to sign the Giving Pledge and promise to give away half their fortune – for example, compared to an average billionaire who has about 4 billion dollar in estimated net worth (like Victor Pinchuk), a billionaire with an estimated net worth of about 15 billion dollars (like Vladimir Potanin) is roughly 50% more likely to promise to give away half of her/his fortune. Third, billionaires whose fortune comes from the technology/telecommunications industry are about twice as likely to announce that they will give away at least half of their fortune, compared to billionaires from other sectors.

The influence of other factors is small and less precisely estimated: older billionaires tend to be more likely to sign (possibly because being closer to the end of one’s life makes one think more about what one wants to leave behind), as do those who have more children (maybe because having more children makes it more likely that the inheritance will lead to fights among family members) or those having a Ph.D. Moreover, billionaires from the food and retail industry tend to be less likely to sign than those from the metallurgy industry.

Taken together my model predicts for Ukraine that Victor Pinchuk is the Ukrainian billionaire who is most likely to sign (4% probability), being 10 times more likely to sign than Yuriy Kosiuk (the Ukrainian billionaire who is least likely to sign with 0.4% probability). The difference in estimated net worth (3.8 billion versus 1.6 billion), age (52 versus 44), the number of children (4 versus 1) and education (Ph.D versus bachelor), and the sector in which they are active (metals and mining versus food and retail) explain this difference in probability. Victor Pinchuk is also about 30% more likely to sign than Rinat Akhmetov – while the latter has a higher estimated net worth (15.4 billion versus 3.8 billion), the effect of education (bachelor versus Ph.D), age (46 versus 52) and children (2 versus 4) play in favor of Victor Pinchuk, outweighing the wealth effect.

While it is definitely fun to do these kinds of computations, my research also has serious implications. The fact that inherited billionaires are much less charitable than the self-made billionaires means that academics should not assume that ‘all money is equal’ as they typically do – how you acquire money affects what you will do with it. It also implies that the countries from CEE/FSU with lots of ‘new’ wealth should modernize their charity laws quickly – once the self-made billionaires pass their wealth on to their children, it will become much more difficult to turn this massive wealth into charity.

▪

References

- Tom Coupé and Claire Monteiro, The Charity of the Extremely Wealthy, Kyiv School of Economics, Discussion Papers 51.

* A version of this policy brief has been published in Russian at Forbes.ua.

Can Public Enforcement of Competition Policy Increase Distortions in the Economy?

Authors: Vasiliki Bageri, University of Athens, Yannis Katsoulacos, Univeristy of Athens, and Giancarlo Spagnolo, SITE.

Competition law has recently been introduced in a large number of developed and emerging economies. Most of these countries adopted the common practice of basing antitrust fines on affected commerce rather than on collusive profits, and in some countries caps on fines have been introduced based on total firm sales rather than on affected commerce. Based on recent research, this policy brief explains how a number of large distortions are connected to these policies, which may facilitate competition authorities in their everyday job but at the high risk of harming the consumer and distorting industrial development. We conclude by discussing the possibility to depart from these distortive rules-of-thumb opened by recent advancements in data availability and econometric techniques, as well as by the considerable experience matured in estimating collusive profits when calculating damages in private antitrust litigation.

Competition policy has become a prominent policy in many developing economies, from Brazil to India. Indeed, the available evidence suggests that in countries where law enforcement institutions are sufficiently effective, a well designed and enforced competition policy can significantly improve total and labor productivity growth.

It is already well known that the private enforcement of competition policy can give rise to large distortions: since competition law is enforced by Judges and not by economist, it is easy for firms to strategically use the possibility to sue under the provision of competition law to protect their market position rather than the law being used to protect competition.

It is somewhat less known that a poor public enforcement of Competition Law by publicly funded competition authorities can also end up worsening market distortions rather than curing them. In the reminder of this policy brief we explain why, according to recent research, a mild and suboptimal enforcement of antitrust provisions – in the sense of fines that are too low to deter unlawful conduct (horizontal agreements and cartels in particular) and fines which are based on firm revenue rather than on the extra profits generated by the unlawful conduct, could significantly harm social welfare, even if we abstract from the direct cost the public enforcement of competition law imply for society.

Current Practice in Setting Fines

A very important tool for the effective enforcement of Competition Law is the penalties imposed on violators by regulators and courts. In this policy brief, we uncover a number of distortions that current penalty policies generate, we explain how their size is affected by market characteristics such as the elasticity of demand, and quantify them based on market data.

In contrast to what economic theory predicts, in most jurisdictions, Competition Authorities (CAs), but also courts where in charge, use rules-of-thumbs to set penalties that – although well established in legal tradition and in sentencing guidelines and possibly easy to apply – are hard to justify and interpret in logical economic terms. Thus, antitrust penalties are based on affected commerce rather than on collusive profits, and caps on penalties are often introduced based on total firm sales rather than on affected commerce.

A First Well Known Distortion Due to Legal Practice

A first and obvious distortive effect of penalty caps linked to total (worldwide) firm revenue is that specialized firms which are active mostly in their core market expect lower penalties than more diversified firms that are also active in several other markets than the relevant one. This distortion – why for God’s sake should diversified firms active on many markets face higher penalties than more narrowly focused firms? – could in principle induce firms that are at risk of antitrust legal action to inefficiently under-diversify or split their business to reduce their legal liability.

In a recent paper published in the Economic Journal, we examine two other, less obvious, distortions that occur when the volume of affected commerce is used as a base to calculate antitrust penalties.

A Second Distortion: Poorly Enforced Competition Law May Increase Welfare Losses from Monopoly Power

If expected penalties are not sufficient to deter the cartel, which seems to be the norm given the number of cartels that CAs continue to discover, penalties based on revenue rather than on collusive profits induce firms to increase cartel prices above the monopoly level that they would have set if penalties were based on collusive profits. Intuitively, this would be done in order to reduce revenues and thus the penalty. However, this exacerbates the harm caused by the cartel relative to a monopolized situation with similar penalties related to profits, or even relative to a situation with no penalties due to the distortive effects of the higher price and, in comparison to a situation with no penalties, the presence of antitrust enforcement costs.

A Third Distortion: Firms at the Bottom of the Value Chain May Pay a Multiple of the Fine Paid by Firms at the Top for an Identical Infringement

Firms with a high revenue/profit ratio, e.g. firms at the end of a vertical production chain, expect larger penalties relative to the same collusive profits that firms with a lower revenue/profit ratio would get. Our empirically based simulations suggest that the welfare losses produced by these distortions can be very large, and that they may generate penalties differing by over a factor of 20 for firms that instead should have faced the same penalty.

Note that this third distortion takes place also when at least for some industries fines are sufficiently high to deter cartels. This distortion means that competition is only enforced in industries that happen to be in the lower end of the production chain, and not in industries where the lack of competition is producing larger social costs. Note also that our estimation is based only on observed fines, i.e. on fines paid by cartels that are not deterred. Since cartels tend to be deterred by higher fines, this suggest that if we could take into account the fines that would have been paid by those cartels that were deterred (if any), the size of the estimated distortion would likely increase!

Concluding remarks

We argue that if one wants to implement a policy, one must be ready to do it well otherwise it may be better to not do it at all. This is particularly relevant for countries with weaker institutional environments where it is likely that political and institutional constraints will not allow for a sufficiently independent and forceful enforcement of the Competition Law.

It is worth noting that – in particular in the US but also increasingly so in the EU – the rules-of-thumb discussed above do not produce any saving in enforcement costs because the prescribed cap on fines requires courts to calculate firms’ collusive profits anyway. Furthermore, the distortions we identified are not substitutes where either one or the other is present. Instead, they are all simultaneously present and add to one another in terms of poor enforcement.

Where there are sufficient resources to allow for a proper implementation and where enforcement of Competition Law is available, developments in economics and econometrics make it possible to estimate illegal profits from antitrust infringements with reasonable precision, as regularly done to assess damages. It is time to change these distortive rules-of-thumb that make revenue so central for calculating penalties, if the only thing the distortions give us is savings in the costs of data collection and illegal profit estimation.

▪

Development Policy After the Millennium Development Goals: Where Do We Go From Here?

This policy brief reports on a discussion of the Post-2015 Development Agenda held during a full day conference at the Stockholm School of Economics on August 23, 2013. The event was organized jointly by the Stockholm Institute of Transition Economics (SITE) and the Swedish Ministry for Foreign Affairs and was the third installment of Development Day, a yearly development policy conference. The Millennium Development Goals established in year 2000 has been an essential concept for global and national efforts to promote economic, social and human development. Highlighting income poverty, health, education, gender equality and environmental sustainability, the targets have focused global efforts on a set of quantifiable and comparable measures of progress. The question for the development community as these goals reach their endpoint is how to build a successful agenda for the future beyond year 2015. To discuss this challenging question, the conference brought together a distinguished and experienced group of policy oriented scholars and practitioners from governments, International Financial Institutions, the business community as well as NGOs.

In September 2000, world leaders adopted the United Nations Millennium Declaration, committing their nations to a global partnership to reduce extreme poverty. The declaration defined eight time-bound targets expiring in 2015, the so-called Millennium Development Goals (MDGs). These goals specify areas of focus; eradicate extreme poverty and hunger, achieve universal primary education, promote gender equality and empower women, reduce child mortality rates, improve maternal health, combat HIV/AIDS, malaria and other diseases, ensure environmental sustainability, and develop a global partnership for development. They also set explicit targets such as halving the number of people living on less than US$ 1.25 a day and reducing maternal mortality by three quarters from 1990 to 2015. Some commendable success has indeed been realized; already in 2010 the worldwide goal to reduce by half the proportion of people living on less than US$ 1.25 a day was achieved. However, much less progress has been seen in some other areas, including maternal health, and there are countries for which none of the goals are expected to be achieved by 2015. Nevertheless, the use of quantifiable, comparable and time-bound targets to create awareness and direct political resources is generally regarded as a success. The question for the development community as 2015 quickly approaches is thus how to build a successful post-2015 development agenda that builds on what has worked but also incorporates areas identified as missing.

The process to establish a new agenda of course raises many questions and reveals some of the trade-offs involved. There seems to be a consensus that the Millennium Declaration and the MDG framework should serve as a starting point, but there are many details to pin down. For instance, there are important challenges not directly mentioned in the original eight goals such as political conflict, rising inequality and youth unemployment. Many also argue that environmental sustainability, though included, may deserve a more prominent role in the future agenda. On the other hand, loading the Agenda with more and more goals may also dilute the global effort across too many areas, and some scholars argue that the whole idea with specific goals is counterproductive based on an organic view of development ill-suited for social engineering from above. To protect credibility, it is also important to get a sense of what is realistic to aim for, and what responsibility to ascribe to the already developed world. Moreover, even if a consensus can be reached with regards to the goals, opinions on how to best reach those goals will most definitely vary widely.

To get the process towards a new agenda started, the UN Secretary General has launched several initiatives including task teams, special advisors and consultations, but also a High-level Panel of Eminent Persons co-chaired by the Presidents of Indonesia and Liberia, and the Prime Minister of the United Kingdom; also including as its member Gunilla Carlsson, Swedish Minister for Development Cooperation. The panel, led by executive secretary and lead author Homi Kharas, submitted a report to the Secretary General on May 31. The program of Development Day 2013 started with a presentation of the report by Dr. Kharas, and remarks from Minister Carlsson. This was followed by an academic session corroborating projections of the report and outlining its limitations, and two panel discussions on sustainable development and Sweden’s potential as a leader in this process. Below follows a short representation of the main arguments and debates of the day.

A New Global Partnership: Eradicate Poverty and Transform Economies through Sustainable Development

Homi Kharas, Senior Fellow and Deputy Director at the Brookings Institution, presented the main messages contained in the report in the first session. An analysis of the situation since year 2000 shows many positive signs such as high global economic growth; increased international connectedness; a reduction in global inequality; and a substantial drop in absolute poverty rates. However, there are also many challenges ahead; rapid population growth, political conflicts, and the fact that the majority of the extremely poor live in conflict zones, increasing urbanization, a deteriorating environment and dwindling aid flows. This, in turn, leads Dr. Kharas to conclude that ‘business as usual’ is no longer feasible, and a new framework replacing the MDGs is needed.

The report seeks to address these issues and is conceived to serve as a set of guidelines, new goals and targets for the UN Secretary General and for the UN member states for the post-2015 period. At the core of the report is a bold aspiration to eradicate absolute poverty by 2030 through a unified framework of sustainable economic growth, increased social equality and environmental sustainability, and a new global partnership paradigm. This universal agenda, in turn, is proposed to be reached via five paradigm shifts to the status quo, (i) universal inclusion and equality, (ii) environmentally sustainable development, (iii) a transformation of national economies for sustainable growth, (iv) peace and effective, transparent public institutions, and (v) a new and more inclusive global partnership. In the report these broad and major shifts are further delineated across 12 illustrative targets, which, if met, will directly affect more than two billion people across the world and would require about $30 trillion spent by the governments worldwide.

Dr, Kharas emphasized that the report was prepared in cooperation with 5000 civil organizations, 250 large international corporations, and thematic, regional and country consultations all over the world, with another one million people taking part in an online questionnaire. He stressed that this kind of broad cooperation and consultation is needed to implement the goals set by the report and especially to operationalize these goals at the level of each of the member states.

Gunilla Carlsson, Swedish Minister for International Development Cooperation and a member of the UN High-Level Panel, continued the discussion and commended the members of the Panel on the impressive amount of work put in the report. She also emphasized the universal character of the agenda presented in the report, largely applicable both to developing and developed countries.

Carlsson stressed what she identified as the core values of the report; eradication of extreme poverty, prevention of violence and conflict, and inclusive peace. She further underlined the importance of local and global partnerships across governments, business communities and civil society. Broader public-private partnerships are essential both for fostering innovation in development work and to guarantee sufficient amounts of financing. The exact design of such a framework, however, is still an open question, but she hopes Sweden can serve as a leading example.

Both Homi Kharas and Gunilla Carlsson also showed great optimism when asked about the potential to implement the substantive initiatives by 2030. They stressed that not only does the world at present have more resources and more aid flows than it ever have, but the international community, including both public and private actors, is also showing more willingness to help the developing countries integrate successful development models than ever before.

Comments and Reflections

Martin Ravallion, Edmond D. Villani Professor of Economics at Georgetown University, started the commentary and reflection session. He showed how there is a strong current trend of between-country convergence of inequality rates (more equal countries becoming more unequal, while more unequal countries are becoming more equal) and declining poverty rate. The latter decline is to a considerable extent driven by Chinese economic growth, but this is far from the only source. He also underlined that the rate of poverty reduction has increased since the adoption of the MDGs in the 2000s, but said it was too early to judge the success or failure of the MDGs on these grounds.

Based on current trends, Ravallion also presented some estimates of the possibility to achieve the core objective of the report, eradication of absolute poverty by 2030. From a broad range of alternatives, the best case scenario, based on 3% annual growth rates of the world economy, absence of major economic crises and at least not decreasing participation of the poor in the benefits of growth, estimated a fall in absolute poverty rates from about 19% at present to 3% by 2030. In a less optimistic scenario, but historically not unlikely, levels of inequality and poverty would fall at a much slower rate, causing 12% to 14% of the world population to live below the absolute poverty line by 2030. Thus, the conclusion is that total eradication of absolute poverty by 2030 is hardly achievable, but substantial progress can be made, and it depends critically on continued high levels of world economic growth.

Professor Ravallion also stressed that these projections were made possible through a recent revolution in data availability, something the High Level Panel was asking for. To a large extent, this is attributed to a massive data collection effort by the World Bank, which not only provided better coverage of countries around the world, but also allowed for deeper insights into the nature of extreme poverty, including re-calculations and harmonization of cross-country comparable Purchasing Power Parity consumption baskets. This revolution provided more reliable inputs for his prediction models and improved the precision of estimates considerably.

Owen Barder, Senior Fellow and Director for Europe at the Center for Global Development, further emphasized this importance of credible statistics. Barder was somewhat skeptical to the report’s claim to be bold and offering a new approach, arguing that it largely reiterated the goals (jobs for young people, partnership with the private sector, reform of the financial system, etc.) already in the Millennium Declaration from year 2000. He also argued that the claim of success for the MDGs is almost entirely made on the basis of paragraph 19 of the Declaration; the objective to reduce by half the number of people living in absolute poverty. Much less progress has been made on the other explicit objectives, and all other aspects emphasized in the Millennium Declaration but which were not necessarily a part of the MDGs.

Barder suggested that there is too little effort to consistently measure whether rich countries are playing their part in the global partnership. Against that background he presented some preliminary results on the last round of the Center for Global Development’s Commitment to Development Index, calculated on the basis of OECD counties’ participation in aid, trade, investments, migration, environment, security and technology transfers. Over the last 10 years, OECD countries demonstrated on average a modest increase from four to five points on a ten-point scale, with Sweden ranked third from the top with a score of 7.2 for 2011 and 6.8 for 2012. Interestingly enough, this deterioration in the index for Sweden is mainly due to deterioration in the security component of the index, in turn resulting from larger sales of arms to undemocratic regimes, and from decreasing aid and immigration. There is obviously variation across countries, but on average there is scant improvements during the 13 years since the Millennium Declaration. This led Barder to question whether the developed countries have contributed their share to the objective of ending poverty, or if too much of the heavy lifting is left for the developing countries.

Barder concluded the presentation by pointing out the difference in language used in the report, namely the imperative used in the parts of the report describing recommendations for the developing countries, and the subjunctive used for recommendations for the developed countries. Again, to him this difference signaled the need to re-emphasize the importance of political commitment and operational goals also for the already developed countries in the Post-2015 Agenda.

Johan Rockström, Executive Director at the Stockholm Resilience Centre, started out noting that the population of the world is estimated to increase to eight billion people by 2030 and to nine billion by 2050. This, in combination with the currently prevailing development paradigm that emphasizes short-term economic growth over long run sustainability, causing degradation of biodiversity and climate change, means that we are hitting the planetary ceiling of eco-capacity. This suggests that ‘business as usual’ is no longer an option, and a new development paradigm is needed.

To address this issue, Rockström formulated a set of goals for human development balancing the needs of the environment, the needs of society and the needs of the people, all within the Earth’s life-support system. He proposed a broader framework for thinking about these issues, the so-called Sustainable Development Goals (SDGs rather than MDGs), which rebalances the relative weight on environmental, human and economic development with relatively more emphasis on the first two. This approach unifies the MDGs with planetary necessities (material use, clean air, nutrient and hydrological cycles, biodiversity, and climate stability), and sustainable development goals (sustainable food and water security, universal clean energy, governance for sustainable societies, etc.).

Discussion Panels

The first panel of the day focused on issues of sustainable development and was started by Klas Waldenström, Senior Advisor on the Post-2015 Development Agenda at Sida. He argued that the main challenge to the new partnership paradigm discussed earlier, will be the creation of trust both across nations and across the private and public sectors. Referring to the experience of Sida, he cited the successful creation of a network of 25 private Swedish companies focusing on models of sustainable development. An important role of official foreign aid in these partnerships, he argued, was to blend direct financial transfers with a combination of political support and business sector outreach, thereby potentially leveraging the financial flows with alternative sources of capital.

David Fergusson, Deputy Director at the Office of Science and Technology at USAID, called for more and better data in order to be able to operationalize and evaluate the new strategies that hopefully will come out of the report. He also reiterated the importance of transformative solutions for sustainable development and the need to understand that ‘business as usual’ is no longer an option. He also referred to the successful cooperation between Sida and USAID as an example of international collaboration of a new kind, more of which will be needed in the future to overcome the status quo and achieve the goals put forward by the report.

Garry Conille, Special Advisor to President Ellen Johnson Sirleaf of Liberia and UNDP, discussed his experience of working with the MDGs and stressed that possibly the most challenging part was the negotiation between different stakeholders to reach a set of issues well-defined and contained enough to be operational. From his point of view, the major challenge is the operationalization of the rather opaque and broadly defined MDGs and how to find a proper allocation of resources across the many commendable ambitions. He therefore called for an effort to make the post-2015 agenda more practical.

The issue of operationalization was discussed further by Stefano Prato, Managing Director at the Society for International Development. He argued that with such large shifts proposed by the post-2015 agenda, it is perhaps difficult to understand how to work with the vision put forward by the panel. His suggestion for the Panel was to dig deeper into the challenging areas of the report but also to develop more applied recommendations for the member states and especially so for the private institutions desired as part of the new partnerships.

This need for operationalization was supported by Jakob Granit, Centre Director at the Stockholm Environment Institute. In his opinion, the broad vision as presented in the report is indeed difficult to work with, but he also suggested that progress on parts of the agenda can be instructive for how to go further also with the more challenging parts. He also emphasized the importance of a regional approach, building on existing networks of regional partnerships, and again stressed the importance of public-private partnerships to solve common international issues.

The second panel was devoted to the role Sweden can play in global sustainable development and the post-2015 agenda. The discussion was started by Ulla Holm, Global Director at Tetra Laval Food for Development Office. She presented some of Tetra Laval’s experiences of sustainable development work in Bangladesh, an example of a successful public-private partnership. In her view, one of the main pillars of sustainability is to prevent unnecessary food loss, and this can be achieved by building an integrated value chain that supports rural development in the long run. The crucial challenge on this path is the need for concurrent public and private investments, and how to overcome coordination problems and lacking trust across stakeholders. She therefore stressed the need to construct successful public-private partnerships on a large scale and in different areas, but also to make sure to document and scale up the existing models in order to replicate success in the most cost efficient way.

Erik Lysen, Director for International Affairs at the Church of Sweden, stressed the challenges in changing existing institutions and briefly discussed the main motives that could make such changes to occur. He also argued that some of the strongest motives that would actually provide the necessary motivation for change, namely fear, could not be desirable in the long run, but still viable in a context of post-2015 agenda if complemented with better social protection, institutes of civil society and a broader public discussion. Here, NGOs could act as watchdogs and catalysts, strengthening the desire for building new institutions and providing material and human support for their construction at the same time.

Stefan Isaksson, Head of Policy Analysis at the Department for Aid Management at the Ministry for Foreign Affairs, continued the discussion on the challenges of changing existing institutions. He described current efforts to remodel the Swedish aid management system in order to become a more effective bureaucracy. In his view, the major shift in thinking is that of understanding aid less as simply giving money away and more as an investment for a common future. This is needed to improve the selection process of aid projects and also to motivate better the need to make projects and their results measurable and accountable. To achieve this, broader collaboration and consultations across stakeholders is needed. He also mentioned that perhaps at present many aid projects are too conservative, that the failure rate is too low because it reflects an aversion to risk that partly defeats the purpose of official foreign aid. The private sector will always be reluctant to venture into areas with high risk even if the potential social rate of return is high, so for official aid to serve as a more effective complement to private flows, more risk tolerance may be needed.

The issue of understanding aid as investment was discussed in detail by Jonas Ahlen, Investment Manager at the Storebrand Kapitalförvaltning. He described current efforts in the area of sustainable investments, mainly centered in microfinance and agricultural loans. In his opinion, broader involvement in such practices from the private sector would facilitate a transition to sustainable practices, but would at the same time require changing existing regulations in home countries to incentivize and alleviate the risks. He also stressed the need for broader public-private partnerships in these areas and briefly described the new consultative practices established by the Ministry of Finance in Sweden to catalyze private capital participation in for instance infrastructure projects in Sub-Saharan Africa.

Finally, Homi Kharas added to the Sweden-centered discussion by stressing that there exists no systematic assessment of what public-private partnerships can do. In his opinion, possibly the most important role for Sweden is to create conditions that would facilitate public-private partnerships in development and aid. By developing and experimenting with forms of public-private partnerships, as well as with new ways of measuring and monitoring of performance of such partnerships, Sweden could create a case for broader involvement of private funding and thus accomplish perhaps the most difficult part of bridging the post-2015 with the experience and skills of the private sector.

Conclusions

In sum, the discussion at the Development Day 2013 clearly highlighted the importance of sustaining some of the positive trends seen lately for economic and human development but also highlighted how crucial it is to take environmental sustainability into account. There is a growing consensus that long run human development necessitates an understanding of the planetary boundaries, even though exactly what trade-offs this involves and where to put the relative weight on more short run economic development is still debatable. There was also a wide consensus around the importance to get all different parts of society involved and working in tandem. Foreign aid cannot be expected to pull the heavy load by itself. The challenges are far too wide and important. Instead, much hope was attributed to public-private partnerships, but there is a lot of work that remains to make sure these vehicles generate the hoped for solutions. The capital, experience and skills of the private sector are needed. On the other hand, getting the incentives right is not a trivial challenge. Finding models of partnerships that work and can be scaled up may be an area in which Sweden can set an example and lead the way for other nations striving to contribute to long run sustainable development.

Capital Structure and Employment Flexibility

Author: Olga Kuzmina, NES.

This policy brief focuses on the relationship between employment policies and their potential impact on firms’ decisions and outcomes. In particular, the question dealt with here is whether policies aiming to promote job stability could have an impact on a firm’s capital structure and the ability to respond to negative shocks and survive. The policy implications of this relationship are important since policy makers, while aiming to promote job stability among workers, may in fact inadvertently harm firms by leaving them less able to withstand downturns, and especially those firms that cannot quickly adjust their capital structure.

Empirical Evidence on Natural Resources and Corruption

This policy brief addresses the relationship between resource wealth and a particular institutional outcome – corruption. We overview some recent empirical evidence on this relationship and outline results of an on-going research project addressing a particular aspect of resource-related political corruption: transformation of resource rents into personal wealth hidden at off-shore deposits. The preliminary results from this project suggest that at least 8 percent of oil and gas rents are converted into personal political rents in countries with poor political institutions.

Transportation Infrastructure and Labor Market Integration: the Moscow Oblast Case

The model of city organization proposed by von Thünen in the beginning of the XIXth century, and then formalized by Alonso followed by Muth and Mills (see Ner (1986)), is one of the most “successful” models in economics in terms of practical applications. The model explains why the gradient of population density and land rents decline from the city center towards the periphery. In fact, almost all modern cities fit this pattern, i.e. the model invented two centuries ago is capable of describing today’s spatial structure of cities. Even though von Thünen’s original idea of a city center as a single “marketplace” is no longer realistic, a multitude of factors beyond this make central locations nevertheless attractive. If firms are located near each other, they can take advantage of a common labor pool, easier access to consumers and suppliers, shared infrastructure, and knowledge spillovers, to name but a few advantages. Access to the center brings tangible economic benefits to both labor and capital and these benefits exceed possible losses due to increased competition, and so the von Thünen mechanism still works today, albeit through different channels.

In cities, there are generally two types of spatial organizations possible with respect to household income. If the advantages of amenities in a city center are not very strong, rich people tend to choose to locate in suburbs in order to consume higher quality housing. Such patterns are typical in US cities. If the advantages of a center are strong, the rich choose to live in the center. (Brueckner et al. (1999)) Due to historical circumstances, such patterns are typical of European or Russian cities. In these cases we observe a declining gradient of income; the further we move from the center, the further residents’ average income falls.

There are two forces at work shaping this declining gradient of wage. First, poor people sort themselves into suburban locations. Second, residents of the suburbs who want to take advantage of the labor market in the center face a barrier involving commuting costs. Many of them forgo high-wage opportunities that require tedious everyday commuting and therefore remain poor as a consequence.

An apparent policy solution to reduce income inequality would be to reduce transportation costs. The higher transportation costs are, the steeper the gradient of income. Fast and convenient transportation promotes the integration of local labor markets, gives the residents of the suburbs more, and often better, job opportunities, and works toward equalization of income across the agglomeration. Moreover, as transportation costs decline, the geographic area of agglomeration grows, which opens new opportunities for real estate development as well as new possibilities for rural residents to commute and participate in large labor market.

We conducted a study at CEFIR (Mikhailova et al. (2012)) comparing the spatial patterns of average wages in the Moscow agglomeration with several agglomerations in Western Europe. We considered municipal-level data for Moscow Oblast and for 25 agglomerations in Sweden, Germany, and Netherlands. In the sample of municipalities that are served by suburban train system, we estimated how average wages in a given municipality respond to different lengths of travel times to the city center.

Figure 1 shows the estimated wage-travel time relationship for Moscow Oblast and Figure 2 for the selected European cities.

Figure 1. Average Wage and Travel Time to the City Center, Moscow Figure 2. Average Wage and Travel Time to the City Center, Europe.

The residents of the Moscow agglomeration are at a clear disadvantage according to the data shown above. Residents of Moscow Oblast, even those who live in relative proximity to the city, loose drastically in terms of average wage. Doubling the travel time (say, from 20 min to 40 min, which is the range most commuters fit into) results in a 25% drop in the average wage for residents in Moscow Oblast compared to only a 5% drop in Europe. The wage in a municipality, from which it would take 90 minutes to travel to the city center, is almost half of the average wage inside Moscow’s Ring Road whereas in Europe 90 minutes translates into a 10% loss of in average wages.

A 90 minutes travel time could be considered as a realistic limit to the size of an agglomeration. This is roughly the maximum distance over which a typical working commuter would be willing to travel each day in each direction. A 90 minute commute in Europe represents approximately a 100 kilometer distance. In Moscow Oblast, however, it is only 63 km. So, Moscow Oblast loses in the effective “reach” of suburban transportation: people who live further than roughly 60 km from the center cannot practically commute.

Even for the same commuting time, the difference in wages between center and suburban municipality is much smaller in Europe (see Figures 1 and 2). This means that a commute for the same time length (in terms of railroad transport) presents a larger barrier for the residents of Moscow Oblast. This is obviously an over simplification of the situation since taking into account only commuting times as the measure of costs we ignore many other critical factors such as price (relative to income), the convenience of schedule and travel comfort, alternative modes of transportation, etc. Suburban trains in Moscow Oblast run infrequently, they are overcrowded, and alternative transportation modes (car or bus) face considerable delays due to road congestion. All of these additional factors serve to reduce the labor market opportunities of the Moscow Oblast residents and make wage inequality even deeper.

Figure 3 presents wage-distance gradients for the Moscow agglomeration under different scenarios using a hypothetical “European” gradient to show what could be the case if changes were made to reduce barriers to transportation bringing the Moscow agglomeration in line with European standards. The graphs end at a distance that corresponds to a typical 90-minute commuting time under various scenarios ranging from the status quo to the best case, where Moscow Oblast replicates European standards. The red curve represents the upper bound estimate of the possible effect of investments to improve the transportation infrastructure to bring Moscow regional transportation network in line with the quality of a typical European agglomeration. The residents of Moscow region could gain up to 24% more in terms of current average wages if this were to take place. The purple curve, however, presents a more modest scenario assuming that the structure of Moscow regional transportation network remains the same, but the travel time were to be cut by 20%. Even in this case, the gains to Moscow Oblast residents are about 3% of wages which is very significant economically for an area populated by 5.5 million people.

Figure 3. Wage Distance Gradient Note: BLUE – Estimated actual wage gradient for Moscow Oblast; Red – European wage gradient applied to Moscow Oblast data, simulation; Purple – a Moscow Oblast gradient given 20% cut in the travel time, simulation.Further, it is important to note that to take advantage of labor market integration residents do not necessarily all have to commute to work to the center. The mere possibility of commuting creates arbitrage opportunities in the labor market and puts upward pressure on wages. As a result, it is important for economic policy to constantly improve transportation infrastructure even if the private benefits of increased usage are modest.

In the end, our analysis did not touch on the other benefits from transportation infrastructure. Apart from labor market integration, improvements in transportation infrastructure promote real estate development (Baum-Snow (2007), Garcia-López(2012)) and expand the market for goods and services. We leave these questions for further research.

▪

References

- Baum-Snow, Nathaniel (2007) “Did Highways Cause Suburbanization?” The Quarterly Journal of Economics 122(2): 775-805

- Brueckner, Jan K., Jacques-François Thisse, and Yves Zenou (1999) “Why is central Paris rich and downtown Detroit poor?: An amenity-based theory.” European Economic Review 43.1: 91-107.

- Garcia-López, Miquel-Àngel (2012) “Urban spatial structure, suburbanization and transportation in Barcelona”, Journal of Urban Economics, Volume 72, Issues 2–3, September–November, Pages 176-190

- Mikhailova, T, V. Rudakov and N. Zhuravlyova (2012) “Economic effects from the Moscow Oblast suburban railroad infrastructure development” («Экономические эффекты от развития инфраструктуры пригородного железнодорожного сообщения в Московской области»), project report, CEFIR.

- Ner, J. B. (1986). The structure of urban equilibria: A unified treatment of the Muth-Mills model. Handbook of regional and urban economics: Urban economics, 2, 821.

Are Natural Resources Good or Bad for Development?

Natural resources development undoubtedly plays an important role in the economies of many countries. Whether their contribution to development is positive or negative is, however, a contested and difficult question. Arguably, countries like Australia, Botswana, and Norway have gained enormously over long periods from sustained natural resources development. Others, such as Azerbaijan, Kazakhstan, and Russia, have achieved significant economic growth through natural resources development but perhaps at the expense of institutional progress. In contrast, in some countries—such as Angola and Sierra Leone—natural resources development has been at the heart of violent conflicts, with devastating consequences for society. With many developing countries being highly resource-dependent, a deeper understanding of the sources of success and the risks associated with natural resources development is highly relevant. This brief reviews the main issues and points to key policy challenges for transforming resource rents from natural resources development into a driver rather than a detriment to overall development.

Is it good for a country to be rich in natural resources? Superficially, the answer to this question would obviously seem to be “yes”. How could it ever be negative to have something in addition to labor and produced capital? How could it be negative to have something valuable “for free”? Yet, the answer is far from that simple and one can relatively quickly come up with counterarguments: “Having natural resources takes away incentives to develop other areas of the economy which are potentially more important for long-run growth”; “Natural resource-income can cause corruption or be a source of conflict”, etc.

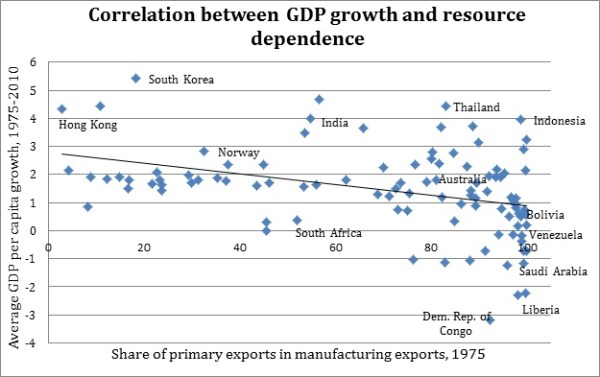

Looking at some of the starkest cases, the “benefits” of resources can indeed be questioned. Take the Democratic Republic of Congo for example. It is the world’s largest producer of cobalt (49% of the world’s production in 2009) and of industrial diamonds (30%). It is also a large producer of gemstone diamonds (6%), it has around 2/3 of the world’s deposits of coltan and significant deposits of copper and tin. At the same time, it has the world’s worst growth rate and the 8th lowest GDP per capita over the last 40 years.[1] The picture for Sierra Leone and Liberia is very similar – they possess immense natural wealth, yet they are found among the worst performers both in terms of economic growth and GDP per capita. While the experiences of countries such as Bolivia and Venezuela are not as extreme their resource wealth in terms of natural gas and oil, respectively, seems to have brought serious problems in terms of low growth, increased inequality and corruption. When one, on top of this, adds that some of the world’s fastest-growing economies over the past decades – such as Hong Kong, South Korea and Singapore – have no natural wealth the picture that emerges is that resources seem to be negative for development.

These are not isolated examples. By now, it is a well-established fact that there is a robust negative relationship between a country’s share of primary exports in GDP and its subsequent economic growth. This relationship, first established in the seminal paper by Sachs & Warner (1995) is the basis for what is often referred to as the resource curse, that is, the idea that resource dependence undermines long-run economic performance.[2]

Based on the World Development Indicators database (World Bank). Primary exports consist of agricultural raw materials exports, fuel exports, ores and metals, and food exports.

At the same time, there are numerous countries that provide counterexamples to this idea. Being the second largest exporter of natural gas and the fifth largest of oil, Norway is one of the richest world economies. Botswana produces 29% of the world’s gemstone diamonds and has been one of the fastest-growing countries over the last 40 years. Australia, Chile, and Malaysia are other examples of countries that have performed well, not just despite their resource wealth, but, to a large extent, due to it.

Given these examples the relevant question becomes not “Are resources good or bad for development?” but rather “Under what circumstances are resources good and when are they bad for development?. As Rick van der Ploeg (2011) puts it in a recent overview: “the interesting question is why some resource-rich economies [.] are successful while others [.] perform badly despite their immense natural wealth”. To begin to answer this question it is useful to first review some of the many theoretical explanations that have been suggested and to see what empirical support they have received. Clearly, our overview is far from complete but we think it gives a fair picture of how we have arrived at our current stage of knowledge.[3]

Theories and Evidence

The most well-known economic explanation of the resources curse suggests that a resource windfall generates additional wealth, which raises the prices of non-tradable goods, such as services. This, in turn, leads to real exchange rate appreciation and higher wages in the service sector. The resulting reallocation of capital and labor to the non-tradable sector and to the resource sector causes the manufacturing sector to contract (so-called “de-industrialization”). This mechanism is usually referred to as “Dutch disease” due to the real exchange rate appreciation and decrease in manufacturing exports observed in the Netherlands following the discovery of North Sea gas in the late 1950s. Of course, the contraction of the manufacturing sector is not necessarily harmful per se, but if manufacturing has a higher impact on human capital development, product quality improvements and on the development of new products, this development lowers long-run growth.[4] Other theories have focused on the problems related to the increased volatility that comes with high resource dependence. In particular, it has been suggested that irreversible and long-term investments such as education decrease as volatility goes up. If human capital accumulation is important for long-run growth this is yet another potential problem of resource wealth.

The empirical support for the Dutch disease and related mechanisms is mixed. Some authors find that a resource boom causes a decline in manufacturing exports and an expansion of the service sector (e.g. Harding and Venables (2010)), others do not (e.g. Sala-i-Martin and Subramanian (2003)). But even the studies that do find evidence of the Dutch disease mechanism, usually do not analyze its effect on the growth rates. In principle, Dutch disease could be at work without this hurting growth. Another problem is that the Dutch disease theory suggests that natural resources are equally bad for development across countries. This means that the theories cannot account for the great heterogeneity of observed outcomes, that is, they cannot explain why some countries fail and others succeed at a given level of resource dependence. The same goes for the possibility that natural resources create disincentives for education. Gylfason 2001, Stijns (2006) and Suslova and Volchkova (2007) find evidence of lower human capital investment in resource-rich countries but the theory cannot explain differences across (equally) resource-rich countries.

As a result, greater attention has been devoted to the political-economic explanations of the resource curse. The main idea in recent work is that the impact of resources on development is heavily dependent on the institutional environment. If the institutions provide good protection of property rights and are favourable to productive and entrepreneurial activities, natural resources are likely to benefit the economy by being a source of income, new investment opportunities, and of potential positive spillovers to the rest of the economy. However, if property rights are insecure and institutions are “grabber-friendly”, the resource windfall instead gives rise to rent-seeking, corruption and conflict, which have a negative effect on the country’s development and growth. In short, resources have different effects depending on the institutional environment. If institutions are good enough resources have a positive effect on economic outcomes, if institutions are bad, so are resources for development.

Mehlum, Moene and Torvik (2006) develop a theoretical model for this effect and also find empirical support for the idea. In resource-rich countries with bad institutions incentives become geared towards “grabbing resource rents” while in countries where institutions render such activities difficult resources contribute positively to growth. Boschini, Pettersson and Roine (2007) provide a similar explanation but also stress the importance of the type of resources that dominate. They show that if a country’s institutions are bad, “appropriable” resources (i.e., resources that are more valuable, more concentrated geographically, easier to transport etc. – such as gold or diamonds) are more “dangerous” for economic growth. The effect is reversed for good institutions – gold and diamonds do more good than less appropriable resources. In turn, better institutions are more important in avoiding the resource curse with precious metals and diamonds than with mineral production. The following graph illustrates their result by showing the marginal effects of different resources on growth for varying institutional quality. Distinguishing the growth contribution of mineral production in countries with good institutions with the effect in countries with bad institutions, the left panel shows a positive effect in the former and a negative one in the latter case. The right-hand panel illustrates the corresponding, steeper effects when isolating only precious metals and diamond production.

Even if these papers provide important insights and allow for the possibility of similar resource endowments having variable effects depending on the institutional setting, two major problems still remain. First, the measures of “institutional quality” are broad averages of institutional outcomes (rather than rules).[5] Even if Boschini et al. (2007), and in particular Boschini, Pettersson and Roine (2011) test the robustness of the interaction result using alternative institutional measures (including the Polity IV measure of the degree of democracy) it remains an important issue to understand more precisely which aspects of institutions that matter. An attempt at studying a particular aspect of this question is the paper by Andersen and Aslaksen (2008), which shows that presidential democracies are subject to the resource curse, while it is not present in parliamentary democracies. They argue that this result is due to higher accountability and better representation of the parliamentary regimes.