Location: Georgia

Gender Gap in Life Expectancy and Its Socio-Economic Implications

Today women live longer than men virtually in every country of the world. Although scientists still struggle to fully explain this disparity, the most prominent sources of this gender inequality are biological and behavioral. From an evolutionary point of view, female longevity was more advantageous for offspring survival. This resulted in a higher frequency of non-fatal diseases among women and in a later onset of fatal conditions. The observed high variation in the longevity gap across countries, however, points towards an important role of social and behavioral arguments. These include higher consumption of alcohol, tobacco, and fats among men as well as a generally riskier behavior. The gender gap in life expectancy often reaches 6-12 percent of the average human lifespan and has remained stubbornly stable in many countries. Lower life expectancy among men is an important social concern on its own and has significant consequences for the well-being of their surviving partners and the economy as a whole. It is an important, yet under-discussed type of gender inequality.

Country Reports

| Belarus Country Report | FROGEE POLICY BRIEF |

| Georgia Country Report | FROGEE POLICY BRIEF |

| Latvia Country Report | FROGEE POLICY BRIEF |

| Poland Country Report | FROGEE POLICY BRIEF |

Gender Gap in Life Expectancy and Its Socio-Economic Implications

Today, women on average live longer than men across the globe. Despite the universality of this basic qualitative fact, the gender gap in life expectancy (GGLE) varies a lot across countries (as well as over time) and scientists have only a limited understanding of the causes of this variation (Rochelle et al., 2015). Regardless of the reasons for this discrepancy, it has sizable economic and financial implications. Abnormal male mortality makes a dent in the labour force in nations where GGLE happens to be the highest, while at the same time, large GGLE might contribute to a divergence in male and female discount factors with implications for employment and pension savings. Large discrepancies in life expectancy translate into a higher incidence of widowhood and a longer time in which women live as widows. The gender gap in life expectancy is one of the less frequently discussed dimensions of gender inequality, and while it clearly has negative implications for men, lower male longevity has also substantial negative consequences for women and society as a whole.

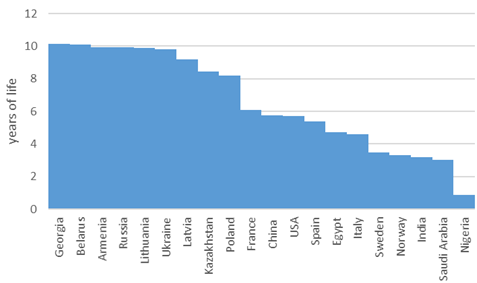

Figure A. Gender gap in life expectancy across selected countries

Source: World Bank.

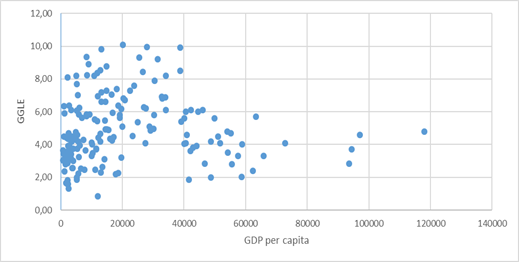

The earliest available reliable data on the relative longevity of men and women shows that the gender gap in life expectancy is not a new phenomenon. In the middle of the 19th century, women in Scandinavian countries outlived men by 3-5 years (Rochelle et al., 2015), and Bavarian nuns enjoyed an additional 1.1 years of life, relative to the monks (Luy, 2003). At the beginning of the 20th century, relative higher female longevity became universal as women started to live longer than men in almost every country (Barford et al., 2006). GGLE appears to be a complex phenomenon with no single factor able to fully explain it. Scientists from various fields such as anthropology, evolutionary biology, genetics, medical science, and economics have made numerous attempts to study the mechanisms behind this gender disparity. Their discoveries typically fall into one of two groups: biological and behavioural. Noteworthy, GGLE seems to be fairly unrelated to the basic economic fundamentals such as GDP per capita which in turn has a strong association with the level of healthcare, overall life expectancy, and human development index (Rochelle et al., 2015). Figure B presents the (lack of) association between GDP per capita and GGLE in a cross-section of countries. The data shows large heterogeneity, especially at low-income levels, and virtually no association from middle-level GDP per capita onwards.

Figure B. Association between gender gap in life expectancy and GDP per capita

Source: World Bank.

Biological Factors

The main intuition behind female superior longevity provided by evolutionary biologists is based on the idea that the offspring’s survival rates disproportionally benefited from the presence of their mothers and grandmothers. The female hormone estrogen is known to lower the risks of cardiovascular disease. Women also have a better immune system which helps them avoid a number of life-threatening diseases, while also making them more likely to suffer from (non-fatal) autoimmune diseases (Schünemann et al., 2017). The basic genetic advantage of females comes from the mere fact of them having two X chromosomes and thus avoiding a number of diseases stemming from Y chromosome defects (Holden, 1987; Austad, 2006; Oksuzyan et al., 2008).

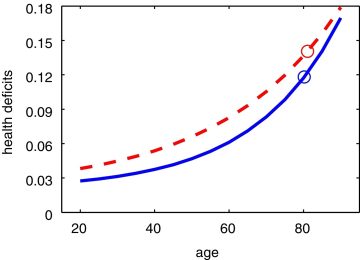

Despite a number of biological factors contributing to female longevity, it is well known that, on average, women have poorer health than men at the same age. This counterintuitive phenomenon is called the morbidity-mortality paradox (Kulminski et al., 2008). Figure C shows the estimated cumulative health deficits for both genders and their average life expectancies in the Canadian population, based on a study by Schünemann et al. (2017). It shows that at any age, women tend to have poorer health yet lower mortality rates than men. This paradox can be explained by two factors: women tend to suffer more from non-fatal diseases, and the onset of fatal diseases occurs later in life for women compared to men.

Figure C. Health deficits and life expectancy for Canadian men and women

Source: Schünemann et al. (2017). Note: Men: solid line; Women: dashed line; Circles: life expectancy at age 20.

Behavioural Factors

Given the large variation in GGLE, biological factors clearly cannot be the only driving force. Worldwide, men are three times more likely to die from road traffic injuries and two times more likely to drown than women (WHO, 2002). According to the World Health Organization (WHO), the average ratio of male-to-female completed suicides among the 183 surveyed countries is 3.78 (WHO, 2024). Schünemann et al. (2017) find that differences in behaviour can explain 3.2 out of 4.6 years of GGLE observed on average in developed countries. Statistics clearly show that men engage in unhealthy behaviours such as smoking and alcohol consumption much more often than women (Rochelle et al., 2015). Men are also more likely to be obese. Alcohol consumption plays a special role among behavioural contributors to the GGLE. A study based on data from 30 European countries found that alcohol consumption accounted for 10 to 20 percent of GGLE in Western Europe and for 20 to 30 percent in Eastern Europe (McCartney et al., 2011). Another group of authors has focused their research on Central and Eastern European countries between 1965 and 2012. They have estimated that throughout that time period between 15 and 19 percent of the GGLE can be attributed to alcohol (Trias-Llimós & Janssen, 2018). On the other hand, tobacco is estimated to be responsible for up to 30 percent and 20 percent of the gender gap in mortality in Eastern Europe and the rest of Europe, respectively (McCartney et al., 2011).

Another factor potentially decreasing male longevity is participation in risk-taking activities stemming from extreme events such as wars and military activities, high-risk jobs, and seemingly unnecessary health-hazardous actions. However, to the best of our knowledge, there is no rigorous research quantifying the contribution of these factors to the reduced male longevity. It is also plausible that the relative importance of these factors varies substantially by country and historical period.

Gender inequality and social gender norms also negatively affect men. Although women suffer from depression more frequently than men (Albert, 2015; Kuehner, 2017), it is men who commit most suicides. One study finds that men with lower masculinity (measured with a range of questions on social norms and gender role orientation) are less likely to suffer from coronary heart disease (Hunt et al., 2007). Finally, evidence shows that men are less likely to utilize medical care when facing the same health conditions as women and that they are also less likely to conduct regular medical check-ups (Trias-Llimós & Janssen, 2018).

It is possible to hypothesize that behavioural factors of premature male deaths may also be seen as biological ones with, for example, risky behaviour being somehow coded in male DNA. But this hypothesis may have only very limited truth to it as we observe how male longevity and GGLE vary between countries and even within countries over relatively short periods of time.

Economic Implications

Premature male mortality decreases the total labour force of one of the world leaders in GGLE, Belarus, by at least 4 percent (author’s own calculation, based on WHO data). Similar numbers for other developed nations range from 1 to 3 percent. Premature mortality, on average, costs European countries 1.2 percent of GDP, with 70 percent of these losses attributable to male excess mortality. If male premature mortality could be avoided, Sweden would gain 0.3 percent of GDP, Poland would gain 1.7 percent of GDP, while Latvia and Lithuania – countries with the highest GGLE in the EU – would each gain around 2.3 percent of GDP (Łyszczarz, 2019). Large disparities in the expected longevity also mean that women should anticipate longer post-retirement lives. Combined with the gender employment and pay gap, this implies that either women need to devote a larger percentage of their earnings to retirement savings or retirement systems need to include provisions to secure material support for surviving spouses. Since in most of the retirement systems the value of pensions is calculated using average, not gender-specific, life expectancy, the ensuing differences may result in a perception that men are not getting their fair share from accumulated contributions.

Policy Recommendations

To successfully limit the extent of the GGLE and to effectively address its consequences, more research is needed in the area of differential gender mortality. In the medical research dimension, it is noteworthy that, historically, women have been under-represented in recruitment into clinical trials, reporting of gender-disaggregated data in research has been low, and a larger amount of research funding has been allocated to “male diseases” (Holdcroft, 2007; Mirin, 2021). At the same time, the missing link research-wise is the peculiar discrepancy between a likely better understanding of male body and health and the poorer utilization of this knowledge.

The existing literature suggests several possible interventions that may substantially reduce premature male mortality. Among the top preventable behavioural factors are smoking and excessive alcohol consumption. Many studies point out substantial country differences in the contribution of these two factors to GGLE (McCartney, 2011), which might indicate that gender differences in alcohol and nicotine abuse may be amplified by the prevailing gender roles in a given society (Wilsnack et al., 2000). Since the other key factors impairing male longevity are stress and risky behaviour, it seems that a broader societal change away from the traditional gender norms is needed. As country differences in GGLE suggest, higher male mortality is mainly driven by behaviours often influenced by societies and policies. This gives hope that higher male mortality could be reduced as we move towards greater gender equality, and give more support to risk-reducing policies.

While the fundamental biological differences contributing to the GGLE cannot be changed, special attention should be devoted to improving healthcare utilization among men and to increasingly including the effects of sex and gender in medical research on health and disease (Holdcoft, 2007; Mirin, 2021; McGregor et al., 2016, Regitz-Zagrosek & Seeland, 2012).

References

- Albert, P. R. (2015). “Why is depression more prevalent in women?“. Journal of Psychiatry & Neuroscience, 40(4), 219.

- Austad, S. N. (2006). “Why women live longer than men: sex differences in longevity“. Gender Medicine, 3(2), 79-92.

- Barford, A., Dorling, D., Smith, G. D., & Shaw, M. (2006). “Life expectancy: women now on top everywhere“. BMJ, 332, 808. doi:10.1136/bmj.332.7545.808

- Holden, C. (1987). “Why do women live longer than men?“. Science, 238(4824), 158-160.

- Hunt, K., Lewars, H., Emslie, C., & Batty, G. D. (2007). “Decreased risk of death from coronary heart disease amongst men with higher ‘femininity’ scores: A general population cohort study“. International Journal of Epidemiology, 36, 612-620.

- Kulminski, A. M., Culminskaya, I. V., Ukraintseva, S. V., Arbeev, K. G., Land, K. C., & Yashin, A. I. (2008). “Sex-specific health deterioration and mortality: The morbidity-mortality paradox over age and time“. Experimental Gerontology, 43(12), 1052-1057.

- Luy, M. (2003). “Causes of Male Excess Mortality: Insights from Cloistered Populations“. Population and Development Review, 29(4), 647-676.

- McCartney, G., Mahmood, L., Leyland, A. H., Batty, G. D., & Hunt, K. (2011). “Contribution of smoking-related and alcohol-related deaths to the gender gap in mortality: Evidence from 30 European countries“. Tobacco Control, 20, 166-168.

- McGregor, A. J., Hasnain, M., Sandberg, K., Morrison, M. F., Berlin, M., & Trott, J. (2016). “How to study the impact of sex and gender in medical research: A review of resources“. Biology of Sex Differences, 7, 61-72.

- Mirin, A. A. (2021). “Gender disparity in the funding of diseases by the US National Institutes of Health“. Journal of Women’s Health, 30(7), 956-963.

- Oksuzyan, A., Juel, K., Vaupel, J. W., & Christensen, K. (2008). “Men: good health and high mortality. Sex differences in health and aging“. Aging Clinical and Experimental Research, 20(2), 91-102.

- Regitz-Zagrosek, V., & Seeland, U. (2012). “Sex and gender differences in clinical medicine“. Sex and Gender Differences in Pharmacology, 3-22.

- Rochelle, T. R., Yeung, D. K. Y., Harris Bond, M., & Li, L. M. W. (2015). “Predictors of the gender gap in life expectancy across 54 nations“. Psychology, Health & Medicine, 20(2), 129-138. doi:10.1080/13548506.2014.936884

- Schünemann, J., Strulik, H., & Trimborn, T. (2017). “The gender gap in mortality: How much is explained by behavior?“. Journal of Health Economics, 54, 79-90.

- Trias-Llimós, S., & Janssen, F. (2018). “Alcohol and gender gaps in life expectancy in eight Central and Eastern European countries“. European Journal of Public Health, 28(4), 687-692.

- WHO. (2002). “Gender and road traffic injuries“. World Health Organization.

- WHO. (2024). “Global health estimates: Leading causes of death“. World Health Organization.

- Łyszczarz, B. (2019). “Production losses associated with premature mortality in 28 European Union countries“. Journal of Global Health.

About FROGEE Policy Briefs

FROGEE Policy Briefs is a special series aimed at providing overviews and the popularization of economic research related to gender equality issues. Debates around policies related to gender equality are often highly politicized. We believe that using arguments derived from the most up to date research-based knowledge would help us build a more fruitful discussion of policy proposals and in the end achieve better outcomes.

The aim of the briefs is to improve the understanding of research-based arguments and their implications, by covering the key theories and the most important findings in areas of special interest to the current debate. The briefs start with short general overviews of a given theme, which are followed by a presentation of country-specific contexts, specific policy challenges, implemented reforms and a discussion of other policy options.

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Unlocking Export Potential of Georgia: Strategic Insights for High-Growth Sectors and European Market Expansion

A new report by the ISET Policy Institute provides a comprehensive analysis of Georgia’s fastest-growing export sectors, revealing significant opportunities for small and medium-sized enterprises (SMEs) to increase their export potential to European markets. Supported by the European Union and the United Nations Development Programme (UNDP), the study identifies six key sectors in Georgia that demonstrate strong potential for export diversification and market expansion across Europe.

High-Growth Sectors in Georgia: Key Findings and Export Opportunities

This detailed ISET report blends both quantitative data and qualitative insights from industry stakeholders, highlighting the top six sectors:

- manufacture of beverages,

- transport,

- telecommunications,

- computer and information services, and

- manufacture of wearing apparel.

Each of these sectors is shown to have substantial export competitiveness, growing demand in European markets, and opportunities for sustainable growth despite existing challenges.

Beverage Manufacturing in Georgia: High Export Potential for Wine and Spirits

One of the highest-ranking sectors in Georgia is beverage manufacturing, particularly in the production and export of wine, mineral water, and spirits. Although Georgia’s beverage exports are growing rapidly, the report reveals untapped potential in the European Union market. By enhancing certification processes and building export capacity, Georgia’s beverage industry could significantly increase its presence in Europe, particularly in high-demand niche markets like organic wines and premium spirits.

Digital Economy Growth: Telecommunications, Computer, and Information Services

Georgia’s telecommunications, computer, and information services sector is another high-potential industry. With SMEs contributing 84% of turnover in computer services, the sector plays a vital role in Georgia’s digital economy. Demand for these services is growing across Europe, making this sector a key driver for future export growth. The report suggests targeting European digital markets and strengthening public-private partnerships to further enhance the sector’s international competitiveness.

Strategic Recommendations to Boost Georgia’s Export Competitiveness

The report provides actionable recommendations to further boost Georgia’s export performance. These include improving infrastructure quality, expanding access to financing for SMEs, and encouraging public-private collaboration. To stay competitive in European markets, Georgian SMEs are advised to focus on green technology adoption, niche market targeting, and meeting international quality standards through certification improvements.

Preparing Georgia for Sustainable Export Growth and European Market Integration

With significant export potential across multiple sectors, Georgia is poised to expand its presence in European markets. By investing in strategic policy frameworks and fostering SME growth, the country can accelerate its economic integration with Europe. Georgia’s small and medium-sized enterprises (SMEs) have a crucial role to play in driving sustainable economic growth and export diversification in the coming years.

About ISET Policy Institute

ISET Policy Institute is the leading economic policy think tank in Georgia, specializing in research, training, and policy consultation in the South Caucasus region. The institute focuses on promoting good governance and fostering inclusive economic development.

For more information, visit ISET Policy Institute.

To read more policy briefs published by the ISET Policy Institute, visit the Institute’s page on the FREE Network’s website.

Disclaimer: The opinions expressed in policy briefs, news posts, and other publications are those of the authors and do not necessarily reflect the views of the FREE Network and its research institutes.

Media (de)Polarization Index | July 2024

In July 2024, the Georgia Media Polarization Index saw a notable rise due to several key political events. For instance, the United States indefinitely postponed the “Worthy Partner 2024” military exercise. Additionally, President Salome Zurabishvili returned proposed Pension Law amendments to Parliament for further review. Moreover, she appointed a non-judge member to the Supreme Council of Justice, though the court later suspended this member. However, during periods of opposition party unification and Georgian athletes’ successes at the Olympics, the index experienced a decline.

Interactive Chart: Polarity Index Only – July

Media (de)Polarization Index – 2020-2024 (as of July 2024)

What is the Georgia Media Polarization Index?

The Georgia Media Polarization Index, created by the ISET Policy Institute, serves as a powerful tool for measuring the level of political bias and polarization across Georgia’s leading media outlets. This index examines the political dissimilarities in news coverage, offering a clear, data-driven analysis of media bias in Georgia.

How the Media Polarization Index Works

The Media Polarization Index utilizes a weighted average to assess political dissimilarities between various Georgian media outlets. Media sources with higher ratings exert greater influence on the overall results, providing a more comprehensive understanding of political content distribution. This method helps in identifying where each media outlet stands on the political spectrum, allowing users to visualize the extent of media bias.

Importance and Application of the Media Polarization Index

The Georgia Media Polarization Index is crucial for researchers, policymakers, and media watchdogs focused on monitoring media bias and polarization trends. It provides valuable insights into how Georgian media outlets shape political discourse and evolve over time. The findings from the index support efforts to promote balanced media coverage, inform policy decisions, and encourage dialogue on the media’s influence in Georgia’s political landscape.

About ISET Policy Institute

ISET Policy Institute is the leading economic policy think tank in Georgia, specializing in research, training, and policy consultation in the South Caucasus region. The institute focuses on promoting good governance and fostering inclusive economic development. For more information, visit ISET Policy Institute.

To read more policy briefs published by the ISET Policy Institute, visit the Institute’s page on the FREE Network’s website.

Disclaimer: The opinions expressed in policy briefs, news posts, and other publications are those of the authors and do not necessarily reflect the views of the FREE Network and its research institutes.

Why the National Bank of Georgia Is Ditching Dollars for Gold

The National Bank of Georgia (NBG) recently acquired 7 tons of high-quality monetary gold valued at $500 million, constituting approximately 11 percent of the banks’ total reserves. This marked the first occasion that Georgia acquired gold for its reserves since regaining its independence. The acquisition is a significant event, prompted by the NBG’s stated aim to enhance diversification amidst increased global geopolitical risks. However, diversification is just one of the reasons many countries are extensively purchasing gold. Another reason for increasing gold reserves is to lessen one’s reliance on the US dollar and to protect against sanctions, as seen with Russia and Belarus following the annexation of Crimea. While the NBG’s gold acquisition aligns with economic rationale, recent domestic developments suggest other motives. Actions like sanctions on political figures, anti-Western rhetoric, and recent legislation (the Law of Transparency of Foreign Influence), diverging Georgia from an EU pathway call for speculation that the gold purchase is driven by fear a of potential sanctions and as a preparedness strategy.

Introduction

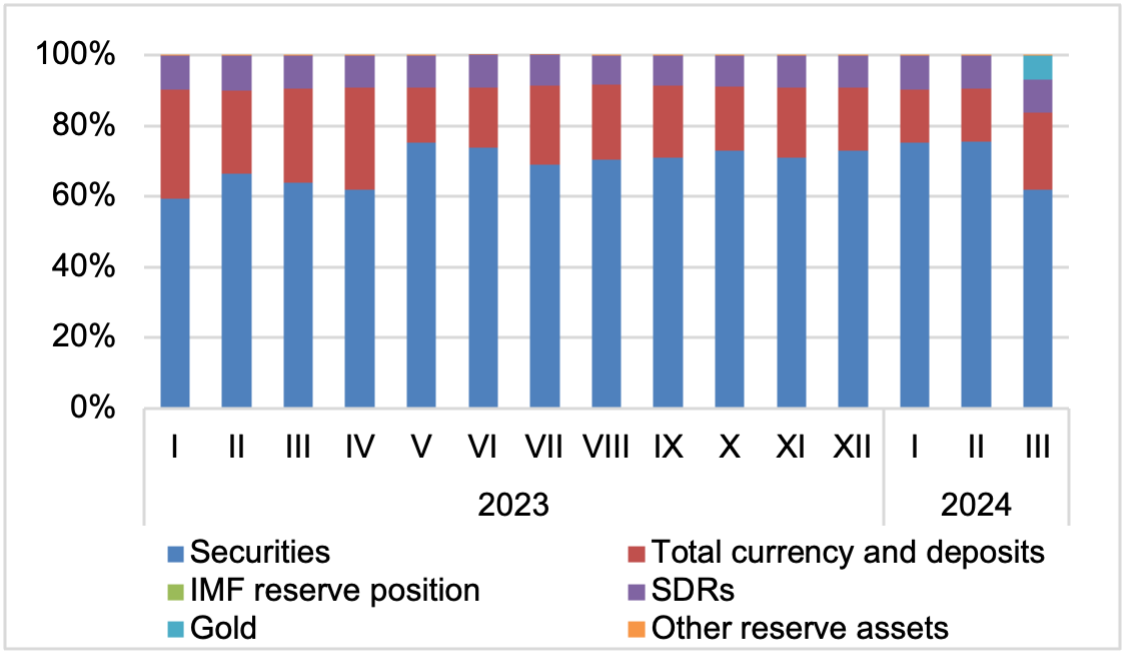

The National Bank of Georgia (NBG) has broken new ground by adding gold to the country’s international reserves for the first time ever. Georgia has thus become the first country in the South Caucasus to purchase gold for its reserves. In line with its Board’s decision on March 1, 2024, the NBG procured 7 tons of the highest quality (999.9) monetary gold. The acquisition, valued at 500 million US dollars, took the form of internationally standardized gold bars, purchased from the London gold bar market and currently stored in London. Presently, the acquired gold represents approximately 11 percent of the NBG’s international reserves (see Figure 1).

Figure 1. NBG’s Official Reserve Assets and Other Foreign Currency Assets, 2023-2024.

Source: The National Bank of Georgia.

The NBG emphasizes in its official statement that the acquisition of gold is not merely symbolic but rather reflects a deliberate strategy of diversifying NBG’s portfolio and enhancing its resilience to external shocks. The NBG’s decision was made during a period marked by significant economic and political events both within and outside Georgia. Key among these were global and regional geopolitical tensions that amplified concerns about economic downturns and rising inflation. The Covid-19 pandemic in 2020 led to stagflation across many countries, including Georgia. Despite some recovery in GDP, high inflation continued into 2021. Furthermore, the Russian war on Ukraine disrupted supply chains, and pushed global inflation to a 24-year high 8.7 percent in 2022. In response, stringent monetary policies aimed at controlling inflation were implemented across both developing and advanced economies. Looking ahead, there is an expectation of a shift toward more expansionary monetary policies that should help lower interest rates (and lower yields on assets held by central banks). These global conditions provide context for the NBG’s strategic focus on diversification.

However, alongside these economic events, Georgia also faces significant political challenges. Since the beginning of Russia’s war in Ukraine in 2022, political tensions in Georgia have escalated. Notable actions such as the U.S. imposing sanctions on influential Georgian figures, including judges and the former chief prosecutor, have, among other things, intensified scrutiny into the Russian influence in Georgia. Concerns about the independence of the Central Bank, which changed the rule of handling sanctions applications for Georgia’s citizens, and legislative initiatives like the Law of Transparency of Foreign Influence, which undermines Georgia’s EU accession ambitions, have triggered reactions from the country’s partners and massive public protests. Moreover, anti-Western rhetoric from the ruling party has raised concerns. In addition, the parliament of Georgia recently approved an amendment to the Tax Cide, a so-called ‘law on offshores’. The opaque nature of the law, as well as the context and speed at which it was advanced, sparked outcry and conjecture about its true purpose. These elements lead to speculation that the decision to purchase gold may be motivated by a desire for greater autonomy or a fear of potential sanctions, rather than purely economic reasons.

In the context of the above, this policy brief seeks to explore the motivations behind gold acquisitions by Central Banks, drawing on the experiences of both developed and developing countries. It aims to review existing literature that explores various reasons for gold acquisitions, providing a comprehensive analysis of economic and potentially non-economic factors influencing such decisions.

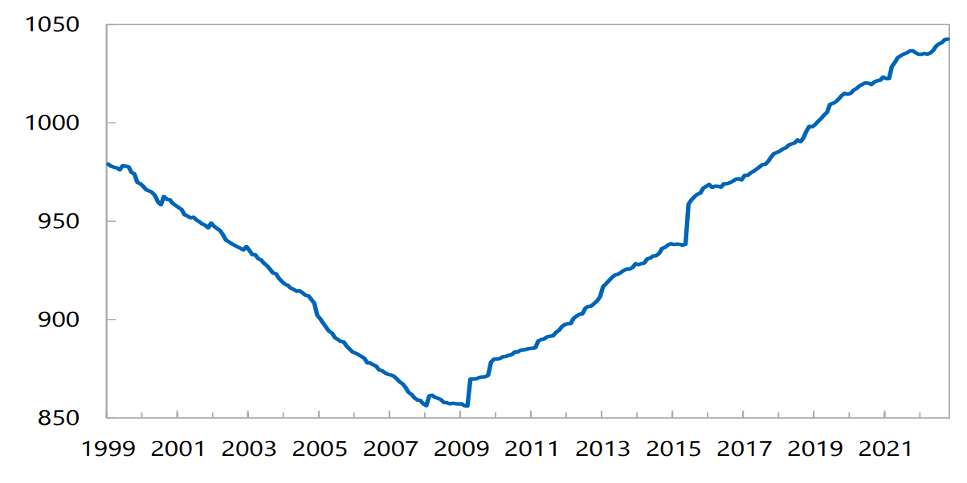

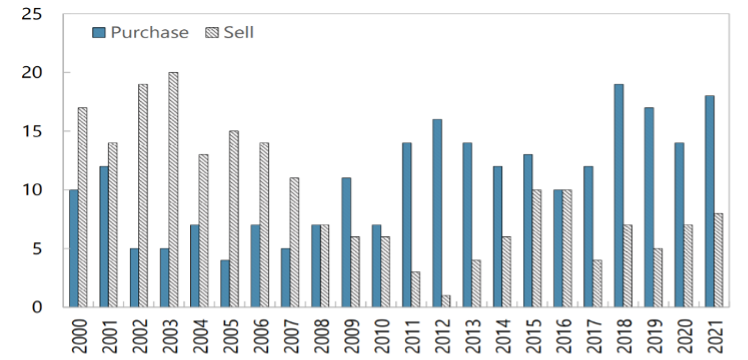

The Return of Gold in Global Finance

Over the past decade, central bank gold reserves have significantly increased, reversing a 40-year trend of decline. The shift that began around the time of the 2008-09 Global Financial Crisis is depicted in Figures 2 and 3, highlighting the transition from a pre-crisis period of more countries selling gold, to a post-crisis period where more countries have been purchasing gold.

Figure 2. Gold Holdings in Official Reserve Assets, 1999-2022 (million fine Troy ounces).

Source: IMF, International Financial Statistics.

Figure 3. Number of Countries Purchasing/Selling Monetary Gold, 2000-2021 (at least 1 metric ton of gold in a given year).

Source: IMF, International Financial Statistics.

In 2023, central banks added a considerable amount of gold to their reserves. The largest purchases have been reported for China, Poland, and Singapore, with these nations collectively dominating the gold buying landscape during the year.

China is one of the top buyers of gold worldwide. In 2023, the People’s Bank of China emerged as the top gold purchaser globally, adding a record 225 tonnes to its reserves, the highest yearly increase since at least 1977, bringing its total gold reserves to 2,235 tonnes. Despite this significant addition, gold still represents only 4 percent of China’s extensive international reserves.

The National Bank of Poland was another significant buyer in 2023, acquiring 130 tonnes of gold, which boosted its reserves by 57 percent to 359 tonnes, surpassing its initial target and reaching the bank’s highest recorded annual level.

Other central banks, including the Monetary Authority of Singapore, the Central Bank of Libya, and the Czech National Bank, also increased their gold holdings, albeit on a smaller scale. These purchases reflect a broader trend of central banks diversifying their reserves and enhancing financial security amidst global economic uncertainties.

Conversely, the National Bank of Kazakhstan and the Central Bank of Uzbekistan were notable sellers, actively managing their substantial gold reserves in response to domestic production and market conditions. The Central Bank of Bolivia and the Central Bank of Turkey also reduced their gold holdings, primarily to address domestic financial needs.

The U.S. continues to hold the world’s largest gold reserve (25.4 percent of total gold reserves), which underscores the metal’s enduring appeal as a store of value among the world’s leading economies. The U.S. is followed by Germany at 10.5 percent, and Italy and France at 7.6 percent respectively. At present, around one-eighth of the world’s currency reserves comprise of gold, with central banks collectively holding 20 percent of the global gold supply (NBG, 2024).

Why Central Banks are Buying Gold Again

A 2023 World Gold Council survey (on central banks revealed five key motivations for holding gold reserves: (1) historical precedent (77 percent of respondents), (2) crisis resilience (74 percent), (3) long-term value preservation (74 percent), (4) portfolio diversification (70 percent), and (5) sovereign risk mitigation (68 percent). Notably, emerging markets placed a higher emphasis (61 percent) on gold as a “geopolitical diversifier“ compared to developed economies (45 percent).

However, the increasing use of the SWIFT system for sanctions enforcement (e.g., Iran in 2015 and Russia in 2022) has introduced a new factor influencing gold purchases of some governments: safeguarding against sanctions (Arslanalp, Eichengreen and Simpson-Bell, 2023).

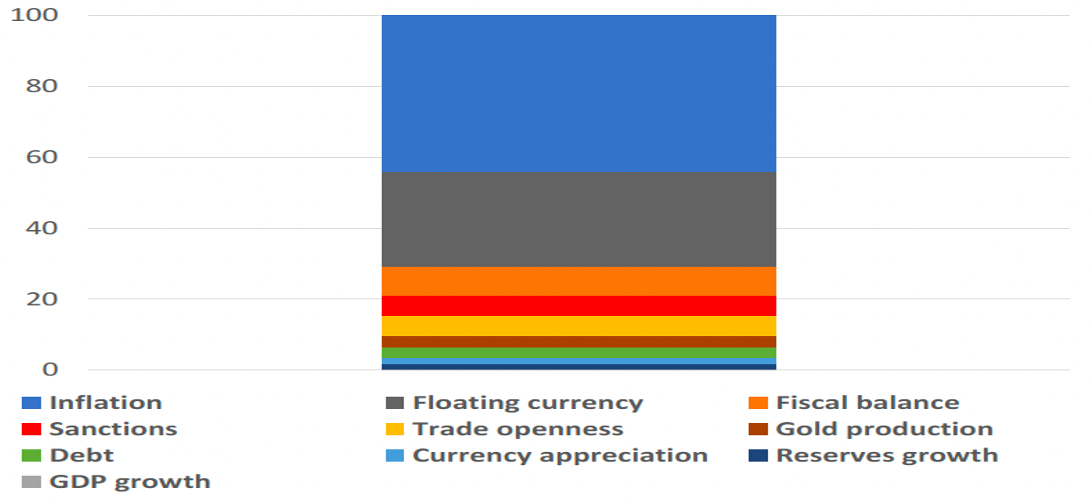

In addition, Arslanalp, Eichengreen, and Simpson-Bell (2023) conclude that central banks’ decisions to acquire gold are primarily driven by the following factors; inflation, the use of floating exchange rates, a nation’s fiscal stability, the threat of sanctions, and the degree of trade openness (see Figure 4).

Figure 4. Determinants of Gold Shares in Emerging Market and Developing Economies.

Source: Arslanalp, Eichengreen, and Simpson-Bell (2023).

Gold as a Hedging Instrument

Gold is considered a safe haven and an attractive asset in periods of significant economic, financial, and geopolitical uncertainty (Beckman, Berger, & Czudaj, 2019). This is particularly relevant when returns on reserve currencies are low, a scenario prevalent in recent years.

A hedge against inflation: Inflation presents a significant challenge for central banks, as it erodes the purchasing power of a nation’s currency. Gold has been a long-standing consideration for central banks as a potential inflation hedge. Its price often exhibits an inverse relationship with the value of the US dollar, meaning it tends to appreciate as the dollar depreciates. This phenomenon can be attributed to two primary factors: (1) increased demand during inflationary periods; and (2) gold tends to have intrinsic value unlike currencies (Stonex Bullion, 2024).

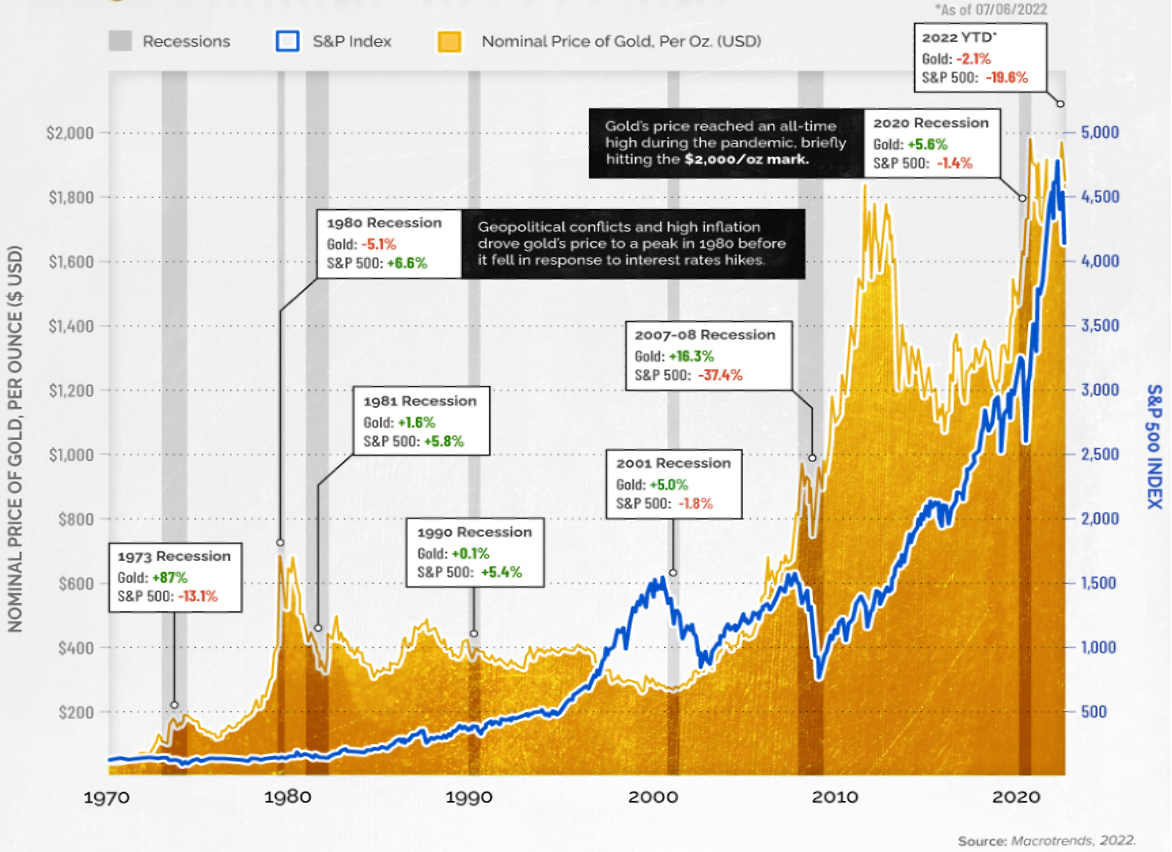

Diversification of portfolio: Diversification is a cornerstone principle of portfolio management. It involves allocating investments across various asset classes to mitigate risk. Gold, with its negative correlation to traditional assets like stocks and bonds, can be a valuable tool for portfolio diversification. In simpler terms, when stock prices decline, gold prices often move in the opposite direction, offering a potential hedge against market downturns (see Figure 5).

Figure 5. How Gold Performs During Recession, 1970-2022.

Source: Bhutada (2022).

Hedge against geopolitical risks: de Besten, Di Casola and Habib (2023) suggest that geopolitical factors may have influenced gold acquisitions for some central banks in 2022. A positive correlation appears to exist between changes in a country’s gold reserves and its geopolitical proximity to China and Russia (compared to the U.S.) for countries actively acquiring gold reserves. This pattern is particularly evident in Belarus and some Central Asian economies, suggesting they may have increased their gold holdings based on geopolitical considerations.

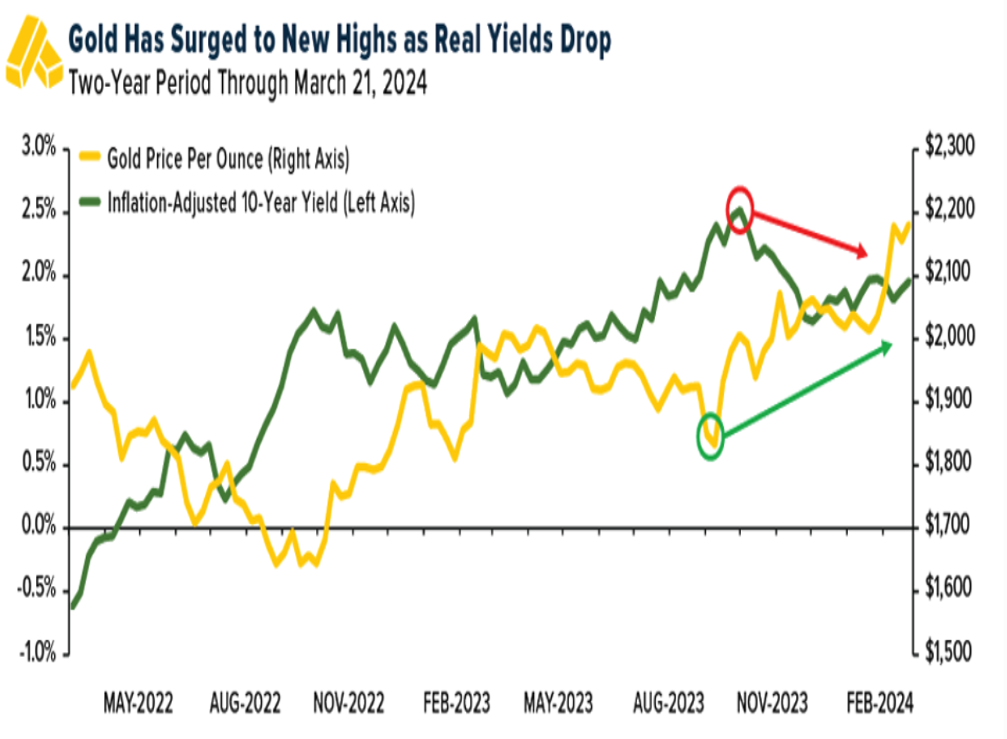

Low or Negative Interest Rates: When interest rates on major reserve currencies like the US dollar are low or negative, it reduces the opportunity cost of holding gold (gold is a passive asset that does not generate periodic income, dividends, and interest benefits). In other words, gold becomes a more attractive option compared to traditional investments that offer minimal or no returns. The prevailing low-interest rate environment, particularly for major reserve currencies like the US dollar, has diminished the opportunity cost of holding gold.

This phenomenon applies to both advanced economies and emerging market economies (EMDEs). Notably, EMDEs with significant dollar-denominated debt are particularly sensitive to fluctuations in US interest rates. Arslanalp, Eichengreen, and Simpson-Bell (2023) conclude that reserve managers are increasingly incorporating gold into their portfolios when returns on reserve currencies are low. Figure 6 illustrates the inverse relationship between the price of gold and the inflation-adjusted 10-year yield.

Figure 6. Gold Price and Inflation-Adjusted 10-Year Yield.

Source: Bloomberg, U.S. Global Investors.

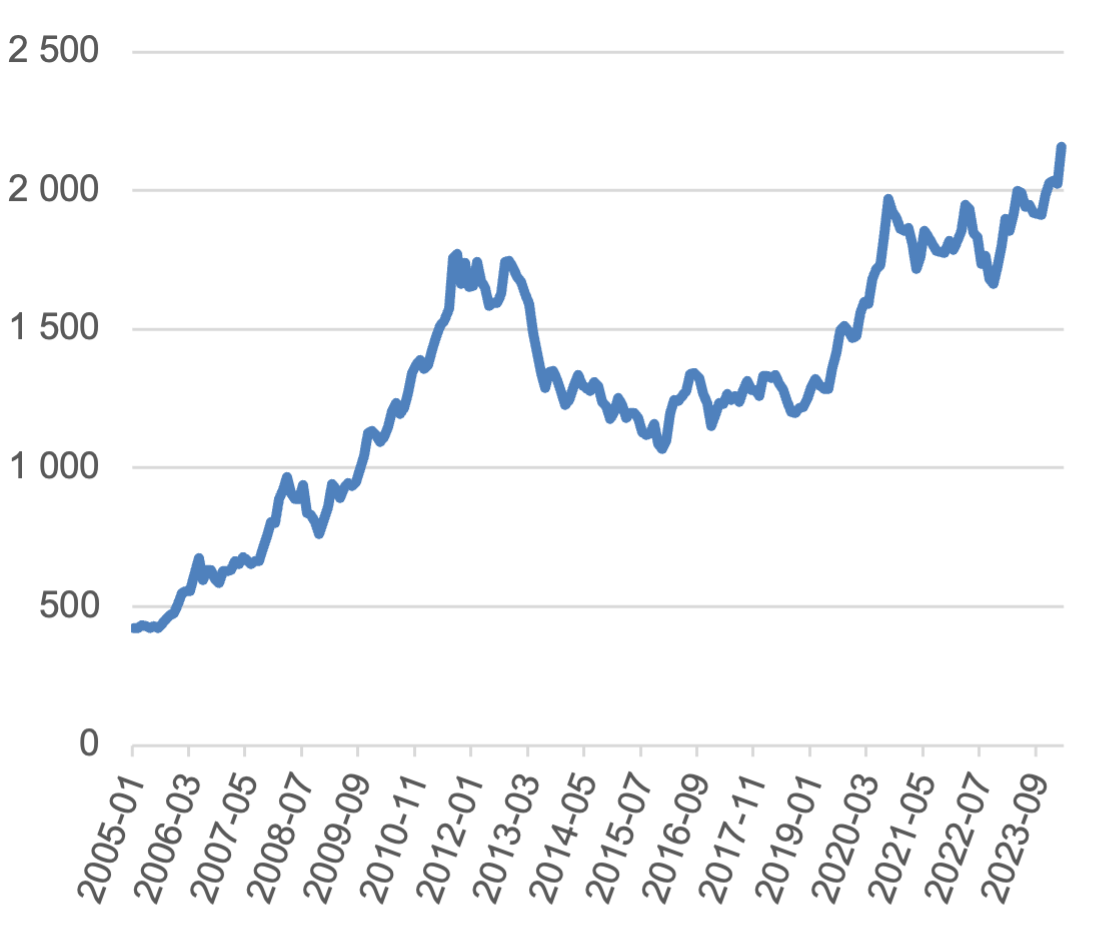

In addition to its aforementioned advantages, gold offers central banks a long-term investment opportunity despite its lack of interest payments, unlike traditional securities. While gold exhibits short-term price volatility, its historical price trend suggests a long-term upward trajectory (see Figure 7).

Figure 7. Gold Price per Troy Ounce (approximately 31.1 grams), in USD.

Source: World Gold Council.

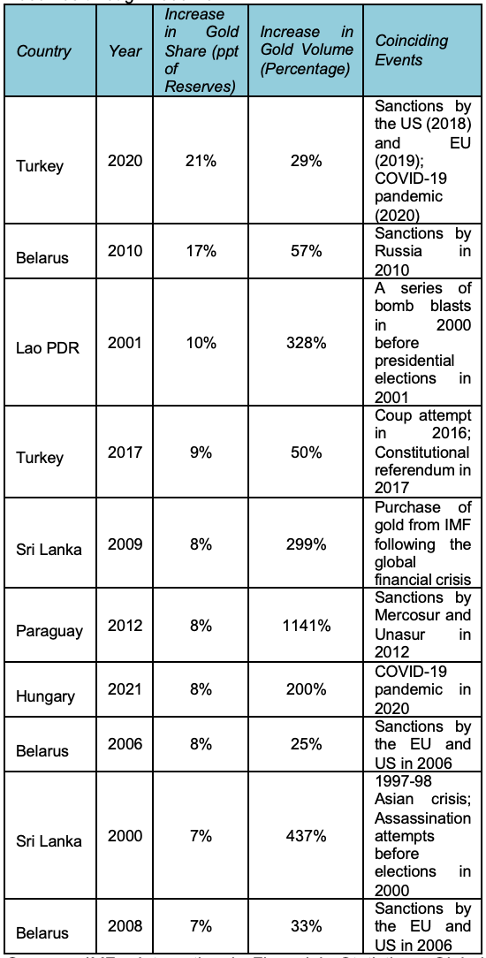

Gold as a Safeguard Against Sanctions

Gold is perceived as a secure and desirable reserve asset in situations where countries face financial sanctions or the risk of asset freezes and seizures (see Table 1). The decision by G7 countries to freeze the foreign exchange reserves of the Bank of Russia in 2022 highlighted the importance of holding reserves in a form less vulnerable to sanctions. Following Russia’s annexation of Crimea in 2014, the Bank of Russia intensified its gold purchases. By 2021, it had confirmed that its gold reserves were fully vaulted domestically. The imposition of sanctions on Russia, which restrict banks from engaging in most transactions with Russian counterparts and limit the Bank of Russia’s access to international financial markets, further underscores the appeal of gold as a safeguard.

While the recent sanctions imposed by G7 countries, which limit Russian banks from conducting most business with their counterparts and restrict the Bank of Russia from accessing its reserves in foreign banks, are an extreme example, similar sanctions have previously impacted or threatened financial operations of other nations’ central banks and governments. This situation raises the question of whether the risk of sanctions has influenced the observed trend of countries’ increasing their gold reserves (IMF, International Financial Statistics, 2022).

Table 1. Top 10 Annual Increases in the Share of Gold in Reserves, 2000-2021.

Source: IMF, International Financial Statistics; Global Sanctions Database (GSDB). Note: Excludes countries with central bank gold purchases from domestic producers.

As outlined in Arslanalp, Eichengreen and Simpson-Bell (2023), there were eight active diversifiers into gold in 2021, each purchasing at least 1 million troy ounces (Kazakhstan, Belarus, Turkey, Uzbekistan, Hungary, Iraq, Argentina, Qatar), exhibiting distinct international economic or political concerns. Kazakhstan, Belarus, and Uzbekistan maintain ties with Russia through the Eurasian Economic Union. Turkey has faced sanctions from both the European Union and the U.S. Iraq has experienced disputes with the U.S., while Hungary has faced similar issues with the European Union. In 2017-21, Qatar was subjected to a travel and economic embargo by Saudi Arabia and neighboring countries. Argentina may have had concerns about asset seizures by foreign courts due to sovereign debt disputes.

Furthermore, according to the Economist (2022), gold is costly to transport, store, and protect. It is expensive to use in transactions and doesn’t earn interest. However, it can be lent out like currencies in a central bank’s reserves. When lent out or used in swaps (where gold is exchanged for currency at agreed dates), it can generate returns. But banks prefer gold to be stored in specific places like the Bank of England or the Federal Reserve Bank of New York, which brings back the risk of sanctions. For instance, During the Iranian Revolution in 1979 and the subsequent hostage crisis, the United States froze Iranian assets, including the gold reserves held in U.S. banks (Arslanalp, Eichengreen and Simpson-Bell, 2023). The National Bank of Georgia intends to transport its acquired gold from England to Georgia for storage, which could potentially reduce storage costs, but further decrease liquidity.

Arslanalp, Eichengreen, and Simpson-Bell (2023) conclude that since the early 2000s, half of the significant year-over-year increases in central bank gold reserves can be attributed to the threat of sanctions. By examining an indicator that tracks financial sanctions by major economies like the United States, United Kingdom, European Union, and Japan, all key issuers of reserve currencies, the authors have confirmed a positive correlation between such sanctions and the proportion of reserves held in gold. Furthermore, their findings suggest that multilateral sanctions imposed by these countries collectively have a more pronounced effect on increasing gold reserves than unilateral sanctions. This is likely because unilateral sanctions allow room for shifting reserves into the currencies of other non-sanctioning nations, whereas multilateral sanctions increase the risks associated with holding foreign exchange reserves, thus making gold a more attractive option.

The NBG’s Historic Decision

The National Bank of Georgia’s (NBG) recent acquisition of gold for its reserves is likely motivated by a desire to diversify its portfolio and hedge against inflation and geopolitical risks. However, recent developments in Georgia raise questions about the timing of this policy decision, bringing political considerations into the picture.

Among these developments is the 2023 suspension of the IMF program for Georgia, due to concerns about the NBG’s governance (Intellinews, 2023). The amendments to the NBG law in June 2023, which created a new First Deputy and Acting Governor position – superseding the existing succession framework – contradicted IMF Safeguards recommendations and raised concerns about increased political influence (International Monetary Fund, 2024). How the recent gold purchase reflect on the future of IMF cooperation is thus a relevant question to ask.

Another ground for concern is the recent approval by the Georgian Parliament of the anti-democratic “Foreign Influence Transparency” law and the anti-Western rhetoric of the ruling party, which have sparked intensive public protests. European partners warn that the law will not align with Georgia’s European Union aspirations and that it could potentially hinder the country’s advancement on the EU pathway. Rather, the law might distance Georgia from the EU. This law has also increased the concerns for further sanctions on members of the ruling party, government officials, and individuals engaging in anti-West and anti-EU propaganda.

Furthermore, the recent amendment of the Tax Code, the so-called “offshores law” allows for tax-free funds transfers from offshore zones to Georgia. This, combined with other developments, raises questions about whether the government is preparing for potential sanctions, should its relationship with Russia continue to strengthen.

Conclusion

In conclusion, this policy brief highlights that central banks’ acquisition of gold reserves, especially in emerging economies, is motivated by a combination of economic and political factors. The economic incentives include the need for portfolio diversification and protection against inflation and geopolitical instabilities, a trend that became more pronounced following the 2008 global financial crisis. Politically, the accumulation of gold serves as a strategic move to lessen dependency on the U.S. dollar and as a defensive measure against potential international sanctions, as highlighted by the post-2014 geopolitical shifts following Russia’s annexation of Crimea.

In 2024, Georgia purchased gold for the first time since regaining its independence. While its gold purchasing strategy seems to align with these economic motives, the recent domestic political dynamics suggest a deeper, possibly strategic political rationale by the National Bank of Georgia. The imposition of U.S. sanctions on key figures, and recent legislative actions deviating from European Union standards, all amidst increasing anti-Western sentiment, indicate that the NBG’s gold acquisitions might also be driven by a quest for greater safeguard against potential future sanctions. Thus, while economic reasons for the purchase are significant, the political underpinnings in the NBG’s recent actions raise numerous unanswered questions.

References

- Arslanalp, S., Eichengreen, B., & Simpson-Bell, C. (2023). Gold as International Reserves: A Barbarous Relic No More? IMF Working Papers.

- Beckman, J., Berger, T., & Czudaj, R. (2019). Gold Price Dynamics and the Role of Uncertainty. Quantitative Finance , 663-681.

- Bhutada G. (2022). Does Gold’s Value Increase During Recessions? Elements Visualcapitalist.

- de Besten, T., Di Casola, P., & Habib M. M. (2023). Geopolitical fragmentation risks and international currencies. The international role of the euro.

- The Economist. (2022). Why gold has lost some of its investment allure. https://www.economist.com/finance-and-economics/2022/01/08/why-gold-has-lost-some-of-its-investment-allure

- International Monetary Fund (2024). Georgia: 2024 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Georgia. IMF Country Reports 24/135

- Intellinews. (2023). https://www.intellinews.com/georgia-s-national-bank-president-confirms-suspension-of-imf-programme-294545/

- StoneX Bullion (2024). Why Central Banks Buy Gold.

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Georgia (de)Media Polarization Index: Measuring Political Bias Across Media Outlets

The Georgia Media Polarization Index, developed by the ISET Policy Institute, is a key tool for measuring political dissimilarity across the country’s leading media outlets. This Index captures the level of polarization in Georgian media by examining the political differences in news coverage. It offers a clear, data-driven approach to understanding media bias.

What the Media Polarization Index Measures

The Media Polarization Index uses a weighted average to measure political dissimilarities between various Georgian media outlets. Ratings determine the weight assigned to each outlet, so higher-rated sources have a greater influence on the results. The Index evaluates how different the political content is across these media platforms. This creates a clear picture of where each media outlet stands in terms of political bias.

The Role of Natural Language Processing (NLP) Models

To build the Index, the ISET Policy Institute uses advanced Natural Language Processing (NLP) techniques. The analysis relies heavily on two models: Word2Vec and Doc2Vec. These models analyze the language in political news articles and extract deeper meanings from the content.

The Doc2Vec model, specifically trained for the Georgian language, plays a central role in this process. It was developed using a large collection of over 250,000 political news articles from diverse media outlets in Georgia. This training allows the model to interpret nuanced meanings in political news. As a result, it provides a highly detailed analysis of media content.

How the Index Measures Dissimilarity

The Doc2Vec model is applied to political news articles from several prominent Georgian media outlets, including Imedi, Mtavari, TV Pirveli, 1TV (Public Broadcaster), Formula, PosTV, and Rustavi2. Using cosine similarity metrics, the model maps the articles into a high-dimensional space. The cosine similarity metric then measures how closely the political content of one outlet aligns with others. A wider angle between vectors, or a smaller cosine similarity, indicates greater political dissimilarity between media outlets.

Clustering Media Outlets Based on Bias

One of the most important insights from the Index is the identification of media clusters. The Index not only measures political dissimilarity across all outlets but also identifies clusters of outlets with similar political biases. The politically biased dissimilarity is calculated by comparing the total dissimilarity with the average dissimilarity within these clusters. This helps the Index identify both the overall level of polarization and the specific biases between different media groups.

Application of the Media Polarization Index

The Georgia Media Polarization Index is an essential tool for analyzing political bias and dissimilarity across Georgian media outlets. It provides critical insights for researchers, policymakers, and media watchdogs who monitor how media bias and polarization evolve over time. The findings from the Index can guide policy decisions, support the push for more balanced media coverage, and encourage constructive dialogue on the media’s role in shaping political discourse in Georgia.

About ISET Policy Institute

ISET Policy Institute is the leading economic policy think tank in Georgia, specializing in research, training, and policy consultation in the South Caucasus region. The institute focuses on promoting good governance and fostering inclusive economic development. For more information, visit ISET Policy Institute.

To read more policy briefs published by the ISET Policy Institute, visit the Institute’s page on the FREE Network’s website.

Disclaimer: The opinions expressed in policy briefs, news posts, and other publications are those of the authors and do not necessarily reflect the views of the FREE Network and its research institutes.

Russian Wheat Policies and Georgia’s Strategic Trade Policies

Russia is known for periodically halting its grain exports to impact global wheat prices. This has become a significant policy concern in recent years, most notably during the Covid-19 pandemic and in the wake of Russia’s war in Ukraine. Georgia heavily depends on wheat imports, and over 95 percent of its wheat has historically been sourced from Russia. Despite Russia’s periodic bans and restrictions on wheat exports occurring every 2-3 years, Georgia is yet to effectively diversify its sources of wheat imports. This policy brief analyses the impact of Russia’s most recent wheat policies on Georgia’s wheat market, examines Georgia’s response, and provides policy recommendations in this regard.

In June 2023, the Georgian government introduced a temporary import duty on wheat flour imported from Russia in response to requests from the Georgian Flour Producers Association. The association began advocating for an import duty after Russia, in 2021, imposed a so-called “floating tariff” on wheat which made it relatively more expensive to import wheat in comparison to wheat flour. As a result of the “floating tariff” on wheat, wheat flour imports skyrocketed and almost fully substituted wheat imports. Eventually, many Georgian mills shut down and local wheat producers struggled to sell domestically produced wheat. Such an increase in flour imports raises the risk of completely replacing domestically produced flour with flour imported from Russia.

To address the above, the government has implemented a temporary import duty of 200 GEL (75 USD) per ton on wheat flour imported from Russia (the average import price ranges between 225 USD/ton and 435 USD/ton). In turn, millers have agreed to purchase 1 kilogram of wheat from Georgian farmers for 0.7 GEL (0.3 USD). This policy measure is in effect until March 1, 2024.

The Georgian Flour Producers Association advocates for an extension of the temporary import duty beyond March 1, 2024, to uphold fair competition in the wheat and flour market. According to the Georgian Flour Producers Association, an extension is desirable due to the following (Resonance daily, 2024):

- Under the import duty, fair competition between wheat flour and wheat has been restored, and Georgian mills have resumed their operations.

- Following the government intervention, farmers have successfully sold over 50,000 tons (on average half of the annual production) of domestically produced wheat. The Ministry of Environmental Protection and Agriculture has reported a 60 percent increase in local wheat production over the past two years, with expectations of sustained growth.

- Wheat imports have resumed, with Georgia importing 20,000 to 25,000 tons of wheat monthly, while prior to the government intervention, the average monthly wheat imports amounted to 15,337 tons (in 2022). Additionally, 8,000 to 12,000 tons of wheat flour, on average, are also imported monthly, while in the absence of government intervention, wheat flour imports surged to over 15,000 tons (in 2022).

- Post-intervention, the price of 100 kilograms of first-quality flour has remained stable, ranging from 45 to 49 GEL. Consequently, the price of bread has not increased but remains steady.

- The import duty has generated an additional 20 million GEL in government revenue.

- Through the efforts of the mills, the country now enjoys a steady and strategically managed supply of wheat, in accordance with UN recommendations. Coupled with the seasonal harvest of Georgian wheat, this ensures complete food security in any unforeseen critical scenario.

While many arguments support the decision to preserve the import duty on wheat flour, in order to make an informed decision on that matter, it is essential to thoroughly assess production, trade and price dynamics in the wheat market in Georgia. Additionally, to design adequate trade policy measures, one has also to consider the issue in a broader perspective and assess the risks associated with a high dependency on Russian wheat, especially given Russia’s history of imposing wheat export restrictions.

Russian Policy on the Wheat Market

Russia has long been one of the dominant players on the global wheat market, and its periodic decisions to halt grain exports have heavily affected international wheat prices (see Table 1). This concern became especially stringent in recent years, during the Covid-19 pandemic and Russia’s war in Ukraine.

Table 1. Russia’s policy interventions in the wheat market and their estimated impact on wheat prices, 2007-2023.

Source: United States Department of Agriculture, 2022.

The Government of the Russian Federation.

The Kansas City Wheat Futures, The U.S. Wheat Associates.

One of Russia’s most recent interventions in the wheat market is its withdrawal from the Black Sea Grain Initiative – an agreement between Russia, Ukraine, Turkey, and the United Nations (UN) during the Russian invasion of Ukraine on the Safe Transportation of Grain and Foodstuffs from Ukrainian ports. While Georgia doesn’t directly import wheat from Ukraine and isn’t immediately threatened by famine, Russia’s export policies regarding wheat have raised significant food security concerns in the country. Georgia heavily depends on wheat imports from Russia, with over 95 percent of its wheat historically being sourced from there. Despite Russia’s recurrent bans and restrictions on wheat exports every 2-3 years, Georgia is yet to successfully diversify its import sources.

The Georgian Wheat Market in Figures

Domestic Production

Historically, Georgia’s agricultural sector has struggled to achieve a large-scale and sufficient wheat production due to the prevalence of small-sized farms. However, over the past decade, Georgian domestic wheat production has shown significant growth (see Figure 1). This growth has been particularly sizeable in recent years, with production increasing by 32 and 53 percent in 2021 and 2022, respectively, as compared to 2020.

Figure 1. Wheat production in Georgia, 2014-2022.

Source: Geostat, 2024.

Such increase in local production positively contributes to the self-sufficiency ratio, which increased from 7 percent in 2014 to 22 percent in 2022, in turn implying higher food security levels.

Wheat Imports

Before the introduction of Russia’s floating tariff on wheat, wheat flour imports to Georgia were almost non-existent. However, after the floating tariff was imposed on wheat, imports of wheat flour increased more than 20 times – from 743 tons in January 2021 to 15,086 tons in May 2023 – peaking at 23,651 tons in August 2022 (see Figure 2). At the same time wheat imports declined by almost 60 percent, from 29,397 tons in January 2021 to 12,133 tons in May 2023, with the smallest import quantity being 2,743 tons in May 2022 (as depicted in Figure 2).

Figure 2. Georgian wheat and wheat flour imports, 2021-2023.

Source: Geostat, 2024. Note: Imports include meslin (a mixture of wheat and rye grains).

After the introduction of the temporary import duty on wheat flour in June 2023, wheat imports have picked up, although not reaching the levels seen in 2021. Similarly, wheat flour imports have declined while remaining at higher levels than in 2021. This indicates a change in Georgia’s wheat market dynamics. Historically, Georgia predominantly imported wheat; now it imports both wheat and wheat flour. This shift must be considered in future policy design, as it has implications for domestic wheat farmers and mills.

The continued wheat flour imports, despite the temporary import duty imposed by the Georgian Government can likely be attributed to a smaller price gap between wheat and wheat flour import prices (see Table 2).

Table 2. Average import prices of wheat and wheat flour in Georgia, 2021-2023.

Source: Geostat, 2024.

In 2021, prior to Russia’s introduction of a floating tariff on wheat, the import price of wheat flour in Georgia was 24 percent higher than the import price of wheat. After the introduction of the floating tariff, importing wheat became more expensive, and the import price gap between wheat flour and wheat decreased to 22 percent by the end of 2021. Subsequently, in 2022, this gap further narrowed, and by the first half of 2023, the import price of wheat flour was 5 percent lower than the import price of wheat. This significant decrease in the price gap resulted in nearly full substitution of wheat imports with wheat flour imports. After the introduction of the import duty on wheat flour and as international wheat prices declined, a marginal positive price gap has reappeared, amounting to just 1 percent. As it stands, importing wheat flour remains more advantageous than importing wheat.

Price Effects

Russia’s floating tariff on wheat led to increased bread and wheat flour prices in 2021-2022. In June 2022, bread prices experienced the most significant surge, increasing by 36 percent, while wheat flour prices reached their peak in September 2022 with a year-on-year increase of 41 percent (see Figure 3). The primary reason for this was the record increase in wheat prices, leading to a corresponding surge in wheat flour prices in 2022. This spike occurred as the world price of wheat reached its highest point in five years.

Figure 3. Annual change in bread and wheat flour prices, 2021-2023.

Source: Geostat, 2024.

Nevertheless, in 2023 bread and wheat flour prices decreased, indicating that the import duty on wheat flour did not lead to increased prices. This could partially be explained by the fact that mills pay farmers 0.5 GEL/kg, which is lower than agreed price of 0.7 GEL/kg. Another and more crucial factor is the decline in global wheat prices. They began their descent in June 2022 and have since maintained a downward trajectory. This decrease, combined with increased local production, has so far acted as a barrier to any new bread and wheat flour price increases.

The Way Forward

The question that must be addressed is whether the import duty on wheat flour imported from Russia should be extended.

The import duty may have contributed to increased local production as higher import duties can incentivize local businesses to invest in expanding their production capacity or improving their technology to meet an increased demand. It is however essential to note that the impact of import duties on local production varies depending on the level of domestic competition, the availability of inputs (high quality seed, fertilizer etc.), technological capabilities, and government policies beyond import duties (such as investment incentives, infrastructure development, and regulatory environment). Additionally, import duties can also lead to retaliatory measures from trading partners, affecting overall trade dynamics – potentially incurring unintended consequences. Therefore, while import duties can contribute to an increased local production under certain conditions, it is just one of many factors influencing production dynamics.

Secondly, as previously detailed, the import duty has so far not resulted in increased bread prices. However, the effect of an import tariff on retail prices depends on various factors, including elasticity of demand and supply, market, competitiveness, and the extent to which the tariff is passed on to consumers by importers and retailers. Since demand for bread is inelastic, one has to keep in mind that the importers and retailers can fully pass on the increased cost from an import tariff to consumers.

Given that the floating tariff and the import duty make wheat and wheat flour imports to Georgia more expensive, one should expect future bread price increases. This unless international wheat prices continue to decline and/or producers agree to reduce their profit margins or make supply chain changes. Therefore, an extension of the import duty might be a suitable solution in the short and medium-term, but it should not be seen as a permanent solution.

To limit the risks of food scarcity in Georgia in the long run, it is essential to design strategies helping the country to reduce its dependency on Russian wheat and wheat flour. Some measures to achieve this objective may include:

Further supporting local production. Encourage investment in domestic agriculture to increase the productivity and quality of wheat production in Georgia. This can be achieved through subsidies, incentives for modern farming techniques, and access to credit for farmers.

Improving the quality of local production. Currently, most of the domestically produced wheat is unsuitable for milling into wheat flour. A significant portion of domestically produced wheat is of poor quality and instead used for feeding livestock. It is essential to invest in research and development to improve the quality of domestically produced wheat. This includes developing wheat varieties that are resistant to diseases and better suited for local growing conditions.

Seeking alternative markets for import diversification. One alternative for Georgia may be to focus on the Kazakh and Ukrainian markets (once the war is over) and negotiate possible ways to decrease the cost of transporting wheat to Georgia with state and private sector representatives.

Reducing the Georgian dependence on Russian wheat imports requires a multifaceted approach that addresses various aspects of agricultural policy, trade diversification, and domestic production capacity.

References

Resonance daily. (2024). The Association of Wheat and Flour Producers of Georgia requests an extension of the import tax on imported flour. https://www.resonancedaily.com/index.php?id_rub=4&id_artc=197847

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

The Impact of Rising Gasoline Prices on Households in Sweden, Georgia, and Latvia – Is This Time Different?

Over the last two years, the world has experienced a global energy crisis, with surging oil, coal, and natural gas prices. For European households, this translates into higher gasoline and diesel prices at the pump as well as increased electricity and heating costs. The increase in energy related costs began in 2021, as the world economy struggled with supply chain disruptions caused by the Covid-19 pandemic, and intensified as Russia launched a full-scale invasion of Ukraine in late February 2022. In response, European governments have implemented a variety of energy tax cuts (Sgaravatti et al., 2023), with a particular focus on reducing the consumer cost of transport fuel. This policy paper aims to contextualize current transport fuel prices in Europe by addressing two related questions: Are households today paying more for gasoline and diesel than in the past? And should policymakers respond by changing transport fuel tax rates? The analysis will focus on case studies from Sweden, Georgia, and Latvia, countries that vary in economic development, energy independence, reliance on Russian oil, transport infrastructure, and transport fuel tax rates. Through this study, we aim to paint a nuanced picture of the implications of rising fuel prices on household budgets and provide policy guidance.

Record High Gasoline Prices, Historically Cheap to Drive

Sweden has a long history of using excise taxes on transport fuel as a means to raise revenue for the government and to correct for environmental externalities. As early as in 1924, Sweden introduced an energy tax on gasoline. Later, in 1991, this tax was complemented by a carbon tax levied on the carbon content of transport fuels. On top of this, Sweden extended the coverage of its value-added tax (VAT) to include transport fuels in 1990. The VAT rate of 25 percent is applied to all components of the consumer price of gasoline: the production cost, producer margin, and excise taxes (energy and carbon taxes).

In May 2022, the Swedish government reduced the tax rate on transport fuels by 1.80 SEK per liter (0.16 EUR). This reduction was unprecedented. Since 1960, there have only been three instances of nominal tax rate reductions on gasoline in Sweden, each by marginal amounts in the range of 0.04 to 0.22 SEK per liter. Prior to the tax cut, the combined rate of the energy and carbon tax was 6.82 SEK per liter of gasoline. Adding the VAT that is applied on these taxes, amounting to 1.71 SEK, yields a total excise tax component of 8.53 SEK. This amount is fixed in the short run and does not vary with oil price changes.

Figure 1. Gasoline Pump Price, 2000-2023.

Source: Drivkraft Sverige (2023).

Figure 1 shows the monthly average real price of gasoline in Sweden from January 2000 to October 2023. The price has slowly increased over the last 20 years and has been historically high in the last year and a half. Going back even further, the price is higher today than at any point since 1960. Swedish households have thus lately been paying more for one liter of gasoline than ever before.

However, a narrow focus on the price at the pump does not take into consideration other factors that affect the cost of personal transportation for households.

First, the average fuel efficiency of the vehicle fleet has improved over time. New vehicles sold in Sweden today can drive 50 percent further on one liter of gasoline compared to new vehicles sold in 2000. Arguably, what consumers care about the most is not the cost of gasoline per se but the cost of driving a certain distance, as the utility one derives from a car is the distance one can travel. Accounting for vehicles’ fuel efficiency improvement over time, we find that even though it is still comparatively expensive to drive today, the current price level no longer constitutes a historical peak. In fact, the cost of driving 100 km was as high, or higher, in the 2000-2008 period (see Figure 2).

Figure 2. Gasoline Expenditure per 100 km.

Source: Trafikverket (2023) and Drivkraft Sverige (2023).

Second, any discussion of the cost of personal transportation for households should also factor in changes in household income over time. The Swedish average real hourly wage has increased by more than thirty percent between 2000-2023. As such, the cost of driving 100 km, measured as a share of household income, has steadily declined over time. Further, this pattern is consistent across the income distribution; for instance, the cost trajectory for the bottom decile is similar to that of all wage earners (as illustrated in Figure 3). In 1991, when the carbon tax was implemented, the average household had to spend around two thirds of an hour’s wage to drive 100 km. By 2020, that same household only had to spend one third of an hour’s wage to drive the same distance. There has been an increase in the cost of driving over the last two years, but in relation to income, it is still cheaper today to drive a certain distance compared to any year before 2013.

Figure 3. Cost of Driving as a Share of Income, 1991-2023.

Source: Statistics Sweden (2023).

Source: Statistics Sweden (2023).

Taken all together, we see that on the expenditure side, vehicles use fuel more efficiently over time and on the income side, households earn higher wages. Based on this, we can conclude that the cost of travelling a certain distance by car is not historically high today.

Response From Policymakers

It is, however, of little comfort for households to know that it was more expensive to drive their car – as a share of income – 10 or 20 years ago. We argue that what ultimately matters for households is the short run change in cost, and the speed of this change. If the cost rises too fast, households cannot adjust their expenditure pattern quickly enough and thus feel that the price increase is unaffordable. In fact, the change in the gasoline price at the pump has been unusually rapid over the last two years. Since the beginning of 2021, until the peak in June 2022, the (nominal) pump price rose by around 60 percent.

So, should policymakers respond to the rapid price increase by lowering gasoline taxes? The perhaps surprising answer is that lowering existing gasoline tax rates would be counter-productive in the medium and long run. Since excise taxes are fixed and do not vary with the oil price, they reduce the volatility of the pump price by cushioning fluctuations in the market price of crude oil. The total excise tax component including VAT constitutes more than half of the pump price in Sweden, a level that is similar across most European countries. This stands in stark contrast with the US, where excise taxes make up around 15 percent of the consumer price of gasoline. As a consequence, a doubling of the price of crude oil only increases the consumer price of gasoline in Sweden by around 35 percent, while it increases by about 80 percent in the US. Households across Sweden, Europe, and the US have adapted to the different levels of gasoline tax rates by purchasing vehicles with different levels of fuel efficiency. New light-duty vehicles sold in Europe are on average 45 percent more fuel-efficient compared to the same vehicle category sold in the US (IEA 2021). As such, US households do not necessarily benefit from lower gasoline taxation in terms of household expenditure on transport fuel. They are also more vulnerable to rapid increases in the price of crude oil. Having high gasoline tax rates thus reduces – rather than increases – the short run welfare impact on households. Hence, policymakers should resist the temptation to lower gasoline tax rates during the current energy crisis. With imposed tax cuts, households will, in the medium and long run, buy vehicles with higher fuel consumption and thus become more exposed to price surges in the future – again compelling policymakers to adjust tax rates, creating a downward spiral. Instead, alternative measures should be considered to alleviate the effects of the heavy price pressure on low-income households – for instance, revenue recycling of the carbon tax revenue and increased subsidies of public transport.

Conclusion

To reach environmental and climate goals, Sweden urgently needs to phase out the use of fossil fuels in the transport sector – Sweden’s largest source of carbon dioxide emissions. This is exactly what a gradual increase of the tax rate on gasoline and diesel would achieve. At the same time, it would benefit consumers by shielding them from the adverse effects of future oil price volatility.

The most common response from policymakers regarding fuel tax rates however goes in the opposite direction. In Sweden, the excise tax on gasoline and diesel was reduced by 1.80 SEK per liter in 2022 and the current government plans to further reduce the price by easing the biofuel mandate. Similar tax cuts have been implemented in a range of European countries. Therefore, the distinguishing factor in the current situation lies in the exceptional responses from policymakers, rather than in the gasoline costs that households are encountering.

Gasoline Price Swings and Their Consequences for Georgian Consumers

The energy crisis that begun in 2021 has also made its mark on Georgia, where the operational expenses of personal vehicles, encompassing not only gasoline costs but also maintenance expenses, account for more than 8 percent of the consumer price index. The rise in gasoline prices sparked public protest and certain opposition parties proposed an excise tax cut to mitigate the gasoline price surge. In Georgia, gasoline taxes include excise taxes and VAT. Until January 1, 2017, the excise tax was 250 GEL per ton (9 cents/liter), it has since increased to 500 GEL (18 cents/liter). Despite protests and the suggested excise tax reduction, the Georgian government chose not to implement any tax cuts. Instead, it initiated consultations with major oil importers to explore potential avenues for reducing the overall prices. Following this, the Georgian National Competition Agency (GNCA) launched an inquiry into the fuel market for motor vehicles, concluding a manipulation of retail prices for gasoline existed (Georgian National Competition Agency, 2023).

The objective of this part of the policy paper is to address two interconnected questions. Firstly, are Georgian households affected by gasoline price increases? And secondly, if they are, is there a need for government intervention to mitigate the negative impact on household budgets caused by the rise in gasoline prices?

The Gasoline Market in Georgia

Georgia’s heavy reliance on gasoline imports is a notable aspect of the country’s energy landscape. The country satisfies 100 percent of its gasoline needs with imports and 99 percent of the fuel imported is earmarked for the road vehicle transport sector. Although Georgia sources its gasoline from a diverse group of countries, with nearly twenty nations contributing to its annual gasoline imports, the supply predominantly originates from a select few markets: Bulgaria, Romania, and Russia. In the last decade, these markets have almost yearly accounted for over 80 percent of Georgia’s total gasoline imports. Furthermore, Russia’s share has substantially increased in recent years, amounting to almost 75 percent of all gasoline imports in 2023. The primary reason behind Russia’s increased dominance in Georgia’s gasoline imports is the competitive pricing of Russian gasoline, which between January and August in 2023 was almost 50 percent cheaper than Bulgarian gasoline and 35 percent cheaper than Romanian gasoline (National Statistics Office of Georgia, 2023). Given the dominance of Russian gasoline in Georgia, the end-user (retail) prices of gasoline in Georgia, are closer to gasoline prices in Russia than EU gasoline prices (see Figure 1).

Figure 1. End-user Gasoline Prices in Georgia, Russia and the EU, 2013-2022.

Source: International Energy Agency, 2023.

However, while the gasoline prices increased steadily in 2020-2022 in Russia, gasoline prices in Georgia increased sharply in the same period. This more closely replicated the EU price dynamics rather than the Russian one. The sharp price increase in gasoline raised concerns from the Georgian National Competition Agency (GNCA). According to the GNCA one possible reason behind the sharp increase in gasoline prices in Georgia could be anti-competitive behaviour among the five major companies within the gasoline market. Accordingly, the GNCA investigated the behaviour of major market players during the first eight months of 2022, finding violations of the Competition Law of Georgia. Although the companies had imported and were offering consumers different and significantly cheaper transport fuels compared to fuels of European origin, their retail pricing policies were identical and the differences in product costs were not properly reflected in the retail price level. GNCA claims the market players coordinated their actions, which could have led to increased gasoline prices in Georgia (National Competition Agency of Georgia. (2023).

Given that increased gasoline prices might lead to increased household expenditures for fuel, it is important to assess the potential impact of recent price developments on household’s budgets.

Exploring Gasoline Price Impacts

Using data from the Georgian Households Incomes and Expenditures Survey (National Statistics Office of Georgia, 2023), weekly household expenditures on gasoline and corresponding weekly incomes were computed. To evaluate the potential impact of rising gasoline prices on households, the ratio of household expenditures on gasoline to household income was used. The ratios were calculated for all households, grouped in three income groups (the bottom 10 percent, the top 10 percent and those in between), over the past decade (see Figure 2).

Figure 2. Expenditure on Gasoline as Share of Income for Different Income Groups in Georgia, 2013-2022.

Source: National Statistics Office of Georgia, 2023.

Figure 2 shows that between 2013 and 2022, average households allocated 9-14 percent of their weekly income to gasoline purchases. There is no discernible increase in the ratio following the energy crisis in 2021-2022.

Considering the different income groups, the upper 10 percent income group experienced a slightly greater impact from the recent rise in gasoline prices (the ratio increased), compared to the overall population. For the lower income group, which experienced a rise in the proportion of fuel costs relative to total income from 2016 to 2021, the rate declined between 2021 and 2022. Despite the decline in the ratio for the lower-level income group, it is noteworthy that the share of gasoline expenditure in the household budget has consistently been high throughout the decade, compared to the overall population and the higher-level income group.

The slightly greater impact from the rise in gasoline prices for the upper 10 percent income group is driven by a 4 percent increase in nominal disposable income, paired with an 8 percent decline in the quantity of gasoline (Figure 3) in response to the 22 percent gasoline price increase. Clearly, for this income group, the increase in disposable income was not enough to offset the increase in the price of gasoline, increasing the ratio as indicated above.

For the lower 10 percent income group, there was a 23 percent increase in nominal disposable income, paired with a 9 percent decline in the quantity of purchased gasoline (Figure 3) in response to the 22 percent gasoline price increase . Thus, for this group, the increase in disposable income weakened the potential negative impact of increased prices, eventually lowering the ratio.

Figure 3. Average Gasoline Quantities Purchased, by Household Groups, per Week (In Liters) 2013-2022.

Source: National Statistics Office of Georgia, 2023.

Conclusion