Location: Poland

Liberal Democracy in Transition – The First 30 Years

This year marks 30 years since the first post-communist election in Poland and the fall of the Berlin Wall. Key events that started a dramatic transition process from totalitarian regimes towards liberal democracy in many countries. This brief presents stylized facts from this process together with some thoughts on how to get this process back on a positive track. In general, the transition countries that joined the EU are still far ahead of the other transition countries in terms of democratic development.

The recent decline in democratic indicators in some EU countries should be taken seriously as they involve reducing freedom of expression and removing constraints on the executive, but should also be discussed in light of the significant progress transition countries entering the EU have shown during the first 30 years of transition. The brief shows that changes in a democracy can happen fast and most often happen around elections, so getting voters engaged in the democratic process is crucially important. This requires politicians that engage the electorate and have an interest in preserving democratic institutions. An important question in the region is what the EU can do to promote this, given its overloaded political agenda. Perhaps it is time for a Greta for democracy to wake up the young and shake up the old.

This brief provides an overview of political developments in transition countries since the first post-communist elections in Poland and the fall of the Berlin Wall 30 years ago. It focuses on establishing stylized facts based on quantitative indices of democracy for a large set of transition countries rather than providing in-depth studies of a small number of countries. The aim of the brief is thus to find common patterns across countries that can inform today’s policy discussion on democracy in the region and inspire future studies of the forces driving democracy in individual transition countries.

The first issue to address is what data to use to establish stylized facts of democratic development in the region. By now, there are several interesting indicators that describe various aspects of democratic development, which are produced by different organizations, academic institutions and private data providers. In this brief, three commonly used and well-respected data providers will be compared in the initial section before we zoom in on more specific factors that make up one of these indices.

The big picture

The three indicators that we look at first are: political rights produced by Freedom House; polity 2 produced by the Polity IV project; and the liberal democracy index produced by the V-Dem project. Figures 1-3 show the unweighted average of these indicators for two groups of countries. The EU10 are the transition countries that became EU members in 2004 and 2007 and include Bulgaria, the Czech Republic, Estonia, Hungary, Lithuania, Latvia, Poland, Romania, Slovakia, and Slovenia. The second group, FSU12, are the 12 countries that came out of the Soviet Union minus the three Baltic countries in the EU10 group, so the FSU12 group consists of Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine, and Uzbekistan.

Figure 1. Freedom House

Source: Freedom House and author’s calculations

Note: Scale inverted, 1 is best and 7 worst score

Figure 2. Polity IV project

Source: Polity IV project and author’s calculations

Note: Scale from -10 (fully autocratic) to 10 (fully democratic)

Figure 3. V-Dem

Source: V-Dem project and author’s calculations

Note: Scale from 0 to 1 where higher is more democratic

All three indicators convey the message that the democratic transformation in the EU10 group was very rapid in the early years of transition and the indicators have remained at high levels since the mid-90s only to show some decline in the most recent years for two of the three indicators. The FSU12 set of countries have made much less progress in terms of democratic development and remain far behind the EU10 countries in this regard. Overall, there is little evidence at the aggregate level that the democratic gap between the EU10 and FSU12 groups is closing. While the average EU10 country is more or less a full-fledged democracy, the average FSU12 country is at the lower end of the spectrum for all three democracy measures.

The average indicators in Figures 1-3 obviously hide some interesting developments in individual countries and in the following analysis, we will take a closer look at the liberal democracy index at the country level. We will then investigate what sub-indices contribute to changes in the aggregate index in the countries that have experienced significant declines in their liberal democracy scores.

For the first part of the analysis, it is useful to break down the democratic development in two phases. The first phase is from the onset of transition (1989, 1991 or 1993 depending on the specific country) to the time of the global financial crisis in 2009 and the second phase is from 2009 to 2018 (the last data point).

Figure 4. Liberal democracy, the first phase

Source: V-Dem project and author’s calculations

Figures 4 and 5 compare how the liberal democracy indicator changes from the first year of the period (measured on the horizontal axis) to the last year of the period (on the vertical axis). The smaller blue dots are the individual countries that make up the EU10 group while the red dots are the FSU12 countries. The 45-degree line indicates when there is no change between start and end years, while observations that lie below (above) the line indicate a deterioration (improvement) of the liberal democracy index in a specific country.

In the first phase of transition (Figure 4), all of the EU10 countries increased their liberal democracy scores and the average increase for the group was almost 0.5, going from 0.26 to 0.74. This was a result of many of the countries in the group making significant improvements without any countries deteriorating. The FSU12 group had a very different development with the average not changing at all since the few countries that improved (Georgia and Ukraine) were counterbalanced by a significant decline in Belarus and a more modest decline in Armenia.

Figure 5. Liberal democracy, the second phase

Source: V-Dem project and author’s calculations

The very rapid improvement in the liberal democracy index in the EU10 countries in the first phase of transition came to a halt and also reversed in several countries in the second phase of transition. Of course, as they had improved so much in the first period, there was less room for further positive developments, but the rapid decline in some of the countries was still negative news. However, it does point towards that reform momentum was very strong in the EU accession process, but once a country had entered the union, the pressure for liberal democratic reforms has faded.

Overall, the EU10 average fell by 0.1 from 2009 to 2018. This was a result of declining scores in several countries. The particularly large declines in this period have been seen in Hungary (-0.28), Poland (-0.27), Bulgaria (-0.14), the Czech Republic (-0.14), and Romania (-0.12). Again, the average FSU12 score did not change much, although Ukraine (-0.2) put its early success in reverse and lost as much in this period as it had gained earlier.

Country developments

Since much of the current discussion centers on how democracy is being under attack, the figures name the countries that have seen significant declines in the liberal democracy score in the first or second phase of transition. Figures 6 and 7 show the time-series of the liberal democracy index in the countries with significant drops at some stage of the transition process.

Figure 6. FSU12 decliners

Source: V-Dem project and author’s calculations

In many countries, the drop comes suddenly and sharply, with the first and most prominent example being Belarus. There, it only took three years to go from one of the highest ranked FSU12 countries to fall to one of the lowest liberal democracy scores. In Poland, Romania, Bulgaria and Armenia, the process was also very rapid and significant changes happened in 2-3 years.

Figure 7. EU10 decliners

Source: V-Dem project and author’s calculations

In the Czech Republic and Hungary, the period of decline was much longer and in the case of Hungary, the drop was the most significant in the EU10 group. Ukraine stands out as more of an exception with a roller-coaster development in its liberal democracy score that first took it up the list and then back down to where it started. For those familiar with politics in these countries, it is easy to identify the elections and change in government that have occurred at the times the index has started to fall in all of these countries. In other words, the democratic declines have not started with coups but followed election outcomes where in most cases the incumbent leaders have been replaced by a new person or party.

How democracy came under attack

We will now take a closer look at what has been behind the instances of decline in the aggregate index by investigating how the sub-indices have developed in these countries. The sub-indices that build up the liberal democracy index are: freedom of expression and alternative sources of information; freedom of association; share of population with suffrage; clean elections; elected officials; equality before the law and individual liberty; judicial constraints on the executive; and legislative constraints on the executive (the structure is a bit more complex with mid-level indices, see V-Dem 2019a).

Table 1 shows how these indicators have changed in the time period the liberal democracy indicator has fallen significantly (with shorter versions of the longer names listed above but in the same order). The heat map of decline indicated by the different colours is constructed such that positive changes are marked with green, smaller declines are without colour, declines greater that 0.1 but smaller than 0.2 are in yellow and larger declines in red. Note that the liberal democracy index is not an average of the sub-indices but based on a more sophisticated aggregation technique (see V-Dem 2019b). Therefore, the Czech Republic and Bulgaria can have a greater fall in top-level liberal democracy index that what is indicated by the sub-indices.

Table 1. Changes in liberal democracy indicators at times of democratic decline

Source: V-Dem project and author’s calculations

For the countries with the largest changes in the liberal democracy index, it is clear that both freedom of expression and alternative sources of information have come under attack together with reduced judicial and legislative constraints on the executive. Among the EU10 countries, Hungary and Poland stand out in terms of reducing freedom of expression, while Romania has seen most of the decline coming from reducing constraints on the executive. Not surprisingly, Belarus stands out in terms of the overall decline in liberal democracy coming from reducing both freedom of expression and constraints on the executive in the most significant way.

On a more general level, the attack on democracy does differ between the countries, but in the cases where serious declines can be seen, the attack has been particularly focused on information aspects and constraints on the executive. At the same time, all countries let all people vote (suffrage always at 1) and let the one with the most votes get the job (elected officials).

Policy conclusions

This brief has provided some stylized facts on the first 30 years of liberal democracy in transition and some details on how democracy has come under attack in individual countries. It leaves open many questions that require further studies and some of these are indeed ongoing in this project and will be presented in future briefs and policy papers here.

Some observations have already been made here that can inform policy discussions on liberal democratic developments in the region. The first is that changes can happen very rapidly, both in terms of improvements but also in terms of dismantling important democratic institutions, including those that provide constraints on the executive or media that provides unbiased coverage before and after elections. What is also noteworthy is that these changes have almost always happened after an election where a new person or party has come to power, so the democratic system is used to introduce less democracy in this sense.

It is also interesting that in all of the countries, the most easily observed indicators of democracy such as suffrage and having the chief executive or legislature being appointed by elections are given the highest possible scores. In other words, even the most autocratic regime wants to look like a democracy; but as the old saying goes, “it is not who votes that is important, it is who counts”.

The regime changes at election times that have led to declining liberal democracy scores have also in many cases come as a result of the incumbents not doing a great job or voters not turning up to vote. It was enough for Lukashenko in Belarus to promise to deal with corruption and rampant inflation that was a result of the old guard’s mismanagement to turn Belarus into an autocracy. In Hungary, the change of regime came after the Socialist leader was caught on tape saying he had been lying to voters. While in Romania, only 39% voted in the 2016 election. And in Bulgaria, around half of the voters stayed at home in the presidential election the same year.

In sum, both incompetent and corrupt past leaders and disengaged or disillusioned voters are part of the decline in a liberal democracy that we have seen in recent years. It is clearly time for policy makers that are interested in preserving liberal democracy in the region and elsewhere to think hard about how democracy can be saved from illiberal democrats. Part of the answer clearly will have to do with how voters can be engaged in the democratic process and take part in elections. It also involves defending free independent media and the thinkers and doers that contribute to the liberal democracy that we cherish. The question is if the young generation will find a Greta for democracy that can kick-start a new transition to liberal democracy in the region and around the world.

For those readers that want to participate more actively in this discussion and have a chance to be in Stockholm on November 12, SITE is organizing a conference on this theme which is open to the public. For more information on the conference, please visit SITE’s website (see here).

References

- Freedom house data downloaded on Oct 4, 2019, from https://freedomhouse.org/content/freedom-world-data-and-resources

- Freedom house methodological note available at https://freedomhouse.org/report/methodology-freedom-world-2018

- Polity IV project data downloaded on Oct 4, 2019, from http://www.systemicpeace.org/inscrdata.html

- Polity IV project manual available at http://www.systemicpeace.org/inscr/p4manualv2018.pdf

- V-Dem project data downloaded on Sept 24, 2019, from https://www.v-dem.net/en/data/data-version-9/

- Coppedge, Michael, John Gerring, Carl Henrik Knutsen, Staffan I. Lindberg, Jan Teorell, David Altman, Michael Bernhard, M. Steven Fish, Adam Glynn, Allen Hicken, Anna Lührmann, Kyle L. Marquardt, Kelly McMann, Pamela Paxton, Daniel Pemstein, Brigitte Seim, Rachel Sigman, Svend-Erik Skaaning, Jeffrey Staton, Steven Wilson, Agnes Cornell, Lisa Gastaldi, Haakon Gjerløw, Nina Ilchenko, Joshua Krusell, Laura Maxwell, Valeriya Mechkova, Juraj Medzihorsky, Josefine Pernes, Johannes von Römer, Natalia Stepanova, Aksel Sundström, Eitan Tzelgov, Yi-ting Wang, Tore Wig, and Daniel Ziblatt. 2019a. “V-Dem [Country-Year/Country-Date] Dataset v9”, Varieties of Democracy (V-Dem)

- Pemstein, Daniel, Kyle L. Marquardt, Eitan Tzelgov, Yi-ting Wang, Juraj Medzihorsky, Joshua Krusell, Farhad Miri, and Johannes von Römer. 2019b. “The V-Dem Measurement Model: Latent Variable Analysis for Cross-National and Cross-Temporal Expert-Coded Data”, V-Dem Working Paper No. 21. 4th edition. University of Gothenburg: Varieties of Democracy Institute.

The Polish 1999 Administrative Reform and Its Implications for Inclusive Regional Development

On 1 January 1999, four major reforms took effect in Poland in the areas of health, education, pensions and local administration. After 20 years, only in the last case does the original structural design remain essentially unchanged. We examine the implications of this reform from the perspective of the distance of municipalities from their regional administrative capitals. We show that despite fears of negative consequences for municipalities which ended up on the periphery with respect to their post-reform administrative centres, the reform did not result in slower socio-economic development in these regions. We argue that regional inclusiveness in the process of development is likely to be an important factor behind the stability of Poland’s administrative design.

Introduction

Four major reforms took effect on 1 January 1999 in Poland, substantially changing the structure of healthcare, education, the pension system and local government administration. The extent of the changes and the fact that all four reforms were implemented on the same day could in fact be considered as representing a symbolic final step of the Polish socio-economic transition which had started nearly ten years earlier. However, in 2019, twenty years after the reforms took effect, the originally introduced structural design remains unchanged in only one of the four areas – local government.

In a recent paper (Myck and Najsztub, 2019) we take a close look at the implications of the 1999 administrative reform treating it as a form of a “natural experiment” and analysing its consequences for socio-economic development dynamics in municipalities, which ended up on the periphery with respect to their post-reform administrative capitals. Using a broad set of indicators we find that the reform did not have significant negative consequences for these municipalities and ensured inclusive development at the regional level. This might be an important factor which has determined the longevity of the administrative design implemented in 1999.

The local administrative design in Poland before and after 1999

Major administrative reforms are relatively infrequent, which makes the scope and scale of the one implemented in Poland on 1 January 1999 a rather unique point of reference for analysis of potential implications of administrative restructuring. The reform went far beyond the administrative rearrangement of local government, as it was the culmination of a process that reintroduced local autonomy to the Polish political system.

The goal of the reform was to further decentralise political power and increase public finance transparency. The middle tier of local government – the counties (powiats) – was reintroduced as a body responsible for the administration of institutions beyond the scope of a single municipality (e.g. hospitals, secondary schools, public roads, unemployment). At the same time the number of top tier administrative regions – the voivodeships – was reduced from 49 to 16, and their responsibilities were focused on overall regional development, higher education, regional infrastructure and the prospective management of EU funds. In the end, the reform resulted in the formation of 16 voivodeships, 308 counties, 66 towns with county status and 2478 municipalities. This administrative division of Poland has been in place, with minor modifications, since 1 January 1999 (for details and comments, see Blazyca et al. (2002), Regulski (2003) and Swianiewicz (2010)).

The reform implied the loss of regional administrative capital status for 31 cities (administration in two voivodeships, Lubuskie and Kujawsko-Pomorskie, is split between two capitals), and for nearly 60% of municipalities it resulted in an increase in the distance to their regional administrative centre compared with the pre-reform arrangement. These features of the reform are illustrated in Figure 1. Cities marked in blue used to be administrative capitals before 1999, while those marked in red maintained their status after the reform. The blue rays show the distance of municipalities from their respective administrative capitals before 1999, with the post-1999 distances marked in red. In the case of the two new voivodeships where two cities received capital status (Lubuskie and Kujawsko-Pomorskie), we measure the distance to the city that became the site of the regional government (sejmik wojewódzki), which is the key institution responsible for regional development.

Figure 1. Administrative arrangements in Poland before and after the 1999 administrative reform: voivodeships, capitals and distance from municipalities to regional administrative centres.

Notes: Blue rays show the distance of municipalities to their respective administrative capitals before 1999; the post-1999 distances to regional administrative centres is marked in red. Distances (in straight lines) between centroids of municipalities.

Source: BDL, own calculations.

Identifying implications of the reform for regional capitals and peripheral municipalities

An important concern related to the introduction of the reform was first, its consequences for the voivodeship capitals which lost this status due to the reduced number of top-tier regions. Secondly, at the level of municipalities, the question was whether the redesign of the administrative network would result in any negative changes of development dynamics in municipalities, which as a result of the reform landed on the periphery with respect to the new voivodeship capitals. In Myck and Najsztub (2019) we consider both of these concerns looking at a number of indicators of socio-economic developments, including population dynamics, local government finances as well as the intensity of nighttime lights measured by satellites, which has recently been treated in the literature as an overall proxy for economic development (Henderson et al., 2012; Pinkovskiy and Sala-i-Martin, 2016). We look at each of these problems using the difference-in-differences approach. In the first instance we compare the developments before and after the reform for voivodeship capitals, which maintained the status and those which did not, and in the latter we look at municipalities for which the distance to their administrative capital increased relative to those for which it remained unchanged or fell.

In the case of voivodeship capitals, due to the obvious differences between the two groups of pre-1999 capitals which in the end determined their post-reform status, our estimates can only be treated as descriptive. In the second case though, since municipalities had little choice with regard to their assignment to the new voivodeships, the results can safely be interpreted as causal. To address the differences between the two groups of municipalities, we apply the entropy balancing method of matching to ensure pre-reform uniformity in the distribution of the analysed municipality characteristics (Hainmueller, 2012; Adda et al., 2014). A summary of the results of both sets of estimations is presented in Table 1 where we show the difference-in-differences coefficients for six socio-demographic outcomes. The estimation period covers the years 1995-2012.

As we can see in Table 1 the only consistently negative and significant coefficient which we find in the two main specifications concerns net migration. Other than that, the results seem to go against the initial concerns with positive coefficients on own revenues, which are statistically significant in the case of the voivodeship capitals, though not in the case of peripheral municipalities. Results for the intensity of nighttime lights are negative in both cases but are not statistically significant. Particularly in the case of peripheral municipalities – where as we argued we can treat the results as causal – we find no evidence of major negative implications of the reform for socio-economic dynamics. This result, as we show in Myck and Najsztub (2019) is confirmed in a number of robustness tests.

Table 1. Diff-in-diff regression estimates for voivodeship capitals and municipalities

| Outcome | Voivodeship capitals: effect of loss of regional capital status | Municipalities: increased distance to administrative capitals | ||||

| Coeff. | t-stat. | Signif. | Coeff. | t-stat. | Signif. | |

| Population | ||||||

| Births, log | -0.139 | (-5.718) | *** | -0.000 | (-0.027) | |

| Deaths, log | 0.020 | (1.339) | 0.002 | (0.160) | ||

| Net migration, pers. | -1.902 | (-2.906) | ** | -12.579 | (-2.372) | * |

| Finances | ||||||

| Own revenues, p.c. log | 0.076 | (1.872) | + | 0.024 | (1.028) | |

| Own non-capital revenues, p.c. log | 0.136 | (2.307) | * | 0.033 | (1.246) | |

| Economic indicators | ||||||

| Total lights, p.c. log | -0.028 | (-1.396) | -0.002 | (-0.049) | ||

| Number of observations: | 882 | 43218 | ||||

Note: + p < 0.10, * p < 0.05, ** p < 0.01, *** p < 0.001; standard errors clustered at the municipality level. Monetary values in real 2005 PLN terms. Values in log in cases where the dependent variable is log-normally distributed. Per capita estimations (p.c.) weighted by population size. All estimations include capital/municipality and time fixed effects.

Source: Authors’ calculations using data from the Local Data Bank (Bank Danych Lokalnych, BDL; data on population and finances) provided by the Polish Central Statistical Office (GUS) and nighttime lights data provided by the National Oceanic and Atmospheric Administration (NOAA) (Elvidge et al., 2009; National Geophysical Data Center (NGDC), 2010). Data for years 1995-2012.

The socio-economic development in central and peripheral municipalities with respect to the new voivodeship capitals seems therefore to be unaffected by the reform. Importantly also, despite concerns about the marginalization of the cities which lost the voivodeship capital status in 1999, their socio-economic performance has not been much worse compared to those which remained capitals and received greater administrative responsibilities and budgets to manage. From this point of view, the stability of the structure of Poland’s local government and the longevity of the administrative design implemented in 1999 should not be surprising. The claims of the need to change the Polish administrative design and promises of changes resurface at each parliamentary election. These promises have so far been left unmet and inclusivity of socio-economic development at the regional level that followed the reform is likely to be an important factor behind this.

Acknowledgements

The authors gratefully acknowledge the support of the Polish National Science Centre through project no. 2016/21/B/HS4/01574. For the full list of acknowledgments see Myck and Najsztub (2019).

References

- Adda, Jérôme, McConnell, Brendon, Rasul, Imran, 2014. Crime and the depenalization of cannabis possession: evidence from a policing experiment. Journal of Political Economy 122, 1130-1202. doi:10.1086/676932

- Blazyca, G., Heffner, K., & Helińska-Hughes, E. (2002). Poland – Can Regional Policy Meet the Challenge of Regional Problems? European Urban and Regional Studies, 9(3), 263–276. doi:10.1177/096977640200900305

- Elvidge, Christopher D., Ziskin, Daniel, Baugh, Kimberley E., Tuttle, Benjamin T., Ghosh, Tilottama, Pack, Dee W., Erwin, Edward H., Zhizhin, Mikhail, 2009. A fifteen year record of global natural gas flaring derived from satellite data. Energies 2, 595-622. doi:10.3390/en20300595

- Hainmueller, Jens, 2012. Entropy balancing for causal effects: a multivariate reweighting method to produce balanced samples in observational studies. Political Analysis 20, 25-46. doi:10.1093/pan/mpr025

- Henderson, J. Vernon, Storeygard, Adam, Weil, David N., 2012. Measuring economic growth from outer space. American Economic Review 102, 994-1028. doi:10.1257/aer.102.2.994

- Myck, M. and Najsztub, M., 2019. Implications of the Polish 1999 administrative reform for regional socio-economic development. CenEA Working Paper 1/2019.

- National Geophysical Data Center (NGDC), 2010. Version 4 DMSP-OLS night-time lights time series. https://ngdc.noaa.gov/eog/dmsp/downloadV4composites.html. Accessed 15 June 2015.

- Pinkovskiy, Maxim, Sala-i-Martin, Xavier, 2016. Lights, camera … income! Illuminating the national accounts–household surveys debate. The Quarterly Journal of Economics 131, 579-631. doi:10.1093/qje/qjw003

- Regulski, Jerzy, 2003. Local Government Reform in Poland: An Insider’s Story. Local Government and Public Service Reform Initiative, Budapest.

- Swianiewicz, Paweł, 2010. If territorial fragmentation is a problem, is amalgamation a solution? An East European perspective. Local Government Studies 36, 183-203. doi:10.1080/03003930903560547

Disclaimer: Opinions expressed in policy briefs and other publications are those of the authors; they do not necessarily reflect those of the FREE Network and its research institutes.

Unemployment in Transition and Its Long-Term Consequences

We examine the relationship between the experience of unemployment in the early years of the socio-economic transition in Poland and a number of wellbeing measures about two decades later. The analysis takes advantage of the rich content of data from the Survey of Health, Ageing and Retirement in Europe (SHARE) by matching retrospective information on labour market experiences with outcomes observed in the survey after year 2006. While there is a strong correlation between unemployment and general wellbeing measures such as life satisfaction, depression and subjective assessment of material conditions, the relationship cannot be interpreted as causal. On the other hand, we find that unemployment in the early years of the transition has strong, negative, long-term consequences for income and house ownership. The analysis sheds light on the implications of unemployment and on the nature of job losses in the follow-up of the Polish ‘shock-therapy’.

Introduction

Next year, the countries of Central and Eastern Europe will celebrate the 30th anniversary of the political breakthrough and the beginning of a major socio-economic transformation which followed. In the Polish case, the ‘shock therapy’ approach to the reform process implemented by the Mazowiecki government, though not without faults, has generally been viewed as the origin of the country’s economic success story. Afterwards, Poland experienced nearly three decades of uninterrupted economic growth and the Polish GDP returned to its pre-reform level already in 1995.

However, discussions of negative implications of the reform package still fuel the academic discourse as well as the political debate. While the majority of the population managed to avoid significant economic difficulties, many families experienced the painful hardship of the transition period in the form of job losses, poverty and exclusion. Given the scale of the socio-economic change, surprisingly little is known about the long-term consequences of individual experiences at that time. In particular, it is unclear if the negative outcomes observed many years after the reforms started can be causally linked to individual experiences in the early 1990s.

This lack of evidence is not unique for Poland and is largely due to unavailability of good individual-level data spanning the time before and after the collapse of communism. Since the transition cannot be lived through again, we shall never know how socio-economic conditions would have looked like under numerous alternative reform scenarios. However, as we show in a recent paper (Myck & Oczkowska, 2018), much can be learnt from the combination of contemporary and retrospective information on the nature of labour market histories during the transition and their relationship to outcomes recorded many years later.

The analysis presented in Myck and Oczkowska (2018) relies on the treatment of the systemic changes in the early 1990s as a major exogenous shock and on differentiating between reasons behind individual experiences of unemployment. We demonstrate that the observed strong correlation between unemployment in the initial years of the transition and a number of subjective wellbeing measures in later life is endogenous, and may reflect unobservable individual characteristics. It seems plausible to argue that these characteristics were the reasons behind the recorded job losses once the economy was liberalised and firms could fire their least productive employees.

Work histories in the SHARE dataset

The analysis is based on individual-level data from the Polish part of the Survey of Health, Ageing and Retirement in Europe (SHARE). SHARE is a multidisciplinary biennial panel survey focusing on individuals aged 50 years and over. Since the start of the project in year 2004 seven waves of data have been collected, and the survey was conducted in Poland in waves 2, 3, 4, 6 and 7. While the standard waves of the survey focus on contemporary conditions of respondents such as health, economic conditions, labour market activity and social networks, in wave 3 (the so-called SHARE-Life), participants were asked about their life histories including their family history, mobility and labour market experiences. The detailed labour market histories recorded in SHARE-Life allow us to identify transition-related job losses, which can be matched with current information on several measures of material conditions and wellbeing for the same individuals.

In Figure 1 we present labour market profiles since 1988 of those in the sample who were working prior to the start of the reform process.

Figure 1. Labour market status 1988 – 2008 conditional on working in 1988 in Poland

Source: Myck and Oczkowska, 2018.

The figure shows that along with rapidly increasing unemployment rates, the degree of inactivity of the Polish population grew substantially in the two decades following the transition. This data confirms that in the follow-up of the ‘shock-therapy’ reforms many individuals faced unemployment, while others, especially among older groups of employees, used several other labour market exit options, such as retirement or disability.

Analysing long-term consequences of economic shocks

To examine the role of unemployment experiences in the initial years of the transition for outcomes observed a few decades later, we use data from waves 2, 3 and 4 of the SHARE study. The analysis focuses on two groups of later-life outcomes – objective measures of material conditions such as household income, real assets and house ownership, and subjective indicators of wellbeing such as life satisfaction, depression or reporting difficulties in making ends meet.

We are able to control for an extensive set of individual characteristics which are usually unobservable to the researcher, through a complex set of background variables available in SHARE. These include respondents’ childhood conditions, parental background as well as health and labour market experience prior to 1988. With regard to the experience of unemployment we differentiate the instances of unemployment between the initial (1989-1991) and later (1992-1995) period of the transition to examine the potential differential implications of the rapid pace of the reforms in the early 1990s. Most importantly though, the data allows us to distinguish between different reasons behind job losses and we can separately examine the relationship with plant/office closures and other reasons for unemployment. Following other examples in the literature (Farber, 2011; Jacobson et al., 1993), we argue that plant closures can be treated as reasons for exogenous job separations. This in turn allows us on the one hand, to give a causal interpretation to the estimated coefficients, and on the other, to interpret those on other reasons for unemployment in the light of the causal relations.

Effects of unemployment experience on later-life outcomes

We find that experiencing unemployment due to plant/office closure between 1989 and 1991 is associated with almost a 30 percent lower level of household income and a lower probability of house ownership of about 10 percentage points (pp) some two decades afterwards. There is also a strong relationship between unemployment in the early years of the transition and wellbeing measures two decades later – individuals who experienced unemployment in the first three years of the transition have a 14 pp. higher likelihood of reporting great difficulties in making ends meet, a 10 pp. lower probability of high life satisfaction and a 11 pp. higher likelihood of depression. However, since these relations do not hold for unemployment due to plant closures, they cannot be treated as causal. The results are therefore most likely driven by unobserved factors which simultaneously determine the lower level of outcomes two decades after the ‘shock-therapy’ reforms, and the likelihood of experiencing unemployment in the early 1990s.

Conclusion

In this policy brief we outline recent results on long-term implications of labour market developments in the early years of the economic transition in Poland. The analysis is based on a combination of contemporary and retrospective data from the SHARE survey, and focuses on the associations between the experience of unemployment in the initial years of the transition in Poland and a number of outcomes measured about two decades later. Using plant/office closures as exogenous sources of job separations during the early 1990s, we find a strong and statistically significant, negative, long-term effect on income and home ownership, which can be treated as causal.

We also find strong negative associations between unemployment for other reasons than plant / office closures and a number of subjective measures of wellbeing. This relationship however, does not hold for the exogenous reasons for job losses, which suggests an important role of unobservable factors that lead to unemployment and at the same time are responsible for the lower level of outcomes in later life. This is consistent with the labour market reality of central planning characterised by labour hoarding and maintaining employment regardless of workers’ productivity. When the economic reality changed in 1989, the least productive individuals were the first to be fired, and as our analysis shows, these are also the individuals with lower subjective levels of wellbeing two decades later. We confirm thus that those who lost their jobs in the early 1990s have lower measures of the subjective wellbeing outcomes, although the latter cannot be identified as specific consequences of unemployment in the first years of transition.

References

- Farber, H. (2011). “Job loss in the great recession: historical perspective from the Displaced Workers Survey, 1984-2010”, NBER Working Paper No. 17040, National Bureau of Economic Research.

- Jacobson, L., LaLonde, R. and Sullivan, D. (1993). “Earnings losses of displaced workers”, American Economic Review, 83, pp. 685–709.

- Myck, M. and Oczkowska, M. (2018). “Shocked by therapy? Unemployment in the first years of the socio-economic transition in Poland and its long-term consequences”, Economics of Transition, 26(4), pp. 695-724.

Acknowledgement

The authors gratefully acknowledge the support of the Polish National Science Centre through project no. 2015/17/B/HS4/01018. For the full list of acknowledgements see Myck and Oczkowska (2018).

Poland’s Road to “High Income Country” Status: Lessons Learnt – Not Only for Other Countries

In this brief we summarize and discuss results presented in a recent World Bank Report focused on Poland’s path from middle to high-income country status. In the period until 2015, Poland’s economic development distinguished itself by its stability and consistency of the implemented reform package, and its inclusive nature. Poland became classified as a high-income country after only 15 years from gaining a middle-income status. At the same time, income inequality remained stable and absolute poverty levels fell significantly. The World Bank Report offers lessons from and insights for Poland, which are discussed from the perspective of the policies implemented by the governments in the last two years.

Poland’s status in the World Bank nomenclature has recently been “upgraded” from being middle to high-income country. While this categorization is only a nominal change, it reflects the country’s economic development over the recent decades and is an important recognition of the success of a wide range of reforms implemented across a broad number of areas. Notably, Poland moved from the middle to high-income status in a period of less than 15 years.

In a book recently published by the World Bank, it is argued that the Polish experiences from the reform process can serve as valuable lessons for countries that are in the process of, or have just embarked upon major socio-economic reforms, as well as for those, who have fallen into the so-called middle-income trap and are looking for solutions to their stagnant economies. At the same time, in comparison to other established high-income countries, there are a number of insights that Poland’s policy makers ought to bear in mind in order to stay on course of the reform process and continued stable growth.

Looking at policies of the recent governments, however, one gets a strong impression that some important insights have been ignored. As rapid population aging looms over the horizon, the lack of necessary adjustments combined with the risks to stability of the political and economic environment might in the medium run have significant implications for Poland’s further development.

The big picture

The key feature of the Polish socio-economic policy approach, over the period covered by the World Bank analysis (i.e. up to 2015), was a unique consistency of a broad direction taken by subsequent administrations. This allowed the reform process to develop without major breaks or U-turns, which ensured the overall stability of the socio-economic environment and provided stable investment prospects. The World Bank highlights the key role of institutions, including rule of law, property rights, and democratic accountability of different levels of government. Basic market institutions, including the respect for rules on price and product regulations, corporate governance and market regulations, as well as foreign trade and investment, have played a crucial role. This framework allowed for continued improvement in the efficiency of resource allocation – including the allocation between sectors of the economy, as well as between and within enterprises.

Crucially, Poland prepared well and took full advantage of the integration with the European Union. The EU accession was first used as a common anchor for stability of the reform process, and after 2004, the European funds became an additional engine of growth. At the macro level, stability of the fiscal framework with limited deficits and public debt were combined with appropriate regulation and supervision of the financial sector, an independent central bank, and close links to global markets.

Shared prosperity

While the above points provided the basis for Poland’s economic development, the Report highlights another unique feature of Poland’s success, namely the degree to which the fruits of the process have been equally shared among different groups of society. The overall income inequality has remained relatively stable, with the Gini coefficient actually falling slightly between 2005 and 2014, from 0.351 to 0.343. Relative income poverty levels remained stable over this period (at about 20%), and the levels of absolute poverty fell significantly. For example, the proportion of the population living on less than $10 per day fell from 51.3% in 2005, to 29.6% in 2014. Growing incomes were primarily driven by increases in labor earnings, but employment growth – in particular among older age groups –also made a contribution. The government’s labor market policy also played a role with a rapid increase in the level of the national minimum wage (NMW), which grew by 65% in real terms between 2005 and 2015, i.e. almost twice as fast as the average wage. While there is evidence that the rapid growth in the NMW had negative effects on employment – in particular among temporary, young, and female workers, these have been relatively modest. Additionally, the tax and benefit policy has contributed to reduced inequality. It has been estimated that nearly half of the reduction in the Gini coefficient, over the period 2005–2014, resulted from reforms of the tax and benefit system (Myck and Najsztub, 2017).

It is clear that human capital was one of the cornerstones of Poland’s success in recent years. Developments on the labor market, such as a rapid productivity growth, were facilitated by a well-educated labor force, which could respond and adjust to the changing conditions and requirements. In this regard, Poland’s advantage in comparison to many other low and middle-income countries has been the relatively high level of spending on public education and healthcare, not only since the start of the economic transformation in the 1990s, but also before that. Indicators, such as the infant mortality rate, were low in Poland already in the 1980s, and have since further improved (see Figure 1). For a long time, public spending on education has been at levels comparable to those in established high-income countries (see Figure 2). Additionally, a series of reforms to the education system since 1990, have resulted in improvements in the quality and coverage of education. This, in turn, has lead to a rapid improvement of scores in language, mathematics, and science in the PISA study (Programme for International Student Assessment), in which Polish students recently outperformed those from many other OECD countries (OECD 2014). Importantly, the improvements in the education results have been found across the socio-economic spectrum, which further stresses the inclusive character of the changes that have taken place.

Figure 1. Infant mortality rate (per 1,000 live births), 1980 and 2014

Notes: Countries grouped in the following manner: red – middle-income countries; blue – new high-income countries; green – established high-income countries. Horizontal lines represent group averages. Source: World Bank (2017), Figure 5.16, based on World Development Indicators.

Figure 2. Government expenditure on education, percent of GDP, 1990

Source: World Bank (2017), Figure 5.11, see notes to Figure 1.

Insights for Poland

“As economies enter the high-income group, weakness in economic institutions such as the rule of law, property rights, and the quality of governance become increasingly important to sustain convergence.”

World Bank (2017)

While the Polish reform experience, over the period examined in the World Bank Report, offers important lessons for other countries aspiring to the high-income status, the authors point out that Poland’s continued development needs to rely on further improvements in a number of key areas. The following policy areas have been highlighted in the Report:

- Working on more inclusive political and economic institutions and enhancing the rule of law with the focus on the judiciary;

- Adjustments to fiscal policy in particular to deal with the consequences of population aging;

- Increasing the domestic level of savings to facilitate large investment needs;

- Supporting innovation through more intense competition and high quality research education;

- Improving social assistance programs and access to high quality health and education for low income groups;

- Increasing the progressivity of the tax system to support inclusive growth;

- Adjusting migration policies to bring in skills and innovative ideas and compensate for the country’s aging workforce.

“Sustaining Poland’s record of high, stable growth will require adjustments to fiscal policy (…). Government will need to create the fiscal space to deal with the increasing pressures coming from aging, the inevitable decline of EC structural funds for investment, and a more uncertain global context.”

World Bank (2017)

Lessons, insights and recent policies

While several of the Law and Justice majority governments’ policies since 2015 have been well in line with the World Bank recommendations, there have also been a number of questionable policy areas. One major concern seems to relate to the broad background of reforms of the judiciary, which have drawn significant criticism of the European Commission and other international institutions. Implications of such major changes for economic growth are uncertain but potentially very damaging.

Another long-term concern arises from the new pension age reform. From the socio-economic perspective, rapid ageing of the population is one of the main challenges facing the country. Between 2015 and 2030, the number of people aged 65+ will grow from 6.1 million to 8.6 million, i.e. by over 40%. This will put significant strains on the country’s public finances due to increasing public-pension expenditures and growing costs of health and long-term care. These pressures will only be exacerbated by the current government’s decision to lower the statutory retirement age to 60 for women and 65 for men, from the target uniform age of 67 legislated in the reform of 2012. Given the contributions-defined nature of the Polish pension system, this will result in significantly lower levels of pensions, especially among women, and a substantial drain on public finances resulting from lower levels of contributions and taxes.

The generous family benefits of the Family 500+ Program – implemented in 2016 and which cost about 1.3% of the GDP – have also been criticized on a number of grounds. They have undoubtedly changed the financial conditions of numerous families and limited the extent of child poverty. At the same time, they contribute to maintaining low levels of female labor-force participation and there is so far little indication that they have significantly changed Poland’s very low fertility rate. It seems that while the program may have positive long-term consequences resulting from reduced poverty, it is unlikely to shift the demographic dynamics.

Uncertainty also surrounds the consequences of a haphazard major education reform, which is another trademark policy of the Law and Justice party. The reform re-introduced the 8+4 system in place of the post-1999 three-level educational arrangement (6+3+3). The new system takes the number of years of general education back from 9 to 8 years, and instead extends by one year the length of secondary schooling. While the potential effects of such a change are difficult to foresee, the 8+4 system may be in particular disadvantageous to children from rural areas, who are most likely to continue their education in their rural primary schools for the two extra years.

A number of steps taken by the government since late 2015, and in particular those related to the redistributive policies implemented in the last two years, seem to be consistent with the World Bank insights. On the other hand, the approach towards the reforms of the judiciary, the general approach to the rule of law, and the reforms of education and pension regulations, quite clearly appear to ignore not only the insights, but also the lessons resulting from Poland’s own experience of the recent decades. Given the challenge of rapid aging in the Polish population, there seems to be much gained from taking them seriously if the current and future administrations want to ensure Poland’s continued inclusive growth and to secure its status as an established high-income country.

********

This policy brief draws heavily on the World Bank (2017) Report: “Lessons from Poland, Insights for Poland: A sustainable and inclusive transition to high-income status” (co-authored by Michal Myck) and the accompanying Working Paper by Myck and Najsztub (2016). Views and opinions expressed in this brief are the sole responsibility of the author and are not endorsed by the World Bank or CenEA.

References

- Myck, M., and M. Najsztub (2016) “Distributional Consequences of Tax and Benefit Policies in Poland: 2005–2014.” CenEA Microsimulation Report 02/16, Centre for Economic Analysis, Szczecin.

- OECD (Organisation for Economic Co-operation and Development) (2014) PISA 2012 Results: What Students Know and Can Do—Student Performance in Mathematics, Reading and Science (Volume I: Revised edition, February 2014). Paris: OECD Publishing.

- World Bank (2017) “Lessons from Poland, Insights for Poland: A sustainable and inclusive transition to high-income status”, The World Bank, Washington.

Socio-Economic Policy in Poland: A Year of Major Changes in Benefits, Taxes, and Pensions

2016 was the first full calendar year of the new Polish government elected to power in October 2015. The year marked a number of major changes legislated in the area of socio-economic policy some of which have already been implemented and others that will take effect in 2017. In this policy brief, we analyse the distributional consequences of changes in the direct tax and benefit system, and discuss the long-term implications of these policies in combination with the policy to reduce the statutory retirement age.

The Law and Justice party (Prawo i Sprawiedliwość, PiS) won an absolute majority of seats in both houses of the Polish Parliament in the parliamentary elections of October 2015. Earlier that year, Andrzej Duda of PiS was elected President of the Polish Republic. In both cases, the electoral victories came on the wave of pledges of significant financial support to families with children and to low-income households, especially pensioners. The new president pledged to cut back the pension age to the levels prior to the 2012 reform, which introduced a gradual increase from 60 and 65 to 67 for both women and men, and to nearly triple the income tax allowance. Following Duda’s victory in May 2015, PiS reiterated these pledges in the parliamentary election campaign and added the promise to increase the total level of financial support for families with children by over 140% through a nearly universal benefit called “Family 500+” and to hike the minimum wage by over 8%.

Despite a rather tight budget situation, the government went ahead with the “Family 500+” and successfully rolled it out in April 2016 (Myck et al., 2016a). The new instrument directs support of 500 PLN per child per month (110 EUR) to all second and subsequent children in the family in the age group between 0 and 17. Benefits for the first child in the family in this age group are granted conditional on overcoming an income threshold of 800 PLN (180 EUR) per person per month. Since April 2016, over 2.7 million families have received the benefit and 60% of them received the means tested support (if they have more than one child this is paid out in combination with the universal benefit).

The second key electoral pledge – to increase the tax allowance from 700 to 1,850 EUR at an estimated cost of 4.8 billion EUR – has so far been postponed (CenEA, 2015a). Increases in the allowance became a major policy issue in October 2015 when the Constitutional Tribunal ruled that maintaining its level below minimum subsistence, as it was at the time, was unconstitutional. To satisfy the Tribunal’s ruling, the allowance would have to increase to ca. 1,500 EUR at a cost of nearly 15 billion PLN (3.4 billion EUR, and about 0.8% of GDP, CenEA 2015b). Instead of a simple increase in the allowance, the government decided to implement a digressive tax allowance for 2017. This raised the value to the required minimum subsistence level for the lowest income tax payers, but since it is rapidly withdrawn as taxable income rises, the allowance will be unchanged to a large majority of taxpayers and will cost the public purse only 0.2 billion EUR (CenEA, 2016). This policy will be more than paid for by the fiscal drag given the decision to freeze all other parameters of the tax system, which will cost the taxpayers 0.5 billion EUR (Myck et al., 2016b).

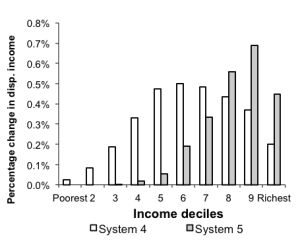

The policies that directly affect household budgets will in total amount to about 5.5 billion EUR in 2017 (1.3% of GDP and 6.2% of the planned central budget expenditures) and will include also an increase in the minimum pension to benefit about 1.5 million pensioners. The cost of the “Family 500+” reform makes up the large majority of this value (5.4 billion EUR). Households from the lower income decile groups will benefit the most from this reform package, with their monthly disposable income increasing on average by 15.1% (ca. 60 EUR). High-income households from the top income decile will see their income grow on average by only 0.5% (see Figure 1). Overall, nearly all of the gains will go to families with children, with single parents gaining on average about 95 EUR and married couples with children about 84 EUR per month. Other types of families will, on average, see negligible changes in their household disposable incomes (see Figure 2). Thus, the implemented package clearly has a very progressive nature and redistributes significant resources to families with children.

Figure 1. Distributional consequences of changes in direct tax and benefit measures implemented between 2016-2017

Source: calculations using CenEA’s microsimulation model SIMPL based on PHBS 2014 data.

Source: calculations using CenEA’s microsimulation model SIMPL based on PHBS 2014 data.

The pension age and public finances in the years to come

The most recent major reform, legislated at the end of 2016 and which will come into effect in October 2017, represents an implementation of yet another costly electoral pledge. This policy has overturned gradual increases in the statutory retirement age, initiated by the previous government in 2012. Despite the very rapid ageing of the Polish population, the new government decided to return to the pre-2012 retirement ages of 60 and 65 for women and men, respectively. This comes at a time when, according to EUROSTAT (Eurostat, 2014), the old-age dependency ratio in Poland, i.e. the proportion of the 65+ population to the working-age population, will grow from the current 24% to 27% in 2020 and to 40% in 2040. With the defined contribution pension system, the shorter working lives resulting from this change will be reflected in significantly reduced benefits (Figure 2). For example, pension benefits of men retiring in 2020 will on average be 13.5% lower than the pre-reform value. For women that retire in 2040, the pension benefits will on average fall by 15.2%, which corresponds to a 43% lower benefit than the pre-reform value, and with consequences of the reform becoming more severe over time. The reform will also be very costly to the government budget. In 2017, it is expected to cost 1.3 billion EUR and its full effect will kick in after 2021, when the cost of the reform will exceed 3.9 billion EUR per year (Figure 2).

Figure 2. Reducing the statutory retirement age and its implications on pension benefits and public finances

Source: Based on data from Council of Ministers (2016).

Source: Based on data from Council of Ministers (2016).

Conclusion

Since coming to power in October 2015, the PiS government has implemented a majority of its costly electoral pledges. Direct changes in taxes and benefits will cost 5.5 billion EUR in 2017 and benefit primarily those in the lower end of the income distribution and in particular families with children. The reduced statutory retirement age will add an extra 1.3 billion EUR in 2017 and as much as 3.9 billion EUR four years later. The very generous “Family 500+” programme has significantly reduced child poverty and may have important positive long-term effects in terms of health and education for today’s beneficiaries. However, its fertility implications are still uncertain and the programme is expected to reduce the employment rate among mothers. While the government maintains that its financing is secured, it is becoming clear that maintaining the policy will not be possible without higher taxes.

The government came to power claiming that the implementation of this programme will be based on reducing tax fraud and that only a small fraction will be financed from tax increases. While it seemed likely at the time when these declarations were made, the expected major shift in the reduction of tax fraud has yet not materialised. The government have withdrawn from the pledge of reducing the VAT and from assisting those with mortgages denominated in Swiss Francs, while its income tax allowance reform was nearly thirty times less expensive compared to that announced in its electoral programme.

With a very tight budget for 2017 based on relatively optimistic assumptions, the key factors determining further realisations of the generous programme will be the rate of economic growth and related dynamics on the labour market. Developments of the labour market will also be essential for the longer-term economic success of the implemented reform package. This relates both to the future level of participation of women and to the success of extend working lives of people who will soon reach the new reduced retirement age.

References

- CenEA (2015a) Konsekwencje prezydenckiej propozycji podwyższenia kwoty wolnej od podatku (Consequences of the presidential proposal to raise the incoem tax allowance), CenEA press release, 3 December 2015.

- CenEA (2015b) Co z kwotą wolną od podatku po wyroku Trybunału Konstytucyjnego? (what will happen to the income tax allowance after the decision of the Constitutional Tribunal?), CenEA press release, 13 November 2015.

- CenEA (2016) Zmiany w kwocie wolnej od podatku za 800 mln rocznie (Changes in the income tax allowance at the cost of 800m per year), CenEA press release, 29 November 2016.

- EUROSTAT (2014) Eurostat – Population projections EUROPOP2013, access 21 December 2016.

- Myck, M., Kundera, M., Najsztub, M., Oczkowska, M. (2016a) 25 miliardów złotych dla rodzin z dziećmi: projekt Rodzina 500+ i możliwości modyfikacji systemu wsparcia. (25bn for families with children: plans for the Family 500+ reform and other options to modify the system of support.), CenEA Commentaries, 18 January 2016.

- Myck, M., Kundera, M., Najsztub, M., Oczkowska, M., 2016b, Zamrożony PIT i utrzymane wyższe stawki VAT – jak brak zmian w podatkach wpłynie na budżety gospodarstw domowych? (Frozen PIT and higher VAT – how lack of changes in taxees will affect househod budgets?), CenEA Commentaries, 05 October 2016.

- Council of Ministers (2016) Position of the Council of Ministers on the presidential bill proposal, Warsaw, 25 July 2016.

Traces of Transition: Unfinished Business 25 Years Down the Road?

This year marks the 25-year anniversary of the breakup of the Soviet Union and the beginning of a transition period, which for some countries remains far from completed. While several Central and Eastern European countries (CEEC) made substantial progress early on and have managed to maintain that momentum until today, the countries in the Commonwealth of Independent States (CIS) remain far from the ideal of a market economy, and also lag behind on most indicators of political, judicial and social progress. This policy brief reports on a discussion on the unfinished business of transition held during a full day conference at the Stockholm School of Economics on May 27, 2016. The event was organized jointly by the Stockholm Institute of Transition Economics (SITE) and the Swedish Ministry for Foreign Affairs, and was the sixth installment of SITE Development Day – a yearly development policy conference.

A region at a crossroads?

25 years have passed since the countries of the former Soviet Union embarked on a historic transition from communism to market economy and democracy. While all transition countries went through a turbulent initial period of high inflation and large output declines, the depth and length of these recessions varied widely across the region and have resulted in income differences that remain until today. Some explanations behind these varied results include initial conditions, external factors and geographic location, but also the speed and extent to which reforms were implemented early on were critical to outcomes. Countries that took on a rapid and bold reform process were rewarded with a faster recovery and income convergence, whereas countries that postponed reforms ended up with a much longer and deeper initial recession and have seen very little income convergence with Western Europe.

The prospect of EU membership is another factor that proved to be a powerful catalyst for reform and upgrading of institutional frameworks. The 10 countries that joined the EU are today, on average, performing better than the non-EU transition countries in basically any indicator of development including GDP per capita, life expectancy, political rights and civil liberties. Even if some of the non-EU countries initially had the political will to reform and started off on an ambitious transition path, the momentum was eventually lost. In Russia, the increasing oil prices of the 2000s brought enormous government revenues that enabled the country to grow without implementing further market reforms, and have effectively led to a situation of no political competition. Ukraine, on the other hand, has changed government 17 times in the past 25 years, and even if the parliament appears to be functioning, very few of the passed laws and suggested reforms have actually been implemented.

Evidently, economic transition takes time and was harder than many initially expected. In some areas of reform, such as liberalization of prices, trade and the exchange rate, progress could be achieved relatively fast. However, in other crucial areas of reform and institution building progress has been slower and more diverse. Private sector development is perhaps the area where the transition countries differ the most. Large-scale privatization remains to be completed in many countries in the CIS. In Belarus, even small-scale privatization has been slow. For the transition countries that were early with large-scale privatization, the current challenges of private sector development are different: As production moves closer to the world technology frontier, competition intensifies and innovation and human capital development become key to survival. These transformational pressures require strong institutions, and a business environment that rewards education and risk taking. It becomes even more important that financial sectors are functioning, that the education system delivers, property rights are protected, regulations are predictable and moderated, and that corruption and crime are under control. While the scale of these challenges differ widely across the region, the need for institutional reforms that reduce inefficiencies and increase returns on private investments and savings, are shared by many.

To increase economic growth and to converge towards Western Europe, the key challenges are to both increase productivity and factor input into production. This involves raising the employment rate, achieving higher labor productivity, and increasing the capital stock per capita. The region’s changing demography, due to lower fertility rates and rebounding life expectancy rates, will increase already high pressures on pension systems, healthcare spending and social assistance. Moreover, the capital stock per capita in a typical transition country is only about a third of that in Western Europe, with particularly wide gaps in terms of investment in infrastructure.

Unlocking human potential: gender in the region

Regardless of how well a country does on average, it also matters how these achievements are distributed among the population. A relatively underexplored aspect of transition is to which extent it has affected men and women differentially. Given the socialist system’s provision of universal access to education and healthcare, and great emphasis on labor market participation for both women and men, these countries rank fairly well in gender inequality indices compared to countries at similar levels of GDP outside the region when the transition process started. Nonetheless, these societies were and have remained predominantly patriarchal. During the last 25 years, most of these countries have only seen a small reduction in the gender wage gap, some even an increase. Several countries have seen increased gender segregation on the labor market, and have implemented “protective” laws that in reality are discriminatory as they for example prohibit women from working in certain occupations, or indirectly lock out mothers from the labor market.

Furthermore, many of the obstacles experienced by small and medium-sized enterprises (SMEs) are more severe for women than for men. Female entrepreneurs in the Eastern Partnership (EaP) countries have less access to external financing, business training and affordable and qualified business support than their male counterparts. While the free trade agreements, DCFTAs, between the EU and Ukraine, Georgia, and Moldova, respectively, have the potential to bring long-term benefits especially for women, these will only be realized if the DCFTAs are fully implemented and gender inequalities are simultaneously addressed. Women constitute a large percentage of the employees in the areas that are the most likely to benefit from the DCFTAs, but stand the risk of being held back by societal attitudes and gender stereotypes. In order to better evaluate and study how these issues develop, gendered-segregated data need to be made available to academics, professionals and the general public.

Conclusion

Looking back 25 years, given the stakes involved, things could have gotten much worse. Even so, for the CIS countries progress has been uneven and disappointing and many of the countries are still struggling with the same challenges they faced in the 1990’s: weak institutions, slow productivity growth, corruption and state capture. Meanwhile, the current migration situation in Europe has revealed that even the institutional development towards democracy, free press and judicial independence in several of the CEEC countries cannot be taken for granted. The transition process is thus far from complete, and the lessons from the economics of transition literature are still highly relevant.

Participants at the conference

- Irina Alkhovka, Gender Perspectives.

- Bas Bakker, IMF.

- Torbjörn Becker, SITE.

- Erik Berglöf, Institute of Global Affairs, LSE.

- Kateryna Bornukova, Belarusian Research and Outreach Center.

- Anne Boschini, Stockholm University.

- Irina Denisova, New Economic School.

- Stefan Gullgren, Ministry for Foreign Affairs.

- Elsa Håstad, Sida.

- Eric Livny, International School of Economics.

- Michal Myck, Centre for Economic Analysis.

- Tymofiy Mylovanov, Kyiv School of Economics.

- Olena Nizalova, University of Kent.

- Heinz Sjögren, Swedish Chamber of Commerce for Russia and CIS.

- Andrea Spear, Independent consultant.

- Oscar Stenström, Ministry for Foreign Affairs.

- Natalya Volchkova, Centre for Economic and Financial Research.

The Economic Complexity of Transition Economies

‘Diversification’ is a constant concern of policy-makers in resource rich economies, but measurement of diversification can be hard. The recently formulated Economic Complexity Index (ECI) is a promising predictor of economic development characterizing the overall complexity and diversity of the economy as a system. The ECI is based on the diversity and ubiquity of a country’s exports. This brief uses ECI to discuss the economic diversity of transition economies in the post-Soviet decades, and the relationship between economic diversification and per capita income.

The search for and construction of appropriate predictors of economic development are among the main goals of economists and policy-makers. Education, infrastructure, rule of law, and quality of governance are all among the commonly used indicators based on inputs. The recently formulated Economic Complexity Index (Hidalgo and Hausmann, 2009) is a new promising predictor of economic development characterizing the overall complexity and diversity of the economy as a system.

Indeed, the importance of production and trade diversification for economic development has been highlighted by the economic literature. Numerous studies have found a positive relationship between diversified and complex export structure, income per capita and growth (Cadot et al., 2011; Hesse, 2006; Hausmann et al., 2007). In line with this, Hausmann et al. (2014) demonstrate the predictive properties of the ECI for economic development and GDP per capita, which implies that the ECI can serve as a useful complement to the input-based measures for policy analysis by reasoning from current outputs to future outputs.

This brief uses the ECI to discuss the evolution of economic diversification, its relationship to per capita income in transition economies in the post-Soviet decades, and its policy implications.

How is economic complexity measured?

The economic complexity index (ECI) is a novel measure that reflects the diversity and ubiquity of a country’s exports. The index considers the number of products a country exports with revealed comparative advantage and how many other countries in the world export such goods. If a country exports a high number of goods and few other countries export these products, then its economy is diversified (a wide range of exports products) and sophisticated (only a few other countries are able to export these goods). Thus, the measure tries to capture not a specific aspect of the economy, but rather its overall sophistication.

For example, Japan, Switzerland, Germany and Sweden have been in a varying order at the top of the ranking of the Economic Complexity Index from 2008 until 2013. This means that these countries export a large number of highly sophisticated products.

In contrast, Tajikistan is among the countries at the bottom of the world ranking by the ECI with raw aluminum, raw cotton and ores making up 85% of all Tajikistan’s exports in 2013. However, not only are Tajikistan’s exports concentrated among very few narrow products, these products are also ubiquitous and the ability to export them does not require knowledge and skills that can be used in the production and exports of many other products.

As the index for each country is constructed relative to other countries’ exports, it is comparable over time.

What can we learn from the economic complexity of transition economies?

The economic complexity index can serve as a useful indicator for understanding transition economies in the post-Soviet period. A strong relationship between GDP per capita and economic complexity is found in the sample of transition economies in Figure 1. This figure presents the relationship for the last year for which data is available for the sample of 13 post-Soviet states and Poland. As can be seen in Figure 1, the economic complexity is positively related to income per capita. This is especially true for Poland, Estonia, Lithuania, Latvia and Russia, who all have higher than average economic complexity and high levels of per capita income. While Belarus and Ukraine also have diverse and complex economies, they have somewhat lower income per capita than the first group.

Figure 1. Economic Complexity and GDP per capita

Source: Data on GDP per capita is from the World Bank, and the data on the Economic Complexity Index is from the Observatory of Economic Complexity.

Source: Data on GDP per capita is from the World Bank, and the data on the Economic Complexity Index is from the Observatory of Economic Complexity.

Natural resource-rich, or rather, oil-rich countries are the exception from the abovementioned correlation. Most transition countries with below than average economic complexity are characterized by low income per capita levels, except for Kazakhstan and Azerbaijan, which are oil-rich countries. Still, the overall picture is straightforward: countries with a complex export structure have a higher level of income.

One of the advantages of a systemic measure like export complexity is its straightforward policy application. The overall diversity and sophistication of the economy can thus be a complementary measure for the assessment of economic progress and development to GDP and GDP per capita, which are more susceptible to the volatile factors such as commodity prices.

Figure 2 shows the development of economic complexity for 14 post-Soviet countries and Poland between 1994 and 2013 (due to data availability issues, only one year is available for Armenia).