Tag: investment

Navigating Market Exits: Companies’ Responses to the Russian Invasion of Ukraine

Russia’s invasion of Ukraine on 24 February 2022 led to widespread international condemnation. As governments imposed sanctions on Russian businesses and individuals tied to the war, international companies doing business in Russia came under increasing pressure to withdraw from Russia voluntarily. In the first part of this policy brief, we show what kind of companies decided to leave the Russian market using data collected by the LeaveRussia project. In the second part, we focus on prominent Swedish businesses which announced a withdrawal from Russia, but whose products were later found available in the country by investigative journalists from Dagens Nyheter (DN). We collect the stock prices for these companies when available and show how investors respond to these news.

Business Withdrawal from Russia

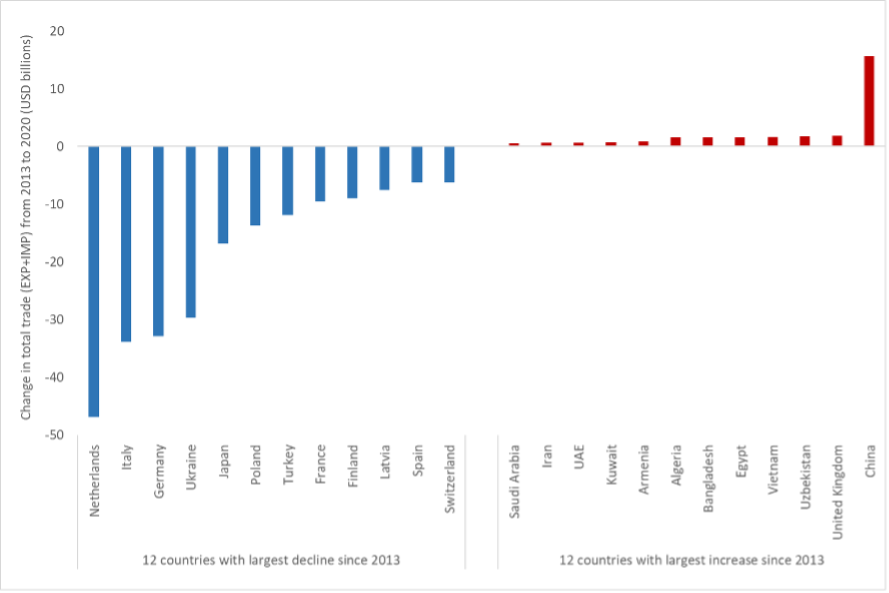

The global economy is highly interconnected, and Russia forms an important part. Prior to the invasion, Russia ranked 13th in the world in terms of global goods exports value and 22nd in terms of imports (Schwarzenberg, 2023). In the months following the full-scale invasion of Ukraine, Russia’s imports dropped sharply (about 50 percent according to Sonnenfeld et al., 2022). Before February 24th, Russia’s main trading partners were China, the European Union (in particular, Germany and the Netherlands) and Belarus (as illustrated in Figure 1). While there is some evidence of Russia shifting away from Western countries and towards China following the annexation of Crimea in 2014 and the resulting sanctions, Western democracies still made up about 60 percent of Russia’s trade in 2020 (Schwarzenberg, 2023). In the same year, Sweden’s exports to Russia accounted for 1.4 percent of Sweden’s total goods exports, of which 59 percent were in the machinery, transportation and telecommunications sectors. 1.3 percent of Swedish imports were from Russia (Stockholms Handelskammare, 2022).

Figure 1. Changes in trade with Russia, 2013-2020.

Source: IMF Direction of Trade Statistics, data until 2020. From Lehne (2022).

In response to Russia’s invasion of Ukraine in February 2024, Western governments imposed strict trade and financial sanctions on Russian businesses and individuals involved in the war (see S&P Global, 2024). These sanctions are designed to hamper Russia’s war effort by reducing its ability to fight and finance the war. The sanctions make it illegal for, e.g., European companies to sell certain products to Russia as well as to import select Russian goods (Council of the European Union, 2024). Even though sanctions do not cover all trade with Russia, many foreign businesses have been pressured to pull out of Russia in an act of solidarity. The decision by these businesses to leave is voluntary and could reflect their concerns over possible consumer backlash. It is not uncommon for consumers to put pressure on businesses in times of geopolitical conflict. For instance, Pandya and Venkatesan (2016) find that U.S. consumers were less likely to buy French-sounding products when the relationship between both countries deteriorated.

The LeaveRussia Project

The LeaveRussia project, from the Kyiv School of Economics Institute (KSE Institute), systematically tracks foreign companies’ responses to the Russian invasion. The database covers a selection of companies that have either made statements regarding their operations in Russia, and/or are a large global player (“major companies and world-famous brands”), and/or have been mentioned in relation to leaving/waiting/withdrawing from Russia in major media outlets such as Reuters, Bloomberg, Financial times etc. (LeaveRussia, 2024). As of April 5th, 2024, the list contains 3342 firms, the companies’ decision to leave, exit or remain in the Russian market, the date of their announced action, and company details such as revenue, industry etc. The following chart uses publicly available data from the LeaveRussia project to illustrate patterns in business withdrawals from Russia following the invasion of Ukraine.

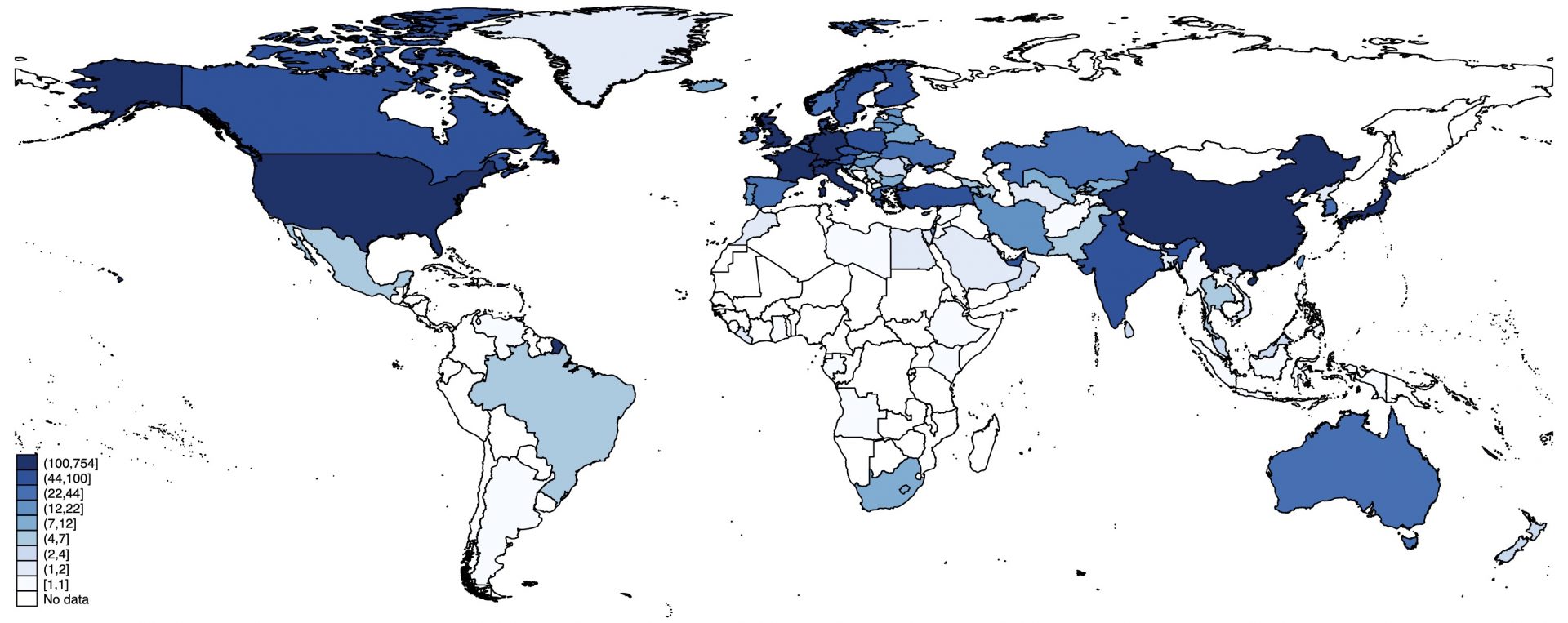

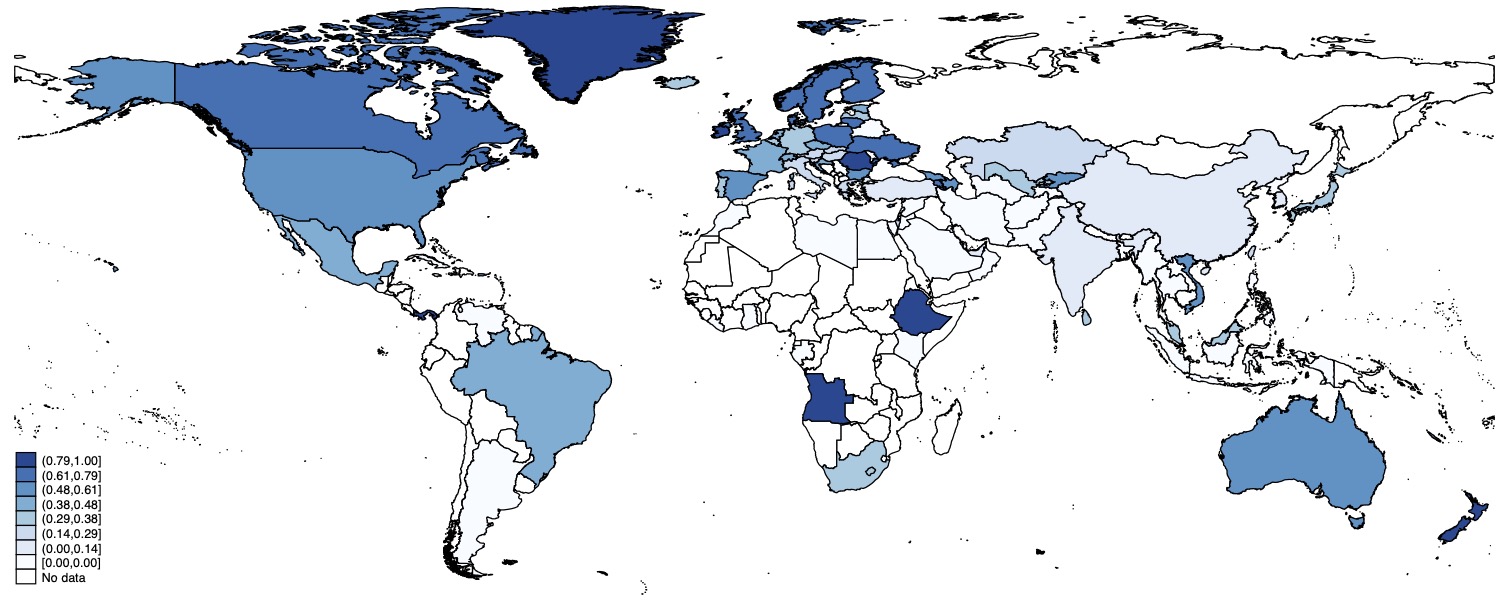

Figure 2a shows the number of foreign companies in Russia in the LeaveRussia dataset by their country of headquarters. Figure 2b shows the share of these companies that have announced a withdrawal from Russia by April 2024, by their country of headquarters.

Figure 2a. Total number of companies by country.

Figure 2b. Share of withdrawals, by country.

Source: Authors’ compilation based on data from the LeaveRussia project and global administrative zone boundaries from Runfola et al. (2020).

Some countries (e.g. Canada, the US and the UK) that had a large presence in Russia prior to the war have also seen a large number of withdrawals following the invasion. Other European countries, however, have seen only a modest share of withdrawals (for instance, Italy, Austria, the Netherlands and Slovakia). Companies headquartered in countries that have not imposed any sanctions on Russia following the invasion, such as Belarus, China, India, Iran etc., show no signs of withdrawing from the Russian market. In fact, the share of companies considered by the KSE to be “digging in” (i.e., companies that either declared they’d remain in Russia or who did not announce a withdrawal or downscaling as of 31st of March 2024) is 75 percent for more than 25 countries, including not only the aforementioned, but also countries such as Argentina, Moldova, Serbia and Turkey.

Withdrawal Determinants

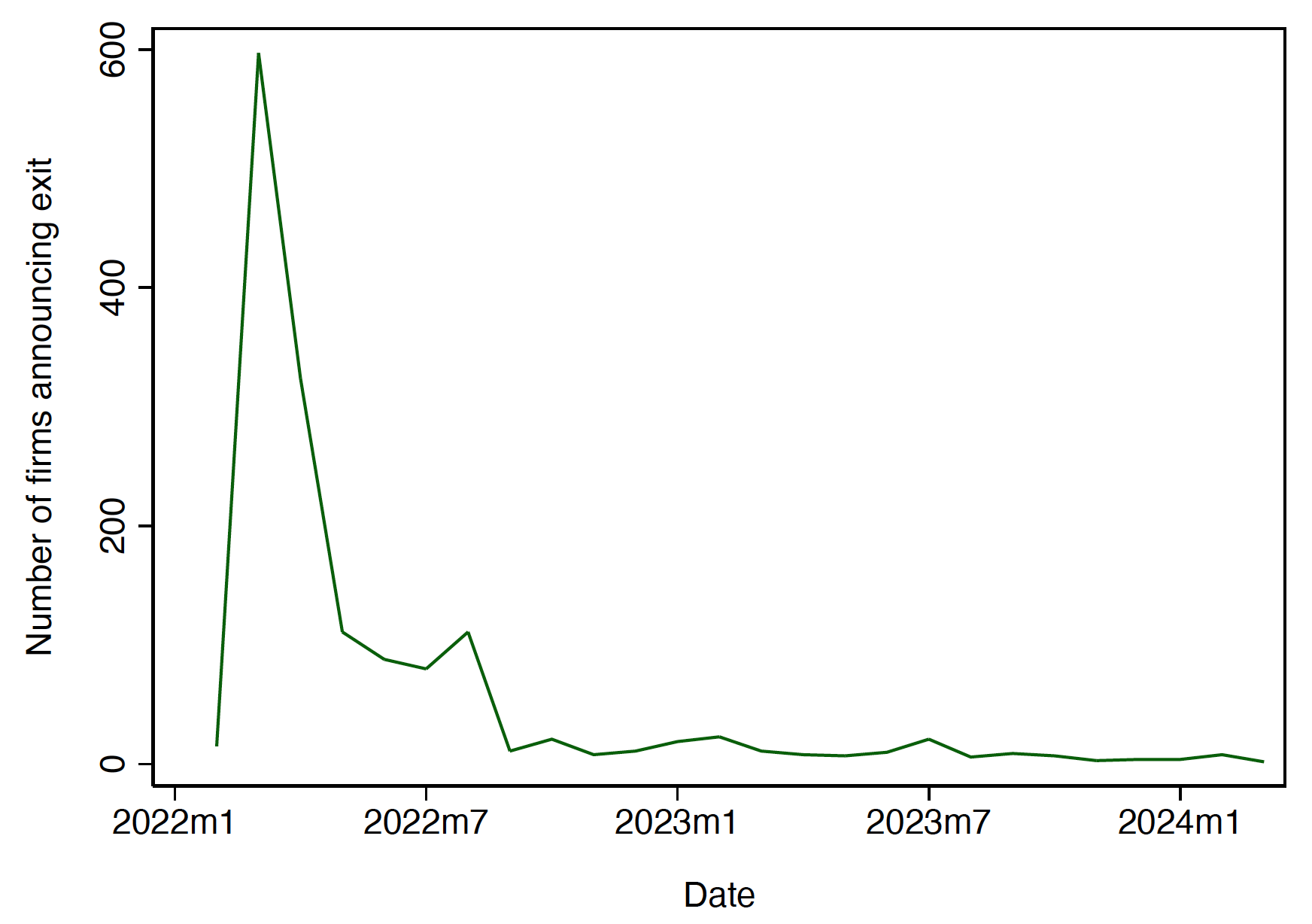

The decision for companies to exit the market may range from consumer pressure to act in solidarity with Ukraine, to companies’ perceived risk from operating on the Russian market (Kiesel and Kolaric, 2023). Out of the 3342 companies in the LeaveRussia project’s database, about 42 percent have, as of April 5th, 2024, exited or stated an intention to exit the Russian market. This number increases only slightly to 49 percent when considering only companies headquartered in democratic (an Economist Intelligence Unit Democracy Index score of 7 or higher) countries within the EU. Figure 3 shows the number of companies that announced their exit from the Russian market, by month. A clear majority of companies announce their withdrawal in the first 6 months following the invasion.

Figure 3. Number of foreign companies announcing an exit from the Russian market, 2022-2024.

Source: Authors’ compilation based on data from the LeaveRussia project.

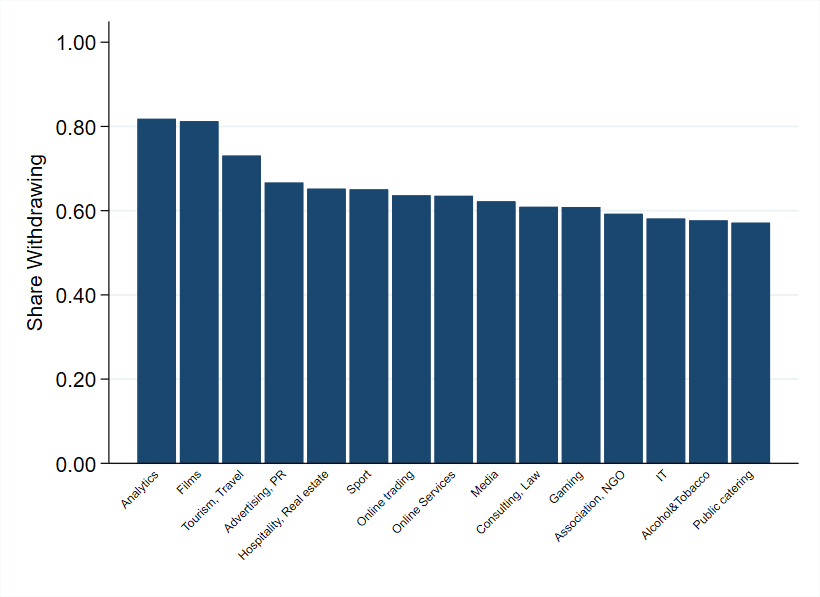

Similarly to the location of companies’ headquarters, the decision to exit the Russian market varies by industry. Figure 4 a depicts the top 15 industries with the highest share of announced withdrawals from the Russian market among industries with at least 10 companies. Most companies with high levels of withdrawals are found in consumer-sensitive industries such as the entertainment sector, tourism and hospitality, advertising etc.

Figure 4a. Top 15 industries in terms of withdrawal shares.

Figure 4b. Bottom 15 industries in terms of withdrawal shares.

Source: Authors’ compilation based on data from the LeaveRussia project.

In contrast, Figure 4b details the industries with the lowest share of companies opting to withdraw from the Russian market. Only around 10 percent of firms in the “Defense” and “Marine Transportation” industries chose to withdraw. Two-thirds of firms within the “Energy, oil and gas” and “Metals and Mining” sectors have chosen to remain in business in Russia following the war in Ukraine.

Several sectors have been identified as crucial in supplying the Russian military with necessary components to sustain their military aggression against Ukraine, mainly electronics, communications, automotives and related categories. We find that many of these sectors are among those with the lowest share of companies withdrawing from Russia. Companies for which Russia constitute a large market share have more to lose from exiting than others. Another reason for not exiting the market relates to the current legal hurdles of corporate withdrawal from Russia (Doherty, 2023). Others may simply not have made public announcements or operate within an industry dominated by smaller companies that are not on the radar of the LeaveRussia project. Nonetheless, Bilousova et al. (2024) detail that products from companies within the sanction’s coalition continue to be found in Russian military equipment destroyed in Ukraine. This is due to insufficient due diligence by companies as well as loopholes in the sanctions regime such as re-exporting via neighboring countries, tampering with declaration forms or challenges in jurisdictional enforcement due to lengthy supply chains, among others. (Olofsgård and Smitt Meyer, 2023).

And Those Who Didn’t Leave After All

The data from the LeaveRussia project details if and when foreign businesses announce that they will leave Russia. However, products from companies that have announced a departure from the Russian market continue to be found in the country, including in military components (Bilousova, 2024). In autumn 2023, investigative journalists from the Swedish newspaper Dagens Nyheter exposed 14 Swedish companies whose goods were found entering Russia, in most cases contrary to the companies’ public claims (Dagens Nyheter, 2023; Tidningen Näringslivet, 2023). For this series of articles, the journalists used data from Russian customs and verified it with information from numerous Swedish companies, covering the time period up until December 2022. This entailed reviewing thousands of export records from Swedish companies either directly to Russia or via neighboring countries such as Armenia, Kazakhstan, and Uzbekistan. All transactions mentioned in the article series have been confirmed with the respective companies, who were also contacted by DN prior to publication (Dagens Nyheter, 2023b). DNs journalists also acted as businessmen, interacting with intermediaries in Kazakhstan and Uzbekistan, exposing re-routing of Swedish goods from a company stated to have cut all exports to Russia in the wake of the invasion (Dagens Nyheter, 2023d).

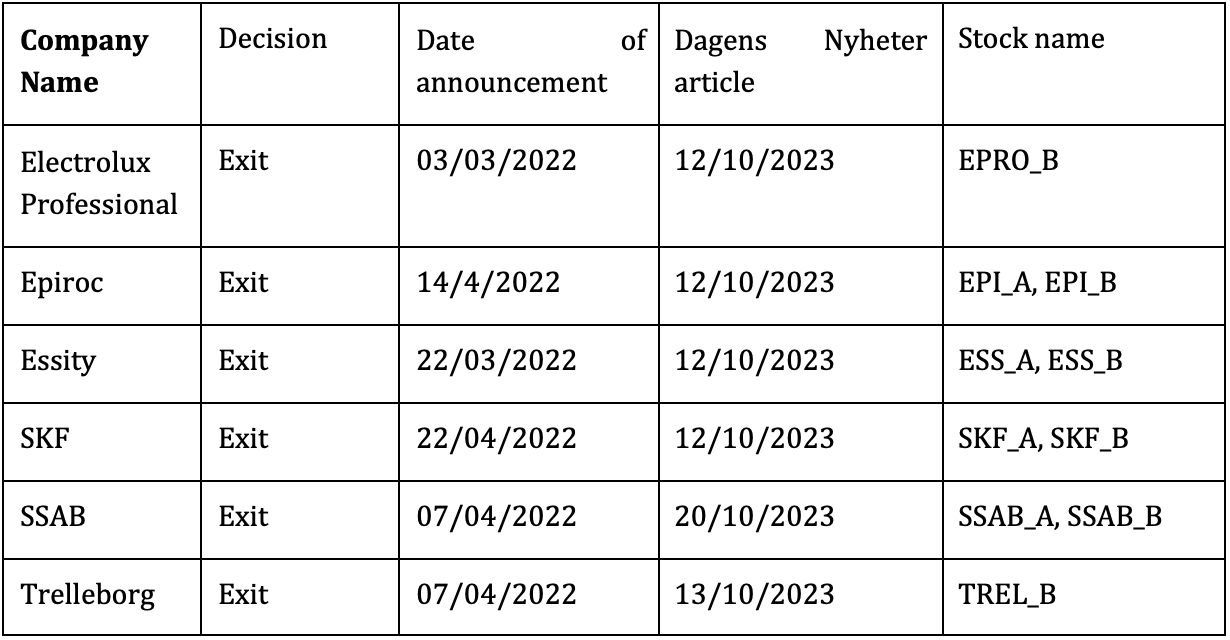

For Sweden headquartered companies exposed in DN and that are traded on the Swedish Stock Exchange, we collect their stock prices and trading volume. Our data includes information on each stock’s average price, turnover, number of trades by date from around the date of the DN publications as well as the date of each company’s prior public announcement of exiting Russia. Table 1 details the companies who were exposed of doing direct or indirect business with Russia by DN and who had announced an exit from the Russian market previously. In their article series, DN also shows that goods from the following companies entered Russia; AriVislanda, Assa Abloy, Atlas Copco, Getinge, Scania, Securitas Tetra Pak, and Väderstad. Most of the companies exposed by DN operate within industries displaying low withdrawal shares.

Table 1. Select Swedish companies’, time of exit announcement and exposure in Dagens Nyheter and stock names.

Source: The LeaveRussia project, 2023; Dagens Nyheter, 2023b, 2023c, 2023d. Note: The exit statements have been verified through companies’ press statements and/or reports when available. For Epiroc, the claim has been verified via a previous Dagens Nyheter article (Dagens Nyheter, 2023a).

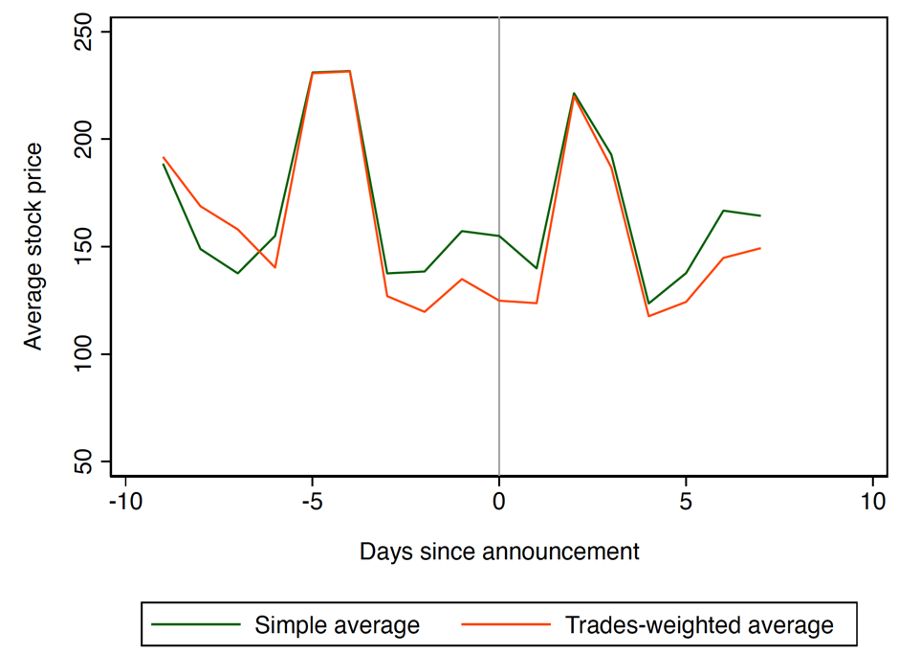

In Figure 5, we show the average stock price and trades-weighted average stock price of the Swedish companies in Table 1 around the time when the companies announced that they are leaving Russia.

Figure 5. Average stock price of companies in Table 1 around Russian exit announcements.

Source: Author’s compilation based on data from Nasdaq Nordic.

There appears to be an immediate increase in stock prices after firms announced their exit from the Russian market. Stock prices, however, reverse their gains over the next couple of days. In general, stock prices are volatile, and we also see similar-sized movements immediately before the announcement. Due to this volatility and the fact that we cannot rule out other shocks impacting these stock prices at the same time, it is difficult to attribute any movements in the stock prices to the firms’ decisions to leave Russia.

The academic evidence on investors’ reactions to firms divesting from Russia is mixed. Using a sample of less than 300 high-profile firms with operations in Russia compiled by researchers at the Yale Chief Executive Leadership Institute, Glambosky and Peterburgsky (2022) find that firms that divest within 10 days after the invasion experience negative returns, but then recover within a two-week period. Companies announcing divesting at a later stage do not experience initial stock price declines. In contrast, Kiesel and Kolaric (2023) use data from the LeaveRussia project to find positive stock price returns to firms’ announcements of leaving Russia, while there appears to be no significant investor reaction to firms’ decisions to stay in Russia.

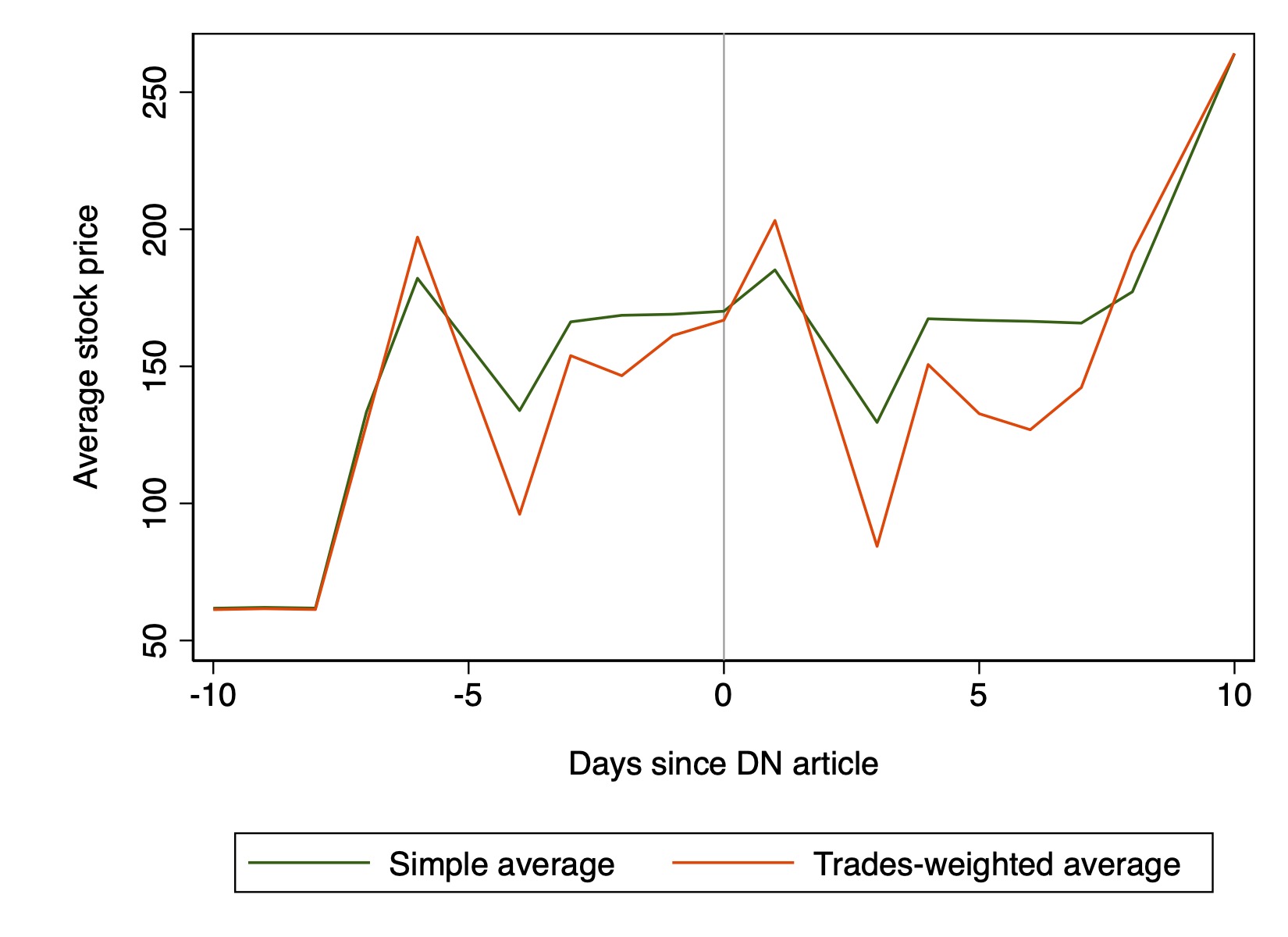

When considering the effect from DN’s publications, the picture is almost mirrored, with the simple and trades-weighted average stock prices dipping in the days following the negative media exposure before not only recovering, but actually increasing. Similar caveats apply to the interpretation of this chart. In addition, the DN publication occurred shortly after the Hamas attacks on Israel on October 7 and Israel’s subsequent war on Gaza. While conflict and uncertainty typically dampen the stock market, the events in the Middle East initially caused little reaction on the stock market (Sharma, 2023).

Figure 6. Average stock price for companies listed in Table 1 around the time of DN exposure.

Source: Author’s compilation based on data from Nasdaq Nordic.

Discussion

As discussed in Becker et al. (2024), creating incentives and ensuring companies follow suit with the current sanctions’ regime should be a priority if we want to end Russia’s war on Ukraine and undermine its wider geopolitical ambitions. Nevertheless, Bilousova et al. (2024), and Olofsgård and Smitt Meyer (2023), highlight that there is ample evidence of sanctions evasions, including for products that are directly contributing to Russia’s military capacity. Even in countries that have a strong political commitment to the sanctions’ regime, enforcement is weak. For instance, in Sweden, it is not illegal to try and evade sanctions according to the Swedish Chamber of Commerce (2024). There is little coordination between the numerous law enforcement agencies that are responsible for sanction enforcement and there have been very few investigations into sanctions violations.

Absent effective sanctions enforcement and for the many industries not covered by sanctions, can we rely on businesses to put profits second and voluntarily withdraw from Russia? Immediately after the start of Russia’s invasion of Ukraine, as news stories about the brutality of the war proliferated, many international companies did announce that they will be leaving Russia. However, a more systematic look at data collected by the LeaveRussia project and KSE Institute reveals that more than two years into the war, less than half of companies based in Western democracies intend to distance themselves from the Russian market. A closer look at companies who are continuing operations in Russia reveals that they tend to be in sectors that are crucial for the Russian economy and war effort, such as energy, mining, electronics and industrial equipment. Many of these companies are probably seeing the war as a business opportunity and are reluctant to put human lives before their bottom line (Sonnenfeld and Tian, 2022).

Whether companies who announce that they are leaving Russia actually do leave is difficult to independently verify. A series of articles published in a prominent Swedish newspaper (Dagens Nyheter) last autumn revealed that goods from 14 major Swedish firms continue to be available in Russia, despite most of these firms publicly announcing their withdrawal from the country. The companies’ reactions to the exposé were mixed. A few companies, such as Scania and SSAB, have decided to cut all exports to the intermediaries exposed by the undercover journalists (for instance, in Kazakhstan, Uzbekistan and Kyrgyzstan). Other companies stated that they are currently investigating DN’s claims or that the exports exposed in the DN articles were final or delayed orders that were accepted before the company decided to withdraw from Russia. Another company, Trelleborg – a leading company within polymer solutions for a variety of industry purposes – reacted to the DN exposure by backtracking from its earlier commitment to exit the Russian market (Dagens Nyheter 2023b, 2023d). Wider reaction to these revelations was muted. Looking at changes in stock prices for the exposed companies, we find little evidence that investors are punishing companies for not honoring their public commitment to withdraw from Russia.

In an environment, where businesses themselves withdraw at low rates and investors do not shy away from companies contradicting their own claims, the need for stronger enforcement of sanctions seems more pressing than ever.

References

- Becker, T., Fredheim, K., Gars, J., Hilgenstock, B., Katinas, P., Le Coq, C., Mylovanov, T., Olofsgård, A., Perrotta Berlin, M., Pavytska, Y., Ribakova, E., Shapoval, N., Spiro, D. and Wachtmeister, H. (2024). Sanctions on Russia: Getting the Facts Right. FREE Policy Brief. https://freepolicybriefs.org/2024/03/14/sanctions-russia-war-ukraine/

- Bilousova, O., Hilgenstock, B., Ribakova, E., Shapoval, N., Vlasyuk, A. and Vlasiuk, V. (2024). CHALLENGES OF EXPORT CONTROLS ENFORCEMENT HOW RUSSIA CONTINUES TO IMPORT COMPONENTS FOR ITS MILITARY PRODUCTION. Yermak-McFaul International Working Group on Russian Sanctions & KSE Institute. https://kse.ua/wp-content/uploads/2024/01/Challenges-of-Export-Controls-Enforcement.pdf

- Council of the European Union. (2023). Sanctions against Russia explained. European Council. https://www.consilium.europa.eu/en/policies/sanctions-against-russia/sanctions-against-russia-explained/#services

- Dagens Nyheter. (2023a). DN avslöjar: Wallenbergs gruvjätte gjorde affärer med ryskgrundat bolag – efter krigsutbrottet.

- Dagens Nyheter. (2023b). DN avslöjar: Svenska storbolagen i affärer med Rvssland – trots löftena.

- Dagens Nyheter. (2023c). Svenska miljardbolaget svek löftet – sålde till ryska hamnprojekt.

- Dagens Nyheter (2023d). Mellanhanden avslöjar: Så levereras stålet från SSAB till Ryssland.

- Doherty, B. (2023). Business in Russia: Why some firms haven’t left. BBC. https://www.bbc.com/worklife/article/20230918-business-in-russia-why-some-firms-havent-left

- Glambosky, M. and Peterburgsky, S. (2022). Corporate activism during the 2022 Russian invasion of Ukraine, Economics Letters, 217, 110650. https://doi.org/10.1016/j.econlet.2022.110650

- Kiesel, F. and Kolaric, S. (2023) Should I stay or should I go? Stock market reactions to companies’ decisions in the wake of the Russia-Ukraine conflict. Journal of International Financial Markets, Institutions and Money, Forthcoming. http://dx.doi.org/10.2139/ssrn.4088159

- LeaveRussia Project. (2024). https://leave-russia.org/our-methodology

- Lehne, J. (2022). https://www.youtube.com/watch?v=I1EFcZdj2Gw

- Olofsgård, A. and Smitt Meyer, C. (2024) How to Undermine Russia’s War Capacity: Insights from Development Day 2023. FREE Policy Brief. https://freepolicybriefs.org/2024/01/15/undermine-russias-war-capacity/

- Pandya, S. S., and Venkatesan, R. (2016) French roast: consumer response to international conflict—evidence from supermarket scanner data. Review of Economics and Statistics, 98(1), 42-56.

- Runfola, D., Rogers, L., Habib, J., Horn, S., Murphy, S., Miller, D., Day, H., Troup, L., Fornatora, D., Spage, N., Pupkiewicz, K., Roth, M., Rivera, C., Altman, C., Schruer, I., McLaughlin, T., Biddle, R., Ritchey, R., Topness, E., Turner, J., Updike, S., Buckman, H., Simpson, N., Lin, J., Anderson, A., Baier, H., Crittenden, M., Dowker, E., Fuhrig, S., Goodman, S., Grimsley, G., Layko, R., Melville, G., Mulder, M., Oberman, R., Panganiban, J., Peck, A., Seitz, L., Shea, S., Slevin, H., Yougerman, R. and Hobbs, L. (2020). geoBoundaries: A global database of political administrative boundaries. Plos One, 15(4), e0231866.

- Schwarzenberg. A. (2023). Russia’s Trade and Investment Role in the Global Economy. Congressional Research Services, Report IF12066. https://crsreports.congress.gov/product/pdf/IF/IF12066

- Sharma, R. (2023). Why markets are relatively calm in the geopolitical storm. Financial Times. https://www.ft.com/content/d194a8a2-60c1-4afe-83bf-44e529e16d40

- Sonnenfeld, J. and Tian, S. (2022). Some of the Biggest Companies Are Leaving Russia. Others Just Can’t Quit Putin. Here’s a List. The New York Times. https://www.nytimes.com/interactive/2022/04/07/opinion/companies-ukraine-boycott.html

- Sonnenfeld, J., Tian, S., Sokolowski, F., Wyrebkowski, M., and Kasprowicz, M. (2022). Business Retreats and Sanctions Are Crippling the Russian Economy. http://dx.doi.org/10.2139/ssrn.4167193

- Stockholms Handelskammare. (2022). Regionala handelsmönster med Ryssland. https://www.mynewsdesk.com/se/stockholmshandelskammare/documents/siffror-se-ru-punkt-pdf-420259

- Swedish Chamber of Commerce. (2024). Förslag på åtgärder mot kringgående av sanktioner. https://www.kommerskollegium.se/globalassets/publikationer/rapporter/2024/forslag-pa-atgarder-mot-kringgaenden-av-sanktioner.pdf

- S&P Global. (2024). Sanctions against Russia – a timeline. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/sanctions-against-russia-8211-a-timeline-69602559

- Tidningen Näringslivet (2023). Svensk export till Rysslands grannar rusar. https://www.tn.se/naringsliv/30641/svensk-export-till-rysslands-grannar-rusar/

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Creative Industries: Impact on the Development of Ukraine’s Economy

This brief is based on research investigating the effects of creative industries on the development of the Ukrainian economy. The results indicate that capital investment in creative industries has a significantly greater effect on economic growth than a simple increase in the consumption of the respective industry’s products. Thus, we conclude that to achieve a more substantial economic effect of spending in creative industries, it is necessary not only to increase the expenditures in these industries and boost consumption of their products but also to support these industries in developing production capacity. The underlying study “Creative Industries: Impact on the Development of Ukraine’s Economy” was prepared by the Kyiv School of Economics in cooperation with the Ministry of Culture and Information Policy of Ukraine. The first results from the study were presented at the international forum “Creative Ukraine” in 2020.

Background

In 2019, the United Nations (UN) General Assembly declared 2021 as the International Year of Creative Economy for Sustainable Development. This nomination was a recognition of the growing role of creative industries in the economic development of both developed and developing countries. The program of events taking place under the theme of the International Year of the Creative Economy for Sustainable Development includes forums, conferences, and intergovernmental meetings, which intend to draw attention to the problems that hinder the development of creative industries (CI) and the opportunities that these areas create.

The importance of CIs, which lie at the crossroads of art, business, and technology, is constantly growing both at the national level and in terms of international competition between countries. CIs have become a strategic direction for increasing competitiveness, productivity, employment, and sustainable economic growth (UNCTAD 2019) [1]. Exceptional rates of growth in turnover, creation of new jobs, and resilience to the economic crisis make creative industries an attractive area for investment at both the private and governmental levels. (UNCTAD 2004) [2]. On the other hand, the scope of knowledge about the economic role of CIs and their impact on the development of other sectors of the economy is quite limited.

This brief describes the economic effect of spending in CIs. Particularly, using input-output and computable general equilibrium models, we outline CI multiplier effects on the development of other industries and discuss implications for government support of CI.

Creative Industries in Ukraine

Although the term creative industry is becoming more common, countries have different approaches to the definition. There have been attempts to introduce an international standard, but the goal has not yet been achieved [3].

Ukrainian law define CIs as “types of economic activity aimed at creating added value and jobs through cultural (artistic) and/or creative expression”.

Currently, the Cabinet Ministers of Ukraine list 34 basic economic activities belonging to CIs, including visual arts, performing arts, publishing, design, fashion, IT, audiovisual arts, architecture, advertising, libraries, archives and museums, folk arts and crafts.

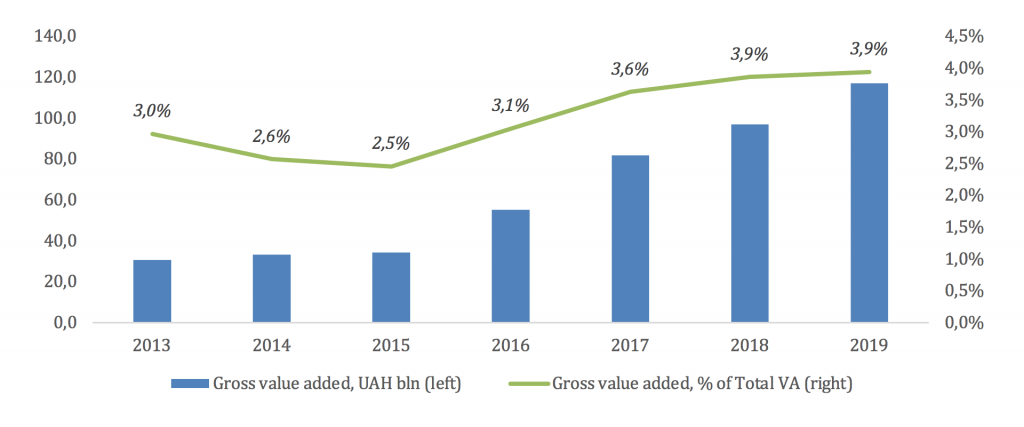

The gross value added (GVA) of CIs in Ukraine is growing rapidly. In 2013, the GVA of creative industries amounted to UAH 31 billion (3% of total value added), and in 2019 it amounted to UAH 117.2 billion (3.9% of total value added) (Figure 1). The number of companies and employees in the field of CI is also growing rapidly. In 2019, there were 205.5 thousand business entities and more than 350 thousand employees.

Figure 1. Gross value added of CI in Ukraine

Source: State Statistics Service of Ukraine

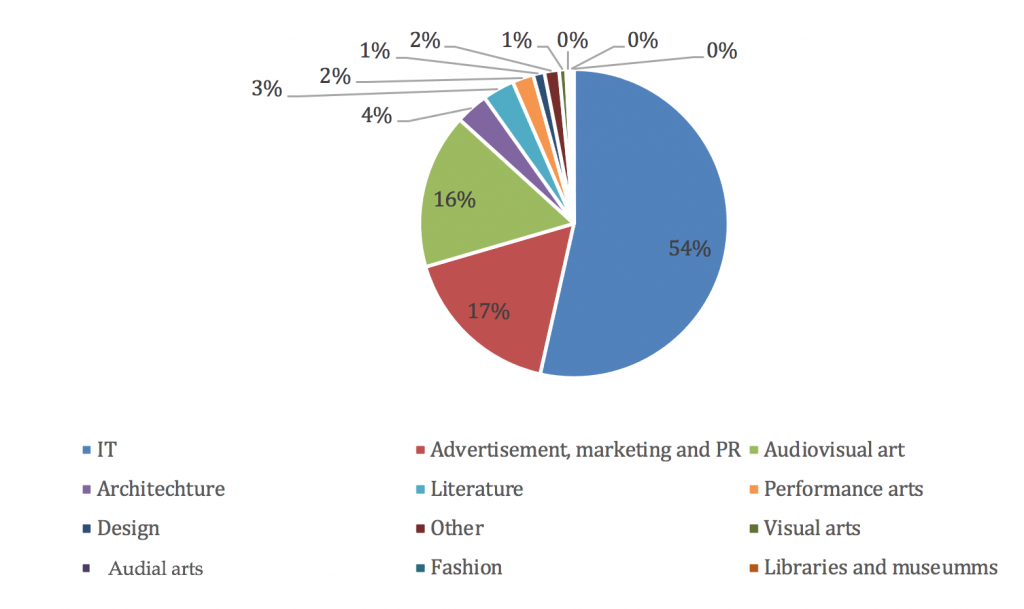

Most GVA of CIs is generated by information technology (IT) activities. In 2019, the IT sector generated UAH 63.7 billion of GVA or 54.3% of the national CI GVA (Figure 2). In second place, there is Advertising, ¢Marketing and PR – UAH 20.2 billion of GVA or 17% of national GVA. In third place with a small gap there is Audiovisual Art – UAH 19.4 billion of GVA or 17% of national GVA.

Figure 2. Structure of Gross Value Added CI in Ukraine, 2019.

Source: State Statistics Service of Ukraine

Methodology and Data

To assess the economic effect of creative industries, we employ a computable general equilibrium (CGE) approach. CGE estimates a general equilibrium model of an economy using real-life economic data. It models interactions of individual markets – such as manufactured goods, services, and factors of production – encompassing the entire economic system. In doing so, the model takes into account reactions of economic agents – economic sectors, households, government, external sectors – and assumes that markets are perfectly competitive. The resulting set of simultaneous equations then employs real data from the economy in question to estimate the equilibrium in these markets by balancing supply and demand in all markets via the appropriate choice of prices.

In this way, the CGE model is a good reflection of a studied economy. In particular, in application to our research question, it allows us to distinguish the economic impact of additional consumption and capital investments in creative industries, and therefore to form reasonably precise recommendations for policy measures. This feature makes the CGE approach much more relevant than the alternative methods, such as the input-output approach.

Limitations of the CGE approach include increased analytical difficulty and computational demands, calibration and the use of estimated parameters, etc.

Data utilized by the CGE model are given by the Social Accounting Matrix (SAM). The SAM structure is related to the input-output table. Each row and column reflects the income and expenses of a particular economic agent. The main principle of SAM is balance, i.e., income from the sale of goods and services equals expenditures.

As a result, the availability of input-output table data is a crucial factor for our analysis. The State Statistics Service of Ukraine publishes an input-output table for 42 industries, which is not sufficient to distinguish creative industries from other sectors of the economy. To compensate for these deficiencies, we use the following sources:

- input-output table for Ukraine for 2018.

- input-output table for Poland for 2015 (latest available) to approximate the intermediate consumption of creative industries, not available from Ukrainian input-output tables.

- annual report on state budget expenditures of Ukraine for 2018.

- balance of payments of Ukraine for 2018.

- structural business statistics of Ukrainian enterprises in part of gross value added and sales volume for 2018.

Results

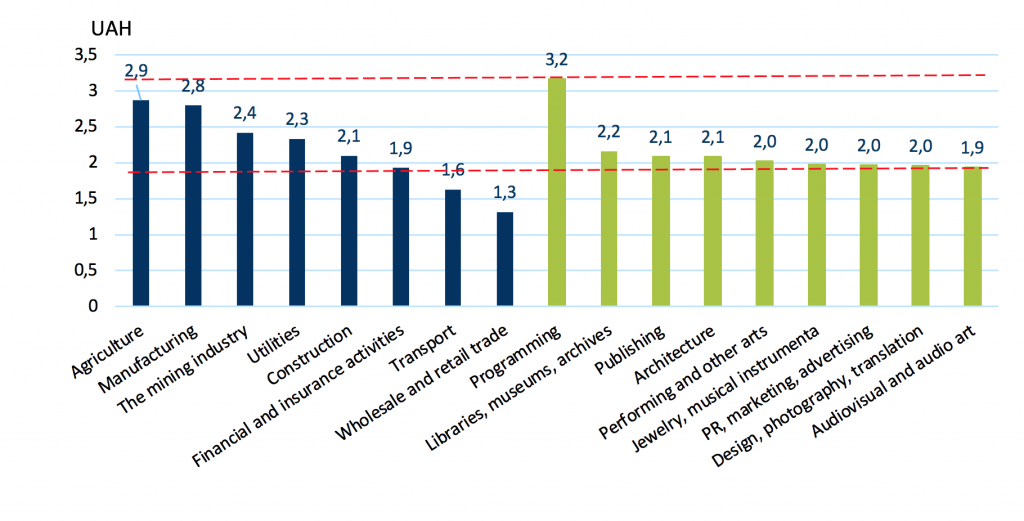

The results of the CGE model suggest a strong effect of investment in CIs. The sizes of the multipliers across the most creative industries are similar. The exception is the programming industry, for which for a one hryvnia investment leads to a total GDP growth of 3.2 hryvnias. This value is the highest among all sectors of the economy, not only among the CIs. For the rest of the CIs, the multiplier ranges from 1.9-2.2, which is comparable to the multipliers of the construction and finance and insurance sector (Figure 3). Accordingly, the increase in GDP for one hryvnia of investment by the industry is:

- UAH 2.2 for libraries, museums, archives.

- UAH 2.1 for publishing.

- UAH 2.1 for architecture.

- UAH 2.0 for performing and other arts.

- UAH 2.0 for production of jewellery, costume jewellery, musical instruments.

- UAH 2.0 for public relations, marketing, advertising.

- UAH 2.0 for design, photography, translation.

- UAH 1.9 for audiovisual and audio art.

Figure 3. GDP change per one hryvnia of capital expenditures*

* Estimated assuming 5% increase in capital Source: Our calculations are based on data from State Statistics Service of Ukraine and Poland, as described in the data section.

While the above results are obtained by estimating GDP response to a 5% increase in capital, the results are quite similar for different sizes of investments.

Conclusion

Our estimations show that investment in creative industries has a considerable impact on GDP. Investment in the IT sector has the highest multiplier, even compared to “non-creative” sectors of the economy. Other CIs’ multipliers can be compared to the construction and finance and insurance sector. Therefore, the results suggest that creative industries offer a highly valuable investment opportunity.

We also find that increase in capital investment in a creative industry has a stronger positive impact on GDP than an increase in the consumption of the respective industry’s products. An immediate policy implication of this finding is that, to achieve a more significant economic effect of government spending in creative industries, it is necessary not only to increase the expenditures on these industries or boost consumption of their products but also to support them in expanding production capacity.

References

- Nikolaeva, O., Onoprienko, A., Taran, S., Sholomitskyi, Y. and Iavorskyi, P., 2020. Creative Industries: Impact on the Development of Ukraine’s Economy. Ministry of Culture and Information Policy of Ukraine.

- UNCTAD, 2019. How can the creative economy help power development? https://unctad.org/news/how-creative-economy-can-help-power-development

- UNCTAD, 2004. Creative Industries and Development. https://unctad.org/system/files/official-document/tdxibpd13_en.pdf

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Energy Storage: Opportunities and Challenges

As the dramatic consequences of climate change are starting to unfold, addressing the intermittency of low-carbon energy sources, such as solar and wind, is crucial. The obvious solution to intermittency is energy storage. However, its constraints and implications are far from trivial. Developing and facilitating energy storage is associated with technological difficulties as well as economic and regulatory problems that need to be addressed to spur investments and foster competition. With these issues in mind, the annual Energy Talk, organized by the Stockholm Institute of Transition Economics, invited three experts to discuss the challenges and opportunities of energy storage.

Introduction

The intermittency of renewable energy sources poses one of the main challenges in the race against climate change. As the balance between electricity supply and demand must be maintained at all times, a critical step in decarbonizing the global energy sector is to enhance energy storage capacity to compensate for intermittent renewables.

Storage systems create opportunities for new entrants as well as established players in the wind and solar industry. But they also present challenges, particularly in terms of investment and economic impact.

Transitioning towards renewables, adopting green technologies, and developing energy storage can be particularly difficult for emerging economies. Some countries may be forced to clean a carbon-intensive power sector at the expense of economic progress.

The 2021 edition of Energy Talk – an annual seminar organized by the Stockholm Institute of Transition Economics – invited three international experts to discuss the challenges and opportunities of energy storage from a variety of academic and regulatory perspectives. This brief summarizes the main points of the discussion.

A TSO’s Perspective

Niclas Damsgaard, the Chief strategist at Svenska kraftnät, gave a brief overview of the situation from a transmission system operator’s (TSO’s) viewpoint. He highlighted several reasons for a faster, larger-scale, and more variable development of energy storage. For starters, the green transition implies that we are moving towards a power system that requires the supply of electricity to follow the demand to a much larger extent. The fact that the availability of renewable energy is not constant over time makes it crucial to save power when the need for electricity is low and discharge it when demand is high. However, the development and facilitation of energy storage will not happen overnight, and substantial measures on the demand side are also needed to ensure a more dynamic energy system. Indeed, Damsgaard emphasized that demand flexibility constitutes a necessary element in the current decarbonization process. However, with the long-run electrification of the economy (particularly driven by the transition of the transport industry), extensive energy storage will be a necessary complement to demand flexibility.

It is worth mentioning that such electrification is likely to create not only adaptation challenges but also opportunities for the energy systems. For example, the current dramatic decrease in battery costs (around 90% between 2010 and 2020) is, to a significant extent, associated with an increased adoption of electric vehicles.

However, even such a drastic decline in prices may still fall short of fully facilitating the new realities of the fast-changing energy sector. One of the new challenges is the possibility to store energy for extended periods of time, for example, to benefit from the differences in energy demand across months or seasons. Lithium-ion batteries, the dominant battery technology today, work well to store for a few hours or days, but not for longer storage, as such batteries self-discharge over time. Hence, to ensure sufficient long-term storage, more batteries would be needed and the associated cost would be too high, despite the above-mentioned price decrease. Alternative technological solutions may be necessary to resolve this problem.

Energy Storage and Market Structure

As emphasized above, energy storage facilitates the integration of renewables into the power market, reduces the overall cost of generating electricity, and limits carbon-based backup capacities required for the security of supply, creating massive gains for society. However, because the technological costs are still high, it is unclear whether the current economic environment will induce efficient storage. In particular, does the market provide optimal incentives for investment, or is there a need for regulations to ensure this?

Natalia Fabra, Professor of Economics and Head of EnergyEcoLab at Universidad Carlos III de Madrid, shared insights from her (and co-author’s) recent paper that addresses these questions. The paper studies how firms’ incentives to operate and invest in energy storage change when firms in storage and/or production have market power.

Fabra argued that storage pricing depends on how decisions about the storage investment and generation are allocated between the regulator and the firms operating in the storage and generation markets. Comparing different market structures, she showed as market power increases, the aggregate welfare and the consumer surplus decline. Still, even at the highest level of market concentration, an integrated storage-generation monopolist firm, society and consumers are better off than without energy storage.

Fabra’s model also predicts that market power is likely to result in inefficient storage investment.

If the storage market is competitive, firms maximize profits by storing energy when the prices are low and releasing when the prices are high. The free entry condition implies that there are investments in storage capacity as long as the marginal benefit of storage investment is higher than the marginal cost of adding an additional unit of storage. But this precisely reflects the societal gains from storage; so, the competitive market will replicate the regulator solution, and there are no investment distortions.

If there is market power in either generation or storage markets, or both, the investment is no longer efficient. Under market power in generation and perfectly competitive storage, power generating firms will have the incentive to supply less electricity when demand is high and thereby increase the price. As a result, the induced price volatility will inflate arbitrage profits for competitive storage firms, potentially leading to overinvestment.

If the model features a monopolist storage firm interacting with a perfectly competitive power generation market, the effect is reversed. The firm internalizes the price it either buys or sells energy, so profit maximization makes it buy and sell less energy than it would in a competitive market, in the exact same manner as the classical monopolist/monopsonist does. This underutilization of storage leads to underinvestment.

If the model considers a vertically integrated (VI) generation-storage firm with market power in both sectors, the incentives to invest are further weakened: the above-mentioned storage monopolist distortion is exacerbated as storage undermines profits from generation.

Using data on the Spanish electricity market, the study also demonstrated that investments in renewables and storage have a complementary relationship. While storage increases renewables’ profitability by reducing the energy wasted when the availability is excess, renewables increase arbitrage profits due to increased volatility in the price.

In summary, Fabra’s presentation highlighted that the benefits of storage depend significantly on the market power and the ownership structure of storage. Typically, market power in production leads to higher volatility in prices across demand levels; in turn, storage monopolist creates productive inefficiencies, two situations that ultimately translate into higher prices for consumers and a sub-optimal level of investment.

Governments aiming to facilitate the incentives to invest in the energy storage sector should therefore carefully consider the economic and regulatory context of their respective countries, while keeping in mind that an imperfect storage market is better than none at all.

The Russian Context

The last part of the event was devoted to the green transition and the energy storage issue in Eastern Europe, with a specific focus on Russia.

Alexey Khokhlov, Head of the Electric Power Sector at the Energy Center of Moscow School of Management, SKOLKOVO, gave context to Russia’s energy storage issues and prospects. While making up for 3% of global GDP, Russia stands for 10% of the worldwide energy production, which arguably makes it one of the major actors in the global power sector (Global and Russian Energy Outlook, 2016). The country has a unified power system (UPS) interconnected by seven regional facilities constituting 880 powerplants. The system is highly centralized and covers nearly the whole country except for more remote regions in the northeast of Russia, which rely on independent energy systems. The energy production of the UPS is strongly dominated by thermal (59.27%) followed by nuclear (20.60%), hydro (19.81%), wind (0.19%), and solar energy (0.13%). The corresponding ranking in capacity is similar to that of production, except the share of hydro-storage is almost twice as high as nuclear. The percentage of solar and wind of the total energy balance is insignificant

Despite the deterring factors mentioned above, Khokhlov described how the Russian energy sector is transitioning, though at a slow pace, from the traditional centralized carbon-based system towards renewables and distributed energy resources (DER). Specifically, the production of renewables has increased 12-fold over the last five years. The government is exploring the possibilities of expanding as well as integrating already existing (originally industrial) microgrids that generate, store, and load energy, independent from the main grid. These types of small-scaled facilities typically employ a mix of energy sources, although the ones currently installed in Russia are dominated by natural gas. A primary reason for utilizing such localized systems would be for Russia to improve the energy system efficiency. Conventional power systems require extra energy to transmit power across distances. Microgrids, along with other DER’s, do not only offer better opportunities to expand the production of renewables, but their ability to operate autonomously can also help mitigate the pressure on the main grid, reducing the risk for black-outs and raising the feasibility to meet large-scale electrification in the future.

Although decarbonization does not currently seem to be on the top of Russia’s priority list, their plans to decentralize the energy sector on top of the changes in global demand for fossil fuels opens up possibilities to establish a low-carbon energy sector with storage technologies. Russia is currently exploring different technological solutions to the latter. In particular, in 2021, Russia plans to unveil a state-of-the-art solid-mass gravity storage system in Novosibirisk. Other recently commissioned solutions include photovoltaic and hybrid powerplants with integrated energy storage.

Conclusion

There is no doubt that decarbonization of the global energy system, and the role of energy storage, are key in mitigating climate change. However, the webinar highlighted that the challenges of implementing and investing in storage are both vast and heterogenous. Adequate regulation and, potentially, further government involvement is needed to correctly shape incentives for the market participants and get the industry going.

On behalf of the Stockholm Institute of Transition Economics, we would like to thank Niclas Damsgaard, Natalia Fabra, and Alexey Khokhlov for participating in this year’s Energy Talk. The material presented at the webinar can be found here.

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Does Product Market Competition Cause Capital Constraints?

At the very center of Schumpeter’s (1934, 1942) notion of creative destruction is firms’ access to bank capital, which helps to fund the innovation in competitive product markets that drives out less productive firms in favor of those with more profitable ideas. However, competition is a two-edged sword and may result in firms being unable to fund all of their otherwise economically profitable investments. Using unique survey data from 58 countries, Bergbrant, Hunter, and Kelly (2016) find that product market competition increases capital constraints and has a greater effect than banking sector competition. Further, we show that quantity-of-capital constraints negatively impact firm growth.

Capital and creative destruction

At the very center of Schumpeter’s (1934, 1942) notion of creative destruction is firms’ access to bank capital, which helps to fund the innovation in competitive product markets that drives out less productive firms in favor of those with more profitable ideas. While product market competition may be the fundamental driver of the innovation envisioned by Schumpeter, it may also impede access to the very source of capital that is supposed to fund that innovation. More intense product market competition can affect firms’ ability to finance their projects either by increasing the price of financing or by inducing capital constraints, whereby firms are unable to obtain the quantity of capital needed to fund all their positive net present value projects.

Recent research has focused on the price side of financing, showing that product market competition increases the cost of equity (Hou and Robinson, 2006) and the cost of debt (Valta, 2012). In this brief we examine the quantity side of financing; that is, whether product market competition increases capital constraints.

Isn’t it obvious that competition causes capital constraints?

Actually, no. There is a familiar argument that firms are reluctant to disclose commercially valuable information when competitors are more likely to exploit this information. Theory predicts that it is not optimal for creditors to respond to the resulting asymmetric information by raising interest rates; instead, restricting capital is more appropriate (Stiglitz and Weiss, 1981). However, competition may have the very opposite effect because a competitive environment lowers owners’ cost of monitoring and measuring managerial performance. Theory and recent empirical tests indicate that lower cost of monitoring managers induces greater disclosure by owners.

Whether or not product market competition makes banks restrict the supply of loans is arguably more important than whether it influences the cost of debt. Greenwald, Stiglitz, and Weiss (1984) show that firms’ investment behavior is not particularly sensitive to the interest rates they pay, consistent with the notion that increases in the cost of debt may reduce investment, but only at the margin; i.e., projects change from generating economic profits to generating economic losses (net present value changes from positive to negative). By contrast, increased capital constraints can lead to underinvestment by forcing firms to abandon projects which generate economic profits (net present values are positive), thus hindering investment and preventing firm innovation and growth (see Harford and Uysal, 2014).

What does the research tell us?

Recent research by Bergbrant, Hunter, and Kelly (2016) uses survey data obtained from the World Bank’s World Business Environment Survey, conducted among non-financial firms from around the world. Capital constraints are the response to a question about the extent of the obstacle to operations and growth posed by capital constraints that managers and owners rank from 1 (No Obstacle) to 4 (Major Obstacle). Competition is represented by an index constructed from eight individual forms of competition reported by firms.

The empirical evidence indicates that the intensity of product market competition significantly increases capital constraints. Table 1 shows the marginal effects of a change in the intensity of competition on capital constraints. For instance, the first row shows that a small (instantaneous rate of) increase in product market competition leads to an increase in the likelihood that capital constraints are a “major obstacle” (4 on a four- point scale) at a rate of 18.9%. Similar results hold when competition is assessed at a one-standard-deviation (3rd row) increase or when competition changes from 0 to 1 on a version of our competition index which ranges from 0 to 1 (5th row).

Table 1: Effect of competition on capital constraints

| For a change of:

|

No obstacle

(1) |

Minor obstacle

(2) |

Mod. obstacle

(3) |

Major obstacle

(4) |

| Marginal | -0.147 | -0.052 | 0.010 | 0.189 |

| p-value | (0.000) | (0.000) | (0.062) | (0.000) |

| +SD | -0.042 | -0.017 | 0.000 | 0.059 |

| p-value | (0.000) | (0.000) | (0.925) | (0.000) |

| 0 to 1 | -0.145 | -0.059 | 0.008 | 0.196 |

| p-value | (0.000) | (0.000) | (0.165) | (0.000) |

Note: The table reports the marginal effects “for a change of” product market competition of varying amounts on firms responding that capital constraints pose one of the four levels of “obstacle” for their operations.

The above results are qualitatively similar when the competition index is replaced by any one of its eight individual components. In addition, competition increases not only a measure of general capital constraints, as employed in the above analysis, but also specific forms of capital constraints. These include the credit constraints that firms experience when, as a precondition for lending, banks require that borrowers have special connections in the banking sector, pledge collateral, satisfy banks’ bureaucratic need for business documents, and pay bribes to corrupt bank officials. Further, the evidence is not unique to domestic bank capital as more intense product market competition also impedes firms’ access to nonbank equity, foreign bank capital, special export financing, and lease financing.

To further validate our main result we account for two well-established strands of research that contend that banking sector competitiveness is among the most important determinants of access to credit and that banking sector structure can also affect the competiveness of non-financial firms’ industries. The evidence reported in Table 2 shows that while (one of three measures of) banking sector competition and the degree of bank freedom affect capital constraints, in general the regulatory structure of the banking sector does not. More important, our main finding is unchanged when controlling for banking sector structure. Finally, it is important to note that in all our models we control for any cost-of-debt (higher-interest-rate) effects.

Table 2: Accounting for banking sector structure

| Competition (10 separate models) | +ve signif. |

| Lerner bank competition index | +ve, signif. |

| Bank concentration ratio | insignif. |

| Boone indicator of banking sector | insignif. |

| private credit as a fraction of GDP | insignif. |

| restrictions on nonbank activities | insignif. |

| fraction of bank applications denied | insignif. |

| bank freedom from gov’t interference | -ve, signif. |

| existence of a credit registry | insignif. |

| foreign bank share of banking system | insignif. |

| government share of banking system | insignif. |

Note: We augment our main model with the above banking sector variables, one at a time, to determine their impact on the significance (signif. or insignif.) of product market competition.

Capital constraints hurt firms’ growth and so we expect our measure of capital constraints to be negatively associated with growth. We confirm this in the data, after controlling for the direct impact of competition on growth. We also find that the quantity-of-capital effect has a greater impact on expected firm growth than the cost-of-capital effect.

Conclusion

Our research indicates that the intensity of product market competition increases capital constraints even in the presence of controls for banking sector competition. Our work suggests several policy recommendations. First, the implementation of a product-market competition policy, for instance by several Central and Eastern European countries in the 1990s (Fingleton et al., 1996; Dutz and Vagliasindi, 2000), should contemplate the possibility that such action is likely to have negative externalities for firms’ access to capital. Second, banking sector reforms aimed at creating a more competitive banking system in order to improve access to capital should not be pursued in isolation and should take into consideration the existing competitiveness of the product market. Third, given that the quantity-of-capital effect has a greater impact on firm growth than the cost-of-capital effect, policymakers should exert at least as much effort in easing quantity constraints as they do to reduce the cost of capital.

References

- Bergbrant, M.; D. Hunter; and P. Kelly, 2016. “Product Market Competition, Capital Constraints and Firm Growth”. Available at SSRN: https://ssrn.com/abstract=2594218.

- Dutz, M. A.; and M. Vagliasindi, 2000. “Competition policy implementation in transition economies: An empirical assessment”. European Economic Review 44, 762-772. Fingleton, J.; E. Fox; D. Neven; and P. Seabright, 1996. “Competition policy and the transformation of central and eastern Europe”. Working paper. CEPR, London.

- Greenwald, B.; J.E. Stiglitz; and A. Weiss, 1984. “Informational imperfections in the capital market and macroeconomic fluctuations”. American Economic Review 74(2), 194-199.

- Harford, J.; and V. B. Uysal, 2014. “Bond market access and investment”. Journal of Financial Economics 112, 147-163.

- Hou, K.; and D. Robinson, 2006. “Industry concentration and average stock returns”. Journal of Finance 61, 1927-1956.

- Schumpeter, J.A., 1934. “The Theory of Economic Development”. Harvard University Press, Cambridge, MA.

- Schumpeter, J. A., 1942. “Capitalism, Socialism and Democracy”. Harper and Brothers, New York, NY.

- Stiglitz, J.; and A. Weiss, 1981. “Credit rationing in markets with imperfect information”. Amer. Econ. Review 71, 393-410.Valta, P., 2012. “Competition and the cost of debt”. Journal of Financial Economics, 105(3), 661-682.